-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- Smart Minor (Joint) Account

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

JOYSON Electronics (600699 CH) – Expanding into Robotics to Build a Second Growth Curve

Friday, March 6, 2026  3984

3984

JOYSON Electronics(600699)

| Recommendation | BUY (Maintain) |

| Price on Recommendation Date | $27.370 |

| Target Price | $33.400 |

Weekly Special - 1361 361 DEGREES

Company Profile

As a leading global supplier in automotive electronics and automotive safety, Joyson Electronics provides one-stop solutions in key technology areas of intelligent electric vehicles to global OEMs. The Company's business is divided into two major segments: automotive electronics and automotive safety. The automotive electronics segment mainly includes intelligent cockpit, intelligent connectivity, intelligent driving and new energy management, while the automotive safety segment mainly includes products related to seatbelts, airbags, intelligent steering wheels and integrated safety solutions. In 2025, the Company strategically extended into the upstream and downstream of the robotics industry chain, newly positioning itself as "Automotive + Robotics Tier1" and actively building a second growth curve.

Investment Summary

The Company Released Its 2025 Earnings Forecast: Core Profit up 17%

It is expected that in 2025 the Company will realise net profit attributable to owners of the parent company of approximately RMB1.35 billion (RMB, the same below), up 40.56% yoy; net profit attributable to the parent company excluding non-recurring items is expected to be approximately RMB1.5 billion, up approximately 17.02% yoy. The difference between the two is mainly due to non-recurring losses of approximately RMB160 million arising from the transfer of the weighing apparatus business by the Company's listed subsidiary Guangdong Xiangshan Weighing Apparatus Group Co., Ltd. (002870.CH), as well as the optimisation and disposal of certain overseas factories. The Company attributes the growth in results to the gradual effectiveness of various profitability improvement and business integration measures implemented across global business regions in 2025, as well as the continued recovery in profitability of overseas operations.

Profitability of Core Businesses Continued to Improve

Through optimising and integrating its global operations, particularly achieving notable results in reducing global raw material costs and improving operational efficiency, the Company has significantly enhanced its operating performance and profitability. The Company's overall gross margin increased from 11.1% in 2022 to 14.5% in 2023, further rising to 16.2% in 2024, and continued to increase to 18.31% as of the third quarter of 2025. From a regional perspective, overseas markets have focused on continuously reducing raw material costs by introducing Chinese suppliers and optimising procurement prices from existing suppliers. Meanwhile, the Company's global operational improvement team has continued to optimise and enhance OEE (Overall Equipment Effectiveness) at overseas factories, while adjusting and relocating production capacity from high-cost countries/regions to low-cost countries/regions, thereby steadily driving gross margin improvement. In particular, cost improvement measures in the European region were implemented earlier and achieved significant gross margin enhancement during the reporting period. Cost improvement measures in the Americas were implemented relatively later, and gross margin is expected to improve correspondingly in the future, with profitability continuing to strengthen.

Sufficient Orders on Hand with Sustainable Growth Potential in Core Businesses

In the third quarter of 2025, the Company secured new orders with a total full lifecycle amount of approximately RMB40.2 billion. In the first three quarters, the Company's cumulative global newly secured orders reached approximately RMB71.4 billion in total full lifecycle amount, of which approximately RMB39.6 billion was from the automotive safety segment and approximately RMB31.8 billion was from the automotive electronics segment. According to Frost & Sullivan, in 2024 the Company's market share in automotive safety products ranked second globally, with global and China market shares of 22.9% and 26.1%, respectively. It is estimated that by 2029, the global and domestic market sizes of the automotive passive safety industry will grow to RMB213.6 billion and RMB49.7 billion, respectively, representing CAGR of 5.4% and 7.8%, respectively, from 2025. It is further expected that by 2029, the global and China automotive electronics market sizes will reach RMB3,330.3 billion and RMB1,892.6 billion, respectively, representing CAGR of 5.8% and 9.4%, respectively, from 2025. In H1 2025, the automotive safety and automotive electronics segments accounted for 62.53% and 27.53% of revenue, respectively. As the Company firmly drives development through technological innovation in automotive electronics, maintaining intensive R&D investment in intelligent cockpit, intelligent driving, intelligent connectivity, vehicle-road-cloud coordination and high-voltage fast charging for new energy vehicles, it ensures sustained leadership in key technology areas and possesses long-term growth potential.

Expanding into Robotics to Build a Second Growth Curve

According to Frost & Sullivan, the humanoid robot market size is expected to surge from USD2.3 billion in 2025 to USD12.9 billion in 2029, representing a CAGR of 54.4%. The Company has established strategic partnerships with several leading domestic and international robotics companies and has successfully launched a series of products, including AI-empowered robot head assemblies, integrated robot domain controllers and next-generation robot energy management solutions.

Investment Thesis

As a leading enterprise in automotive safety and automotive intelligence, the Company possesses strong R&D capabilities. Its automotive-related businesses are expected to continue benefiting from the global trends of vehicle electrification and intelligence, while its expansion into the humanoid robotics field is poised to open up a second growth curve.

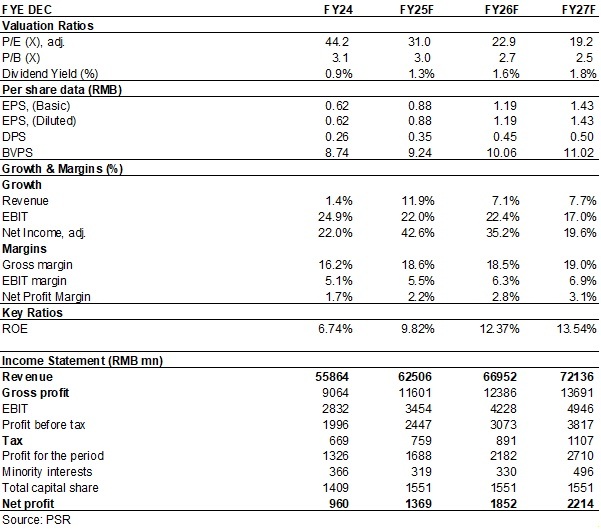

We expect Joyson's EPS for 2025-2027 to be 0.88/1.19/1.43 yuan. We revised the target price of RMB 33.4 equivalent to 37.8/28.0/23.4x E P/E 2025-2027 and assign Buy ratings. (Closing price as at 2 March)

Risk

Operating collision in Joyson's M&A

Worse-than-expected downstream demand

Financials

(Closing price as at 2 March)

Source: PSR

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|