With current assets of 8 million or above, you can apply for an registration of "professional investor" and enjoy special offers of various investment products and services.

Commission Rate low as 0.03% #

Financing amount up to HKD 40 million

US stock Day Trade Commission: USD 5。

#Subject to Assets under management(AUM) and transaction volume requirements.

*Rate of margin financing is based on the collateral quality, the concentration of securities and the company's internal rating of one's portfolio.

Introduction

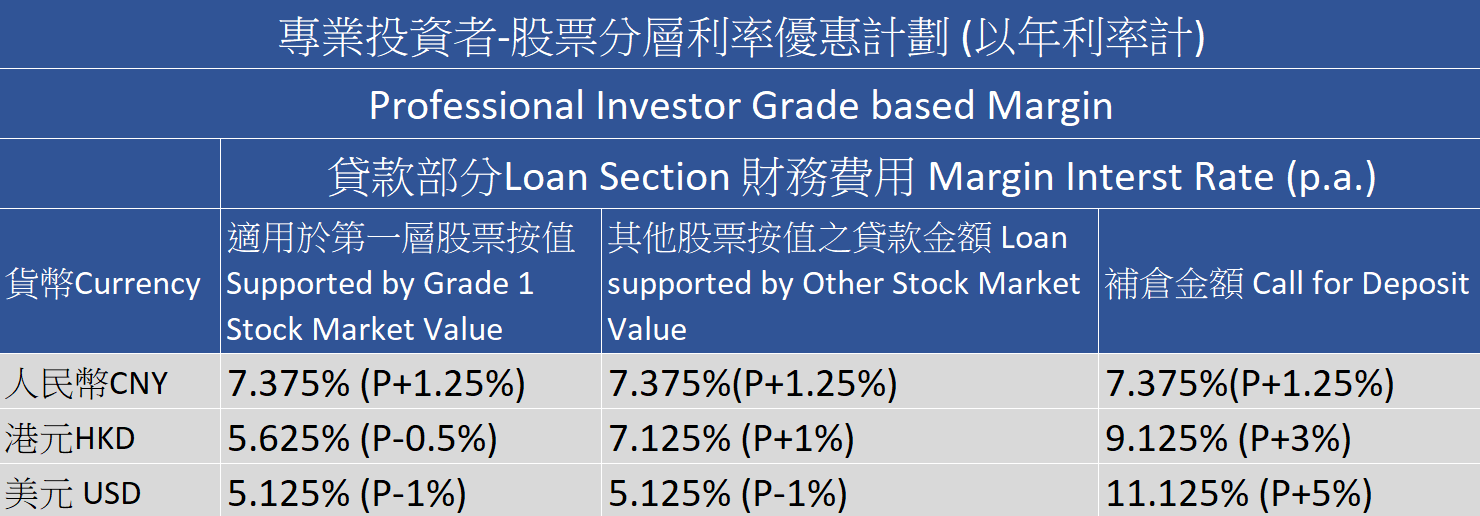

The interest rate and the interest calculation in Professional Investor Grade-Based Margin (“PI GBM”) financing are calculated based on the grading of each stock in your portfolio.

By being a Professional Investor, you can join our Professional Investor Grade-Based (“PI GBM”) Financing.

Higher proportion of Grade 1 Stock in securities portfolio, lower interest rate!

The margin financing rate of the portion of the Grade 1 Stock holding over HKD $1,000,000 can be reduced to as low as *P-1.5%.

Complete the form and submit it to your account executive to register as a Professional Investor with us today.

The calculation of interest rate is as follows:

Table Footnotes:

P refers to the Prime rate of Standard Chartered Bank.

Other stock refers to all stocks that are not in Grade 1 Stock List.

Call for Deposit interest rate for Chinese Yuan Renminbi (CNY) is 4.88% p.a.

Call for Deposit interest rate for Hong Kong Dollar (HKD) is 8.5% (P+3%) p.a.

