-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Fuyao Group (3606.HK) - A next growth cycle is coming

Friday, March 27, 2015  18954

18954

Fuyao Group(3606)

| Recommendation | Accumulate |

| Target Price | $19.700 |

Weekly Special - 1836 Stella International

China's largest and the world's second largest automotive glass producer

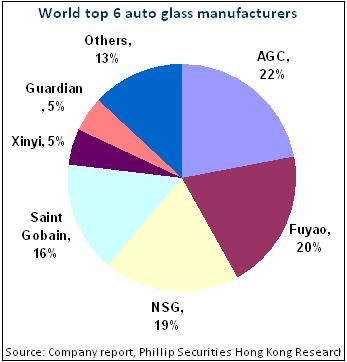

Fuyao Glass with the headquarters located in Fuzhou mainly produces automotive glass and float glass. About 96% of its revenue comes from automotive glass and the float glass is mainly supplied for the company itself. The company is now China's largest and the world's second largest automotive glass manufacturer. According to the sales volume in 2013, it took up 63% shares of China's automotive market, and 72% shares of the glass OEM market for passenger cars in China; it also owned 20% market shares in the global automotive glass market.

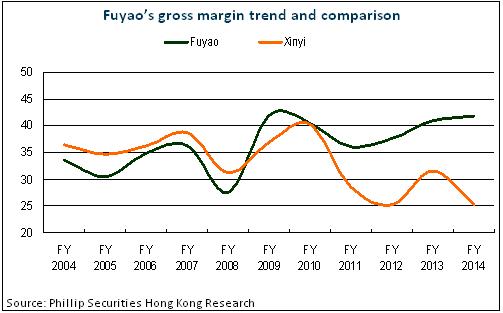

Excellent Profitability brought about by efficient operation management

Ever since 2000, the company has been continuously expanding in accordance with the domestic automotive main engine plants, at the same time extending foreign markets; in the recent 14 years, it has reported the rapid and extremely steady growing of sales revenue, which increased from 750 million Yuan to 12, 800 million Yuan, and the annual compound growth rate is 22.5%.The net margin grew from 150 million Yuan to 2.2 billion Yuan and the annual compound growth rate was 21%. For the recent 10 years, the company's average gross margin is above 35%, which remains around 40% in the past three years; the average net profit rate is close to 16% and average ROE is around 30%.

We believe the reasons why Fuyao Glass has remained such excellent profitability come from the following competitive advantages:

1) Fuyao enjoyed lower logistics and consumption costs than other competitors at home concerning base amount and layout, and build competitive advantages in costs and supplies` promptness, which is also good for establishing stable partnership with clients.

2) The company has established a flexible production mode "varieties of products in small quantities", appealing to the trend of the whole automobile market.

3) Fuyao focuses more on the automobile glass and continuous R&D enabled its products been recognized by the Four major Vehicle Series.

4) The efficient corporate governance system. The solid management will better push forward the formulation of the strategic decisions of the company.

The overseas market will be the next core objective

To obtain more room for growth, the company is planning to expand further in the international market. At present, the company owns a production base of automobile glass in Russia, and is building a production base in America and another one in Russia respectively. The proportions of the overseas revenues to the total business revenues for 2011, 2012, 2013 and 2014 are respectively 31.5%, 32.6%, 32.0%, 32.2% and 33.5%. The net amount of the capital raising of Fuyao Glass is about 6.21 billion to 7.15 billion HK$. The 80% of the money will be used to expand the overseas production lines.We predict that with the successive operation of the production lines in Russia and America in the following 2 years, the company's overseas income contribution is expected to increase quickly and become the powerful engine of the company's next growth cycle.

Investment Thesis

The dividend payout rate of the company in the recent years keeps high (over 50%), and overseas expansion can enable the company to enjoy the cheaper natural gas and other energy sources more adequately; in addition, the company is expected to develop clients in the field of higher gross margins such as low-emission construction glass, and the new round of performance growth of the company will be opened again under the condition of the stable growth of gross margin.

