-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- Smart Minor (Joint) Account

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Weichai (2338.HK) - Continue to Lead in Market Share, Profitability Rallies Significantly

Friday, December 29, 2023  5955

5955

Weichai(2338)

| Recommendation | Accumulate |

| Price on Recommendation Date | $12.840 |

| Target Price | $15.300 |

Weekly Special - 3606 Fuyao Glass

Company Profile

Weichai is one of the automobile and equipment manufacturing groups with the strongest comprehensive strength in China's heavy truck industry. Based on the powertrain system including engine, axle and gearbox, the Company extends upstream components and downstream heavy trucks, and takes the lead in forklifts and intelligent warehousing. After years of development, the Company has built a synergetic development pattern of four major industrial segments including powertrain (engine, transmission, axle/hydraulics), vehicle and machinery, intelligent logistics and other segments.

Investment Summary

Remarkable Performance Driven by Strong Demand for Natural Gas-fueled Heavy Trucks and Robust Exports

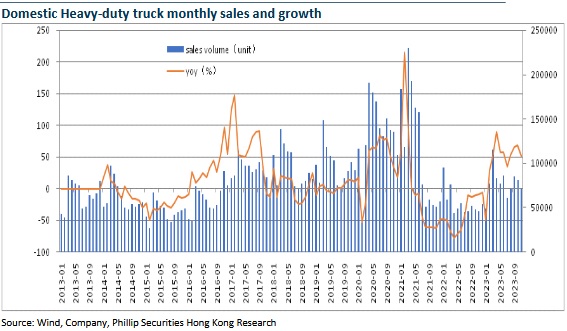

The domestic economy has entered a plateau phase, after an impulse-type increase at the beginning of the year. The heavy truck industry has been driven by multiple favorable factors, such as economic recovery, the constant release of policy effects, and a low base in the same period last year. Nevertheless, as affected by the complex international environment and insufficient domestic demand, the industry still faces certain pressure. Specifically, 701 thousand heavy trucks were cumulatively sold from January to September 2023, with an increase of 34%yoy. The cumulative sales this year so far have already surpassed the total sales of 670 thousand last year.

Particularly, as natural gas prices are dramatically lower than diesel prices, natural gas-fueled heavy trucks have emerged to be the most eye-catching segment during the recovery of the heavy truck industry this year. The cumulative domestic sales of natural gas-fuelled heavy trucks from January to September amounted to 107.4 thousand, up 255% yoy. Weichai Power Co., Ltd. (hereinafter referred to as "Weichai Power" or the "Company") is, without a doubt, the leader of engines for natural gas-fueled heavy trucks in China, with a market share of nearly 70%. Additionally, the export of heavy trucks has maintained a fast growth this year. Statistically, 210 thousand heavy trucks were exported from January to September, up 70% yoy, which represented up to 30% of the total exports and hit a record high.

Thanks to several favorable factors, Weichai Power sold 548 thousand engines in the first three quarters, which climbed by 24.5% yoy. Particularly, 52 thousand of them were exported, with a year-on-year increase of 35.6%. In terms of commercial vehicle business, Shaanxi Heavy Duty Automotive Co., Ltd. (Shaanxi Zhongqi), a controlling subsidiary of the Company, sold 92 thousand heavy trucks in the first three quarters, up 52% yoy, wherein 42 thousand were exported with a year-on-year increase of 71.9%. In regard to intelligent logistics business, KION Group AG (KION), a controlling subsidiary of the Company, recorded the net profit before interest and tax of EUR570 million in the first three quarters, which jumped by 171.6% yoy.

Continue to Lead in Market Share, Profitability Rallies Significantly

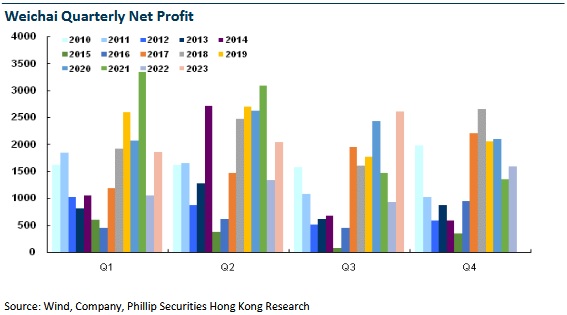

In accordance with the reports of Weichai Power for the first three quarters: The Company's revenue grew by 22.9% yoy to RMB160.38 billion from January to September 2023. The net profit attributable to the parent company stood at RMB6.5 billion with a year-on-year growth of 96.3%. The basic EPS was RMB0.75. Particularly, the revenue for the third quarter was RMB54,248 million, with a year-on-year and quarter-on-quarter increase of 23.9% and 2.9%, respectively. Additionally, the net profit attributable to the parent company amounted to RMB2,602 million, up 181.2% and 27.3% yoy and qoq, respectively.