Call for Deposit interest rate for United States Dollar (USD) is 10.5% (P+5%) p.a.

For introduction and margin cost calculation, please click Graded-based Margin . For margin rates of other currencies, please visit Margin Rates

Footnote 1: The above grade-based interest rate will be based on the effective rate which is subject to the latest Hong Kong Dollar Prime (P) rate of Standard Chartered Bank.

Footnote 2: The flat interest rate for non grade-based margin account is P(HKD Prime rate of Standard Chartered Bank) + 3%.

*The margin ratio of stock is for reference only, which is subjected to change as determined by both the market and specific company factor. The company deserves the right to provide a different ratio to client based on his account situation.

Clients must submit supporting documentation to the Company to confirm that the depository payment is from his/her own bank account. Acceptable documentation include, but is not limited to, bank statements, cheque images, and online banking screenshots. The deposit will be credited to the Client account on the day that supporting documentation is provided. Until the supporting documentation is submitted, the deposit will not be treated as “credited”. The daily cut-off time for collecting the supporting documentation is 4:00 p.m., any supporting documentation received after 4:00 p.m. will be deemed to be received on next working day. Clients will be liable for any relevant interest, commission, fines and other charges incurred as a result of not being "credited".

Various Choices

No Platform Fee

No Handling Fee

Interest rate is as low as 3.88% p.a. for UT financing

No Platform Fee

Interest rate is as low as 3.88% p.a. for bond financing.

The following bonds are for PI only:

https://www.hkex.com.hk/Products/Securities/Equities?sc_lang=zh-HK Please click the "Full List of Securities" and download the excel file

Commission rate 0.08% ,minimum HK$ 10

Monthly saving plan for ETF, commssion HK$ 5 for each transaction

Other features of Smart Minor Account:

- Independent account; to manage family members' asset separately

- Preferential commission rate after depositing money / asset

- The authority of operating and the ownership belong to the adult joint account holder

- Except Stamp Duty and CCASS fee, minor attending full age and could have authority of operating and the ownership of asset by a general joint account / individual account without extra cost charged by the company.

- Minor shall own investment portfolio when attending full age

The Phillip HKD Money Market Fund seeks to preserve principal value and to maintain a high degree of liquidity while generating a higher rate of return* as compared to personal deposits of HKD by investing primarily in HKD-denominated money market instruments, short-term debt securities and short-term deposits. For details, please refer to the relevant Prospectus under Related Documents. Client could join the service Surplus Cash Facility or subscribe The Phillip HKD Money Market Fund directly.

*The average running yield is based on the annualized percentage change in Net Asset Value over the last 30 days.

