INSIGHTS &

REPORTS

Market Update

The IPO market in March is a blooming flower in dead wood

Farewell to February when no IPO were listed on the Hong Kong Stock Exchange (HKEX), a total of 7 IPOs were listed in March, reflecting a slight recovery in the IPO market. As of March 31, the stock prices of the 7 companies listed in March have generally performed satisfactorily. Among them, Lesi Group (2540.HK) and WK Group (2535.HK) have increased by 526.4% and 132.0% respectively since their listing. Only Lianlian (5298.HK) has fallen by 7.6% since its listing.

Phillip Hong Kong Newly Listed Equities Index ETF (2835.HK)

The ETF aims to fully replicate the Solactive Hong Kong Newly Listed Equities Index, a rules-based equity benchmark designed to track the performance of securities that had a recent initial public offering or new listing on the main board of the HKEX. The Index is rebalanced quarterly, incorporating securities with IPOs or new listings within the last 756 business days, aiming for a total of 50 securities based on free-float market capitalization. The Index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalization criteria.

March Monthly Review

After the quarterly rebalancing of the Solactive HK Newly Listed Equities Index, there are 5 new constituents were added, which are Giant Biogene (2367.HK), ZJLD Group (6979.HK), ZX Inc (9890.HK), Keep (3650.HK) and Star CM (6698.HK). On the other hand, there are 16 existing constituent were removed, which are New Oritental-S (9901.HK), Haier Smart Home (6690.HK), JD Health (6618.HK), Beke-W (2423.HK), China Resources Mixc (1209.HK), Pop Mart (9992.HK), RemeGen (9995.HK), Sunac Services (1516.HK), Huitongda Network (9878.HK), ANE Group(9956.HK), Starplus Legend (6683.HK), 3D Medicines (1244.HK), Pagoda Group (2411.HK), Joinn Laboratories (6127.HK), Wellcell Holdings (2477.HK) and YH Entertainment (2306.HK). The current number of constituent stocks has dropped from 48 to 37.

Among the 5 new constituents, Giant Biogene (2367.HK) performed better. The company designs, develops and manufactures professional skin treatment products with recombinant collagen as the key bioactive ingredient. They also develop and manufacture rare ginsenosides technology-based functional foods. They utilize proprietary synthetic biology technology to develop and manufacture multiple types of recombinant collagen and rare ginsenosides in-house. Bioactive ingredients offer a wealth of beauty and health properties such as skin repair, anti-aging, whitening, moisturizing, and immunity improvement with a broad range of applications in the beauty and health sectors. Their market share was approximately 1.1% of China’s overall skin care and treatment market in terms of retail sales in 2021. They primarily focus on the professional skin treatment product market, including functional skincare products and medical dressings. Professional skin treatment products are used to address various skin issues, such as skin sensitivity, premature skin aging, chronic eczema, and allergies, and can also be used for general skin care of consumers.

For the year ended 31 December 2023, the company revenue amounted to RMB 3524.1 million, increasing 49.0% YoY. The Gross profit amounted to RMB 2947.1 million, increasing 47.7%. The Gross profit margin was 83.6%, slightly decreasing 0.8 percentage points. The profit for the year attributable to owners of the parent amounted to RMB 1451.8 million, increasing 44.9% YoY. The revenue increase was primarily due to their continued expansion of product types, extensive development of online channels, and creation and enhanced marketing of star products, which further improved product and brand influence, bringing a faster growth in sales revenue. However, an increase in the costs of sales and the expansion of product types lead to the gross profit margin.

