-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Market Brief

The articles are produced in Chinese only.

呷哺呷哺 (00520.HK)

Tuesday, November 20, 2018  5361

5361

Stock Commentary Date: 19/11/2018

Stock: XIABU XIABU Catering Management (China) HLDG. LTD. (520.HK)

Closing price: $11.12 (19/11/2018)

52 weeks range: $9.442 – 18.052

Shares outstanding: 1,075,943,928

Market Capitalization: HK$ 12.201 Billion (19/11/2018)

Target Price (12 months): Neutral

Business Summary:

- The company operated Hot-Pot restaurant chains in China. Currently, the company operates 780 restaurants throughout China under Xiabu Xiabu (呷哺呷哺)brand name as well as the newly created brand Cou Cou (湊湊),a Taiwanese style Hot-pot dining concept.

- The company enjoyed growth with its revenue turnover due to continual growth the catering sector in China as well as spending growth. However, the company also faced with a greater competitions as well as rising input cost, especially raw materials and staff.

- Apart from the competition as well as rising cost, the company must also deal with the issue of safety and staff training in order to strengthen their branding.

- Through horizontal expansion, the company started Hot-Pot delivery business and aimed to using this new business to develop a new source of revenue as well as promoting its brand name.

Business Report:

1. For the six months ended 30 June 2018, revenue of the Group increased by RMB 553.4 million or 35.1%, to RMB 2,129.1 million as compared to the same period 2017. The company’s profit increased by 11.2%,from RMB 188.2 million to RMB 209.4 million.

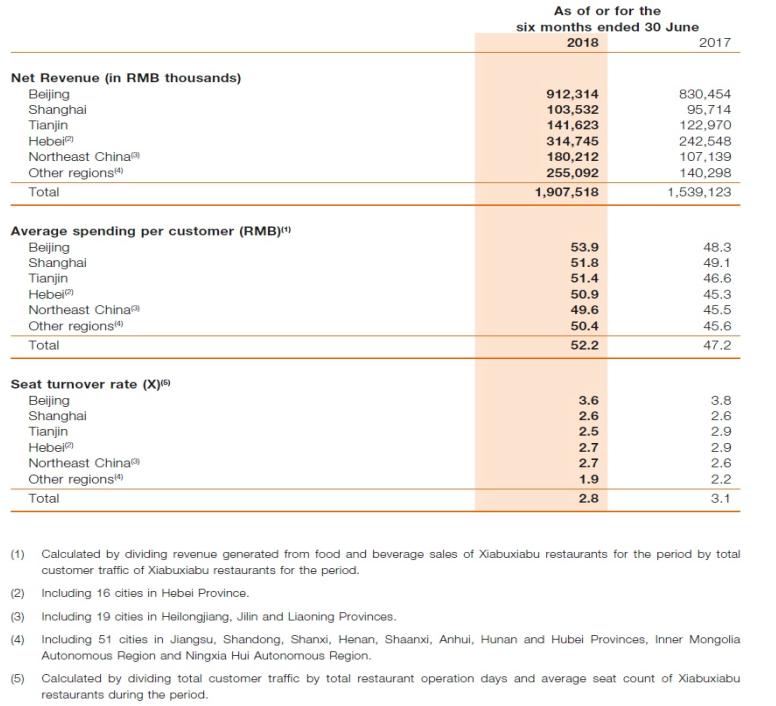

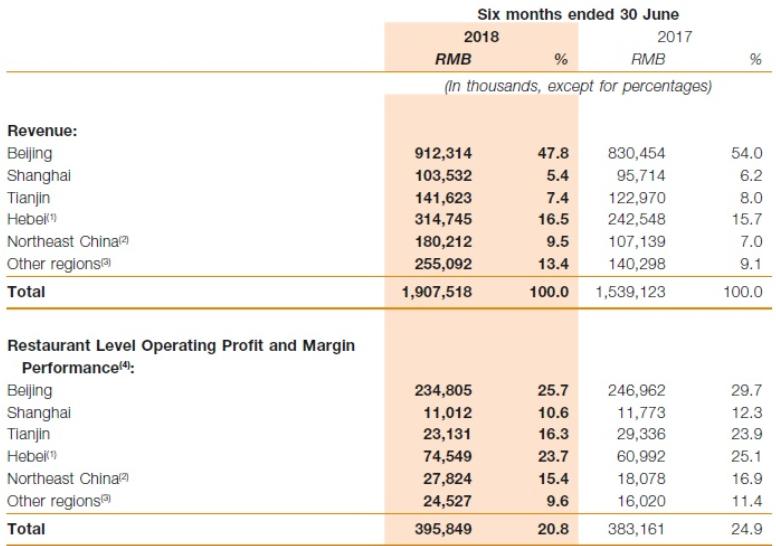

2. The company’s major business operation is in Beijing; significant portion of revenue as well as operating profit are derived from this geographical area:

