-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- Smart Minor (Joint) Account

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

XIMEI RESOURCES (9936.HK) - With the high growth in demand for tantalum and niobium in the market, the company is poised to embark on a long-term growth trajectory

Thursday, February 26, 2026  2745

2745

XIMEI RESOURCES(9936)

| Recommendation | Accumulate |

| Price on Recommendation Date | $14.220 |

| Target Price | $15.550 |

Weekly Special - 1361 361 DEGREES

Overview

The company is a manufacturer of tantalum and niobium metallurgical products in China. These products are essential for downstream manufacturing used in various high-tech industries such as specialty alloys, chemicals, electronic ceramics, aerospace, high-end electronic consumer goods, national defense, and cemented carbide. The company's main products are tantalum oxide and niobium oxide. The company also produces and sells potassium flutantalate. The company processes its products to different purities and specifications to meet the demands of various end products. Additionally, the company sells processed products such as tantalum bars, carbon oxide, niobium bars, and niobium powder by either commissioning third-party metallurgical companies to process its pentoxide products and potassium fluotantalate, or by purchasing these processed goods from third-party metallurgical companies. Furthermore, the company provides processing services to convert tantalum and niobium ores provided by customers into pentoxide products and potassium fluotantalate.

Analysis of the Tantalum and Niobium Industry Chain

Highly Concentrated Upstream Resources with Heavy Reliance on Imports

The upstream segment of the tantalum and niobium industry involves ore mining and processing, with global resource distribution being highly concentrated. The supply of raw materials consists of four parts: tantalum and niobium concentrates, tin slag, lithium ore by-products, and tantalum and niobium recycled materials. According to data from Antaike, from 2020 to 2024, global tantalum mine production increased from 1,700 metric tons (metal content) to 2,500 metric tons (metal content), representing an average annual growth rate of 4.5%. The Great Lakes Region in Central Africa (including the Democratic Republic of the Congo, Rwanda, Ethiopia, Mozambique, and other countries) has become a significant global source of tantalum raw materials. Relying on surface outcrop ores and manual operations, this region holds a 68% market share. In 2024, the world's largest tantalum mine producer was the Democratic Republic of the Congo (DRC), accounting for 40% of global output, followed by Rwanda (22%), Brazil (18.4%), and Nigeria (6.2%). The combined production share of these four countries reached as high as 86.6%. In China, the only tantalum mine currently achieving large-scale mining is the Yichun Tantalum-Niobium Mine. During the same period, global niobium mine production increased from 68,000 metric tons (metal content) to 87,000 metric tons (metal content), with an average annual growth rate of 5.1%. Brazil is the world's largest niobium mine producer, with its output rising from 60,000 metric tons (metal content) in 2020 to 78,000 metric tons (metal content) in 2024, an average annual increase of 4.5%. As a major consumer of tantalum and niobium, China's supply remains highly dependent on imports. According to statistics, by 2024, China's import value in the tantalum and niobium industry was 8.976 billion RMB yuan, while the export value was 1.366 billion RMB yuan.

Midstream Full-Industry-Chain Layout Becomes Key, with Technological Barriers Building Competitive Advantage

The midstream sector encompasses hydrometallurgy (extracting oxides), pyrometallurgy (preparing alloys), and the processing of high-end products. Leading domestic companies have formed a technological monopoly (closed-loop system), resulting in an oligopolistic market structure. Key players include OTIC (the largest production base for tantalum and niobium products in China and a technology- leading research center for these metals), CMOC Group (a globally leading producer of copper, cobalt, molybdenum, tungsten, and niobium, which indirectly holds a 100% interest in the Brazil NML niobium mine; this mine's operations cover the exploration, mining, extraction, processing, and sale of niobium ore, with its main product being ferroniobium), and XIMEI RESOURCES.

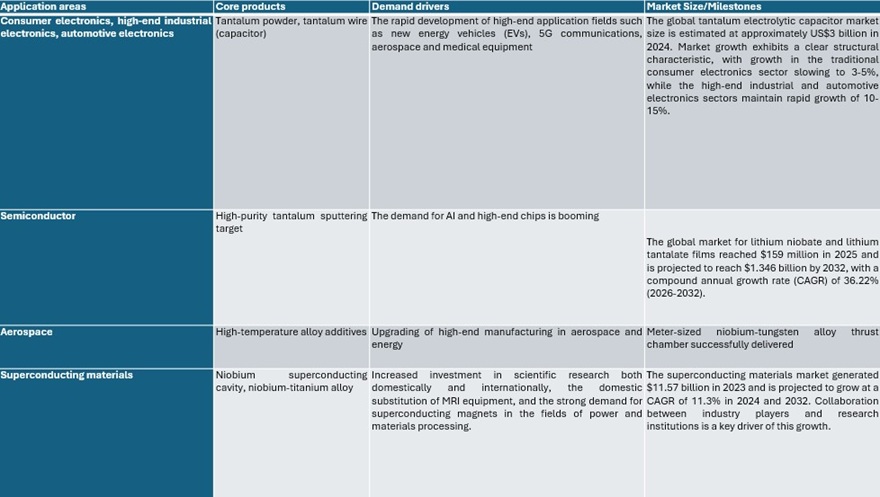

Surge in Demand from Downstream High-End Sectors, Offering Structural Growth Opportunities

