-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Robosense (2498.HK) - Global leader of automotive LiDAR, with Robot Business Milestone Breakthrough

Friday, March 28, 2025  3334

3334

Robosense(2498)

| Recommendation | Accumulate |

| Price on Recommendation Date | $40.550 |

| Target Price | $48.000 |

Weekly Special - 1318 MAO GEPING

Investment Summary

RoboSense is a leading global company in the field of LiDAR and perception solutions. Its main products currently include three categories: robot LiDAR, automotive LiDAR, and solutions. Benefiting from the increasing penetration of intelligent vehicles, the market size of automotive LiDAR is expected to continue to grow exponentially, with the industry competition following a "four-player competition" pattern. As the market penetration of LiDAR increases, the Company is seeing the release of scale effects, with its losses significantly narrowing. The Company is currently upgrading its strategy from a "vehicle sensor supplier" to a "robot perception system platform," and breakthroughs in overseas markets are also helping to unlock performance growth potential.

Company profile

RoboSense is a global leader in the field of LiDAR and perception solutions and was listed on the Hong Kong main board in January 2024. The Company is focused on chip-driven LiDAR hardware while also investing in artificial intelligence (AI) perception software technologies to form solutions. Through a "hardware + software" collaborative approach, it has built a complete technological ecosystem with chip-driven LiDAR hardware as the foundation and AI perception algorithms as the core. This enables large-scale commercial deployment in both automotive ADAS (Advanced Driver Assistance Systems) and robotics sectors. The Company's main products currently include three categories: robot LiDAR, automotive LiDAR, and solutions, with automotive LiDAR accounting for over 80% of its revenue.

According to data from China Insights Consultancy, the Company is one of the first global LiDAR companies to deploy proprietary chip technology. Its leading market position, customer-driven technology and products, and mass production capabilities are its main competitive advantages. The Company continually iterates to improve chip performance, developing proprietary chips to replace standard chips and optimize LiDAR technology. Its products include fully solid-state (E series), semi-solid-state (M series), and mechanical (R series) LiDAR products, allowing for the switching of LiDAR products based on mainstream technological routes to maintain its competitive advantage. The Company holds 1,849 patents (the highest globally), covering chip design (such as 2D scanning chips), optical systems (940nm laser solutions), and perception algorithms (RS-LiDAR-Algorithm).

The Company has established partnerships with more than 290 global automotive manufacturers and Tier 1 suppliers. In the rapidly growing intelligent robotics market, it has provided incremental components and solutions to over 2,600 robotics and other industrial clients, with customers in more than 40 countries and regions around the world.

Industry Analysis: Demand Surge, LiDAR Enters the "Intelligent Driving Equality" Era

LiDAR, through perception solutions that integrate vision or other sensors, can provide vehicles and robots with sensory capabilities that surpass human eyes. With automakers like BYD, Li Auto, and XPeng Motors integrating LiDAR into vehicles priced between RMB150,000 and RMB200,000, the penetration rate is expanding from the high-end market to the mainstream market, driving robust industry growth.

According to the Gasgoo Auto Research Institute, the total number of LiDAR units installed in China in 2024 is expected to reach 1.535 million, a yoy increase of approximately 180%. Among them, RoboSense ranks first with 515,000 units, a yoy growth rate of 311%. Its market share in automotive LiDAR stands at 33.5%, an increase of 10.7 percentage points year on year. Huawei and Hesai Technology rank second (27.4%) and third (25.6%), respectively, while Seyond holds 13.4% of the market. The top four players occupy the vast majority of the market (99.9%), with the industry presenting a "four-player competition" pattern.

According to China Insights Consultancy, with the acceleration of intelligent driving equality and the development of high-end vehicles with L3-level and above autonomous driving, the global automotive LiDAR market is expected to exceed RMB1,000.3 billion by 2030, with China's market approaching RMB346.1 billion. The global and Chinese Compound Annual Growth Rates (CAGR) from 2022 to 2030 are projected to be 103.2% and 104.2%, respectively.

Performance Trends Validate Growth Logic: High Revenue Growth, Improving Gross Margin

With the increase in domestic automotive LiDAR shipments, the Company's automotive LiDAR shipment volume grew from 37 thousand units in 2022 to 515 thousand units in 2024. This has driven segment revenue from RMB160 million in 2022 to RMB940 million in Q1-Q3 of 2024. In the robotics business, the Company's shipments remained stable from 2022 to Q1-Q3 of 2024, with segment revenue decreasing from RMB240 million in 2022 to RMB130 million in Q1-Q3 of 2024, primarily due to product structure adjustments, with business revenue accounting for approximately 12% of total revenue.