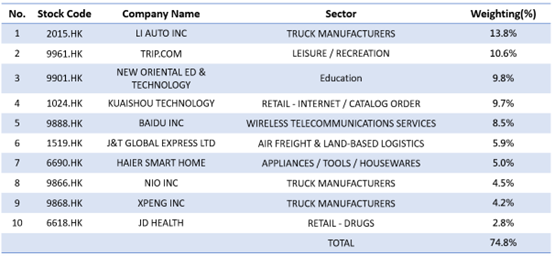

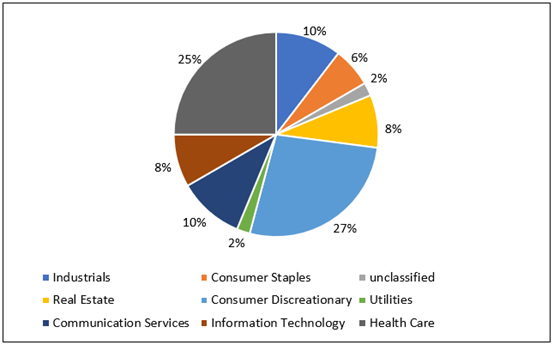

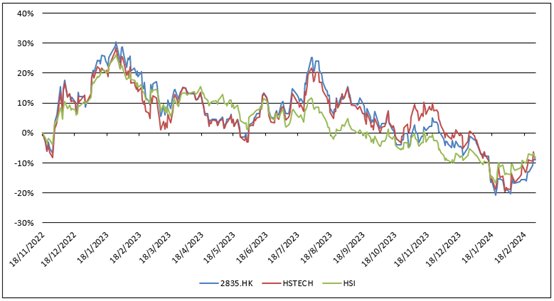

Top 10 holdings

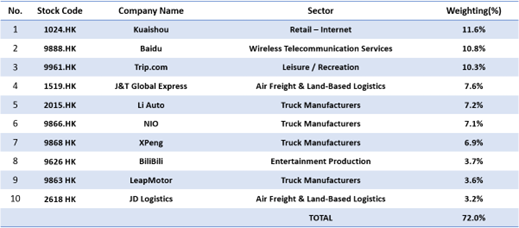

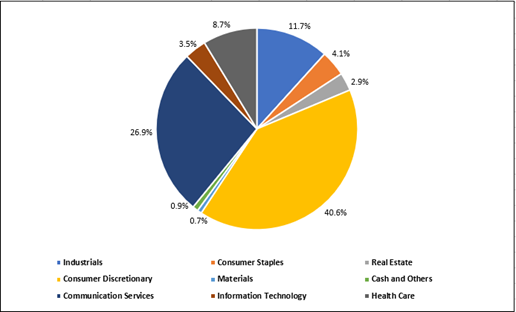

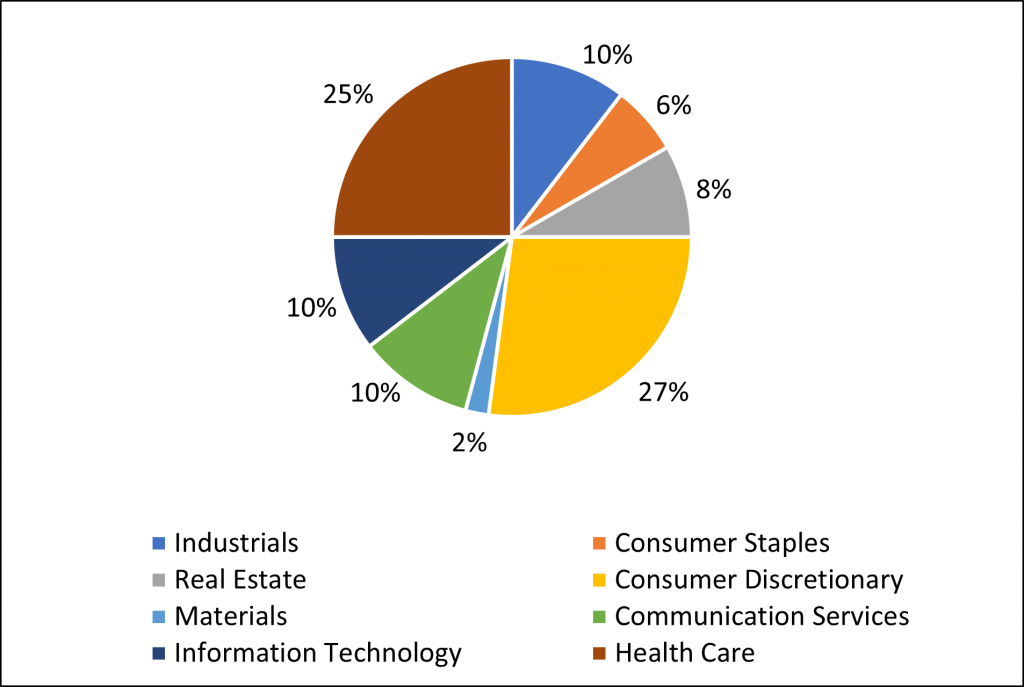

The top 10 holdings of the Solactive Hong Kong IPO Index have changed this month. Among the top ten holdings in February, New Oritental-S (9901.HK), Haier Smart Home (6690.HK) and JD health (6618.HK) excluded from the index because exceeded 756 trading days. On the other hand, Bilibili (9626.HK), LeapMotor (9863.HK) and JD Logistics (2618.HK) have entered top 10 holdings. The industries that the index currently focuses on include communication services (including Baidu, Kuaishou and Bilibili), Consumer Durables (including EV companies like Li Auto, Nio, X Peng and LeapMotor) and Industrials (including J&T Global Express and JD Logistics). The following table shows the top 10 holdings and sector breakdown of the Phillip HK Newly Listed Equities Index:

Key Components Update

- Kuaishou (1024.HK): The company announced its results for the year ended December 31, 2023. The company revenue amounted to RMB 113,470 million, increasing 20.5% YoY. The gross profit amounted to RMB 57,391 million, increasing 36.2% YoY. The gross profit margin was 50.6%, increasing 5.8 percentage points YoY. The adjusted net profit amounted to RMB 10,271 million, turning a loss into a profit YoY. The company’s average Daily Active Users (DAUs) in 2023 reached 382.5 million, increasing by 4.5% YoY. Average online marketing services revenue per DAU amounted to RMB 47.6, increasing 15.5% YoY. The total e-commerce GMV amounted to RMB 403,908.2 million, increasing 29.3%.