Xiabu Xiab (520.HK) 2018 interim report

Also, Beijing is where the company has operated most restaurants and was successful in developing its brand:

Xiabu Xiab (520.HK) 2018 interim report

3. The Group's largest cost were raw materials & consumables used (which includes food consumables, utensils etc) and staff. In the first half of 2018, both items increased by 42% and 40.1%, from RMB 557.6 million to RMB 791.7 million and RMB 203.5 million to RMB 268.0 million respectively.

Commentary

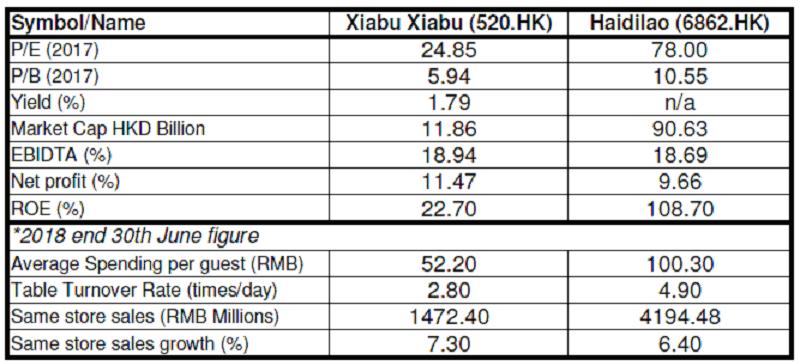

- There are few key components to estimate whether the company is growing and generating profit from their business. The first one is average spending per guest. The chart indicated that the guests whom visited Haidilao, on average, spent twice as much as they do in Xiabu Xiabu. Such spending difference may be attributed by the types of guests those two operators were targeting. This figure can be further consolidated by the fact that the same stores sales for Haidilao is almost three times as much as Xiabu Xiabu. Such difference was highlighted by their Table Turnover rate, whereby Haidilao was around 1.75 times higher than Xiabu Xiabu. Further observation may be warranted to explain such vast difference between these two companies

- Although Haidilao seems to be operating a more profitable business than Xiabu Xiabu, Xiabu Xiabu is still enjoying growth with its business expansion, especially catering revenue in China is still experiencing growth. As pointed out in their interim report, in order to maintain their competitiveness, the company continue their expansion in other parts of China, while using various strategies to market their brand.

Peer Comparison:

In terms of business, we can use Haidilao (6862.HK) to make the comparison, since both companies operate Hot-Pot restaurant chains and their business model is very similar to each other’s.

Xiabu Xiab (520.HK) & Haidilao (6862.HK) 2018 interim report

SWOT ANALYSIS:

Strength :

- China's catering service market generated approximately RMB 4000 billion revenue in 2017. It is expected this sector to continue to grow at a CAGR of 9.6% from 2017 to 2022. Hot-Pot is one of the most popular style of dinning in China and enjoyed the fastest growth in recent years.

- The group was established well in Beijing and using its brand to develop Northern region of China.

Weakness :

- Rising cost of raw materials and staff. The cost of both these items rose faster than its revenue growth which might impede its profit growth.

.

Opportunities :

- Online take away business.

- Cou Cou (湊湊) to tap into high spending customers. (The peer comparison table above highlighted that Haidilao’s success may has to do with its strategy in target high spending customers.)

Threat :

- Food safety issue. On 10th Sept 2018, a customer discovered a dead rat in their Hot-Pot while dinning. The stock price plummeted and decreased its value by 14% or HKD 1.5 billion in two days period.

「註:本人倪國權為證監會持牌人士。截至本評論文章發表日止,本人及/或其有聯繫者並無持有全部提及之証券的所有相關財務權益。」; Or

” I, Ni Kwok Kuen Alex, am a licensed person under the Securities and Futures Commission. Until the date this commentary was published, neither I and/or my affiliates are the beneficiary of the securities mentioned herein or are entitled to any financial interests in relation thereto. “

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|