Thanks to the explosion of automotive LiDAR demand, the Company's MX series products saw rapid growth. In Q1-Q3 of 2024, the Company's total revenue reached RMB1,135 million, a yoy increase of 91.52%. Benefiting from the scale effect and the chip-based and integrated nature of products, fixed costs were diluted, leading to significant cost reduction on the E platform, and the gross margin increased by 8.93 percentage points to 14.96% compared to 2023.

In terms of average unit price, the average price of the Company's automotive LiDAR has gradually decreased from nearly RMB10,000 in 2021 to approximately RMB2,500 in Q1-Q3 of 2024. The new generation of mid-range MX products is expected to be priced below USD200, with further price reductions expected. The average price of the Company's robot LiDAR has decreased from over RMB15,000 in 2021 to approximately RMB8,200 in Q1-Q3 of 2024.

According to the positive profit warning announcement issued by the Company on February 24, 2025, the total revenue for 2024 is expected to reach RMB1.63 billion to RMB1.67 billion, a yoy increase of 45.5% to 49.1%, with net losses narrowing by 88% to 90%, estimated at RMB430 million to RMB520 million. This performance validates the Company's continuing release of scale effects amid the increased market penetration of LiDAR technology and the significant narrowing of losses.

Robot Business Milestone Breakthrough, Overseas Market Expansion Boosts Valuation

According to a report by China Insights Consultancy, the global robot LiDAR market is expected to grow from RMB8.2 billion in 2022 to RMB216.2 billion by 2030, equivalent to a CAGR of 50.6%. China is projected to become the largest market by 2030, accounting for about 31.8% of the global market, nearing RMB70 billion.

In January 2025, the Company delivered its 1 millionth LiDAR unit (E1R) to humanoid robot enterprises and held the “Hello Robot” event, where it launched three new types of robot vision products: EM4 (ultra-long-range digital radar), E1R (robot fully solid-state digital LiDAR), and Airy (hemispherical digital LiDAR). The Company also released robot vision solutions like ActiveCamera and key robot components such as the second-generation dexterous hand, FS-3D force sensor, and DC-G1 domain controller, marking the Company's strategic upgrade from a "vehicle sensor supplier" to a "robot perception system platform." As of November 2024, the Company has established partnerships with over 2,600 robotics companies, and it is expected that robot shipments will surpass 100 thousand units in 2025, potentially becoming the second growth curve after ADAS.

In March 2025, Mercedes-Benz announced plans to equip global vehicle models with RoboSense LiDAR. This marks the first time Chinese LiDAR technology has entered the supply chain of a top international automaker. The Company has already secured agreements with four overseas OEMs (original equipment manufacturers). In the long run, breakthroughs in overseas markets will open up significant growth potential for the Company's performance.

Investment Thesis

As a leading player in automotive-grade LiDAR, the Company has passed stringent automotive-grade certification, giving it a quality advantage and cost advantages from large-scale production. As the leader in automotive-grade LiDAR, the Company is expected to continue expanding its market share in the robotics sector. Its accelerated entry into the robotics industry will unlock a new growth point for the Company's performance.

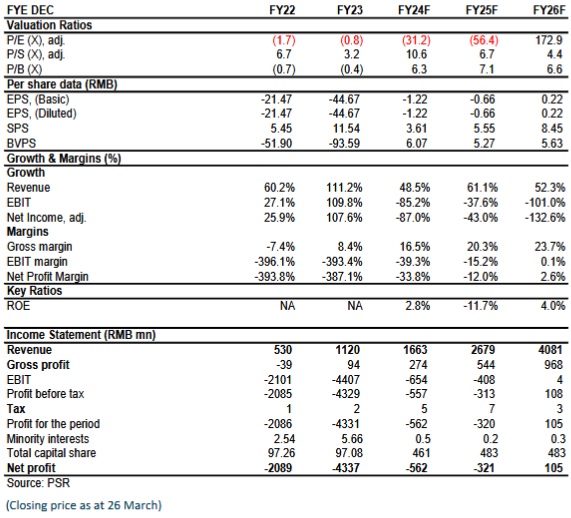

As for valuation, we expected diluted SPS (Sales Per Share) of Robosense to RMB 3.61/5.55/8.45 of 2024/2025/2026, considering the explosive potential of its robot business, we gave the target price to HKD 48, respectively 12.5/8/5.2x P/S for 2024/2025/2026. "Accumulate" rating. (Closing price as at 26 March)

Risk

Car sales fell short of expectations, and the promotion of intelligence was slower than expected, dragging down the demand for LiDAR

The progress of robot advancement is lower than expected

The change in technical path affects the demand for LiDAR

Risk of rising raw material prices

Competitor catch-up risk

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|