- Baidu (9888.HK): There were earlier reports that Baidu would provide AI functions for the iPhone 16, Mac system and the Chinese version of iOS18 released by Apple (AAPL.US) this year. However, China Daily quoted people close to Apple as denying this, saying that the two parties have not yet reached a cooperation.

- com (9961.HK): Trip.com released the “2024 Tomb-Sweeping Day Holiday Travel Summary”, which shows that during the holiday, domestic local travel and peripheral travel orders increased by 211% and 350% YoY respectively; the tradition of returning to one’s hometown to worship ancestors has led to the popularity of rural micro-tourism, with rural tour orders increasing by 239% YoY.

- J&T Global Express (1519.HK): The company announced its results for the year ended December 31, 2023. The company revenue amounted to USD 8849.3 million, increasing 21.8% YoY. The gross profit amounted to USD 472.8 million, turning a loss into a profit YoY. The gross profit margin was 5.3%. The adjusted net loss amounted to USD 432.2 million, a loss narrowed by 71.0%. Calculated based on parcel volume, the company’s market share in SEA in 2023 was 25.4%, increasing 2.9 percentage points; market share in China in 2023 was 11.6%, increasing 0.7 percentage points; market share in New Market such as Saudi Arabia, UAE, Mexico, Brazil, and Egypt in 2023 was 6.0%, increasing 4.4 percentage point.

- Li Auto (2015.HK): The company released the March 2024 Delivery Update, the company delivered 28,984 vehicles in March 2024, increasing by 39.2% YoY. This brought the company’s first-quarter deliveries to 80,400, up 52.9% YoY. The cumulative deliveries of Li Auto vehicles reached 713,764 as of the end of March 2024.

