-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- Smart Minor (Joint) Account

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Desay SV (002920 CH) - Continuous Updates of Intelligent Products

Friday, January 9, 2026  3790

3790

Desay SV(2920)

| Recommendation | Buy (Initiation) |

| Price on Recommendation Date | $120.300 |

| Target Price | $147.000 |

Weekly Special - 1361 361 DEGREES

Investment Summary

Company profile

Desay SV, established in 1986, is a leading company in the automotive electronics field, with its main products including intelligent cockpits, intelligent driving, and connected services. As the cornerstone of the company's revenue, the intelligent cockpit generated a revenue of RMB18.23 billion in 2024, (RMB, the same below), accounting for 66.01% of total revenue. The intelligent driving business also saw growth, with 2024 revenue reaching RMB7.314 billion, a yoy increase of 63.06%, accounting for 26.5%. The company's total revenue in 2024 amounted to 27.618 billion yuan, up 26.06% yoy, with a net profit of 2.005 billion, up 29.62% yoy.

Strong Performance in the First Three Quarters

In the first three quarters of 2025, the Company achieved revenues/net profits/net profits excluding non-recurring items of RMB22.337 billion/RMB1.788 billion/RMB1.724 billion, marking yoy increases of 17.72%/27.08%/19.02%, respectively. The gross margin was 19.70%, down 0.5 percentage points yoy. In the third quarter of 2025 alone, the company achieved revenues/net profits/net profits excluding non-recurring items of RMB7.692 billion/RMB0.565 billion/RMB0.571 billion, marking yoy increases of 5.63%, but a decline of 0.57% and 13.25%, respectively. Compared to the previous quarter, revenues/net profits/net profits excluding non-recurring items decreased by 2.04%, 11.74%, and 12.86%, respectively. The third-quarter performance declined quarter-on-quarter, mainly due to the decrease in sales from the core customer Li Auto and industry-wide price reduction pressures. However, with the upcoming launch and delivery of new models such as the Li Auto i6 and Xpeng X9 in the fourth quarter, it is expected that the increase in sales driven by the launch of multiple new models will improve performance in the fourth quarter.The quarter-on-quarter decline in performance was mainly influenced by lower sales of core customer Li Auto's vehicles and price reduction pressures in the industry. However, with the upcoming launch and delivery of new models such as the Li Auto i6 and XPeng X9 in the fourth quarter, it is expected that the increase in sales from these new models will improve fourth-quarter performance.

Ongoing Investment in R&D, Continuous Updates of Intelligent Products, Leading the Industry

In 2024, the company's R&D expenses were RMB2.256 billion, accounting for 8.17% of revenue. In the first three quarters of 2025, R&D expenses amounted to RMB2.003 billion, accounting for 8.97% of revenue. The continued increase in R&D investment has provided strong support for new technologies and products. 1) Intelligent Cockpit: The company's fourth-generation intelligent cockpit has been scaled up for mass production in collaboration with Li Auto, Xiaomi Auto, and Geely Auto, and has continued to receive new project orders from GAC Passenger Cars, Geely Auto, and GAC Aion. The fourth-generation flagship intelligent cockpit domain controller is now in mass production for Chery Auto.

The fifth-generation intelligent cockpit platform has secured new project orders from Li Auto and attracted attention from several top global OEMs. The company's HUD (Head-Up Display) first mass production project has been launched, marking a significant breakthrough in the intelligent driving visual field. New project orders have been received from Shanghai GM, GAC Passenger Cars, and Dongfeng Nissan. 2) Intelligent Driving: In the field of advanced driver-assistance systems (ADAS), the company continues to maintain the highest market share in China and continuously optimizes and upgrades its products to meet the needs of different vehicle levels. Several flagship ADAS domain controllers have been mass-produced and successfully delivered to prominent clients such as Xiaomi Auto, Li Auto, Great Wall Motors, XPeng Motors, GAC Toyota, Geely Auto, and GAC Aion. New project orders have been received from Great Wall Motors, Geely Auto, Chery Auto, GAC Aion, and Dongfeng Passenger Vehicles. The company also offers several lightweight ADAS solutions for mid- to low-priced vehicles, the largest segment of the market, and has secured new project points from major clients such as GAC Toyota, Chery Auto, and Toyota. These solutions will be promoted to more customers. 3) Connected Services: The company has successfully achieved mass production of UWB (Ultra-Wideband) and BLE (Bluetooth Low Energy) solutions, becoming the first supplier in China to implement UWB solutions. This first-mover advantage has helped the company win key client collaborations with Li Auto and Chery Auto.