輝立卓越理財客戶選用資本管理服務計劃,服務費率折扣高達6折。請聯絡我們查詢有關服務詳情。

| Available Short Sell Stock List | |||||

|---|---|---|---|---|---|

| Stock Code | Stock Name | Stock Code | Stock Name | Stock Code | Stock Name |

| 2 | CLP HOLDINGS | 662 | Asia Financial | 1361 | 361 DEGREES |

| 4 | WHARF HOLDINGS | 688 | CHINA OVERSEAS | 1398 | ICBC |

| 5 | HSBC HOLDINGS | 696 | TRAVELSKY TECH | 1898 | CHINA COAL |

| 17 | NEW WORLD DEV | 700 | TENCENT | 1928 | SANDS CHINA LTD |

| 20 | WHEELOCK | 728 | CHINA TELECOM | 1988 | MINSHENG BANK |

| 27 | GALAXY ENT | 751 | SKYWORTHDIGITAL | 2007 | COUNTRY GARDEN |

| 66 | MTR CORPORATION | 753 | AIR CHINA | 2318 | PING AN |

| 83 | SINO LAND | 762 | CHINA UNICOM | 2328 | PICC P&C |

| 144 | CHINA MER HOLD | 811 | XINHUA WINSHARE | 2343 | PACIFIC BASIN |

| 151 | WANT WANT CHINA | 813 | SHIMAO PROPERTY | 2388 | BOC HONG KONG |

| 173 | K. WAH INT'L | 855 | CHINA WATER | 2600 | CHALCO |

| 175 | GEELY AUTO | 857 | PETROCHINA | 2628 | CHINA LIFE |

| 189 | DONGYUE GROUP | 882 | TIANJIN DEV | 2689 | ND PAPER |

| 242 | SHUN TAK HOLD | 883 | CNOOC | 2777 | R&F PROPERTIES |

| 267 | CITIC PACIFIC | 939 | CCB | 2800 | TRACKER FUND* |

| 272 | SHUI ON LAND | 941 | CHINA MOBILE | 2823 | X ISHARES A50* |

| 308 | CHINA TRAVEL HK | 991 | DATANG POWER | 3323 | CNBM |

| 315 | SMARTONE TELE | 1038 | CKI HOLDINGS | 3328 | BANKCOMM |

| 330 | ESPRIT HOLDINGS | 1088 | CHINA SHENHUA | 3333 | EVERGRANDE |

| 358 | JIANGXI COPPER | 1109 | CHINA RES LAND | 3383 | AGILE PROPERTY |

| 363 | SHANGHAI IND H | 1114 | BRILLIANCE CHI | 3818 | CHINA DONGXIANG |

| 386 | SINOPEC CORP | 1171 | YANZHOU COAL | 3933 | UNITED LAB |

| 388 | HKEX | 1186 | CHINA RAIL CONS | 3968 | CM BANK |

| 390 | CHINA RAILWAY | 1199 | COSCO PACIFIC | 3988 | BANK OF CHINA |

| 546 | FUFENG GROUP | 1200 | MIDLAND HOLDING | 3993 | CMOC |

| 552 | CHINACOMSERVICE | 1211 | BYD COMPANY | 6030 | CITIC SEC |

| 590 | LUK FOOK HOLD | 1288 | ABC | ||

| 656 | FOSUN INTL | 1299 | AIA | ||

| *Settled in CNY | |||||

| A-share ETF: | |||||

|---|---|---|---|---|---|

| 2822 | 南方A50 | 3188 | 華夏滬深300 | *83188 | 華夏滬深300-R |

| 2823 | X安碩A50中國 | *82822 | 南方A50-R | ||

股票掛鉤票據教室

產品供高風險承受程度及具備衍生工具知識的專業投資者(PI)購買何謂專業投資者(P.I.)?

- 高資產淨值專業投資者,單獨或聯同其有聯繫者(配偶或子女),於某聯權共有帳戶擁有的現金或投資組合不少於HKD 800萬或等值外幣。

- 一名或聯同其有聯繫者(配偶或子女)全擁有的任何法團,而其唯一業務是持有投資項目, 擁有的投資組合不少於HKD 800萬或等值外幣。

- 法團或合夥擁有的投資組合不少於HKD 800萬或等值外幣,或擁有的總資產不少於HKD 4000萬或等值外幣。

- 信託法團擔任一項或多於一項信託的信託人,而在該項或該等信託下獲託付的總資產不少於HKD 4000萬或等值外幣,或該總資產值。

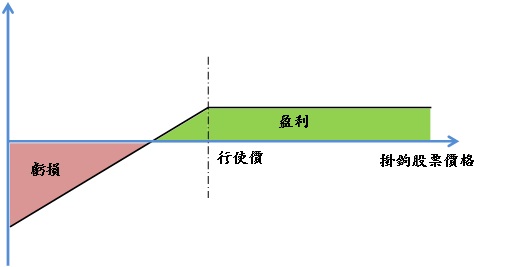

什麽是股票掛鉤票據(ELN)?