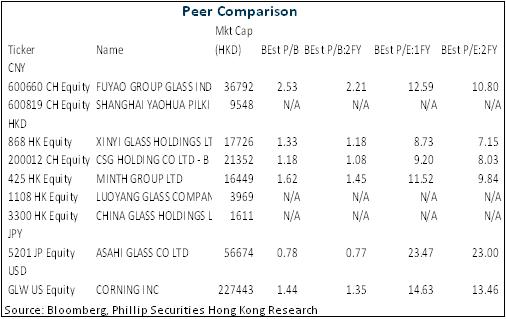

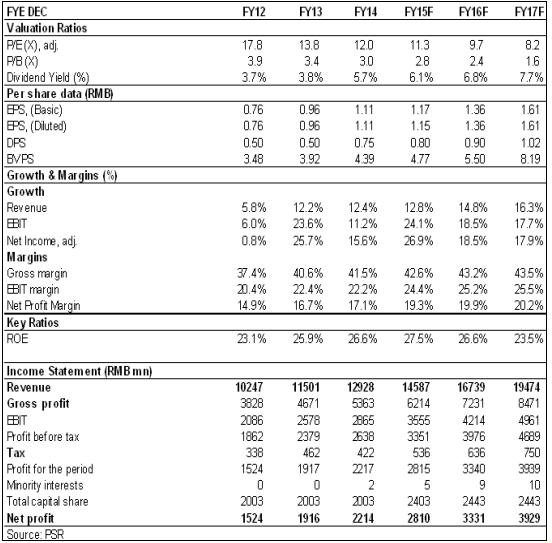

As analyzed above, we expected EPS expectation of the Company to RMB 1.15/1.36/1.61 for 2015/2016/2017. We covered the company initially with the target price of 19.7, respectively 13.3/11.4/9.6x P/E for 2015/2016/2017, 17.3% upside from the issue price cap, "Accumulate" rating.

Company Profile: China's largest and the world's second largest automotive glass producer

Fuyao Glass with the headquarters located in Fuzhou mainly produces automotive glass and float glass. About 96% of its revenue comes from automotive glass and the float glass is mainly supplied for the company itself. The company is now China's largest and the world's second largest automotive glass manufacturer. According to the sales volume in 2013, it took up 63% shares of China's automotive market, and 72% shares of the glass OEM market for passenger cars in China which was close to two times of the total market shares of the manufacturers with the ranking from the second to the sixth; it also owned 20% market shares in the global automotive glass market. The company was listed in A-stock market in 1993, and the current market value is about 30 billion Yuan.

The company's main clients include the top twenty automotive manufacturers in the world and the top ten passenger car manufactures in China. The customers, includes joint-venture passenger car manufacturers, like Shanghai General Motors Co., Ltd., FAW-Volkswagen, Shanghai Volkswagen, Beijing Hyundai, Dongfeng Nissan, and major international auto manufacturers, such as Toyota, Volkswagen, General Motors Corp., Ford, Hyundai, Renault-Nissan, Fiat, Honda, BMW, Mercedes-Benz, Bentley, Rolls-Royces and Porsche.

Industry overview of automotive glass market

Automotive glass consists of two market segments: new car supporting market and after-sales fittings market; and the market share ratio of the two is about 8:2 (for global market) and 9:1 (for China). According to the data of Roland Berger, for the new car supporting market, it increased at a compound growth rate of 10.1% from 2009 to 2013, which was higher than 6.6%, the compound growth rate of global automotive market in the same period. Main cause of the growth was the market's increasing demand for large windshield and the growing popularity of auto sunroof. It is expected that sales volume of global new car supporting market and the compound annual growth rate in 2018 will respectively reach 423 million m2 and 5%. While the rate of increase of global after-sale fittings market's was slightly smaller; from 2009 to 2013, the annual compound growth rate was 5.0%; up to 2018, it is expected to reach 105 million m2 and 4.6% annual compound growth rate. The entire market sales are 4.8 times of Fuyao's current total production capacity.

As far as the Chinese automotive glass market is concerned, the after-sale market's growth rate is higher than that of the new car supporting market, which is mainly determined by the features of the stage that the Chinese automobile market is in. It is expected that up to 2018, the annual compound growth rates of new car sales and after-sale supporting will be respectively 9.0% and 11.7%, and the market sales will be respectively 133.3 and 17.3 million m2, which accounts for 1.37 times of the current total production capacity of Fuyao Glass.

Profitability brought about by efficient operation management

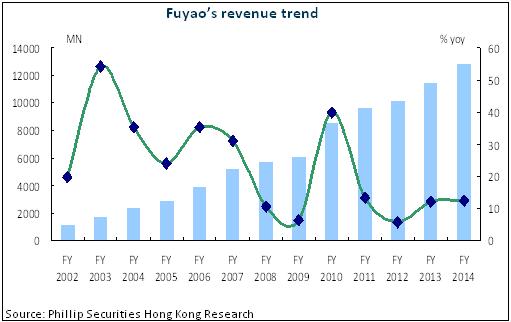

Ever since 2000, the company has been continuously expanding in accordance with the domestic automotive main engine plants, at the same time extending foreign markets; in the recent 14 years, it has reported the rapid and extremely steady growing of sales revenue, which increased from 750 million Yuan to 12, 800 million Yuan, and the annual compound growth rate is 22.5%.