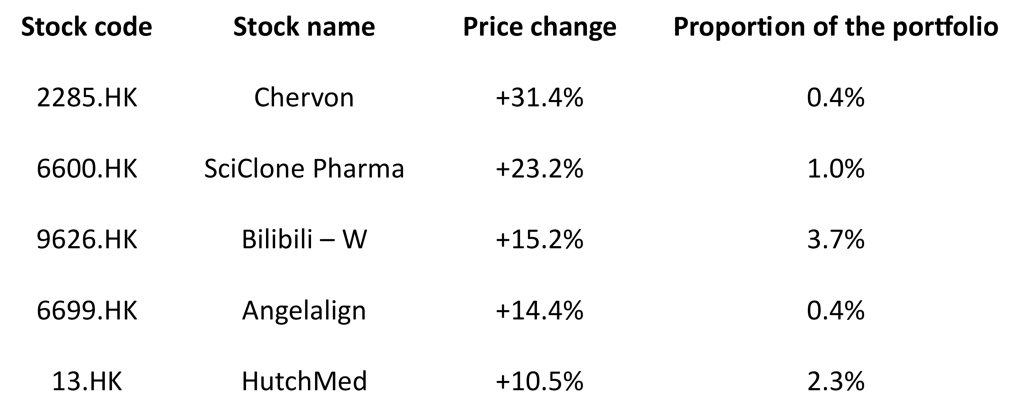

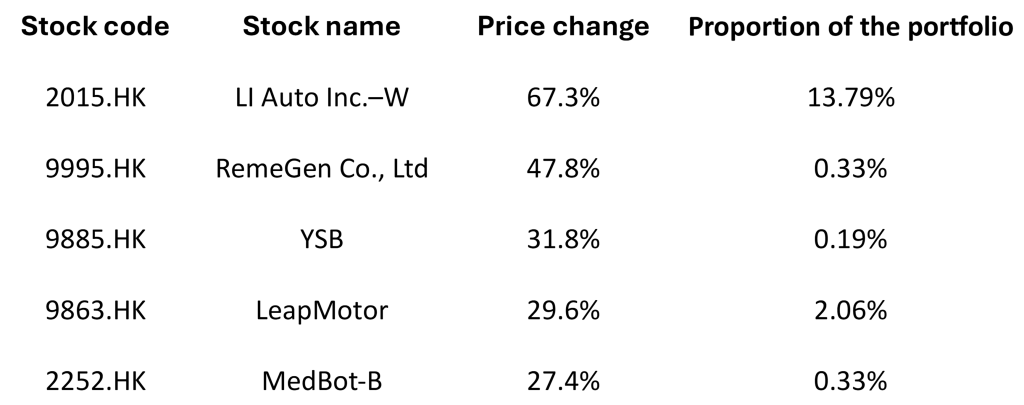

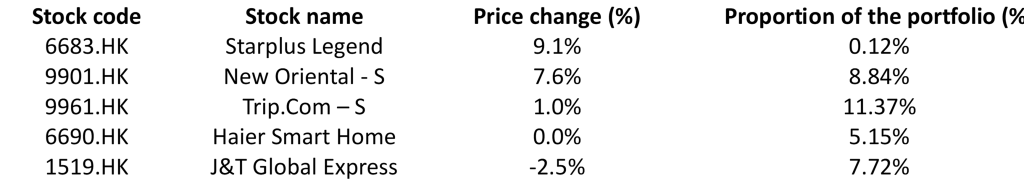

Top Constituent movers in March:

