-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Market Brief

The articles are produced in Chinese only.

ZHAOJIN MINING INDUSTRY CO.LTD (1818.HK)

Tuesday, July 17, 2018  7268

7268

Stock Commentary Date: 13/07/2018

Stock: ZHAOJIN MINING INDUSTRY CO.LTD (1818.HK)

Closing price: $6.10 (16/07/2018)

52 weeks range: $5.437 – 7.257

Shares outstanding: 1,049,215,000

Market Capitalization (H Shares): HK$ 6,410,703,650 (16/07/2018)

Target Price (12 months): Neutral

Summary :

Zhaojin mining industry Co. Ltd. (1818.HK) is one of the leading producers of gold bullions and gold related products in PRC. In the midst of various factors that impede the price of gold, such as trade conflicts between USA and the rest of the world, interest upward movement as well as economic slowdown in Asia region. Also, the gold price movement is negatively correlated with the USD movement and we witnessed an upward movement in the USD (contributed by the increase in rate as well as cessation of quantitative easing) and in turn, may affect the demand for gold. Nevertheless, the group aimed to consolidate its position as the number one gold producer in the region and continued to implement various means or measures that enhance its gold qualities while minimize the impact of mining on the environment.

Overview – 2017 :

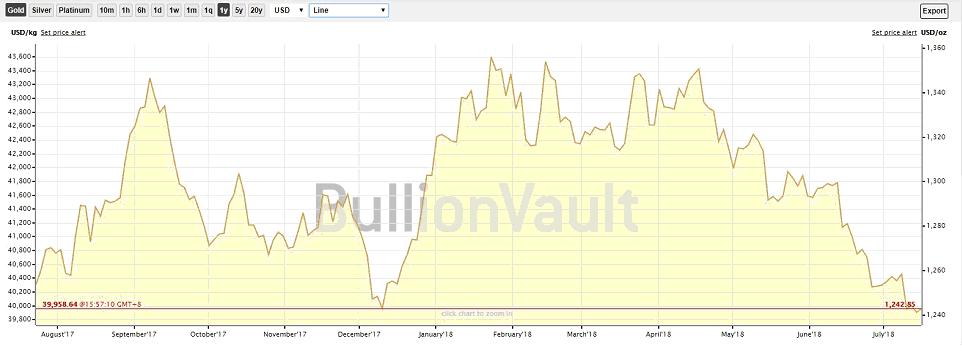

- Quick glance of the gold price:

As shown on the chart above, Gold had been trading within a range between USD1240/OZ to USD1365 /OZ throughout second half of 2017 and first half of 2018. The failure of the Gold price to make a breakthrough of such trading tunnel might be attributed by the USD movement. Against the backdrop was the US Trump administration initiated various trade conflicts with different countries as well as the normalization of the interest rate after years of quantitative easing. In a short term, the gold price might not be able to reverse such trend; on the other hand, it is possible that the gold price may resume the downtrend movement after US Federal Reserve held their third meeting in early August.

- The company, Zhaojin Mining and its subsidiaries (together referred to as the “Group”) are mainly engaged in the exploration, mining, ore processing, smelting and sale of gold products. The main product of the group included “Au9999” and “Au9995” standard gold bullions and other gold products under the company’s brand name of “Zhaojin”

- The Group’s revenue increased by 0.14% comparing to last year (comparing to a decrease in the first half of the year). However, the group’s gross profit margin recorded a decrease in comparison to 2016. The group attributed the decline to the decrease in the sales of volume of gold.

- However, the group had an overall decrease in gold production in 2017, a reduction of 6.51% in comparison to the 2016, to approximately 652,704.36ozs. The Output had actually improved in the second half of the year ( the gold production output decreased by 11.77% in the first of half 2017 in comparison to the first half of 2016)

- Earnings per share had a significant increase as compared to last year, from RMB 0.12 to RMB 0.2 (basic and diluted), an approximate 66.7% increase.

- Nevertheless, the company again recorded a decline in revenue in the 1st half of 2018. However, further elaboration may be disclosed in the half yearly reported in August.

SWOT ANALYSIS:

Strength :

- The group is one of the major gold producers of PRC.

- The group continue to strengthen its internal control and effective management as mentioned in its yearly report

Weakness :

- The group’s revenue is correlated with the international gold price. The price of gold had been stagnant for the past year due to lethargic demand.

.

Opportunities :

- Through internal management upgrade, the company can consolidate its position.

- Also, through various technological upgrades, the company may be able to enhance output while minimize the COGS

Threat :

- US dollar may strengthen due to Fed’s policies to cease quantitative easing, in turn, it may weaken the gold price

- Slowdown in Asia economy may also affect the gold demand.

「註:本人倪國權為證監會持牌人士。截至本評論文章發表日止,本人及/或其有聯繫者並無持有全部提及之証券的所有相關財務權益。」; Or

” I, Ni Kwok Kuen Alex, am a licensed person under the Securities and Futures Commission. Until the date this commentary was published, neither I and/or my affiliates are the beneficiary of the securities mentioned herein or are entitled to any financial interests in relation thereto. “

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|