-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Main

Last Update Date:8 January 2020

Notes, Risk Disclosure and Disclaimer

Independence intermediary

Phillip Securities (Hong Kong) Ltd. is an independent intermediary for the product of bonds because:

1. we do not receive fees, commissions, or any other monetary benefits, provided by any party in relation to the distribution of the investment product to you; and

2. we do not have any close links or other legal or economic relationships with the product of bond issuers, or receive any non-monetary benefits from any party, which are likely to impair its independence to favour any bond product, any class of bond products or any bond issuer.

Key Product Risks

It is crucial to understand the specific forms and risks mentioned in the relevant offering documents (if applicable) before investing. Key risks include but are not limited:

●Credit Risk

Investors assume credit risk of the Issuer and the Guarantor (if applicable). Any changes to the credit rating of them will affect the price and value of the bonds. Bonds are subject to the risk of the issuer defaulting on its obligations, i.e. An issuer fails to make principal and interest payments when due. The worst case such as bankruptcy of the Issuer/Guarantor will result in the loss of your entire investment. Credit ratings assigned by credit rating agencies do not guarantee the creditworthiness of the issuer.

●Liquidity Risk

The bond may have limited liquidity and may not be actively traded and/or quoted by brokers in the market. As such,

(i)The value of bond and/or indicative bid/offer price will depend on market liquidity and conditions and may not be available at all times;

(ii)It may take a longer time or impossible to sell the bond to the market and;

(iii)The executable sale price may be unfavourably different by large amounts from the indicative bid price quoted.

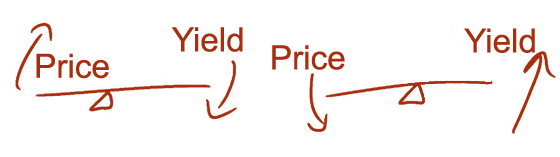

●Interest Rate Risk

Bonds are more susceptible to fluctuations in interest rates and generally prices of bonds will fall when interest rates rise.

●Market Risk

The value of investments may fluctuate due to changing political, legal, economic conditions and change in interest rate. This is common to all markets and asset classes. Investor may get back an amount substantially less than initially invested.

●Currency Risk

For bonds denominated in a foreign currency, there may be an exchange loss when converting the redemption amount back to the local or base currency.

For Product denominated in Renminbi (RMB) or with underlying assets that are denominated in RMB only

Conversion between RMB and foreign currencies, including Hong Kong dollar, subject to PRC regulatory restrictions – RMB is currently not freely convertible and conversion of RMB through banks in Hong Kong is subject to certain restrictions. The PRC government regulates conversion between RMB and foreign currency both in Hong Kong SAR and mainland China, which as a result may affect the liquidity.

Some bonds may contain special features and risks that warrant special attention. These include bonds:

●Risk associated with Subordinated Debentures

Holders of subordinated debentures will bear higher risks than holders of senior debentures of the issuer due to a lower priority of claim in event of the Issuer’s liquidation. Subordinated debentures are unsecured and have lesser priority than that of an additional debt claim of the same asset. They usually have a lower credit rating than senior bonds. Investor’s specific attention is drawn to the credit information of this product, including the respective credit rating of the issuer, the debenture and/or the guarantor, as the case may be.

●Risk associated with Variable Coupon/ Coupon Deferral Features

If the bonds contain variable and/or deferral of interest payment terms and investors would face uncertainty over the amount and time of the interest payments to be received.

●Risk associated with Extendable Maturity Date

If the bonds contain extendable maturity dates terms and investors would not have a definite schedule of principal repayment.

●Risk associated with Convertible or Exchangeable Debentures

They are convertible or exchangeable in nature and investors are subject to both equity and bond investment risk; and/or that have contingent write-down or loss absorption feature and the bond may be written-off fully or partially or converted to common stock on the occurrence of a trigger event.

●Risk associated with High Yield Bond

1.Higher default risk: The bonds with higher yield are usually with a lower investment grading or even no credit rating, therefore their default risk is higher;

2.During the economic recession, the issuers of high yield bonds may be more susceptible to financial difficulties, therefore their default risk is higher;

3.The liquidity of high yield bonds are usually lower, a higher discount may be needed when selling or even cannot sell in the secondary market;

4.When there is adverse news in the market or the issuer, the price or liquidity of the high yield bonds may even drop further.

●Risk associated with Complex Bond

1.Complex bonds are bonds with special features (including, but not limited to, perpetual or subordinated bonds, or those with variable or deferred interest payment terms, extendable maturity dates, or those which are convertible or exchangeable or have contingent write down or loss absorption features, or those with multiple credit support providers and structures) and/or bonds comprising one or more special features;

2.SFC has not audited the related offering documents of the bonds, investors have to understand the terms clearly before taking actions;

3.As the bonds contain complex terms, the past performance of the bonds is less useful for reference and cannot be an indicator of future performance.

●Risk associated with Non-rated Bond

1.Non-rated bonds present additional uncertainties because of the difficulties in determining their comparability to rated bonds;

2.Non-rated bonds are often compared to speculative bonds as they generally carry more uncertainties than investment grade bonds;

3.Non-rated bonds tend to have smaller issue size; these bonds may have less liquidity than rated bonds that have a larger issue size;

4.Bondholders may face significant price volatility, or potential lack of liquidity and investment loss.

●Risk associated with Perpetual Debentures

1.The bondholder may face reinvestment risk when the issuer exercises its right to redeem the bond before it matures. This usually occurs when interest rates have fallen substantially since the issuance date;

2.Reinvestment risk refers to the risk that the rate at which coupon and principal cash flows from a bond are reinvested will be lower than the expected rate in effect when the bond was purchased;

3.The predictability of cash flow pattern of a callable bond may be uncertain due to the embedded option;

4.The price appreciation potential of a callable bond would be limited relative to a comparable option-free bond since the upside of the bond price is capped at the call price;

5.As time passes, uncertainties over the creditworthiness of the issuer increase;

6.Interest rate may rise substantially since the issuance date. Under such situation, the coupon rate paid by the perpetual bond may be significantly lower than the prevailing interest rate.

●Risk associated with Callable Bond

1.The bondholder may face reinvestment risk when the issuer exercises its right to redeem the bond before it matures. This usually occurs when interest rates have fallen substantially since the issuance date;

2.Reinvestment risk refers to the risk that the rate at which coupon and principal cash flows from a bond are reinvested will be lower than the expected rate in effect when the bond was purchased;

3.The predictability of cash flow pattern of a callable bond may be uncertain due to the embedded option;

4.A call schedule for a callable bond may have different call prices depending on the call dates;

5.The price appreciation potential of a callable bond would be limited relative to a comparable option-free bond since the upside of the bond price is capped at the call price;

6.If an investor bought a bond with a premium, a loss may occur when the bond is called back by an issuer before the date of maturity.

●This is a putable bond. Investors should note that:

1.The bondholder may face reinvestment risk when he/she exercises his/her right to sell the bond before it matures. This usually occurs when interest rates have risen substantially since the issuance date;

2.Reinvestment risk refers to the risk that the rate at which coupon and principal cash flows from a bond are reinvested will be lower than the expected rate in effect when the bond was purchased;

3.The predictability of cash flow pattern of a putable bond may be uncertain due to the embedded option;

4.Once the put option is exercised, the bondholder loses any future coupon payments that he/she may otherwise have been due;

5.In the event of a liquidity problem, an issuer may not able to buy back the bonds when bondholders exercise the put option.

●Risk associated with Make Whole Call Option (Special Feature)

1.The bondholder may face reinvestment risk when the issuer exercises its right to redeem the bond before it matures. This usually occurs when interest rates have fallen substantially since the issuance date;

2.Reinvestment risk refers to the risk that the rate at which coupon and principal cash flows from a bond are reinvested will be lower than the expected rate in effect when the bond was purchased;

3.Under a Make-Whole Call provision, the issuer has to make a payment set as a yield spread over a reference rate, or a payment equal to the present value of all future coupon and principal payments that bondholders would have received, had the bond not been called;

4.The predictability of cash flow pattern of a bond with a make-whole call option may be uncertain;

5.Unlike a normal callable bond, there may be no predetermined callable date and callable price for bonds with a make-whole call option

Bonds Trading

Besides traditional stock market, we are also providing the bonds trading and investing services, which let you enjoy a fixed and steady income under the fast changing environment.

