-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- Smart Minor (Joint) Account

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

JNMPT (000700 CH) - Bumper leader, entering the field of humanoid robots

Friday, January 30, 2026  668

668

JNMPT(700)

| Recommendation | BUY (Initiation) |

| Price on Recommendation Date | $12.680 |

| Target Price | $16.450 |

Weekly Special - 1361 361 DEGREES

Company profile

Jiangnan Mould & Plastic Technology Co., Ltd. is a leading automotive parts supplier in China, with its main business focusing on the R&D, production and sales of automotive exterior systems such as bumpers and lightweight components. The Company has an annual production capacity of over 6 million sets of automotive bumpers, with production bases in Wuxi, Shanghai, Shenyang, Wuhan, Yantai, and Mexico, and R&D centres located in Beijing, Shanghai, and Jiangyin. Its associate company, BMPT, has established production bases in Beijing, Hefei, Chongqing, Chengdu, and Zhuzhou. In 2024, the Company recorded revenue of RMB7,136 million, down 18.18% yoy, and net profit of RMB626 million, up 39.46% yoy.

Investment Summary

Short-Term Performance Pressure in FY2025Q3

In the first three quarters of 2025, the Company achieved revenue/net profit attributable to the parent company/net profit attributable to the parent company excluding non-recurring items of RMB5,107 million/RMB375 million/RMB346 million (RMB, the same below), representing yoy growth of -2.7%/-30.42%/-25.12%, respectively. Sales gross margin was 19.57%, up 1.15 ppts yoy. The sales volume growth from emerging EV makers helped offset the decline in sales from premium car clients, leading to Company revenue growth outperforming the industry average.

In Q3 alone, the Company recorded revenue of RMB1,708 million (up 0.52% yoy, down 5.08% qoq), net profit attributable to the parent company of RMB82 million (down 54.74% yoy, down 43.63% qoq), and net profit attributable to the parent company excluding non-recurring items of RMB104 million (down 22.7% yoy, down 0.7% qoq). Q3 gross margin was 19.6% (up 0.8 ppts yoy, up 1.2 ppts qoq), and net profit margin was 4.8% (down 5.8 ppts yoy, down 3.3 ppts qoq). Gross margin showed signs of recovery, while the decline in net profit margin was mainly due to foreign exchange losses and reduced investment income.

Coverage of High-Quality Clients and New Orders Laying the Foundation for Future Growth

The Company has a strong client portfolio, with core customers covering global premium brands and new energy vehicle manufacturers. Key clients include: BMW, Beijing Benz, SAIC Audi, a well-known North American EV maker, SAIC-GM, SAIC Volkswagen, Chery Jaguar Land Rover, Volvo, BYD, Geely, Great Wall, DFPSA, NIO, Li Auto, and XPeng. While maintaining its advantages among premium carmakers, the Company has actively expanded into the NEV segment, tapping into incremental markets both domestically and internationally. The newly secured orders provide a solid foundation for future growth.

In January 2025, the Company received project nominations for exterior parts for three models from a well-known domestic NEV client. The project is expected to start mass production in May 2026, with a 3-year lifecycle and estimated total sales of RMB1.23 billion to RMB1.32 billion.

In April and July 2025, the wholly owned subsidiary, Shenyang Minghua, received nominations for exterior part projects from a leading premium car client. These projects are expected to commence mass production in April 2027 and January 2028, respectively, with lifecycles of 8 and 5 years, and estimated total sales of RMB2.07 billion and RMB2,044 million, respectively.

In July 2025, Mexico Minghua received a nomination for an exterior part project from a well-known North American EV maker. The project is scheduled to begin mass production in January 2026, with a 5-year lifecycle and estimated total sales of RMB1,236 million.

Seizing Industry Opportunities and Entering the Humanoid Robot Segment

On 16 December 2025, the Company announced that it had signed a component procurement framework agreement with a domestic robotics company and recently received a small-batch purchase order for exterior covering parts of humanoid robots from the client. This small-batch order marks a key milestone in the Company's entry into the humanoid robot segment, signifying that its manufacturing processes and quality assurance system have gained client recognition. It also lays the groundwork for acquiring more robot clients and expanding market share in the future.

Investment Thesis & Valuation

While the Company's core business---automotive bumpers---continues to develop steadily and secure new project nominations, it is simultaneously expanding into the new field of humanoid robotics, presenting potential for business growth.

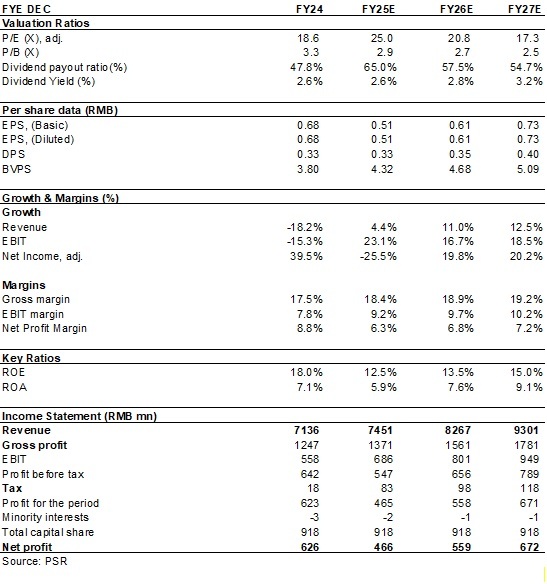

As analyzed above, we expected diluted EPS of the Company to RMB 0.51/0.61/0.73 of 2025/2026/2027. And we accordingly gave the target price to 16.45, respectively 27x P/E for 2026. "Buy" rating. (Closing price as at 29 January)

Historical P/E Band

Source: Wind, Company, Phillip Securities Hong Kong Research

Financials

(Closing price as at 29 January)

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|