Successful Fundraising, Capacity Expansion

In October, the company completed a private placement of A-shares, raising a net amount of RMB4.393 billion. The funds are intended for investment in projects such as the Desay SV automotive electronics base in Central and Western China (Phase I) (RMB1.699 billion), intelligent automotive electronic system-level component production (RMB1.974 billion), and the intelligent computing centre and cockpit integration platform R&D (RMB0.72 billion). The company expects the first two projects, once completed, will add annual revenues of RMB8.276 billion and RMB14.773 billion, respectively, and net profits of RMB0.59 billion and RMB1.187 billion, significantly boosting the company's long-term growth potential and reinforcing its leadership position in the automotive electronics sector.

Deepening International Strategy, Building Ecosystem Collaboration

The company has strengthened its strategic partnerships with global core chip manufacturers and OEMs, successfully securing new project orders from clients such as VW and Toyota, and making breakthroughs with white-spot clients such as Renault and Honda. The company has also established overseas branches in major countries and regions such as Germany, France, Spain, Japan, and Singapore. Regarding overseas production capacity, in May 2025, the company began contributing production capacity in Indonesia, strengthening the supply chain resilience and delivery capabilities in Southeast Asia. In June 2025, the Monterrey plant in Mexico launched its first mass production project, offering more efficient localized service guarantees for the Americas market. The smart factory in Spain is expected to begin mass production in 2026, providing cutting-edge intelligent products for the intelligent cockpit and ADAS fields in Europe. In the first half of 2025, the gross margin of overseas operations reached 28.93%, up 8.22 percentage points yoy, exceeding the domestic gross margin by 9.26 percentage points. The expansion of overseas production capacity will provide strong support for profit growth.

Unmanned Vehicle Launch, Expanding into New Businesses

On September 2, the company launched the "Chuanxing Zhiyuan" vehicle-grade unmanned vehicle brand in Shanghai. Entering the unmanned vehicle field is an extension of the company's core capabilities. The first product, the S6, features a vehicle-grade fully-controlled chassis and modular upper structure. Based on the S6 platform, the vehicle is capable of serving various scenarios such as industrial parks, logistics parks, agricultural trade distribution, express delivery, supermarket distribution, store restocking, fresh food distribution, and pharmaceutical delivery. The S6 series of low-speed unmanned vehicle products has already received multiple customer orders.

Investment Thesis

The Company is a leader in automotive electronics, benefiting from continuous investment in R&D to maintain its technological leadership, while also actively exploring new businesses. We remain highly optimistic about the company's growth prospects.

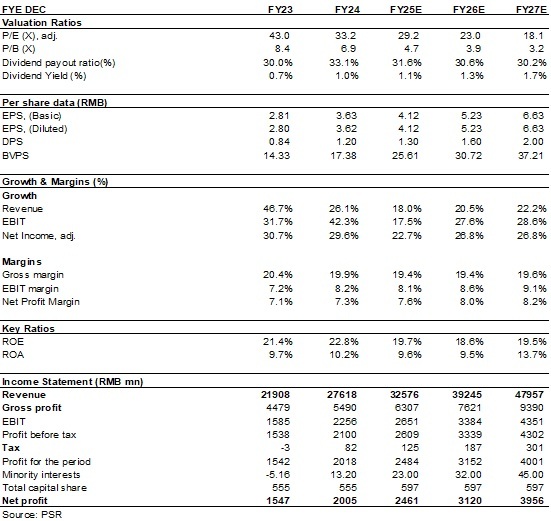

As for valuation, we expected diluted EPS of the Company to RMB 4.12/5.23/6.63 of 2025/2026/2027. And we accordingly gave the target price to RMB147, respectively 35.7/28.1/22.2x P/E for 2025/2026/2027. "Buy" rating. (Closing price as at 31 December 2025)

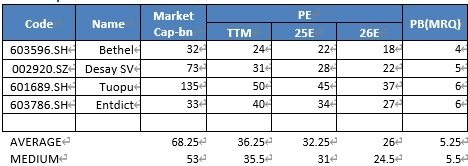

Peer Comparison

Source: Wind, Phillip Securities Hong Kong Research

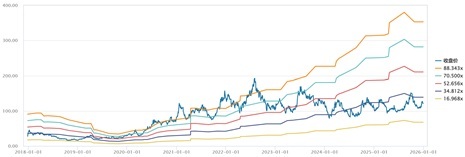

PE BAND

Source: Wind, Phillip Securities Hong Kong Research

Risk

Progress of new production line is below expectations

Electric vehicle sales fall short of expectations

Macroeconomic downturn affects product demand

Sharply rising raw material prices or sharply falling product prices

Financials

(Closing price as at 31 December 2025)

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|