Post-dated eDDA transaction function is now available in both POEMS Web and APP. You may schedule your deposits within a month. Scheduled deposits will be executed at 9am on the day you have chosen.

Important notes for eDDA

Please be aware of the following points when registering for eDDA:

1. Minsheng Bank does not support eDDA;

2. Nanyang Commercial Bank only support account registered with HKID or passport;

3. ICBC: please register with the bank account number not ending with 0;

4. BEA: eDDA does not support comprehensive or multicurrency accounts;

5. Citibank and OCBC Wing Hang: Due to their internal settings, errors may occur during setup or transfer.

Several other banks may also encounter issues when registering for eDDA.

Please rest assured that we are working our hardest to allow our clients to register for eDDA with their banks of choice. We will send out a notification when there are updates and humbly ask for your continued patience.

What are the benefits of eDDA?

eDDA is an FPS-like payment method but with more convenience! With eDDA, clients can initiate a transfer from a bank account to Phillip Local Stock’ account within 30 seconds via POEMS web. Benefits include:

- Not needing to provide proof of deposit

- Free of charge

- 24/7 availability, anytime, anywhere

- Trade with the deposited money instantly

Who is eligible for registering eDDA:

- The client must have an individual POEMS account

- The client has already registered an individual bank account under one’s Phillip account

- The registered bank account supports eDDA service

Take a minute, register now and enjoy the real-time deposit here after!

Register eDDA NOW to receive HKD200 e-Coupon

Terms and Conditions

- First promotion period is valid from 22nd March 2021 until 22nd April 2021, both dates inclusive ("first promotion period"), Second promotion period is valid from 23rd April 2021 until 30th April 2021, both dates inclusive ("second promotion period").

- If clients successfully establish an electronic direct debit authorization (eDDA), and successfully make one eDDA transfer no less than HKD 1,000 within the promotion period to their respective Phillip account, the client will be entitled to a total of HKD 200 E-Coupon.

- The e-coupon will be distributed to clients’ account within three working days after each promotion period.

- Clients entitled to the e-coupon from the first promotion period will not be eligible for the e-coupon in second promotion period.

- All E-Coupons will be valid until 31st December 2021, day inclusive.

- E-Coupon can only be used for commission and handling fee rebate. All rewards are non-exchangeable and non-transferable.

- Phillip reserves the right to cancel, delete, replace, supplement or amend any relevant terms and conditions of this promotion without notice. Phillip reserves the right to make the final decision in case of disputes.

Expand all|Hidden all

Frequently Asked Question

1. What is eDDA?

*Subject to the processing time of your bank(s).

2. What are the benefits of using the eDDA service via POEMS (Mobile Banking)?

*Subject to the processing time of your bank(s).

3. How long does it take to set up an eDDA?

4. Will there be any charge for setting up eDDA?

5. Can I modify or cancel my eDDA instruction?

6. Can I access the eDDA service on my POEMS mobile app?

7 Is there a limit to how much I can transfer?

The maximum temporary fund we will automatically credit to your account is HKD 1,000,000 per deposit.

8. Can I withdraw money through eDDA?

9. Can I set up an eDDA at my own bank?

10. Can I set up an eDDA using any bank?

11. How will I know whether the eDDA initiation / transfer is successful?

12. What product does eDDA support?

13. Why did my eDDA not work? What should I do?

-Using a joint account on either the payment bank and/or Phillip account.

-Mobile number used to register for eDDA is not the same as the one registered with the bank account.

-Registering with Citibank and OCBC Wing Hang. Due to their internal settings, errors may occur during setup or transfer. If this happens to you, please consider registering with another bank.

For any other reasons or enquiries, please contact our Customer Service department.

14. Do I have to give instruction every time when I have an additional financial obligation with Phillip?

15. If I change my mobile device, is re-application required for eDDA Services?

16. Can I submit a transfer instruction that is to be executed in the future?

17. After scheduling a post-dated transfer instruction, how can I modify/cancel the instruction?

18. Why the platform does not shown my deposit yet?

Please note that the temporary fund displayed when depositing Chinese Yuan (CNY) is its current Hong Kong Dollar (HKD) exchange rate value, for reference only. The actual deposit shown in that day's statement will be in CNY.