股票掛鉤票據(Equity Linked Notes, ELN)是一種結構性(金融衍生)產品,以票據形式交易,是一種以賺取高息爲目的之投資工具,爲專業投資者(PI)提供賺取較一般貨幣市場工具更高息口的機會。

ELN是一種與股票掛鉤之債權產品,主要是由短期票據及股票期權短倉組成的結構性產品。其投資回報與相關資產的表現掛鉤,特別適合一些對某公司發展前景有信心,認為股價不會大幅下跌的投資者。

ELN並非保本產品,要是正股價格變動正如投資者所料,投資者便可賺取相關回報。如變動與投資者的看法背道而馳,投資者將承受損失,在最壞的情況下,投資者可能失去全部的投資金額。

為什麼要投資股票掛鉤票據(ELN)?

在市場波幅比較小(“牛皮市”)或低息環境時,股票掛鉤票據可給予投資者另外的投資選擇。只要相關股票的收市價在定價日高於行使價,投資者便可以賺取高於銀行一般定息存款的回報。即使相關股票的收市價低於行使價,投資者也可以用最初市價較折讓的價位購入相關股票。各項指標一般可因應投資者需求釐定。

股票掛鉤票據

在此介紹最為流行的看漲股票掛鉤票據﹕

看漲股票掛鉤票據(Bull ELN)

投資者以折讓的價錢購買看漲股票掛鉤票據,如在到期日當天,股票沒跌穿行使價,投資者便獲得該票據面值,即高息回報。如果到期日股票跌穿行使價,投資者必須以該行使價購買掛鉤之股票。

投資者如何選擇適合自己的股票掛鉤票據(ELN)

選擇正股

先考慮相關股票的基本因素,看好掛鉤股票的長遠前景,不介意接貨作中長線投資。

釐定折讓價

折讓價愈低,息率亦相對低。投資者需考慮是否願意在折讓水平接貨,以及找尋合適的風險及回報。

考慮正股波幅

波幅愈大,風險越高,但折讓或息率愈高。

決定投資期限

因應自己的財務狀況及對正股走勢看法決定。

股票掛鉤票據的運作

股票掛鉤票據買入價通常低於100%之票據面值(即以折扣買入)。在到期日,如果股票收市價低於行使價,投資者需以行使價購入掛鉤股票;反之如果在到期日股票收市價高於行使價,投資者以現金收回票據面值金額(當中賺取折扣差額)。

股票掛鉤票據到期損益圖

例子

交易日

| 股票掛鉤票據條款 | |

|---|---|

| 年期 | 三個月 |

| 掛鉤股票 | 股票A |

| 最初市價 | HK$100 |

| 行使價 | HK$90 |

| 息率 | 約12.4% (p.a.) |

| 買入價 | 票據面值的97% |

| 票據面值 | HK$100萬 |

交易日

投資者買入一張面值HK$100萬的股票掛鉤票據,其買入價為票據面值的97%,行使價HK$90,年期為3個月:

買入所需金額 = 票據面值x97%

買入所需金額 = HK$100萬x97% = HK$97萬元

買入折扣 = 票據面值-買入所需金額

買入折扣 = HK$100萬-HK$97萬=HK$ 3萬元

息率 = (買入折扣/買入所需金額) x 年期換算 x 100%

息率 = (3/97) x (12/3) x 100% = 12.4%(p.a.)

到期日

| (情況一) 最終收市價高於行使價 | ||

|---|---|---|

| 投資者收取票據面值現金 | ||

| 最終收市價 | 現金交收 | 盈利 |

| HK$95 | HK$100萬 | HK$3萬 |

到期日(3個月後)