About bonds

Bond is an instrument of indebtedness of the bond issuer to the holders. Government, corporations and companies issue bonds to raise fund. Buying bonds is same as lending fund to the issuers, issuers are obliged to pay them interest (the coupon) and/or to repay the principal at a later date, termed the maturity. Bond holders can choose to hold to bonds until it matures or sell it before maturity at the market price.

Why Investing Bonds

- Enjoy a higher return than bank fixed deposits

- Receive coupon interest regularly

- Variety of choice. Select the bonds suit you the most

- Credit ratings of government bonds are higher than the banks

- Maturity can be as short as 3 months

- Withdraw before maturity without charging extra interests

- Can be used as stock margin deposits*

- Handling fee as low as 0.15% of the nominal value

- Generally, Corporate bonds are less volatile than the related stock

*Margin ratio of bonds up to 80%

Bonds Investment service in Phillip

We are providing you a comprehensive bonds investment service with a direct hotline, perfect branch network and precise quote service.

- Minimum Investment amount: HKD 500,000 or minimum niminal value for HKD bonds. USD100,000 for USD bonds.

- No interest collection charges or redeem fees.

- Feel free to call us at 2277 6662 to ask for more information and quotes.

債券最新報價亦可參考香港金融管理局的輝立証券(香港)有限公司 債券報價網站。

本公司以主事人身分行事,並與以上產品的發行人沒有從屬關係。

本公司以主事人身分行事,並與以上產品的發行人沒有從屬關係。

輝立証券(香港)有限公司已採取措施提供準確而可靠的資料,但並不保證資料絕對無誤,及不擬就有關由第三方提供的資料所出現的錯誤或違漏承擔任何責任。 以上所有資料只供參考用途。投資決定在於您本人。除非你完全明白及願意承擔債券的相關風險,否則你不應投資該產品。 債券表現受發行人的實際和預計借貸能力所影響。就償債責任而言,債券不保證發行人不會拖欠債務。在最壞情況下(如發行者不履行契約),債券持有人可能無法取回債券的利息和本金。

債券主要提供中長期的投資,並不是短線投機的工具。你應準備於整段投資期內將資金投資於有關債券上;若你選擇在到期日之前提早出售債券,可能會損失部份或全部的投資本金。

債券的利息和本金是由發行者償還,債券持有人須承擔發行者的信貸風險。如果發行者不履行契約,債券持有人可能無法取回債券的利息和本金。在此情況下,債券持有人不能向本公司追討任何賠償,並與以上產品的發行人沒有從屬關係。

債券的利息和本金是由發行者償還,債券持有人須承擔發行者的信貸風險。如果發行者不履行契約,債券持有人可能無法取回債券的利息和本金。在此情況下,債券持有人不能向本公司追討任何賠償,並與以上產品的發行人沒有從屬關係。

有關債券的風險請查看此連結

| Currency | Issuer | Coupon (%) |

Maturity (dd/mm/yyyy) |

Bid | Offer | Yield (%) |

Offer Yield (%) |

Risk | Min. Piece | Increment | Redeem |

|---|---|---|---|---|---|---|---|---|---|---|---|

| USD |

US TREASURY N/B T 2 7/8 06/15/25 |

2.875 | 15-Jun-2025 | 99.85 | 100.15 | - | - | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 5 08/31/25 |

5 | 31-Aug-2025 | 99.9 | 100.24 | 5.55 | 3.03 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 1/4 10/15/25 |

4.25 | 15-Oct-2025 | 99.83 | 100.18 | 4.87 | 3.5 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 1/4 12/31/25 |

4.25 | 31-Dec-2025 | 99.83 | 100.17 | 4.59 | 3.85 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 5/8 02/28/26 |

4.625 | 28-Feb-2026 | 100.08 | 100.43 | 4.49 | 3.92 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 5/8 03/15/26 |

4.625 | 15-Mar-2026 | 100.15 | 100.5 | 4.39 | 3.86 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 1/8 06/15/26 |

4.125 | 15-Jun-2026 | 99.87 | 100.22 | 4.27 | 3.88 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 3/8 08/15/26 |

4.375 | 15-Aug-2026 | 100.16 | 100.5 | 4.22 | 3.9 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 2 11/15/26 |

2 | 15-Nov-2026 | 97.24 | 97.58 | 4.14 | 3.87 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 1/8 02/15/27 |

4.125 | 15-Feb-2027 | 100.12 | 100.45 | 4.04 | 3.83 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 2 3/4 04/30/27 |

2.75 | 30-Apr-2027 | 97.87 | 98.2 | 3.99 | 3.79 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 3 1/4 06/30/27 |

3.25 | 30-Jun-2027 | 98.7 | 99.03 | 3.94 | 3.77 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 1/8 09/30/27 |

4.125 | 30-Sep-2027 | 100.47 | 100.79 | 3.9 | 3.75 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 12/15/27 |

4 | 15-Dec-2027 | 100.26 | 100.58 | 3.89 | 3.75 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 2 3/4 02/15/28 |

2.75 | 15-Feb-2028 | 97.19 | 97.52 | 3.9 | 3.76 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 3 5/8 05/31/28 |

3.625 | 31-May-2028 | 99.29 | 99.62 | 3.89 | 3.76 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 3 7/8 09/30/29 |

3.875 | 30-Sep-2029 | 99.8 | 100.12 | 3.93 | 3.84 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 1 3/4 11/15/29 |

1.75 | 15-Nov-2029 | 91.48 | 91.82 | 3.9 | 3.81 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 3 1/2 04/30/30 |

3.5 | 30-Apr-2030 | 98.01 | 98.33 | 3.96 | 3.88 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 1/8 08/31/30 |

4.125 | 31-Aug-2030 | 100.69 | 101.01 | 3.97 | 3.91 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 2 7/8 05/15/32 |

2.875 | 15-May-2032 | 92.48 | 92.81 | 4.15 | 4.09 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 2 3/4 08/15/32 |

2.75 | 15-Aug-2032 | 91.4 | 91.73 | 4.16 | 4.11 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 5/8 02/15/35 |

4.625 | 15-Feb-2035 | 102.15 | 102.46 | 4.35 | 4.31 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 1/2 02/15/36 |

4.5 | 15-Feb-2036 | 101.43 | 101.93 | 4.33 | 4.27 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 1/2 08/15/39 |

4.5 | 15-Aug-2039 | 98.48 | 98.92 | 4.65 | 4.6 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 3 7/8 02/15/43 |

3.875 | 15-Feb-2043 | 88.4 | 88.76 | 4.86 | 4.83 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 3/8 08/15/43 |

4.375 | 15-Aug-2043 | 94.16 | 94.53 | 4.86 | 4.83 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 3/4 11/15/43 |

4.75 | 15-Nov-2043 | 98.69 | 99.04 | 4.86 | 4.83 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 1/2 02/15/44 |

4.5 | 15-Feb-2044 | 95.46 | 95.81 | 4.87 | 4.84 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 5/8 11/15/44 |

4.625 | 15-Nov-2044 | 96.74 | 97.09 | 4.89 | 4.86 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 3 05/15/45 |

3 | 15-May-2045 | 75.62 | 76.01 | 4.94 | 4.9 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 5 05/15/45 |

5 | 15-May-2045 | 101.52 | 101.85 | 4.88 | 4.85 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 2 3/8 11/15/49 |

2.375 | 15-Nov-2049 | 63.32 | 63.7 | 5 | 4.96 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 1 1/4 05/15/50 |

1.25 | 15-May-2050 | 47.16 | 47.54 | 4.98 | 4.94 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 3/4 11/15/53 |