When making payments, please confirm that the correct mobile phone number for:

Local Stock (HKD): 96908828

Local Stock (CNY): 96908838

is entered, and that the payee name displayed is Phillip Securities (Hong Kong) Ltd.

Local Futures/Foreign Futures/Forex (HKD): 96908868

is entered, and that the payee name displayed is Phillip Commodities (H.K.) Limited (Note: H.K.in abbreviation. Limited in full form)

What are the benefits of using FPS?

We are offering a new service that not only allows clients to make deposits in near-real-time, but also:

1. Not need to provide additional supporting documents to confirm the deposit;

2. Be able to see the deposit in POEMS/SATS in as few as two minutes, depending on the payment bank; and

3. Benefit from 24-hour availability, including weekends and public holidays.

With this system, clients can enjoy the increased efficiency of FPS, without having to worry about calling or sending deposit proof to us.

*The maximum amount of temporary funds we allow is HKD equivalent 1,000,000 per transaction. These temporary funds are automatically added.

Please note that in order for clients to not need to provide a deposit confirmation to us, that your:

a. depositing bank account must be the same bank account as one of your registered accounts with Phillip;

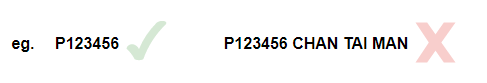

b. account number at Phillip (eg.P123456, Local futures: 123456; Foreign futures: F123456; Forex: 123456) must be typed in the reference ("Message to Beneficiary") section, with no spaces or other characters; and

c. Depositing bank account name is exactly the same as your registered name at Phillip.

Please note that this service is currently only available for Hong Kong local stock, and only supports Hong Kong Dollars (HKD) and Chinese Yuan (CNY) at present.

Note for clients using CMB/Wing Lung:

There may not be a reference field for you to input your Phillip account number. However, if your bank account number and name is exactly the same as registered with Phillip, we will ensure that your deposit will be credited to you as soon as possible.

1. What is FPS?

Faster Payment System (FPS) is a real-time payment service platform which provides full connectivity between banks. It enables instant cross-bank transfer at no cost, 24 hour service availability. Client can send and receive money with just a mobile number upon successful registration.

2. How can I make sure I am depositing to Phillip Securities?

Local Stock (HKD): 96908828

Local Stock (CNY): 96908838

is entered, and that the payee name displayed is Phillip Securities (Hong Kong) Ltd.;

Local Futures/Foreign Futures/Forex (HKD): 96908868

is entered, and that the payee name displayed is Phillip Commodities (H.K.) Limited (Note: H.K.in abbreviation. Limited in full form)

3. How do I know if my deposit has been successfully made?

After clicking ‘Confirm’ for the payment made with your depositing bank, you will be able to see your deposit in:

Local Stock:

POEMS > HK Stock > Teletext > Positions > Fund Trf (POEMS web)

POEMS > Stock > Portfolio > Fund Trf (POEMS App)

SATS > Trade > Positions

Local Futures:

POEMS > HK Futures & Index Options > Futures Trading > TRF (POEMS web)

HK Futures > Portfolio > Account Balance > Fund Trf (POEMS App)

FATS > Indicative Equity > Cash TRF

Foreign Futures:

POEMS>Foreign Futures>Foreign Futures Trading>Financial Summary>Equity (POEMS web)

F Futures > Portfolio > Account Balance > Equity (POEMS App)

FATS>FF Positions>Equity

Forex:

POEMS>Forex>Forex Trading (New)>Balance>Deposit (POEMS web)

Forex > Portfolio > Account Balance > Fund Trf (POEMS App)

You may also receive a confirmation message from your payment bank via SMS and/or Email if the payment was successful. For more information, including your payment history, please contact your payment bank.