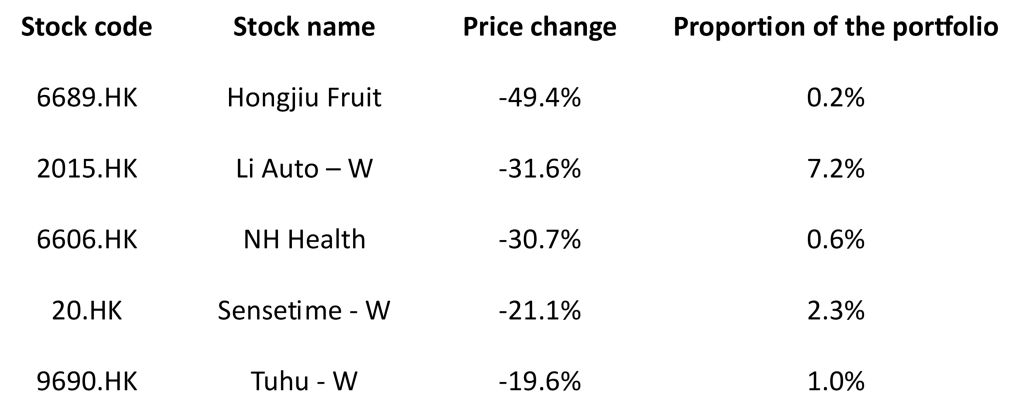

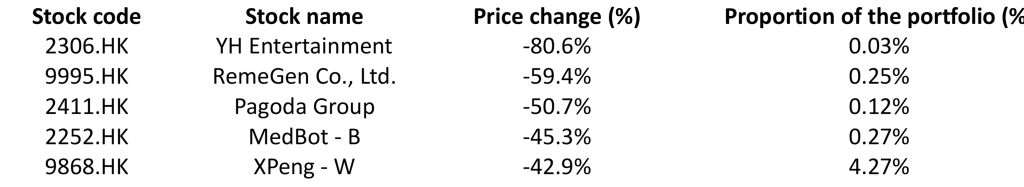

Bottom Constituent movers in March:

The Phillip HK Newly Listed Index ETF (2835.HK) Monthly performance for March

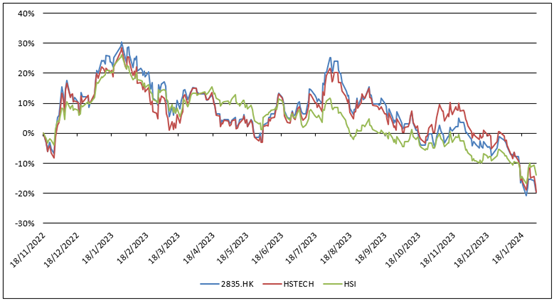

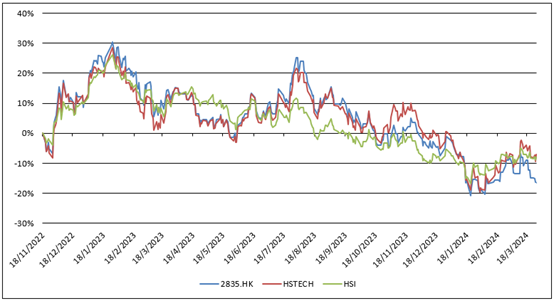

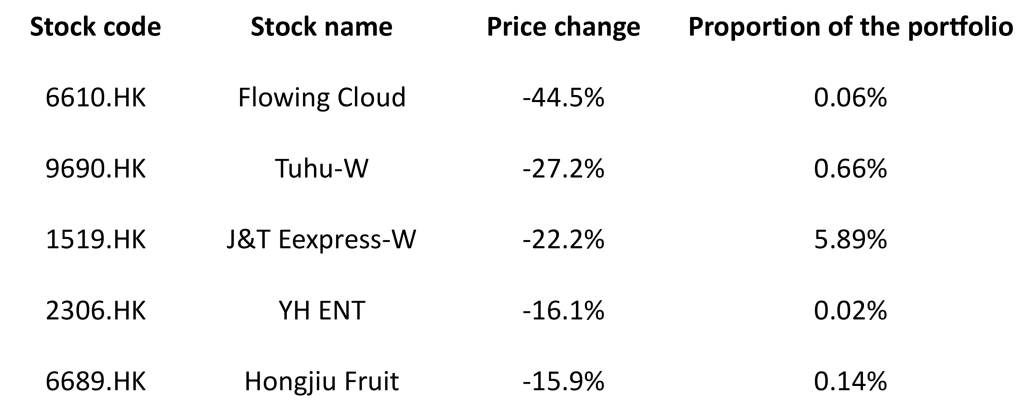

The Phillip HK Newly Listed Index ETF (2835.HK) recorded a monthly loss of 8.4%, underperforming the Hang Seng Index’s (HSI) 0.2% monthly gain, and underperforming the Hang Seng Tech Index’s (HSTI) 1.3% monthly gain. As of 31 March, the ETF has fallen 16.6%, underperforming the HSI’s decline of 8.07%, and underperforming the HSTI’s decline of 7.08%.

The IPO market was silenced in February

Following the listing of only 5 new IPOs (Initial Public Offering) last month, no new IPOs were listed on the Hong Kong Stock Exchange (HKEX) in February. This is consistent with the situation that no new IPOs were listed in February last year, it reflects that companies to be listed are still very cautious in market sentiment.