4.75 | 15-Nov-2053 | 97.63 | 97.98 | 4.91 | 4.88 | - | 20000 | 100 | N |

| USD |

US TREASURY N/B T 4 1/4 02/15/54 |

4.25 | 15-Feb-2054 | 89.83 | 90.18 | 4.92 | 4.89 | - | 20000 | 100 | N |

| Currency | Issuer | Coupon (%) |

Maturity (dd/mm/yyyy) |

Bid | Offer | Yield (%) |

Offer Yield (%) |

Risk | Min. Piece | Increment | Redeem |

|---|---|---|---|---|---|---|---|---|---|---|---|

| USD |

FANTASIA HOLDINGS GROUP FTHDGR 7.95 07/05/22 |

7.95 | 05-Jul-2022 | 2.24 | 3.59 | - | - | - | 200000 | 1000 | Y |

| USD |

SEAZEN GROUP LTD FUTLAN 6 08/12/24 |

6 | 12-Aug-2024 | 99.39 | 100.48 | - | - | - | 200000 | 1000 | N |

| USD |

PINEBRIDGE INVEST LP PIBRIN 6 09/12/24 |

6 | 12-Sep-2024 | 99.1 | 100.25 | - | - | - | 200000 | 1000 | N |

| USD |

SHUI ON DEVELOPMENT HLDG SHUION 6.15 08/24/24 |

6.15 | 24-Aug-2024 | 99.08 | 100.25 | - | - | - | 200000 | 1000 | Y |

| USD |

REDCO PROPERTIES GROUP REDPRO 9.9 02/17/24 |

9.9 | 17-Feb-2024 | 0.63 | 1.84 | - | - | - | 200000 | 1000 | N |

| USD |

ABJA INVESTMENT CO TATAIN 5.95 07/31/24 |

5.95 | 31-Jul-2024 | 99.55 | 100.38 | - | - | - | 200000 | 1000 | N |

| USD |

CHINA SOUTH CITY HOLDING CSCHCN 9 12/11/24 |

9 | 11-Dec-2024 | 25.15 | 27.9 | - | - | - | 200000 | 1000 | Y |

| SGD |

OXLEY MTN PTE LTD OHLSP 6.9 07/08/24 |

6.9 | 08-Jul-2024 | 94.1 | 96.85 | - | - | - | 250000 | 250000 | N |

| USD |

FORTUNE STAR BVI LTD FOSUNI 6.85 07/02/24 |

6.85 | 02-Jul-2024 | 99.35 | 100.34 | - | - | - | 200000 | 1000 | Y |

| USD |

UKRAINE GOVERNMENT UKRAIN 7 3/4 09/01/25 |

7.75 | 01-Sep-2025 | 36.8 | 38.38 | - | - | - | 100000 | 1000 | N |

| USD |

FORTUNE STAR BVI LTD FOSUNI 5.95 10/19/25 |

5.95 | 19-Oct-2025 | 99.49 | 100.45 | 7.79 | 4.19 | - | 200000 | 1000 | Y |

| USD |

JPMORGAN CHASE & CO JPM 5.546 12/15/25 |

5.546 | 15-Dec-2025 | 99.65 | 100.46 | 6.37 | 4.42 | - | 50000 | 1000 | Y |

| SGD |

ESR GROUP LTD ESRCAY 5.1 02/26/25 |

5.1 | 26-Feb-2025 | 99.62 | 100.38 | - | - | - | 250000 | 250000 | N |

| USD |

NETFLIX INC NFLX 5 7/8 02/15/25 |

5.875 | 15-Feb-2025 | 99.63 | 100.4 | - | - | - | 50000 | 1000 | N |

| USD |

SOCIETE GENERALE SOCGEN 4 1/4 04/14/25 |

4.25 | 14-Apr-2025 | 99.65 | 100.38 | - | - | - | 200000 | 1000 | N |

| USD |

AGILE GROUP HOLDINGS LTD AGILE 5 1/2 04/21/25 |

5.5 | 21-Apr-2025 | 5.61 | 7.04 | - | - | - | 200000 | 1000 | Y |

| USD |

AGILE GROUP HOLDINGS LTD AGILE 5 3/4 01/02/25 |

5.75 | 02-Jan-2025 | 5.61 | 7.03 | - | - | - | 200000 | 1000 | Y |

| USD |

AGILE GROUP HOLDINGS LTD AGILE 6.05 10/13/25 |

6.05 | 13-Oct-2025 | 5.7 | 7.23 | - | - | - | 200000 | 1000 | Y |

| USD |

REPUBLIC OF SRI LANKA SRILAN 6 1/8 06/03/25 |

6.125 | 03-Jun-2025 | 61.52 | 65.76 | - | - | - | 200000 | 1000 | N |

| USD |

MITSUBISHI UFJ FIN GRP MUFG 5.063 09/12/25 |

5.063 | 12-Sep-2025 | 99.64 | 100.38 | 7.16 | 2.69 | - | 200000 | 1000 | N |

| GBP |

HEATHROW FINANCE PLC HTHROW 5 3/4 03/03/25 |

5.75 | 03-Mar-2025 | 99.6 | 100.41 | - | - | - | 100000 | 1000 | N |

| USD |

EASY TACTIC LTD GZRFPR 6 1/2 07/11/25 |

6.5 | 11-Jul-2025 | 1.99 | 3.34 | - | - | - | 150000 | 1 | Y |

| USD |

NETFLIX INC NFLX 5 7/8 02/15/25 |

5.875 | 15-Feb-2025 | 99.63 | 100.4 | - | - | - | 50000 | 1000 | N |

| USD |

CK HUTCHISON INTL 16 LTD CKHH 2 3/4 10/03/26 |

2.75 | 03-Oct-2026 | 97.51 | 98.32 | 4.87 | 4.17 | - | 200000 | 1000 | N |

| USD |

REPUBLIC OF SRI LANKA SRILAN 6.825 07/18/26 |

6.825 | 18-Jul-2026 | 64.3 | 65.89 | 58.21 | 55.05 | - | 200000 | 1000 | N |

| AUD |

WELLS FARGO & COMPANY WFC 3.7 07/27/26 |

3.7 | 27-Jul-2026 | 99.25 | 100.02 | 4.45 | 3.68 | - | 50000 | 1000 | N |

| USD |

AGILE GROUP HOLDINGS LTD AGILE 5 1/2 05/17/26 |

5.5 | 17-May-2026 | 5.74 | 7.22 | 902.89 | 769.25 | - | 200000 | 1000 | Y |

| USD |

UKRAINE RAIL (RAIL CAPL) RAILUA 8 1/4 07/09/26 |

8.25 | 09-Jul-2026 | 82.51 | 84.6 | 29.96 | 27.01 | - | 200000 | 1000 | N |

| USD |

UKRAINE RAIL (RAIL CAPL) RAILUA 8 1/4 07/09/26 |

8.25 | 09-Jul-2026 | 82.51 | 84.6 | 29.96 | 27.01 | - | 200000 | 1000 | N |

| USD |

HSBC HOLDINGS PLC HSBC 4.292 09/12/26 |

4.292 | 12-Sep-2026 | 99.53 | 100.3 | 4.71 | 4.02 | - | 200000 | 1000 | Y |

| USD |

AT&T INC T 5.539 02/20/26 |

5.539 | 20-Feb-2026 | 99.68 | 100.46 | 6.08 | 4.75 | - | 50000 | 1000 | Y |

| USD |

SHUI ON DEVELOPMENT HLDG SHUION 5 1/2 06/29/26 |

5.5 | 29-Jun-2026 | 96.76 | 98.17 | 9.09 | 7.51 | - | 200000 | 1000 | Y |

| USD |

PCPD CAPITAL PCPDC 5 1/8 06/18/26 |

5.125 | 18-Jun-2026 | 95.08 | 96.45 | 10.81 | 9.18 | - | 200000 | 1000 | Y |

| USD |

FORTUNE STAR BVI LTD FOSUNI 5 05/18/26 |

5 | 18-May-2026 | 97.75 | 98.79 | 7.78 | 6.48 | - | 200000 | 1000 | Y |

| USD |

UKRAINE GOVERNMENT UKRAIN 7 3/4 09/01/26 |

7.75 | 01-Sep-2026 | 33.32 | 34.87 | 141.76 | 134.77 | - | 100000 | 1000 | N |

| USD |

FORTUNE STAR BVI LTD FOSUNI 5.05 01/27/27 |

5.05 | 27-Jan-2027 | 95.73 | 96.79 | 8.05 | 7.29 | - | 200000 | 1000 | Y |

| USD |

SOFTBANK GROUP CORP SOFTBK 5 1/8 09/19/27 |

5.125 | 19-Sep-2027 | 97.96 | 99.08 | 6.13 | 5.57 | - | 200000 | 1000 | Y |

| USD |

BNP PARIBAS BNP 4 5/8 03/13/27 |

4.625 | 13-Mar-2027 | 99.38 | 100.19 | 5.01 | 4.5 | - | 200000 | 1000 | N |

| USD |

BNP PARIBAS BNP 3 1/2 11/16/27 |

3.5 | 16-Nov-2027 | 97.24 | 98.02 | 4.76 | 4.4 | - | 200000 | 1000 | N |

| USD |

CHINA SOUTH CITY HOLDING CSCHCN 4 1/2 08/19/27 |

4.5 | 19-Aug-2027 | 25.43 | 27.41 | 88.38 | 82.89 | - | 150000 | 1 | Y |

| USD |

EASY TACTIC LTD GZRFPR 6 1/2 07/11/27 |

6.5 | 11-Jul-2027 | 2.11 | 3.45 | 476.55 | 357.36 | - | 150000 | 1 | Y |

| AUD |

WELLS FARGO & COMPANY WFC 4 04/27/27 |

4 | 27-Apr-2027 | 99.37 | 100.14 | 4.37 | 3.92 | - | 50000 | 1000 | N |

| AUD |