4. How do I deposit using FPS?

For us to successfully receive the deposit, the following criteria need to be fulfilled:

a) Depositing bank account must be the same as one already registered with Phillip.

b) Your account number at Phillip (e.g. P123456, Local futures: 123456; Foreign futures: F123456; Forex: 123456) must be typed in the reference section, with no spaces or additional characters.

c) Depositing bank account must be the same name as your name as registered with Phillip.

If you are unable to see your deposit in POEMS / SATS within five minutes, please contact our Customer Service at 2277 6555.

For detailed instructions on how to make deposits via FPS, please click here.

5. Why have I not received my deposit yet?

To ensure that deposits are received and displayed on POEMS/SATS, please make sure to make the deposit with your designated bank account number and input your own Phillip account number (eg.P123456, Local futures: 123456; Foreign futures: F123456; Forex: 123456) with no space and/or other characters. If your deposit was indeed made by a third party, please contact your Account Manager or our Customer Service hotline at 2277 6555.

Please note that 3rd party deposits are NOT accepted. Third-party deposits will be rejected and returned to the depositor’s bank account, or deposited into the depositor’s Phillip account if the depositor has an account with us.

6. Can I make deposits for my family or friends?

We do not accept third-party deposits. If we find that a third-party deposit has been made, we may reject and return the deposit to the depositing bank account, or to the client’s Phillip account if the client has an account with us.

If your deposit was indeed made by a third party, please contact your Account Manager or our Customer Service hotline at 2277 6555.

7. How long does it take for me to see the deposit?

The deposit can be seen in your trading platform in as few as 2 minutes from the moment the deposit is confirmed from your depositing bank.

Please make sure that you are depositing with a bank account registered at Phillip, and that your Phillip account number (e.g. P123456, Local futures: 123456; Foreign futures: F123456; Forex: 123456) is inputted in the customer reference, with no spaces or other characters.

Please note that we do not accept third party deposits; if a third-party deposit is made, the deposit will not be credited to your account.

8. Why is my deposit not shown in my statement?

Deposits made before 5 p.m. the same working day can be seen in the statement of that day. Deposits made after 5pm will be shown in the next working day’s statement.

9. Where do my deposits go?

Deposits made to us will appear in your respective Phillip account. Please note that we currently only accept FPS payments made in Hong Kong Dollars or Chinese Renminbi.

Once a deposit is made successfully, clients will be able to see their deposits in as little as two minutes after logging in the following locations:

Local Stock:

POEMS > HK Stock > Teletext > Positions > Fund Trf (POEMS web)

POEMS > Stock > Portfolio > Fund Trf (POEMS App)

Local Futures:

POEMS > HK Futures & Index Options > Futures Trading > TRF (POEMS web)

HK Futures > Portfolio > Account Balance > Fund Trf (POEMS App)

FATS > Indicative Equity > Cash TRF

Foreign Futures:

POEMS>Foreign Futures>Foreign Futures Trading>Financial Summary>Equity (POEMS web)

F Futures > Portfolio > Account Balance > Equity (POEMS App)

FATS>FF Positions>Equity

Forex:

POEMS>Forex>Forex Trading (New)>Balance>Deposit (POEMS web)

Forex > Portfolio > Account Balance > Fund Trf (POEMS App)

10. Can I use QR code to make deposits?

We do not currently support deposits made via QR codes.

11. What is special about our FPS compared to others?

Local Stock (HKD): 96908828

Local Stock (CNY): 96908838

is entered, and that the payee name displayed is Phillip Securities (Hong Kong) Ltd.;

Local Futures/Foreign Futures/Forex (HKD): 96908868

is entered, and that the payee name displayed is Phillip Commodities (H.K.) Limited (Note: H.K.in abbreviation. Limited in full form)

12. Do I need to register for FPS?

Registration is optional; deposits made via e-Banking transfer will be done via FPS if your depositing bank supports FPS.

13. Do I need to add Phillip Securities as a payee?

Adding Phillip Securities is recommended, as it reduces the amount of time inputting deposit information and also increases the payment limit of FPS, which is subject to your depositing bank's allowance.