Phillip Hong Kong Newly Listed Equities Index ETF (2835.HK)

The ETF aims to fully replicate the Solactive Hong Kong Newly Listed Equities Index, a rules-based equity benchmark designed to track the performance of securities that had a recent initial public offering or new listing on the main board of the HKEX. The Index is rebalanced quarterly, incorporating securities with IPOs or new listings within the last 756 business days, aiming for a total of 50 securities based on free-float market capitalization. The Index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalization criteria.

February Monthly Review

During the monthly fast-track mechanism of the Solactive HK Newly Listed Equities Index, there is 1 new constituent was added, which is WellCell Holdings (2477.HK). Besides, there is 1 new constituent that was removed, which is AInnovation Technology (2121.HK).

WellCell Holdings (2477.HK) is a telecommunication network support and information and communication technology (ICT) integration services provider and software developer in the PRC. Currently, the company is engaged in the provision of telecommunication network support services, comprising wireless telecommunication network enhancement services and telecommunication network infrastructure maintenance and engineering services, ICT integration services and telecommunication network enhancement services. The company revenue from wireless telecommunication network enhancement services, telecommunication network infrastructure maintenance and engineering services, ICT integration services, and telecommunication network-related software development services in 2022 accounted for approximately 0.8%, 0.01%, 0.03% and 2.5%, respectively, of the market share of these industries in the PRC in terms of revenue in the same year.

For the six months ended 30 June 2023, the company revenue amounted to RMB 113.8 million, increasing 10.3% YoY. The operating profit amounted to RMB 18.0 million, increasing 33.2% YoY. The profit for the period attributable to the equity holders of the company amounted to RMB 14.7 million, increasing 56.4% YoY. The net profit margin was 12.9%, increasing 3.8 percentage points YoY. The main reason for the increase in the company’s operating profit was the increase in revenue and the decrease in the main operating cost ratio.

Top 10 holdings

The top ten holdings this month remain the same as last month. The industries that the index currently focuses on include Technology (including Baidu and Kuaishou), Consumer Durables (including EV companies like Li Auto, Nio and X Peng) and Consumer Discretionary (including Trip.com and New Oriental). The following table shows the top 10 holdings and sector breakdown of the Phillip HK Newly Listed Equities Index:

Key Components Update

LI Auto Inc.–W(2015.HK): The company announced its annual result for 2023. The company’s revenue amounted to RMB 123.9 billion, increasing 173.5% YoY. The gross profit amounted to RMB 275.0 billion, increasing 212.8% YoY. The gross profit margin was 22.2%, increasing 2.8 percentage points. The operating profit amounted to RMB 7.4 billion, turning losses into profits YoY. The profit for the period attributable to the equity holders of the company amounted to RMB 11.7 billion, turning losses into profits YoY. riding on the success of three SUV models amid fierce industry competition, Li Auto not only claimed the best-selling brand among SUVs priced above RMB300,000 but also secured the top-seller position in the RMB300,000 and higher NEV market in China. The total deliveries of Li Auto vehicles reached 376,030 in 2023, representing a year-over-year increase of 182.2%, making us the first Chinese emerging energy automaker to cross the 300,000 annual delivery milestones.

Trip.Com – S (9961.HK): The Chinese government announced earlier that it would expand the scope of visa-free countries and implement a pilot visa-free policy for ordinary passport holders from six countries: Switzerland, Ireland, Hungary, Austria, Belgium, and Luxembourg. From March 14 to November 30 this year, ordinary passport holders from the above countries can enter China without a visa if they come to China for business, tourism, visiting relatives and friends, and transit for no more than 15 days.

New Oriental-S (9901.HK): The Ministry of Education issued the “Off-campus Training Management Regulations (Draft for Comments)”. This announcement attracted public attention, and New Oriental’s “Homing Plan” was also mentioned in connection with it. At noon on February 26, New Oriental stated in response, stating that the “Homing Plan” was first proposed in August 2022. It is mainly aimed at the development needs of New Oriental’s emerging businesses such as Oriental Selection and New Oriental Cultural Tourism, it aims to place old employees in re-employment and does not involve subject training in the compulsory education stage.