BNP PARIBAS BNP 4 5/8 03/09/27 |

4.625 | 09-Mar-2027 | 99.06 | 99.84 | 5.22 | 4.71 | - | 200000 | 2000 | N |

| AUD |

MACQUARIE GROUP LTD MQGAU 4.15 12/15/27 |

4.15 | 15-Dec-2027 | 98.95 | 99.75 | 4.61 | 4.26 | - | 200000 | 10000 | N |

| USD |

RKPF OVERSEAS 2019 A LTD ROADKG 6.7 03/30/28 |

6.7 | 30-Mar-2028 | 26.51 | 27.48 | 71.47 | 69.37 | - | 200000 | 1000 | Y |

| USD |

RKPF OVERSEAS 2019 A LTD ROADKG 5.9 09/05/28 |

5.9 | 05-Sep-2028 | 26.04 | 27.68 | 61.91 | 58.91 | - | 200000 | 1000 | Y |

| AUD |

AT&T INC T 4.6 09/19/28 |

4.6 | 19-Sep-2028 | 100.3 | 101.05 | 4.5 | 4.24 | - | 50000 | 10000 | N |

| AUD |

NBN CO LTD NBNAUS 5.2 08/25/28 |

5.2 | 25-Aug-2028 | 102.58 | 103.4 | 4.3 | 4.03 | - | 50000 | 10000 | Y |

| EUR |

UKRAINE GOVERNMENT UKRAIN 6 3/4 06/20/28 |

6.75 | 20-Jun-2028 | 29.1 | 30.59 | 68.81 | 65.61 | - | 100000 | 1000 | N |

| USD |

EASY TACTIC LTD GZRFPR 6 1/2 07/11/28 |

6.5 | 11-Jul-2028 | 2.15 | 3.44 | 340.34 | 245.47 | - | 150000 | 1 | Y |

| USD |

BLACKSTONE PRIVATE CRE BCRED 7.3 11/27/28 |

7.3 | 27-Nov-2028 | 106.15 | 106.94 | 5.28 | 5.03 | - | 50000 | 1000 | Y |

| USD |

UBS GROUP AG UBS 6.442 08/11/28 |

6.442 | 11-Aug-2028 | 103.25 | 104.03 | 5.28 | 5.01 | - | 250000 | 1000 | Y |

| GBP |

HSBC HOLDINGS PLC HSBC 6 3/4 09/11/28 |

6.75 | 11-Sep-2028 | 105.31 | 106.26 | 4.89 | 4.57 | - | 50000 | 50000 | Y |

| USD |

RKPF OVERSEAS 2020 A LTD ROADKG 5.2 07/12/29 |

5.2 | 12-Jul-2029 | 25.11 | 26.58 | 50.52 | 48.32 | - | 200000 | 1000 | Y |

| GBP |

JUST GROUP PLC JUSTLN 8 1/8 10/26/29 |

8.125 | 26-Oct-2029 | 108.04 | 109.41 | 5.97 | 5.62 | - | 100000 | 1000 | N |

| AUD |

BOC AVIATION LTD BOCAVI 3.15 07/11/29 |

3.15 | 11-Jul-2029 | 93.29 | 96.38 | 5.05 | 4.15 | - | 200000 | 2000 | N |

| USD |

RKPF OVERSEAS 2019 A LTD ROADKG 6 03/04/29 |

6 | 04-Mar-2029 | 25.72 | 27.54 | 55.5 | 52.55 | - | 200000 | 1000 | Y |

| USD |

UKRAINE GOVERNMENT UKRAIN 9 3/4 11/01/30 |

9.75 | 01-Nov-2030 | 32.44 | 33.97 | 42.93 | 41.27 | - | 200000 | 1000 | N |

| AUD |

COMMONWEALTH BANK AUST CBAAU 6.86 11/09/32 |

6.86 | 09-Nov-2032 | 104.41 | 105.22 | 6.1 | 5.97 | - | 200000 | 10000 | Y |

| AUD |

WESTPAC BANKING CORP WSTP 4.04 08/08/33 |

4.04 | 08-Aug-2033 | - | - | - | - | - | 200000 | 2000 | N |

| AUD |

WESTPAC BANKING CORP WSTP 6.491 06/23/33 |

6.491 | 23-Jun-2033 | 104.36 | 105.17 | 5.8 | 5.67 | - | 100000 | 100000 | Y |

| USD |

CK HUTCHISON INTL 23 CKHH 4 7/8 04/21/33 |

4.875 | 21-Apr-2033 | 98.58 | 99.62 | 5.1 | 4.93 | - | 200000 | 1000 | Y |

| USD |

HUTCHISON WHAM INT 03/33 CKHH 7.45 11/24/33 |

7.45 | 24-Nov-2033 | 115.17 | 116.35 | 5.19 | 5.03 | - | 100000 | 1000 | N |

| USD |

UKRAINE GOVERNMENT UKRAIN 7 3/8 09/25/34 |

7.375 | 25-Sep-2034 | 30.21 | 31.62 | 30.06 | 28.94 | - | 200000 | 1000 | N |

| USD |

REPUBLIC OF PANAMA PANAMA 6.4 02/14/35 |

6.4 | 14-Feb-2035 | 97.55 | 98.54 | 6.75 | 6.61 | - | 200000 | 1000 | Y |

| AUD |

AUST & NZ BANKING GROUP ANZ 6.736 02/10/38 |

6.736 | 10-Feb-2038 | 107.73 | 108.64 | 5.86 | 5.76 | - | 50000 | 1000 | Y |

| AUD |

COMMONWEALTH BANK AUST CBAAU 6.704 03/15/38 |

6.704 | 15-Mar-2038 | 107.59 | 108.4 | 5.85 | 5.76 | - | 200000 | 10000 | Y |

| USD |

PETROBRAS GLOBAL FINANCE PETBRA 7 1/4 03/17/44 |

7.25 | 17-Mar-2044 | 101.8 | 103.1 | 7.07 | 6.95 | - | 50000 | 1000 | N |

| USD |

REPUBLIC OF INDONESIA INDON 5 1/8 01/15/45 |

5.125 | 15-Jan-2045 | 95.55 | 96.65 | 5.5 | 5.4 | - | 200000 | 1000 | N |

| USD |

KAZMUNAYGAS NATIONAL CO KZOKZ 6 3/8 10/24/48 |

6.375 | 24-Oct-2048 | 92.69 | 93.77 | 7.02 | 6.92 | - | 200000 | 1000 | N |

| USD |

M&G PLC MGNLN 6 1/2 10/20/48 |

6.5 | 20-Oct-2048 | 102.22 | 103.34 | 6.32 | 6.23 | - | 200000 | 1000 | Y |

| USD |

ROMANIA ROMANI 7 5/8 01/17/53 |

7.625 | 17-Jan-2053 | 103.33 | 104.45 | 7.34 | 7.25 | - | 50000 | 2000 | N |

| GBP |

M&G PLC MGNLN 5.56 07/20/55 |

5.56 | 20-Jul-2055 | 93.29 | 94.45 | 6.05 | 5.96 | - | 100000 | 1000 | Y |

| USD |

ELECTRICITE DE FRANCE SA EDF 6 01/22/2114 |

6 | 22-Jan-2114 | 93.6 | 95.12 | 6.41 | 6.31 | - | 50000 | 1000 | N |

| USD |

AGILE GROUP HOLDINGS LTD AGILE 13.476 PERP |

13.476 | 01-Jan-2299 | 2.58 | 4.64 | 522.33 | 290.43 | - | 200000 | 1000 | Y |

| USD |

AGILE GROUP HOLDINGS LTD AGILE 7 3/4 PERP |

7.75 | 01-Jan-2299 | 2.56 | 4.38 | 302.73 | 176.94 | - | 200000 | 1000 | Y |

| USD |

AGILE GROUP HOLDINGS LTD AGILE 15.524 PERP |

15.524 | 01-Jan-2299 | 2.59 | 4.47 | 599.38 | 347.29 | - | 200000 | 1000 | Y |

| SGD |

OLAM GROUP LIMITED OLGPSP 5 3/8 PERP |

5.375 | 01-Jan-2299 | 99.14 | 100.04 | 5.42 | 5.37 | - | 250000 | 250000 | Y |

| GBP |

ELECTRICITE DE FRANCE SA EDF 6 PERP |

6 | 01-Jan-2299 | 99.77 | 100.84 | 6.01 | 5.95 | - | 100000 | 100000 | Y |

| USD |

FWD GROUP HOLDINGS LTD FWDGHD 8.6245 PERP |

8.625 | 01-Jan-2299 | 99.78 | 101.09 | 8.64 | 8.53 | - | 200000 | 1000 | Y |

| USD |

LI & FUNG LTD LIFUNG 5 1/4 PERP |

5.25 | 01-Jan-2299 | 46.68 | 48.27 | 11.25 | 10.88 | - | 200000 | 1000 | Y |

| USD |

RKI OVERSEAS FIN 2017 A ROADKG 7 PERP |

7 | 01-Jan-2299 | 11.02 | 12.64 | 63.52 | 55.38 | - | 200000 | 1000 | Y |

| USD |

RKP OVERSEAS FI 2016 A ROADKG 7.95 PERP |

7.95 | 01-Jan-2299 | 11.15 | 12.68 | 71.3 | 62.7 | - | 200000 | 1000 | Y |

| USD |

SAN MIGUEL CORP SMCPM 5 1/2 PERP |

5.5 | 01-Jan-2299 | 99.55 | 100.38 | 5.52 | 5.48 | - | 200000 | 1000 | Y |

| USD |

SOFTBANK GROUP CORP SOFTBK 6 7/8 PERP |

6.875 | 01-Jan-2299 | 97.67 | 98.94 | 7.04 | 6.95 | - | 200000 | 1000 | Y |

| Currency | Issuer | Coupon (%) |

Maturity (dd/mm/yyyy) |

Bid | Offer | Yield (%) |

Offer Yield (%) |

Risk | Min. Piece | Increment | Redeem |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CNY |