To understand more regarding the payment limit of different banks, please click here

14. What is the payment limit?

The payment limit is set by each bank and is different across all banks. We do not have a transaction limit for receiving payments; however, the maximum amount of temporary funds we allow is HKD equivalent 1,000,000 per transaction. These temporary funds are automatically added and unlimited.

To understand more regarding the payment limit of different banks, please click here.

*Temporary funds can be found under POEMS > Portfolio (POEMS iPhone app) / Positions (POEMS Android app & POEMS website) > Fund Trf. or SATS > Trade > Positions.

15.Who is eligible for FPS?

Only those registered for e-banking are able to use FPS.

16. I deposited to the wrong payee. Can I cancel my deposit?

As all payments are made in real-time and are final upon confirmation, any payments made are irreversible. Please ensure that the recipient and transfer details as shown below are correct before pressing ‘Confirm’.

When making payments, please confirm that the correct mobile phone number for:

Local Stock (HKD): 96908828

Local Stock (CNY): 96908838

is entered, and that the payee name displayed is Phillip Securities (Hong Kong) Ltd.;

Local Futures/Foreign Futures/Forex (HKD): 96908868

is entered, and that the payee name displayed is Phillip Commodities (H.K.) Limited (Note: H.K.in abbreviation. Limited in full form)

17. What should I do if I don’t see my deposit within five minutes?

If you cannot see your deposit in POEMS/SATS within five minutes, please contact our Customer Service hotline at 2277 6555.

Hong Kong Securities Account

Clients can deposit via the following channels:

FPS

FPS- Our Company bank accounts;

- Standard Chartered Bank Easy Pay Account*;

- Submit Cheque In-person. Clients can come in-person to our Company’s Head Office for handling the deposit.

*For customers who opened an account before 21 December, 2019

Non Hong Kong Securities Account

Clients can deposit via the following channels:

- Our Company bank accounts;

- Submit Cheque In-person. Clients can come in-person to our Company’s Head Office for handling the deposit.

Clients should notify our Company immediately via designated electronic channels or phone calls to our Sales and Customers Services Hotline at (852) 2277 6666 / 2277 6555 after deposit completed. Please do not dial other telephone numbers of our Company for deposit notification

Bank of China Internet Banking (Bill Payment)

Clients can use the Easy Pay Account to deposit fund through the "Bill Payment" function in Bank of China Internet Banking. For more detail, please click here.

Online Banking / Phone Banking / ATM / Bank Counter Cash Bank-in Service / Cheque / Telegraphic Transfer

Clients should notify our Company immediately via designated electronic channels or phone calls to our Sales and Customers Services Hotline at (852) 2277 6666 / 2277 6555 after deposit completed. Please do not dial other telephone numbers of our Company for deposit notification.

Cheque deposited to Securities / Stock Options Accounts should be made payable to "輝立証券 (香港) 有限公司" or "Phillip Securities (HK) Limited".

Cheque deposited to Futures / Forex Accounts should be made payable to "輝立商品 (香港) 有限公司" or "Phillip Commodities (HK) Limited".

Cheque deposited to Bullion Accounts should be made payable to "Phillip Bullion Limited".

Trading is allowed for clients only after relevant bank has successfully completed the cheque clearing process.

Clients who need to deposit by telegraphic transfer, please click here for more details.

Payment made after 17:00 on trading day will be updated to your securities trading A/C in next trading day.

Deposit channel without providing notification is NOT recommended. e.g. phonebanking, chequebox.

Please Keep the deposit advice for at least 3 months.

Please note that our Company does not accept deposit from third party(parties)

Standard Chartered Bank Easy Pay Account*

We have created a designated Standard Chartered Easypay account for each client for settling your local stock account transaction. Easier and free of charge! The deposit amount less than HKD 200,000 will be reflected on your local stock account in the following day once the deposit had been confirmed. Deposit HKD 200,000 or above to Standard Chartered Bank “Easy-Pay” Account, is required to provide all documentation as proof of deposit, the proof must clearly show the client's full name OR client’s bank account number as it registered with Phillip Securities (Hong Kong) Limited. Where the initial documentation does not fulfill this requirement, additional proof is needed to confirm the depositor's identity. This can be achieved by providing documentation that shows both the client’s full name AND bank account number. Where a client opts to deposit funds by cheque, the client needs to provide a copy of the cheque and documentary proof that the cheque is drawn from the client’s bank account. Phillip hereby reminds client that our company does not accept deposit from third party.