With respect to registration, the Company occupied 34.1% of the engine market in the third quarter, up 10.1 ppts yoy. Meanwhile, the Company's large diameter engines feature a high ASP and strong profitability, thus maintaining a rapid growth in both sales and revenue in recent years. The Company occupied more than 30% of the domestic market of engines for heavy trucks above 500 horsepower, with a year-on-year increase of nearly 20 ppts.

Benefiting from the scale effect, the optimized sales structure, and the improved profitability of the subsidiary, KION, the Company's profitability recovered prominently. The overall gross margin in the first three quarters was 20.2%, up 3.3 ppts yoy. The net profit margin was 5%, growing by 2.1 ppts yoy. ROE was 8.4%, which climbed by 3.7 ppts yoy. For the third quarter, the gross margin reached 21.8%, with a quarter-on-quarter growth of 1.6 ppts. The net profit margin was 5.9%, up 1.1 ppts qoq.

The Equity Incentive Plan Outperforms Expectations, Indicating Great Confidence

The Company plans to repurchase shares, as shown in its 2023 A-share Restricted Equity Incentive Plan Draft released. It intends to grant 85.44 million shares of restricted shares in total to 716 directors, senior executives, Middle Management members, and core technicians, accounting for 0.98% of the total share capital. The target values of revenue for 2024, 2025, and 2026 in the draft are RMB210.2 billion, RMB231.2 billion, and RMB258.9 billion, respectively. The profit margin from sales is 8%, 9%, and 9%, respectively, and the target values of profit equivalent to these figures are RMB16.8 billion, RMB20.8 billion, and RMB23.3 billion. The above objectives exceed market expectations, indicating the Company's great confidence in its future performance growth.

Looking ahead, the Company's result is expected to continue to benefit from the accelerating penetration into the market of natural gas-fueled heavy trucks, the emerging competitive advantage in large diameter engines, the abundant export demand, and the constant improvement in operations of overseas subsidiaries. In the long run, the heavy truck industry will usher in development opportunities, because of constant economic recovery and the continuous increase in highway transport efficiency. The Company will continue to unleash its advantage of business diversity, accelerate strategic business, such as large diameter engines, hydraulic pressure powertrains, agricultural equipment, intelligent logistics, and new energy, and promote its mid- and long-term development.nated.

Investment Thesis

the Company has a clear strategic framework of "power engine + hydraulics + new energy". The domestic and overseas markets go hand in hand. The space for future development may be expected.

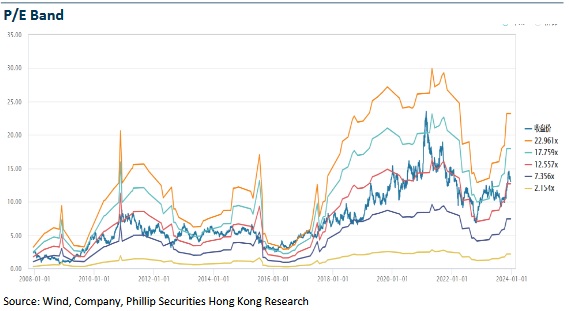

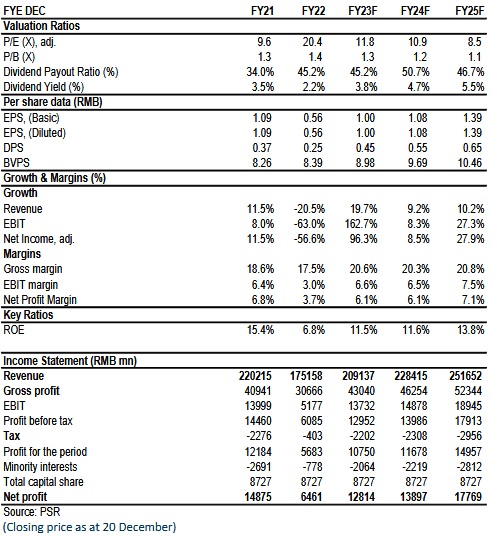

We forecast the EPS of the Company to be RMB 1.00/1.08/1.39 in 2023/2024/2025. We will also revise target price to 15.3 HKD (14.1/13.0/10.1x P/E and 1.6/1.4/1.3x P/B for 2023/2024/2025) and Accumulate rating. (Closing price as at 20 December)

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|