CITIGROUP GLOBAL MARKETS C 3.3 05/22/24 |

3.3 | 22-May-2024 | 99.61 | 100.38 | - | - | - | 500000 | 10000 | N |

| AUD |

DBS BANK LTD/AUSTRALIA DBSSP Float 06/16/25 |

4.964 | 16-Jun-2025 | 99.65 | 100.38 | - | - | - | 250000 | 10000 | N |

| CNY |

EMIRATES NBD BANK PJSC EBIUH 4.05 09/24/25 |

4.05 | 24-Sep-2025 | 100.08 | 100.83 | 3.53 | -0.15 | - | 1000000 | 10000 | N |

| CNY |

QNB FINANCE LTD QNBK 3.8 06/17/25 |

3.8 | 17-Jun-2025 | 99.65 | 100.38 | - | - | - | 1000000 | 10000 | N |

| CNY |

QNB FINANCE LTD QNBK 3.8 09/15/25 |

3.8 | 15-Sep-2025 | 99.96 | 100.73 | 3.91 | -0.42 | - | 1000000 | 10000 | N |

| CNY |

DEUTSCHE BANK AG DB 3.6615 04/10/25 |

3.662 | 10-Apr-2025 | 99.65 | 100.38 | - | - | - | 1000000 | 1000000 | Y |

| USD |

SOCIETE GENERALE SOCGEN 4 1/4 04/14/25 |

4.25 | 14-Apr-2025 | 99.65 | 100.38 | - | - | - | 200000 | 1000 | N |

| USD |

CITIGROUP INC C 3.3 04/27/25 |

3.3 | 27-Apr-2025 | 99.65 | 100.38 | - | - | - | 50000 | 1000 | N |

| USD |

JPMORGAN CHASE & CO JPM 5.546 12/15/25 |

5.546 | 15-Dec-2025 | 99.65 | 100.46 | 6.37 | 4.42 | - | 50000 | 1000 | Y |

| USD |

SOCIETE GENERALE SOCGEN 4 1/4 08/19/26 |

4.25 | 19-Aug-2026 | 98.93 | 99.81 | 5.26 | 4.43 | - | 200000 | 1000 | N |

| USD |

HSBC HOLDINGS PLC HSBC 4 3/8 11/23/26 |

4.375 | 23-Nov-2026 | 99.32 | 100.13 | 4.89 | 4.27 | - | 200000 | 1000 | N |

| USD |

HSBC HOLDINGS PLC HSBC 7.336 11/03/26 |

7.336 | 03-Nov-2026 | 100.47 | 101.21 | 6.94 | 6.34 | - | 200000 | 1000 | Y |

| USD |

HSBC HOLDINGS PLC HSBC 4.292 09/12/26 |

4.292 | 12-Sep-2026 | 99.53 | 100.3 | 4.71 | 4.02 | - | 200000 | 1000 | Y |

| USD |

BANK OF AMERICA CORP BAC 4 1/4 10/22/26 |

4.25 | 22-Oct-2026 | 99.35 | 100.12 | 4.78 | 4.15 | - | 50000 | 1000 | N |

| AUD |

MACQUARIE GROUP LTD MQGAU 4.15 12/15/27 |

4.15 | 15-Dec-2027 | 98.95 | 99.75 | 4.61 | 4.26 | - | 200000 | 10000 | N |

| USD |

STANDARD CHARTERED PLC STANLN 4.3 02/19/27 |

4.3 | 19-Feb-2027 | 98.83 | 99.72 | 5.07 | 4.48 | - | 200000 | 1000 | N |

| USD |

BANGKOK BANK PCL/HK BBLTB 9.025 03/15/29 |

9.025 | 15-Mar-2029 | 112.17 | 113.12 | 5.33 | 5.06 | - | 100000 | 1000 | N |

| USD |

STANDARD CHARTERED PLC STANLN 6.301 01/09/29 |

6.301 | 09-Jan-2029 | 103.34 | 104.18 | 5.24 | 4.98 | - | 200000 | 1000 | Y |

| USD |

HSBC HOLDINGS PLC HSBC 6.161 03/09/29 |

6.161 | 09-Mar-2029 | 103.36 | 104.19 | 5.14 | 4.89 | - | 200000 | 1000 | Y |

| USD |

STANDARD CHARTERED PLC STANLN 6.301 01/09/29 |

6.301 | 09-Jan-2029 | 103.34 | 104.18 | 5.24 | 4.98 | - | 200000 | 1000 | Y |

| GBP |

STANDARD CHARTERED PLC STANLN 5 1/8 06/06/34 |

5.125 | 06-Jun-2034 | 93.52 | 94.57 | 6.09 | 5.93 | - | 100000 | 1000 | N |

| USD |

STANDARD CHARTERED PLC STANLN 6.097 01/11/35 |

6.097 | 11-Jan-2035 | 104.62 | 105.49 | 5.47 | 5.35 | - | 200000 | 1000 | Y |

| USD |

STANDARD CHARTERED PLC STANLN 6.097 01/11/35 |

6.097 | 11-Jan-2035 | 104.62 | 105.49 | 5.47 | 5.35 | - | 200000 | 1000 | Y |

| USD |

HSBC HOLDINGS PLC HSBC 6 1/2 05/02/36 |

6.5 | 02-May-2036 | 107.11 | 107.96 | 5.61 | 5.51 | - | 100000 | 1000 | N |

| GBP |

GOLDMAN SACHS GROUP INC GS 6 7/8 01/18/38 |

6.875 | 18-Jan-2038 | 106.06 | 107.29 | 6.17 | 6.04 | - | 50000 | 1000 | N |

| USD |

HSBC HOLDINGS PLC HSBC 5 1/4 03/14/44 |

5.25 | 14-Mar-2044 | 93.5 | 94.66 | 5.82 | 5.72 | - | 200000 | 1000 | N |

| USD |

STANDARD CHARTERED PLC STANLN 5.7 03/26/44 |

5.7 | 26-Mar-2044 | 95.26 | 96.31 | 6.13 | 6.03 | - | 200000 | 1000 | N |

| USD |

STANDARD CHARTERED PLC STANLN 7.014 PERP |

7.014 | 01-Jan-2299 | 103.47 | 104.62 | 6.78 | 6.7 | - | 100000 | 100000 | Y |

| Currency | Issuer | Coupon (%) |

Maturity (dd/mm/yyyy) |

Bid | Offer | Yield (%) |

Offer Yield (%) |

Risk | Min. Piece | Increment | Redeem |

|---|---|---|---|---|---|---|---|---|---|---|---|

| USD | |||||||||||

| USD |

NAN FUNG TREASURY LTD NANFUN 4 7/8 05/29/24 |

4.875 | 29-May-2024 | 99.61 | 100.35 | - | - | - | 200000 | 1000 | N |

| USD |

NEW METRO GLOBAL LTD FTLNHD 4.8 12/15/24 |

4.8 | 15-Dec-2024 | 99.01 | 100.27 | - | - | - | 200000 | 1000 | Y |

| USD |

SOFTBANK GROUP CORP SOFTBK 4 3/4 09/19/24 |

4.75 | 19-Sep-2024 | 99.46 | 100.38 | - | - | - | 200000 | 1000 | Y |

| USD |

SEAZEN GROUP LTD FUTLAN 4.45 07/13/25 |

4.45 | 13-Jul-2025 | 99.22 | 100.32 | - | - | - | 200000 | 1000 | Y |

| USD |

GLP PTE LTD GLPSP 3 7/8 06/04/25 |