*1. For client who opened an account before 21 December, 2019; 2. If the Standard Chartered Easypay account has not be used for a long period of time, the Easypay accounts will lapse automatically.

Submit Cheque In-person

To protect clients’ interests, clients can come in-person to our Company’s Head Office for handling the deposit.

Cheque deposited to Securities / Stock Options Accounts should be made payable to "輝立証券 (香港) 有限公司" or "Phillip Securities (HK) Limited".

Cheque deposited to Futures / Forex Accounts should be made payable to "輝立商品 (香港) 有限公司" or "Phillip Commodities (HK) Limited".

Cheque deposited to Bullion Accounts should be made payable to "Phillip Bullion Limited".

Trading is allowed for clients only after relevant bank has successfully completed the cheque clearing process.

Payment made after 17:00 on trading day will be updated to your securities trading A/C in next trading day.

Please note that our Company does not accept deposit from third party(parties)

Expedited Account Opening - Clients opening an account online should make a transfer of not less than HK$10,000 via FPS to our mobile number (9690 8828). If your bank does not support FPS, you can bank transfer to our Standard Chartered account (447-0-035931-4).

Stock / Global Securities Accounts

Note:

Please make the check payable to"PHILLIP SECURITIES (HK) LIMITED".

Stock Options Accounts

Note:

Please make the check payable to "PHILLIP SECURITIES (HK) LTD. - OPTION CLIENT".

| Bank | Account | Currency |

|---|---|---|

| Stock Account | ||

| 恒生銀行 HANG SENG BANK | 371-066168-001 | 港元(HKD) |

| 渣打銀行 STANDARD CHARTERED BANK | 447-0-035931-4 | 港元(HKD) |

| 中國銀行 BANK OF CHINA | 012-806000-23356 | 港元(HKD) |

| 匯豐銀行 HONG KONG BANK | 600-816813-001 | 港元(HKD) |

| 工銀亞洲 Industrial and Commercial Bank of China (Asia) | 861-502-01669-2 | 港元(HKD) |

| 匯豐銀行 HONG KONG BANK | 600-816813-209 | 人民幣(CNY) |

| 渣打銀行 STANDARD CHARTERED BANK | 003-447-0-778607-2 | 人民幣(CNY) |

| 中國銀行 BANK OF CHINA | 012-806-0-600520-6 | 人民幣(CNY) |

| 渣打銀行 STANDARD CHARTERED BANK (For Bond or Unit Trust transactions settled in USD only) | 447-1-073302-2 | 美元(USD) |