Data Source: Pu Hua You Ce Consulting, QYResearch, Global Market Insights

Profit Efficiency Significantly Improved

In the first half of 2025, the company's revenue was 954 million RMB (similarly hereinafter), representing a year-on-year increase of 5.7%. This was primarily attributable to the company's active adjustment of its product mix, with significant year-on-year growth in metal products, especially niobium metal products, and trading business during the period. Specifically, revenue from tantalum and niobium wet-method compounds was 234 million RMB, accounting for 24.5%; revenue from tantalum and niobium metals and related products was 505 million RMB, accounting for 52.9%; and revenue from trading products, processing services, and others was 216 million RMB, accounting for 22.6%. The gross profit margin was 23.7%, a year-on-year increase of 2.6 percentage points. This improvement was mainly due to the further release of production capacity during the review period, an increase in the sales proportion of metal products, particularly high-purity metals. Additionally, the company strengthened process controls and enhanced efficiency in production, including the utilization of recycled materials and by-products, driving cost reduction and efficiency gains, thereby increasing the gross profit margin. Net profit attributable to owners of the parent was 92 million RMB, a year-on-year increase of 47.5%, reflecting a significant improvement in profit efficiency.

Decrease in Expense Ratio, Optimizing Operational Efficiency

In H1 2025, sales and distribution expenses amounted to RMB 9.725 million, a year-on-year decrease of 1.2%, primarily due to a slight reduction in employee costs. Administrative expenses totaled RMB 73.938 million, down 15.5% year-on-year, mainly attributable to the conclusion of certain R&D projects. This demonstrates the company's ability to reduce costs through refined management, further unlocking profit margins.

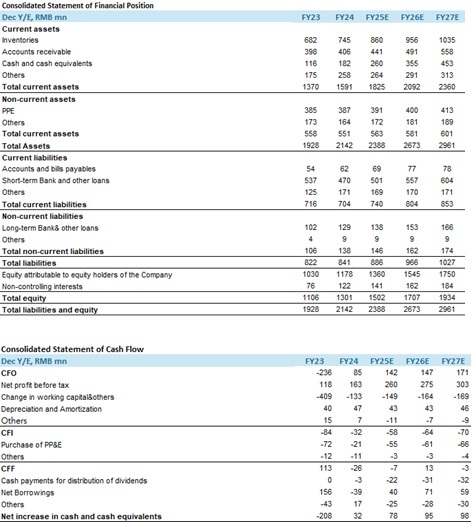

Sound Assets and Liabilities Position, Slight Liquidity Pressure

As of the end of June 2025, the company's total assets stood at RMB 2.387 billion, with a debt to asset ratio of 42.1%, remaining at a reasonable level. However, both the current ratio and quick ratio declined compared to the end of 2024, indicating slight pressure on short-term liquidity. The decrease in the current ratio was primarily due to an increase in inventory. The decline in the quick ratio reflects a rise in the proportion of inventory within current assets. Net cash flow from operating activities was RMB 176 million, and capital expenditure amounted to RMB 14.17 million, indicating that cash flow is sufficient to support daily operations and capacity expansion needs.

Ganfeng's Strong Backing: Resource and Technology Synergies Unlock Long-Term Growth Potential for XIMEI RESOURCES

Ganfeng Lithium currently holds a 15.79% stake in XIMEI RESOURCES, making it the second-largest shareholder. As a global leader in the lithium industry, Ganfeng Lithium has long focused on the new energy metals industry chain. Tantalum and niobium, as critical materials for high-end fields such as semiconductors and aerospace, fall within the same strategic metals category as lithium resources. Through its stake in XIMEI RESOURCES, Ganfeng Lithium likely aims to expand its footprint in strategic metals, forming a diversified resource portfolio of "lithium + tantalum/niobium," while leveraging XIMEI RESOURCES' technological expertise in tantalum and niobium metallurgy to enhance industrial chain synergies in the advanced materials sector. Furthermore, Ganfeng Lithium's shareholding endorsement helps boost market confidence.

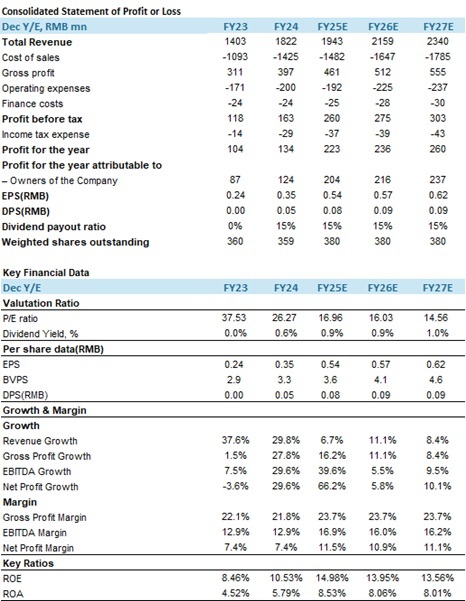

Company valuation

As a core producer of tantalum and niobium metallurgical products in China, Framework Resources is poised to benefit from the growth in high-end downstream demand for tantalum and niobium (semiconductors, aerospace), enabling it to embark on a long-term growth trajectory and achieve performance increases. We forecast the company's revenue for 2025-2027 to be RMB 1.943 billion, RMB 2.159 billion, and RMB 2.340 billion, respectively, with EPS of RMB 0.54, RMB 0.57, and RMB 0.62. We assign a 24x P/E ratio for 2026, resulting in a target price of HKD 14.25. Initiate coverage with an "Accumulate" rating. (Current price as of February 25)

Risk factors

1) Pace of domestic substitution; 2) Risk of overseas supply chain volatility; 3) Intensifying technological competition

Financial

(Current Price as of: 25 Feb 2026)

Exchange rate: HKD/RMB = 0.88

Source: PSHK Est.

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|