3.875 | 04-Jun-2025 | 99.65 | 100.38 | - | - | - | 200000 | 1000 | N |

| USD |

BOC AVIATION LTD BOCAVI 3 1/4 04/29/25 |

3.25 | 29-Apr-2025 | 99.65 | 100.38 | - | - | - | 200000 | 1000 | Y |

| USD |

LI & FUNG LTD LIFUNG 5 1/4 08/18/25 |

5.5 | 18-Aug-2025 | 99.48 | 100.39 | 10.67 | 1.45 | - | 200000 | 1000 | Y |

| USD |

NEW METRO GLOBAL LTD FTLNHD 4 5/8 10/15/25 |

4.625 | 15-Oct-2025 | 97.76 | 99.07 | 13.54 | 8.25 | - | 200000 | 1000 | Y |

| USD |

SUNAC CHINA HOLDINGS LTD SUNAC 6 09/30/25 |

6 | 30-Sep-2025 | 12.76 | 13.53 | - | - | - | 50000 | 1 | Y |

| USD |

HKT CAPITAL NO 2 LTD HKTGHD 3 5/8 04/02/25 |

3.625 | 02-Apr-2025 | 99.63 | 100.36 | - | - | - | 200000 | 1000 | N |

| USD |

VIGOROUS CHAMP INTL LTD PINGIN 2 3/4 06/02/25 |

2.75 | 02-Jun-2025 | 99.65 | 100.38 | - | - | - | 200000 | 1000 | N |

| USD |

GEELY FINANCE HK LTD GEELZ 3 03/05/25 |

3 | 05-Mar-2025 | 99.5 | 100.37 | - | - | - | 200000 | 1000 | N |

| USD |

MALDIVES SUKUK ISSUANCE MVMOFB 9 7/8 04/08/26 |

9.875 | 08-Apr-2026 | 90.35 | 91.78 | 24.91 | 22.51 | - | 200000 | 1000 | N |

| USD |

SOFTBANK GROUP CORP SOFTBK 4 07/06/26 |

4 | 06-Jul-2026 | 97.82 | 98.94 | 6.33 | 5.12 | - | 200000 | 1000 | Y |

| USD |

CHINA WATER AFFAIRS GRP CWAHK 4.85 05/18/26 |

4.85 | 18-May-2026 | 98.03 | 99.27 | 7.28 | 5.74 | - | 200000 | 1000 | Y |

| USD |

ALIBABA GROUP HOLDING BABA 3.4 12/06/27 |

3.4 | 06-Dec-2027 | 97.58 | 98.4 | 4.47 | 4.11 | - | 200000 | 1000 | Y |

| USD |

RAKUTEN GROUP INC RAKUTN 11 1/4 02/15/27 |

11.25 | 15-Feb-2027 | 107.94 | 108.92 | 5.93 | 5.31 | - | 200000 | 1000 | N |

| USD |

INDIA CLEAN ENERGY HLDG INCLEN 4 1/2 04/18/27 |

4.5 | 18-Apr-2027 | 96.04 | 97.15 | 6.92 | 6.23 | - | 200000 | 1000 | Y |

| USD |

HSBC HOLDINGS PLC HSBC 5.887 08/14/27 |

5.887 | 14/8/2027 | 100.91 | 101.72 | 5.42 | 5.01 | - | 200000 | 1000 | Y |

| USD |

LONGFOR HOLDINGS LTD LNGFOR 3 3/8 04/13/27 |

3.375 | 13-Apr-2027 | 90.34 | 91.55 | 9.49 | 8.68 | - | 200000 | 1000 | N |

| USD |

LONGFOR HOLDINGS LTD LNGFOR 4 1/2 01/16/28 |

4.5 | 16-Jan-2028 | 88.92 | 90.16 | 9.57 | 8.97 | - | 200000 | 1000 | N |

| USD |

SUNAC CHINA HOLDINGS LTD SUNAC 6 3/4 09/30/28 |

6.75 | 30-Sep-2028 | 12.69 | 13.44 | 103.82 | 100.12 | - | 50000 | 1 | Y |

| USD |

HKT CAPITAL NO 5 LTD HKTGHD 3 1/4 09/30/29 |

3.25 | 30-Sep-2029 | 94.44 | 95.41 | 4.72 | 4.46 | - | 200000 | 1000 | N |

| USD |

RAKUTEN GROUP INC RAKUTN 9 3/4 04/15/29 |

9.75 | 15-Apr-2029 | 109.01 | 109.9 | 6.98 | 6.72 | - | 200000 | 1000 | N |

| USD |

HSBC HOLDINGS PLC HSBC 6.161 03/09/29 |

6.161 | 09-Mar-2029 | 103.36 | 104.19 | 5.14 | 4.89 | - | 200000 | 1000 | Y |

| USD |

HSBC HOLDINGS PLC HSBC 4.583 06/19/29 |

4.583 | 19/6/2029 | 99.49 | 100.31 | 4.73 | 4.5 | - | 200000 | 1000 | N |

| USD |

BARINGS BDC INC BBDC 7 02/15/29 |

7 | 15-Feb-2029 | 102.79 | 103.73 | 6.12 | 5.83 | - | 50000 | 1000 | Y |

| USD |

NAN FUNG TREASURY LTD NANFUN 3 5/8 08/27/30 |

3.625 | 27-Aug-2030 | 90.78 | 91.71 | 5.73 | 5.5 | - | 200000 | 1000 | N |

| USD |

SUNAC CHINA HOLDINGS LTD SUNAC 7 1/4 09/30/30 |

7.25 | 30-Sep-2030 | 12.64 | 13.82 | 75.6 | 71.12 | - | 50000 | 1 | Y |

| USD |

CK HUTCHISON INTL 20 LTD CKHH 2 1/2 05/08/30 |

2.5 | 08-May-2030 | 90.56 | 91.51 | 4.71 | 4.48 | - | 200000 | 1000 | Y |

| USD |

ADANI ELECTRICITY MUMBAI ADANEM 3.867 07/22/31 |

3.867 | 22-Jul-2031 | 85.68 | 86.68 | 6.8 | 6.58 | - | 200000 | 1000 | Y |

| USD |

LONGFOR HOLDINGS LTD LNGFOR 3.85 01/13/32 |

3.85 | 13-Jan-2032 | 72.21 | 73.3 | 9.72 | 9.44 | - | 200000 | 1000 | N |

| USD |

CK HUTCHISON INTL 23 CKHH 4 7/8 04/21/33 |

4.875 | 21-Apr-2033 | 98.58 | 99.62 | 5.1 | 4.93 | - | 200000 | 1000 | Y |

| USD |

HSBC HOLDINGS PLC HSBC 6.254 03/09/34 |

6.254 | 09-Mar-2034 | 106.13 | 106.95 | 5.36 | 5.24 | - | 200000 | 1000 | Y |

| USD |

UKRAINE GOVERNMENT UKRAIN Float 08/01/41 |

- | 01-Aug-2041 | 73.07 | 74.76 | - | - | - | 50000 | 1000 | Y |

| USD |

VODAFONE GROUP PLC VOD 5.35 03/09/47 |

5.35 | 09-Mar-2047 | - | - | - | - | - | 250000 | 1000 | N |

| USD |

THREE GORGES FIN I KY YANTZE 3.2 10/16/49 |

3.2 | 16-Oct-2049 | 72.59 | 73.74 | 5.2 | 5.1 | - | 200000 | 1000 | Y |

| USD |

CNAC HK FINBRIDGE CO LTD HAOHUA 3.7 09/22/50 |

3.7 | 22/9/2050 | 72.54 | 73.71 | 5.78 | 5.67 | - | 200000 | 1000 | Y |

| USD |

CK HUTCHISON INTL 20 LTD CKHH 3 3/8 05/08/50 |

3.375 | 08-May-2050 | 68.12 | 69.41 | 5.82 | 5.69 | - | 200000 | 1000 | Y |