| Stock Options Account | ||

| 渣打銀行 STANDARD CHARTERED BANK | 447-0-043911-3 | 港元(HKD) |

| 匯豐銀行 HONG KONG BANK | 600-816813-002 | 港元(HKD) |

| 中國銀行 BANK OF CHINA | 012-875-0-041156-7 | 港元(HKD) |

| Global Securities Account | ||

| 渣打銀行 STANDARD CHARTERED BANK | 447-1-072120-2 | 美元(USD) |

| 渣打銀行 STANDARD CHARTERED BANK | 447-0-067675-1 | 日元(JPY) |

| 渣打銀行 STANDARD CHARTERED BANK | 447-0-067671-9 | 新加坡元(SGD) |

| 渣打銀行 STANDARD CHARTERED BANK | 447-1-772661-7 | 加拿大元(CAD) |

| 匯豐銀行 HONG KONG BANK | 600-816813-201 | 美元(USD) |

| 匯豐銀行 HONG KONG BANK | 808-190599-277 | 澳元(AUD) |

| 匯豐銀行 HONG KONG BANK | 808-190599-275 | 歐羅(EUR) |

| 匯豐銀行 HONG KONG BANK | 808-190599-276 | 英磅(GBP) |

| 匯豐銀行 HONG KONG BANK | 808-190599-278 | 日元(JPY) |

| 匯豐銀行 HONG KONG BANK | 808-190599-280 | 新加坡元(SGD) |

| 匯豐銀行 HONG KONG BANK | 808-190599-279 | 加拿大元(CAD) |

| 匯豐銀行 HONG KONG BANK | 808-190599-281 | 瑞士法郎(CHF) |

| 恒生銀行 HANG SENG BANK | 395-669732-883 | 美元(USD) |

| 中國銀行 BANK OF CHINA | 012-875-0-802025-9 | 美元(USD) |

| 工銀亞洲 Industrial and Commercial Bank of China (Asia) | 861-506-937049 | 美元(USD) |

Hong Kong Futures / Global Futures / Forex Account 戶口

Note:Please make the cheque payable to"輝立商品(香港)有限公司" or "Phillip Commodities (HK) Limited".

輝立商品(香港)有限公司 PHILLIP COMMODITIES (HK) LIMITED

| Bank | Account | Currency |

|---|---|---|

| Hong Kong Futures Account | ||

| 渣打銀行 STANDARD CHARTERED BANK | 447-0-043906-7 | 港元(HKD) |

| 渣打銀行 STANDARD CHARTERED BANK | 447-0-680762-9 | 美元(USD) |

| 渣打銀行 STANDARD CHARTERED BANK | 447-1-785714-2 | 人民幣(CNY) |

| 匯豐銀行 HONG KONG BANK | 600-663405-002 | 港元(HKD) |

| 恒生銀行 HANG SENG BANK | 371-210618-001 | 港元(HKD) |

| 中國銀行 BANK OF CHINA | 012-806000-40359 | 港元(HKD) |

| Global Futures / Forex Account | ||

| 渣打銀行 STANDARD CHARTERED BANK | 447-0-059663-4 | 港元(HKD) |

| 渣打銀行 STANDARD CHARTERED BANK | 447-0-059511-5 | 美元(USD) |

| 渣打銀行 STANDARD CHARTERED BANK | 447-0-059507-7 | 日元(JPY) |

| 渣打銀行 STANDARD CHARTERED BANK | 447-1-785715-0 | 人民幣(CNY) |

| 匯豐銀行 HONG KONG BANK | 600-663405-003 | 港元(HKD) |

| 匯豐銀行 HONG KONG BANK | 600-663405-201 | 美元(USD) |

| 中國銀行 BANK OF CHINA | 012-875-0-057998-0 | 港元(HKD) |

| 中國銀行 BANK OF CHINA | 012-806-92-17743-2 | 美元(USD)/人民幣(CNY) |

Bullion Account

Note:

Please make the cheque payable to「Phillip Bullion Limited」。

PHILLIP BULLION LIMITED

| Bank | Account | Currency |

|---|---|---|

| Bullion Account | ||

| 渣打銀行 STANDARD CHARTERED BANK | 447-1-689867-8 | 港元(HKD) |

| 渣打銀行 STANDARD CHARTERED BANK | 447-1-689871-6 | 美元(USD) |

| 匯豐銀行 HONG KONG BANK | 808-695092-292 | 港元(HKD) |

| 匯豐銀行 HONG KONG BANK | 808-695092-274 | 美元(USD) |

| 中國銀行 BANK OF CHINA | 012-806-1-0273259 | 港元(HKD) |

| 美元(USD) |

Deposit Confirmation

- Email to cs@phillip.com.hk or POEMS apps function [Deposit] to upload the proof(s). All documentation provided as proof of deposit must clearly show the client's full name OR client’s bank account number as it registered with Phillip Securities. Where the initial documentation does not fulfill this requirement, additional proof is needed to confirm the depositor's identity. This can be achieved by providing documentation that shows both the client’s full name AND bank account number. Where a client opts to deposit funds by cheque, the client needs to provide a copy of the cheque and documentary proof that the cheque is drawn from the client’s bank account.