Kuaishou – W (1024.HK): Kuaishou Ideal Home, a subsidiary of Kuaishou, announced the launch of Fanhua Plan, the Kuaishou Real Estate Lead Alliance, which provides real estate content creators with a new “real estate clue circulation” business model. The new business model will help Kuaishou Ideal Home further enhance its influence in the real estate field and will also provide more opportunities and platforms for real estate content creators.

Baidu – SW (9888.HK): Chairman and CEO Robin Li revealed that Baidu Intelligent Cloud’s total revenue in the fourth quarter amounted to RMB 8.4 billion, of which large models brought about RMB 660 million in incremental revenue to the cloud business. Wenxin Big Model has been called more than 50 million times a day, increasing 190% QoQ; in December, about 26000 companies used Wenxin Big Model, increasing 150% QoQ. At present, well-known companies such as Samsung, Honor, and Autohome have reached cooperation with Baidu.

Top Constituent movers in February:

Bottom Constituent movers in February:

The Phillip HK Newly Listed Index ETF (2835.HK) Monthly performance for February

The Phillip HK Newly Listed Index ETF (2835.HK) recorded a monthly gain of 13.0% in price in February, outperforming the Hang Seng Index’s (HSI) 6.6% monthly gain, but underperforming the Hang Seng Tech Index’s (HSTI) 14.2% monthly gain. As of 29 February, it was down 9.0% since listing, lightly underperforming the HSI (-8.23%) and underperforming the HSTI (-8.32%).

The IPO market had a quiet start in 2024

In January 2024, there were 5 new IPO (Initial Public Offering) listings on the Hong Kong Exchange (HKEX) compared to 14 in last December, the IPO market remain quiet. As of January 31, the stock prices of the five companies listed in January generally performed well, among them, WellCell Holdings (2477.HK) and Zhongshen Jianye Holding (2503.HK) were 208.0% and 25.0% higher than the listing price respectively (closing price, as of 31/1/2024). Only Concord Healthcare Group (2453.HK) was 14.8% lower than the listing price respectively.

2024 IPO market outlook

One of the Big Four accounting firms, PricewaterhouseCoopers expects that the amount of IPO funds raised in Hong Kong will gradually stabilize. There will be 80 companies listed in Hong Kong in 2024, and the amount of funds raised is expected to exceed HK$100 billion, including 3 companies with an average amount of funds raised of 15 billion, which has once again ranked among the top three fundraising markets in the world. The official implementation of the additional listing rules “Chapter 18C” that allows specialized technology companies to be listed will help connect specialized technology companies with international funds, will bring new opportunities to technology companies and the Hong Kong stock market, and further promote the long-term development of the entire technology industry. It is expected that 3 to 5 specialized technology companies will be listed in Hong Kong through “Chapter 18C” in 2024.

Phillip Hong Kong Newly Listed Equities Index ETF (2835.HK)

The ETF aims to fully replicate the Solactive Hong Kong Newly Listed Equities Index, a rules-based equity benchmark designed to track the performance of securities that had a recent initial public offering or new listing on the main board of the HKEX. The Index is rebalanced quarterly, incorporating securities with IPOs or new listings within the last 756 business days, aiming for a total of 50 securities based on free-float market capitalization. The Index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalization criteria.

January Monthly Review

During the monthly fast-track mechanism of the Solactive HK Newly Listed Equities Index, there is 1 new constituent was added, which is Productive Tech (650.HK). Besides, a total of 3 existing constituents were removed: Asymchem(6821.HK), Linklogis-W(9959.HK) and Jacobio-B (1167.HK). The current number of constituents has dropped from 50 to 48.

Productive Tech (650.HK) is engaged in the semiconductor and pan-semiconductor business of productivity-driven equipment applied in semiconductor and solar cell businesses. It also operates an oil and gas production project in PRC. Currently, the Company has commenced businesses in the development and manufacturing of innovative Wafer Fabrication Equipment (“WFE”) and solar cell production equipment. WFE comprises high-end single-wafer cleaning and low-pressure chemical vapor deposition (“LPCVD”) equipment for front-end wafer processing. Solar cell production equipment includes wet chemical cleaning equipment and copper plating equipment.