| USD |

NIPPON LIFE INSURANCE NIPLIF 5.95 04/16/54 |

5.95 | 16-Apr-2054 | 100.6 | 101.59 | 5.91 | 5.83 | - | 200000 | 1000 | Y |

| SGD | |||||||||||

| SGD |

ARA ASSET MANAGEMENT LTD ARASP 4.15 04/23/24 |

4.15 | 23-Apr-2024 | 99.47 | 100.39 | - | - | - | 250000 | 250000 | N |

| SGD |

CHANGI AIRPORT GROUP SIN CHAAIR 1.88 05/12/31 |

1.88 | 12-May-2031 | 97.38 | 98.4 | 2.36 | 2.17 | - | 250000 | 250000 | N |

| SGD |

MAPLETREE INDUSTRIAL TRU MINTSP 3.15 PERP |

3.15 | 01-Jan-2299 | 99.33 | 100.36 | 3.17 | 3.14 | - | 250000 | 250000 | Y |

| SGD |

MAPLETREE LOGISTICS TRUS MLTSP 5.2074 PERP |

5.207 | 01-Jan-2299 | 99.62 | 100.38 | 5.23 | 5.19 | - | 250000 | 250000 | Y |

| SGD |

SINGTEL GROUP TREASURY STSP 3.3 PERP |

3.3 | 01-Jan-2299 | 100.03 | 101.31 | 3.3 | 3.26 | - | 250000 | 250000 | Y |

| HKD | |||||||||||

| HKD |

MTR CORP CI LTD MTRC 2 1/4 12/28/24 |

2.25 | 28-Dec-2024 | 99.61 | 100.35 | - | - | - | 1000000 | 500000 | N |

| HKD |

STANDARD CHARTERED BANK STANLN 3 1/2 06/13/25 |

3.5 | 13/6/2025 | 99.65 | 100.38 | - | - | - | 1000000 | 1000000 | Y |

| HKD |

HYSAN MTN LTD HYSAN 2.1 03/17/25 |

2.1 | 17/3/2025 | 99.63 | 100.39 | - | - | - | 1000000 | 1000000 | Y |

| HKD |

LINK FINANCE CAYMAN 2009 LINREI 2.35 04/09/25 |

2.35 | 09-Apr-2025 | 99.65 | 100.38 | - | - | - | 1000000 | 500000 | N |

| HKD |

CLP POWER HK FINANCING CHINLP 3.97 03/23/26 |

3.97 | 23-Mar-2026 | 100.55 | 101.35 | 3.17 | 2.01 | - | 1000000 | 1000000 | N |

| HKD |

CLP POWER HK FINANCING L CHINLP 3 1/2 11/28/29 |

3.5 | 28-Nov-2029 | 100.43 | 101.76 | 3.39 | 3.07 | - | 1000000 | 1000000 | N |

| GBP | |||||||||||

| GBP |

BHP BILLITON FINANCE LTD BHP 3 1/4 09/25/24 |

3.25 | 25-Sep-2024 | 99.64 | 100.37 | - | - | - | 100000 | 1000 | N |

| GBP |

GENERAL ELECTRIC CO GE 4 7/8 09/18/37 |

4.875 | 18-Sep-2037 | 89.86 | 91.08 | 6.07 | 5.92 | - | 50000 | 1000 | N |

| GBP |

VODAFONE GROUP PLC VOD 3 08/12/56 |

3 | 12-Aug-2056 | 54.8 | 55.91 | 6.38 | 6.25 | - | 100000 | 1000 | N |

| NZD | |||||||||||

| NZD |

NEW ZEALAND GOVERNMENT NZGB 2 3/4 04/15/25 |

2.75 | 15-Apr-2025 | 99.65 | 100.38 | - | - | - | 50000 | 1000 | N |

| CNY | |||||||||||

| CNY |

AGRICUL DEV BANK CHINA ADBCH 3.05 11/02/26 |

3.05 | 02-Nov-2026 | 101.32 | 102.16 | 2.02 | 1.37 | - | 1000000 | 10000 | N |

| EUR | |||||||||||

| EUR |

BULGARIA BGARIA 2 5/8 03/26/27 |

2.625 | 26-Mar-2027 | 100.12 | 101.21 | 2.55 | 1.89 | - | 100000 | 1000 | N |

| AUD | |||||||||||

| AUD |

EMIRATES NBD BANK PJSC EBIUH 4 3/4 02/09/28 |

4.75 | 09-Feb-2028 | 100.08 | 100.9 | 4.72 | 4.37 | - | 50000 | 10000 | N |

| AUD |

QANTAS AIRWAYS LTD QANAU 2.95 11/27/29 |

2.95 | 27-Nov-2029 | 91.73 | 92.59 | 5.08 | 4.85 | - | 50000 | 10000 | Y |

債券最新報價亦可參考香港金融管理局的輝立証券(香港)有限公司 債券報價網站。

本公司以主事人身分行事,並與以上產品的發行人沒有從屬關係。

本公司以主事人身分行事,並與以上產品的發行人沒有從屬關係。

輝立証券(香港)有限公司已採取措施提供準確而可靠的資料,但並不保證資料絕對無誤,及不擬就有關由第三方提供的資料所出現的錯誤或違漏承擔任何責任。 以上所有資料只供參考用途。投資決定在於您本人。除非你完全明白及願意承擔債券的相關風險,否則你不應投資該產品。 債券表現受發行人的實際和預計借貸能力所影響。就償債責任而言,債券不保證發行人不會拖欠債務。在最壞情況下(如發行者不履行契約),債券持有人可能無法取回債券的利息和本金。

債券主要提供中長期的投資,並不是短線投機的工具。你應準備於整段投資期內將資金投資於有關債券上;若你選擇在到期日之前提早出售債券,可能會損失部份或全部的投資本金。

債券的利息和本金是由發行者償還,債券持有人須承擔發行者的信貸風險。如果發行者不履行契約,債券持有人可能無法取回債券的利息和本金。在此情況下,債券持有人不能向本公司追討任何賠償,並與以上產品的發行人沒有從屬關係。

債券的利息和本金是由發行者償還,債券持有人須承擔發行者的信貸風險。如果發行者不履行契約,債券持有人可能無法取回債券的利息和本金。在此情況下,債券持有人不能向本公司追討任何賠償,並與以上產品的發行人沒有從屬關係。

有關債券的風險請查看此連結

01

Open a Phillip foreign stock account with submitting the Risk Profile Questionnaire and W8 form together.

02

Asking for quotes and placing orders through phone or email.*

*Please make sure the account balance is enough for the trade before placing an order. Please state the bond name, coupon rate, maturity date, account number, client name and ISIN code(if any) when placing order through email.

03

Trades will be confirmed full telephone, if the orders are placed by email, confirmation will be made through email as well.

04

Trade confirmation will be sent through email within 24 hours after the trade had done.

05

Amount will be deducted on the third working day (T+3) after the order placed.^ (Depends on type of bonds traded, for more details please contact bond desk)

^Please deposit the amount into your Phillip account before T+2 if your account does not have enough balance. If the deposit is made by cashier’s order, please deposit before T+1 and fax us the receipt at 28774554.