- Contact Customer Service hotline at 2277 6555 / 2277 6666 for confirmation (Only for transaction amounts which are below HKD200,000 and NOT the multiples of HKD 1,000)

- Fax the deposit slips to Customer Service Department by 2277 6008 / 28685307 (Please clearly write both your Phillip account no. and account name on the deposit slips), or visit our office at Admiralty (For transaction amounts equivalent or above HKD200,000).

- If no deposit confirmation is received after transaction, Phillip will contact the correspondent banks to obtain depositor information, and the additional costs incurred will be borne by the clients.

Confirmation of Deposit is not required for the following methods

For your convenience you are not required to inform or provide us with any deposit notification. The amount will be automatically reflected on your account of that day^.

FPS

FPS- Easy-pay account service

- Reference of your designated account number of Phillip Securities (HK) Ltd is displayed on the bank advice from Bank of China/ Standard Chartered Bank. (Applicable to all accounts).

^All deposits made before 5pm will be processed and shown in the daily statement of that day. Deposits made after 5pm will be processed in the next working day.

Mainland clients can open ICBC (Asia) account through witness service by ICBC (China) and without visit Hong Kong. It can convenient Phillips' client to transfer fund from Phillip account to clients bank account.

A. Application procedure

Mainland clients need to process the following procedures in Mainland:

- Open ICBC (China) bank account (the applicants need to make an appointment)

- Open ICBC (Asia) through ICBC(China)

- Apply ICBC (Asia) online banking

For more detail, please click here.

B. Documents requirements

- China's Permanent ID Card

- Permit or Passport (Effective endorsement more than three months)

- Address proof (i.e. banking statement, Electricity bill, Phone bill, lease agreement and so on. All the documents should not exceed last 3 months).

Also, client can login ICBC (Asia) website to submit online application form in advance before go to ICBC (China) for the formal witness service procedures.

C. Withdrawal Procedure

After the completion of ICBC (Asia) bank account, client can withdraw on the following ways:

First, clients are required to inform their Account Executive or Customer Service Officer accordingly. Instructions given before 09:20 will be processed on the same day, otherwise they will be processed on the following transaction day. The fund will be credited to the client’s ICBC (Asia) account.

After that, client can use ICBC (Asia) "Online banking" to transfer the fund to their ICBC (China) bank account.

Cash Withdrawal and Funds Transfer:

1. Please note that we only transfer funds from your Securities/ Commodities/ Bullion account to client's pre-registered bank account (to nearby area only), and clients are required to inform their Account Executive or Customer Service Officer accordingly. Instructions given before 09:20* will be processed on the same day, otherwise they will be processed on the following transaction day. Also, the administration fees will be applied if clients withdraw fund except to the local bank in Hong Kong Dollar, China Yuan (CNY) and U.S. Dollar; or the transfer will be taken by Telegraphic Transfer.

2. Funds will always be transferred to client's pre-registered bank account by cheque on the following conditions:

- If the withdrawal amount is more than HKD 500,000.

- If clients withdraw money from other than local stock account.

- If client's pre-registered bank account is NOT HSBC/Hang Seng Bank/ Bank of China/ Standard Chartered Bank and has been verified, the processing time may take 3 business days.

- In order to authenticate the client's registered bank account. If it is the first, second and third time money withdrawal to aforementioned banks.

3. Instructions given before cut-off time of transferring money within client's account (before 16:30 of each transaction day) will be processed on the same day, otherwise the transfer will be processed in the next transaction day.

4. The fund withdrawal of the client who has registered the Phillip HKD money market fund may not be handled accordingly due to the uncertain market value of Phillip HKD money market fund.