The net margin grew from 150 million Yuan to 2.2 billion Yuan and the annual compound growth rate was 21%; there were two profit droppings, one of which was caused by the 2008 financial crisis and the other was in 2011, due to the overdrawn consumption of cars brought about by government's subsidy policy, the cardinal number year-on-year basis was relatively high, and there was a loss in subsidiary corporation's architectural-grade float glass on account of adjustment on real estate market. For the recent 10 years, the company's average gross margin is above 35%, which remains around 40% in the past three years; the average net profit rate is close to 16% and average ROE is around 30%.

We believe the reasons why Fuyao Glass has remained such excellent profitability come from the following competitive advantages:

1) The company currently owns 110.3 million m2 of capacity of automotive glass and 1058 thousand tons of production capacity of float glass; the production capacity use ratio is maintained at a high level from 85% to 95%. Fuyao Glass possesses 12 production bases in 8 provinces of China and covers all nearby main automotive production bases of China, so as to more effectively make lower logistics and consumption costs than other competitors at home concerning base amount and layout, and build competitive advantages in costs and supplies` promptness, which is also good for establishing stable partnership with clients.

2) After many years of accumulation, the company has already established a flexible production mode incorporating the information control system, materials storage and transport system, and digitally controlled processing equipment, and is able to respond quickly to the customer needs, satisfying the requirement for the production of "varieties of products in small quantities", effectively reducing the costs, and increasing the diversity of products. The company has adapted itself to the characteristics of the development trend of the global automobile market.

3) The company is one of the few producers of automobile glass whose products have been both recognized by the international clients of matching products and certified by the Four major Vehicle Series. Compared with other competitors, Fuyao focuses more on the automobile glass. The continuous investment in the research and development has enabled the company to possess the advanced capabilities of design and development of high-end products.

4) The efficient cost control system and corporate governance system. More than 80% of the float glass of the company is self-supplied. The vertical product chain system ensures the stable and controllable supply of raw materials. The company is a private enterprise. The founder has been its Chairman for more than 20 years. The solid management will better push forward the formulation of the strategic decisions of the company.

The overseas market will be the next core objective of the company

To obtain more room for growth, the company is planning to expand further in the international market. At present, the company owns a production base of automobile glass in Russia, and is building a production base in America and another one in Russia respectively. The proportions of the overseas revenues to the total business revenues for 2011, 2012, 2013 and 2014 are respectively 31.5%, 32.6%, 32.0%, 32.2% and 33.5%. In 2014, the company has reported an increase of 12.4% in total revenues, with the total revenues amounting to 12.9 billion Yuan. The net profit attributing to shareholders amounted to 2.22 billion Yuan, representing an increase of 15.8% yoy. The earning per share was 1.11 Yuan. The gross margin was 42.3%, increasing by 0.9ppts yoy.

In the view of various regions, the incomes of the domestic market grow by 14% yoy in 2014, and the overseas market is more excellent, with the growth of 17% yoy. The capital expenditure of the company in 2014 increased to 2.8 billion Yuan, with the growth of 48% yoy, and it is predicted to approach 3 billion Yuan in 2015. The net amount of the capital raising of Fuyao Glass is about 6.21 billion to 7.15 billion Hongkong dollars. The 80% of the money will be used to expand the overseas production lines:

About 35% will be used for the glass production facilities automation in Ohio of America and this project is predicted to be completed in December, 2015, and the annual production capacity is designed to be 12.1 million m2; About 30% will be used for the glass production facilities automation in Russia, and the automotive float glass production line project with the annual capacity of 0.45 million tons is predicted to be completed at the end of 2017;

About 15% will be used to build the automated glass production facilities in Russia, and design the second-phase automotive glass base with the capacity of 8.1 million m2, which will be accomplished at the end of 2016;

In addition, about 10% will be used to supplement the circulating funds; about 10% will be used to repay the bank loan.

We predict that with the successive operation of the production lines in Russia and America in the following 2 years, the company's overseas income contribution is expected to increase quickly and become the powerful engine of the company's next growth cycle.

Valuation

The dividend payout rate of the company in the recent years keeps high (over 50%), and overseas expansion can enable the company to enjoy the cheaper natural gas and other energy sources more adequately; in addition, the company is expected to develop clients in the field of higher gross margins such as low-emission construction glass, and the new round of performance growth of the company will be opened again under the condition of the stable growth of gross margin.

As analyzed above, we expected EPS expectation of the Company to RMB 1.15/1.36/1.61 for 2015/2016/2017. We covered the company initially with the target price of 19.7, respectively 13.3/11.4/9.6x P/E for 2015/2016/2017, 17.3% upside from the issue price cap, "Accumulate" rating.

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|