For the six months ended 30 September 2023, the company revenue amounted to HKD 336 million, decreasing 22.3% YoY. Gross profit amounted to HKD 55 million, decreasing 10.0% YoY; Gross profit margin was 16.3%, increasing 2.2 percentage points. Operating loss amounted to HKD 134 million, losses increased significantly by 545.2% YoY. Loss for the period attributable to equity shareholders of the company amounted to HKD 142 million, losses increased significantly by 229.5%. The loss for the period was primarily attributed to the administrative and R&D expenses from the rapid development and expansion of the company’s semiconductor and pan-semiconductor business applied in the semiconductor and solar industry. In addition, the investment loss is caused by changes in the fair value of investment projects.

Top 10 holdings

The top ten holdings this month remain the same as last month. The industries that the index currently focuses on include Technology (including Baidu and Kuaishou), Consumer Durables (including EV companies like Li Auto, Nio and X Peng) and Consumer Discretionary (including Trip.com and New Oriental). The following table shows the top 10 holdings and sector breakdown of the Phillip HK Newly Listed Equities Index:

Key Components Update

- Com – S (9961.HK): According to the “2024 Chinese New Year Tourism Market Forecast Report” released by the company, as of January 13, domestic travel, outbound travel, and inbound travel orders have increased significantly during the 8-day Chinese New Year holiday (February 9 to 17). Domestic travel, outbound travel, and inbound travel orders have all increased significantly. Orders for ice and snow travel products have increased more than 10 times YoY. Most of the popular destinations are northern cities, such as Harbin, Changchun, and Baishan.

- Baidu – SW (9888.HK): Autohome – S (2518.HK) and Baidu Intelligent Cloud, a subsidiary of Baidu – SW (9888.HK), announced a strategic cooperation. Based on Baidu Intelligent Cloud Qianfan large model platform, the two parties will carry out in-depth cooperation in the fields of content creation, intelligent marketing, intelligent customer service, business decision-making and other fields, and jointly explore and promote large model technology innovation and industry application implementation.

- LI Auto Inc.–W(2015.HK): The company voluntarily announced delivery data for January, announcing that it had delivered a total of 31,165 new vehicles, increasing 105.8% YoY, but decreasing 38.1% MoM. In addition, the company 2024 launches will kick off in March with the official release and commencement of deliveries of the high-tech flagship family MPV, Li MEGA will be launched and delivered, alongside the rollout of the 2024 Li L7, Li L8 and Li9. Furthermore, they will continue to increase their investment in research and development and elevate their technical capabilities in autonomous driving, smart space, and smart electrification. In addition, reinforced by their diverse product lineup, together with the strength of our products and enhanced synergies across their production, supply chain, and sales and servicing network, they will challenge themselves with a target of a new high of 800,000 annual deliveries.

- Kuaishou – W (1024.HK): Kuaishou Mall’s New Year’s Day order volume increased by 98% YoY, the number of buyers increased by 65% YoY, and the GMV of branded products increased by 77% YoY, the user base continued to expand, and branded products grew steadily. In addition, during the festival, the number of merchants launching broadcasts increased by 67% YoY, and the total duration of e-commerce broadcasts increased by 235% YoY. The three fields of short video, search, and pan-shelf performance were outstanding.

- New Oriental-S (9901.HK): The Ministry of Education has studied and formed the “Off-campus Training Management Regulations (Draft for Comments)”, which covers a total of 20 articles, expounds the comprehensive regulations on personnel, materials, time, fees, competitions, etc. in the supervision of off-campus training, and providing legal protection for the daily standardized management of off-campus training. The relevant draft clarifies the regulatory guidelines related to off-campus training, which will help companies engaged in off-campus training and education to conduct business in compliance and improve market sentiment.

Top Constituent movers in January:

Bottom Constituent movers in January:

The Phillip HK Newly Listed Index ETF (2835.HK) Monthly performance for January

The Phillip HK Newly Listed Index ETF (2835.HK) recorded a monthly loss of 18.6% in price in January, underperforming the Hang Seng Index’s (HSI) 9.2% monthly loss, but outperforming the Hang Seng Tech Index’s (HSTI) 19.1% monthly loss. As of 31 January, it was down 19.5% since listing, outperforming the HSTI (-19.7%) but underperforming HSI (-13.9%).