5. Virtual Bank Withdraw/Transfer Notice

- We accept client transfer fund to us by Virtual Bank account. But, Online Onboarding Client should register virtual bank as their Phillip account's designated bank account before transfer fund to Phillip;

- Client must successfully transfer fund by mobile number 96960082 via FPS and provide bank proof to Customer Service for registering Virtual Bank as Designated Bank Account;

- We only accept client withdraw Hong Kong Dollars/ China Yuan (CNY) to designated virtual bank account. The Maximum transfer limit is HKD 1 million. If the withdrawal limit is more than HKD 0.5 million or withdraw fund except to Hong Kong Dollar and China Yuan (CNY). The transfer will be taken by Chats or Telegraphic Transfer and it will charge handling fees HKD 150 for Chats and HKD 400 for Telegraphic Transfer.

6. Starting from 16 November, 2020, the Company will process the withdrawal instructions according to the latest activities of the account and calculate the allowable amount of withdrawal immediately before 9:30 A.M..

- The amount of trading activities on the day before the withdrawal (including the PhillipMart trading and the IPO subscription amount deducted on public subscription closing day); and/or

- The amount of done trades and uncompleted buy orders during the Pre-opening Session; and/or

- The amount to be settled on the next working day.

Securities / Commodities Account

Instructions given before cut-off time (16:30) of transferring money within clients' securities / commodites account will be process on the same day, otherwise the transfer will be processed in the next transaction day.

Bullion Account

Client need to submit “Request for Fund Transfer” form to Bullion Department for transferring fund from Securities/ Commodities Account to Bullion Account by fax (852)2277-6866 or email (bullion@phillip.com.hk). Please contact Bullion Department at (852)2277 6711 to confirm the payment.

Client need to submit “Client Money Standing Authority” Form for transferring fund form Bullion Account to Securities/ Commodities Account during open Bullion Account. Please contact Bullion Department at (852)2277-6711 to request fund transfer.

Online Onboarding Client Notice

Online onboarded clients must make fund deposit via online banking to or withdrawal from Client’s Phillip account through their designated bank account. The following deposit channels are not applicable for the online onboarded clients: Standard Chartered Bank “Easy Pay” Account, the Bill Payment function of Bank of China Internet Banking and “PPS”.

Deposit Proof

Online onboarded clients must show that the debited bank account of the transfer is identical to the designated bank account on all deposit proofs. Otherwise, the transfer may be reversed. Phillip does not accept deposit confirmation via other methods (e.g. telephone) for online onboarded clients.

Cash Deposits

Online onboarded clients will be required to visit our head office or branch in person with the original copy of the deposit slips and the identity document provided at the time of the account opening for identity authentication before crediting the deposit to the client’s Phillip account.

Registering an additional Designated Bank Account

Online onboarded clients must transfer not less than HKD 10,000 to the designated bank account of Phillip Securities (Hong Kong) Limited for the first deposit and email the deposit proofs to Customer Service (cs@phillip.com.hk).

Withdrawal Instructions

In order for withdrawal instruction to be done on the same day, clients need to five the instruction to their Account Executive before 9:20am; otherwise the withdrawal will be processed on the following business day. Please be reminded that the fund could only transfer from client’s Phillip account to the client’s designated bank account. In addition, if clients withdraw funds in a currency other than Hong Kong Dollar, China Yuan (CNY) and U.S. Dollar to a local bank, the transfer conducted by Telegraphic Transfer. The associated administrative fees will be passed on to the client.

*Please note that our Company does not accept deposit from third party(parties). Please Keep the deposit advice for at least 3 months.

*Regardless of the currency client deposits, no interest will be paid.

*If no deposit confirmation is received after transaction, Phillip will contact the correspondent banks to obtain depositor information, and the additional costs incurred will be borne by the clients.

*Individual client using a joint bank account that any one of the joint bank account owners is not the client of Phillip to deposit fund/withdraw fund/as a designated bank must explain their relationship and provide identity document of the bank account holder (not client of Phillip) and provide a bank proof with the name of all joint bank account holders (Bank statement/bank card).

*While we endeavor to ensure accuracy and completeness, there may be external circumstances that may affect the time necessary for us to receive your deposits. If you come across any issues, please contact our Customer Service hotline at 2277 6555. Please note that our hotline’s operating hours are 9:00 to 18:00 from Monday-Friday.