Modern Dental Group Limited (3600)

Stock Commentary Date: 17/9/2019

Stock: Modern Dental Group Limited

Closing price: $1.45 (17/09/2019)

52 weeks range: $0.94 - $1.717

Shares outstanding: 981,646,000

Market Capitalization: HK$ 1.423 Billion

Target Price (12 months): No Target

Summary :

- The group is in the transition phase period, consolidating their business through various acquisitions.

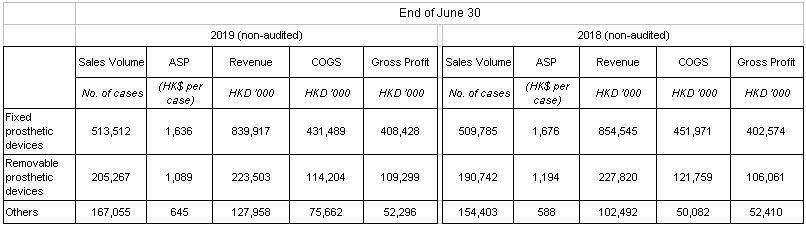

- Focus on higher value products to improve profit margins.

- The incurred loss was from restructuring, re-financing and currency exchange. The group’s core business remained relatively stable.

- The group’s prospect came from local market penetration through their strategic geographical acquisitions.

- Greater China may be the company’s next sales engine as GDP per capita increased, so was the demand for high quality medical/dental care products.

- The group continued to showed prudent use of capital amid the current uncertain economic period.

- The group continued to repurchase stocks from market to support the stock value.

Group half yearly report (June 2019):

- Improvement in gross profit (and gross profit margin). However, the transition phase is still in progress and remained to be seen.

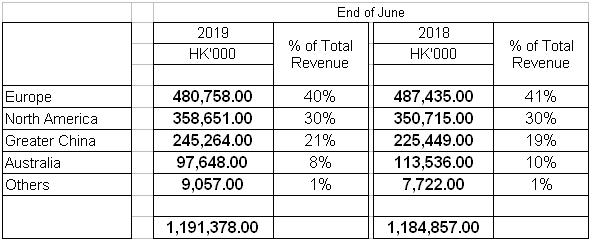

2 While Europe continued to be one of the major contributors of the group’s revenue, Greater China region had a faster growth comparing to other region while North America (including Canada) also had a moderate improvement in terms of revenue growth. As the group continued to consolidate with their acquisitions (especially with MicroDental), the company expected to capitalize on their investments in the future.

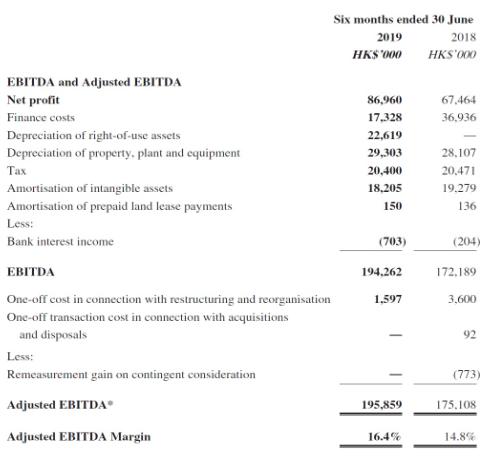

3. The group continued to show improvement with their operation, highlighted by their improvement in EBITDA.

4. The group’s cash level as well as liquidity remained to be solid and showed prudency with their financing strategy as well as capital planning

「註:本人倪國權為證監會持牌人士。截至本評論文章發表日止,本人及/或其有聯繫者並無持有全部提及之証券的所有相關財務權益。」; Or

” I, Ni Kwok Kuen Alex, am a licensed person under the Securities and Futures Commission. Until the date this commentary was published, neither I and/or my affiliates are the beneficiary of the securities mentioned herein or are entitled to any financial interests in relation thereto. “

投資涉及風險,有可能損失投資本金。你應諮詢專業人士,就本身的投資經驗、財務狀況、個人目標及風險取向,以提供投資意見。各類產品的風險,請參閱本公司網頁 http://www.phillip.com.hk《風險披露聲明》。

輝立(或其僱員) 可能持有本文所述有關的投資產品。此外,輝立(或任何附屬公司)隨時可能替向報告內容所述及的公司提供服務、招攬或業務往來。

以上資料為輝立擁有並受版權及知識產權法保護。除非事先得到輝立明確書面批准,否則不應複製、散播或發佈。