情況一:最終收市價高於行使價

投資者收取票據面值現金

盈利 = 票據面值 – 買入金額

盈利 = HK$100萬 – HK$97萬

盈利 = HK$3萬

| (情況二) 最終收市價低於行使價 | ||

|---|---|---|

| 投資者收取股票 | ||

| 最終收市價 | 股票交收 | 虧損 |

| 掛鉤股票 | 11,111股 | 約HK$2.6萬 |

情況二: 最終收市價低於行使價

投資者收取股票

股票交收股數 = 票據面值/行使價

股票交收股數 = HK$100萬/HK$90 = 11,111股

虧損 = (行使價-最終收市價) x 交收股數 - 買入折扣

虧損 =(HK$90-HK$85) x 11,111 - 30,000

虧損 = HK$25,555

股票掛鉤票據是一項結構性產品,產品供高風險承受程度及具備衍生工具知識的專業投資者(PI)購買。

以上資訊只作教學用途,資料僅供參考,並不存有招攬任何投資產品或服務的企圖。

投資並涉及風險 ,有關風險詳情請瀏覽本公司的風險披露聲明 及 股票掛鉤票據(ELN)相關風險。

股票掛鉤票據(ELN)常見用語

| 用語 | 解釋 |

|---|---|

| 交易日 | 即執行買入該股票掛鉤票據的指令的日期。該日為落實所有條款及釐定最初市價的日期。 |

| 年期/投資期 | 投資者需持有該ELN的時期,通常是由交易日至到期日。 |

| 到期日 | 視乎該股票掛鉤票據的條款,投資者將於到期日收取現金,或以實物交收參考資產。 |

| 最初市價 | 執行ELN的認購指令時掛鉤股票的當時市價。 |

| 行使價 | 預先設定的參考價格,用作計算ELN的回報,一般用掛鉤股票的最初市價的一個指定百分比來計算。 |

| 息率 | 以買入價與票據面值的折讓來計算年利率。 |

| 買入價 | 即認購ELN時需要支付的數額,可能相等於面值或以面值的某個折扣計算。 |

| 面值 | 用以計算每份ELN的購入價及於到期日時結算的金額。 |

| 最終收市價 | 掛鉤股票於估價日的收市價,以釐定該股票掛鉤票據於到期時以現金或是實貨交收。 |

股票掛鉤票據是一項結構性產品,產品供高風險承受程度及具備衍生工具知識的專業投資者(PI)購買。

以上資訊只作教學用途,資料僅供參考,並不存有招攬任何投資產品或服務的企圖。

投資並涉及風險 ,有關風險詳情請瀏覽本公司的風險披露聲明 及 股票掛鉤票據(ELN)相關風險。

Enquiry:2277 6688

e-mail: premier@phillip.com.hk

Professional Team for Professional Investor

|

Mr. Michael Fung |

Mr. Michael Fung Graduated from the University of Manchester and majored in Economics and passed Financial Risk Manager (FRM) exam in 2013. He assists client to decide the right investment choice for their risk appetite and investment profile by using market data, asset allocation plans and trading strategies.

e-mail:michaelfung@phillip.com.hk Direct Line: (852) 2277 6633 Whatsapp: (852)6192 8999 Wechat ID: Mic Mic

|

|

Mr Andrew Ng |

Graduated from the Department of Financial Services of the Hong Kong Polytechnic University, Andrew completed the Chartered Financial Analyst (CFA) exam in 2008. He keens on stock research by analyzing basic factors and technical analysis. He has unique insights on derivatives instruments and IPO markets. Currently he is responsible of VIP client of the company and provide tailor-made investment services. e-mail: andrewng@phillip.com.hk Direct Line: (852) 2277 6633 Whatsapp: (852) 9120 2566 Wechat ID: Ng Tsz Ching

|

|

Mr Lewis Ng |

Graduated from Hong Kong University of Science and Technology, Lewis have been involving in Hong Kong stocks since he was in college, and he is particularly enthusiastic about the research of China stock market. The aim of his personal investment is to find the golden decade of the China stock market in the future. e-mail: lewisng@phillip.com.hk Direct Line: (852) 3653 3000 Whatsapp: (852)9236 9745 Wechat ID:吳甲丰Lewis Ng

|