債券最新報價亦可參考香港金融管理局的輝立証券(香港)有限公司 債券報價網站。

本公司以主事人身分行事,並與以上產品的發行人沒有從屬關係。

本公司以主事人身分行事,並與以上產品的發行人沒有從屬關係。

輝立証券(香港)有限公司已採取措施提供準確而可靠的資料,但並不保證資料絕對無誤,及不擬就有關由第三方提供的資料所出現的錯誤或違漏承擔任何責任。 以上所有資料只供參考用途。投資決定在於您本人。除非你完全明白及願意承擔債券的相關風險,否則你不應投資該產品。 債券表現受發行人的實際和預計借貸能力所影響。就償債責任而言,債券不保證發行人不會拖欠債務。在最壞情況下(如發行者不履行契約),債券持有人可能無法取回債券的利息和本金。

債券主要提供中長期的投資,並不是短線投機的工具。你應準備於整段投資期內將資金投資於有關債券上;若你選擇在到期日之前提早出售債券,可能會損失部份或全部的投資本金。

債券的利息和本金是由發行者償還,債券持有人須承擔發行者的信貸風險。如果發行者不履行契約,債券持有人可能無法取回債券的利息和本金。在此情況下,債券持有人不能向本公司追討任何賠償,並與以上產品的發行人沒有從屬關係。

債券的利息和本金是由發行者償還,債券持有人須承擔發行者的信貸風險。如果發行者不履行契約,債券持有人可能無法取回債券的利息和本金。在此情況下,債券持有人不能向本公司追討任何賠償,並與以上產品的發行人沒有從屬關係。

有關債券的風險請查看此連結

Bond is a debt instrument, the purpose of the issuance of bonds is to raise funds by borrowing from the public. Generally, there are terms for each bonds stating the maturity date which principals will be repaid and the coupon interest payment date.

Government Bond

The bonds issue by state or government in its currency. For example, The US department of the Treasury issues bond s to raise funds for the US government.

Semi-Government Bond

The bonds issue by public corporations, which level is lower than government bonds, but the credit ratings of these two bonds are normally the same. E.g.: The Hong Kong Airport Authority (HKAA), Hong Kong Mortgage Corporation Limited (HKMTGC)

Corporate Bond

Mostly issue by private corporations. E.g.: Hutchison Whampoa Limited

Types

Fixed Rate Bond

Interest rate of this bond is fixed, the rate will not change until maturity.

Zero coupon Bond

Holder of this kind of bonds do not entitle any interest, but usually the price of this kind of bond is discounted and the benefits of investing in this bond can be reflected by its bond price

Floating Rate Bond

This bond has a floating interest rate, which depends on the change in market interest rate. Normally the rate takes reference from market rates like HIBOR and LIBOR.

Features of bonds

Coupon rate

The interest rate that will be paid by the issuer per annum

Maturity date

The date when issuer repay the face value to bondholders, normally at 100%

Remaining Tenor

Remaining time to maturity

Yield

The rate of return of the bond

Credit rating

An indication reflecting the bond issuer's financial status and the bond's credit quality.

債券最新報價亦可參考香港金融管理局的輝立証券(香港)有限公司 債券報價網站。

本公司以主事人身分行事,並與以上產品的發行人沒有從屬關係。

本公司以主事人身分行事,並與以上產品的發行人沒有從屬關係。

輝立証券(香港)有限公司已採取措施提供準確而可靠的資料,但並不保證資料絕對無誤,及不擬就有關由第三方提供的資料所出現的錯誤或違漏承擔任何責任。 以上所有資料只供參考用途。投資決定在於您本人。除非你完全明白及願意承擔債券的相關風險,否則你不應投資該產品。 債券表現受發行人的實際和預計借貸能力所影響。就償債責任而言,債券不保證發行人不會拖欠債務。在最壞情況下(如發行者不履行契約),債券持有人可能無法取回債券的利息和本金。

債券主要提供中長期的投資,並不是短線投機的工具。你應準備於整段投資期內將資金投資於有關債券上;若你選擇在到期日之前提早出售債券,可能會損失部份或全部的投資本金。

債券的利息和本金是由發行者償還,債券持有人須承擔發行者的信貸風險。如果發行者不履行契約,債券持有人可能無法取回債券的利息和本金。在此情況下,債券持有人不能向本公司追討任何賠償,並與以上產品的發行人沒有從屬關係。

債券的利息和本金是由發行者償還,債券持有人須承擔發行者的信貸風險。如果發行者不履行契約,債券持有人可能無法取回債券的利息和本金。在此情況下,債券持有人不能向本公司追討任何賠償,並與以上產品的發行人沒有從屬關係。

有關債券的風險請查看此連結

Promotion materials are in Chinese only, please contact (852) 2277 6536 for any enquiry.

For any bond transactions settled in USD, please kindly remit the consideration to the below USD bank account for fund deposit.

• Standard Chartered Bank : 447 – 1 – 073302 – 2 (USD)

For any bond transactions settled in currency other than USD, please kindly remit the consideration to the corresponding bank accounts listed here for fund deposit.

| Item | Description of fees |

|---|---|

| Bonds Transaction Cost* | |

| Handling Fee | 0.15% of Consideration (Except 0.10% of Consideration, for Investment Grade Bond with duration =< 1 Year.) |

| Custodian Fee | 0.05% of nominal value per annum, charged on monthly basis (Minimum HKD25) Charged per ISIN basis. Certain bonds are excluded. |

| Transfer | HKD400 |

| Interest Collection & Maturity Redemption Fee | Waived |

| Apply to Transaction of Bonds Listed under Chapter 37 of the Main Board Listing Rules | |

| Transaction Levy | 0.00285% of Transaction Amount (Include 0.0027% SFC Transaction levy and 0.00015% FRC Transaction levy; those Levy fees rounded to the nearest cent and calculated separately; Effective on 1st January 2022) |

*This fee table is not applicable to iBond, Green Bond and Silver Bond.

How to Trade Bonds with us?

If you have a Phillip Account, you can place your order by contacting your broker or the bond department. You can open a Phillip account at any branches if you don't have one yet.

Do the bonds have any margin value?

We've set different margin value for each bonds, which may up to 70%.

What currencies' bond can we trade?

Our foreign exchange service includes HKD, USD, AUD, NZD and GBP.

How to redeem the bonds?

We will help you redeem the bonds when they mature and deposit the total amount into your Phillip account without any charges.

Are there any extra charges beside commission?An accrued interest will be charged. For example, if you buy the bonds of ICBC at the nominal value 1,000,000 at 100.49% and there are 65 days between the settlement day and the last coupon payment day, so at the day of settlement, you have to pay $1,004,900 of principal plus $2617.81 of accrued interest.

A custodian fee will also be charged at 0.05% of the nominal value of the bonds or a minimum charge at HK$25 monthly. For example, the face value of a bond is 1,000,000, a custodian fee of $41.67 (1,000,000*0.05%/12=$41.67) will be charged per month. The custodian fee will be deducted from your Phillip account at the end of each month.

Are there any extra charges beside commission?An accrued interest will be charged. For example, if you buy the bonds of ICBC at the nominal value 1,000,000 at 100.49% and there are 65 days between the settlement day and the last coupon payment day, so at the day of settlement, you have to pay $1,004,900 of principal plus $2617.81 of accrued interest.

A custodian fee will also be charged at 0.05% of the nominal value of the bonds or a minimum charge at HK$25 monthly. For example, the face value of a bond is 1,000,000, a custodian fee of $41.67 (1,000,000*0.05%/12=$41.67) will be charged per month. The custodian fee will be deducted from your Phillip account at the end of each month.

How to benefit from investing bonds?

Bonds provide interest, generally, you can receive a steady interest income every year, also the yield of bonds are normally higher than the bank deposit rate. In addition, you can sell the bond at the market to make a profit when its price rises.

Do I have to hold the bond until it matures?

Besides holding the bond until it matures, you can sell it at the secondary market when its price rises to make a profit.

What is accrued interest?

Besides principals, an accrued interest will also be charged when buying bonds from the secondary market. Accrued interest is the interest of the bonds between the settlement date and the previous coupon interest payment date which should be entitled by the bondholder, therefore the buyers have to pay the sellers an accrued interest when buying the bonds.

Top of Page

|

Main Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|