-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- Smart Minor (Joint) Account

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

CMOC Group Limited (3993.HK) - Net profit attributable to shareholders of the parent company first exceeded the 20-billion-yuan mark, setting record highs for five consecutive years

Thursday, January 29, 2026  1069

1069

CMOC Group Limited(3993)

| Recommendation | Accumulate (Maintain) |

| Price on Recommendation Date | $24.140 |

| Target Price | $26.970 |

Weekly Special - 1361 361 DEGREES

Net Profit Attributable to Shareholders Surpassed 20 billion Yuan Mark for First Time

CMOC Group has released its 2025 performance forecast. The company expects to achieve a net profit attributable to shareholders of the parent company in the range of 20.0 billion to 20.8 billion yuan (RMB, same below) for the full year, representing a year-on-year increase of 47.80% to 53.71%. After deducting non-recurring gains and losses, the net profit attributable to shareholders is projected to be between 20.4 billion and 21.2 billion yuan, marking a year-on-year growth of 55.5% to 61.6%. This signifies the company's first entry into the 20-billion-yuan profit bracket, setting record-high annual results for the fifth consecutive year. The company has achieved high-quality and sustained growth. This success stems from both the simultaneous increase in volume and price of its primary products and the systematic enhancement of its internal operational and management capabilities. In 2025, CMOC comprehensively advanced refined management practices, built a platform-based organizational structure, and vigorously promoted cost-reduction and efficiency-improvement measures. The results of these initiatives are gradually being reflected in the operating performance. During the year, the company's copper production reached 741,149 tonnes, an increase of over 90,000 tonnes compared to the previous year. Calculated against the mid-point of the annual production guidance, the achievement rate reached 118%. Furthermore, copper output demonstrated a quarter-by-quarter upward trend, with the fourth-quarter single-quarter production nearing 200,000 tonnes. This further highlights the improvement in the company's operational efficiency and the sustainability of its capacity release. All other products also exceeded planned expectations. Specifically, cobalt production was 117,549 tonnes, achieving 107% of the target; molybdenum production was 13,906 tonnes, achieving 103%; tungsten production was 7,114 tonnes, achieving 102%; niobium production was 10,348 tonnes, achieving 103% and also reaching a historical high; phosphate fertilizer production was 1.21 million tonnes, achieving 105%. Additionally, the physical trading volume reached 4.774 million tonnes, achieving 112% of the target.

Acquisition of Brazilian Gold Assets Marks a New Strategic Chapter

In December 2025, CMOC Group acquired four operating gold mines in Brazil from Canada's Equinox Gold for USD 1.015 billion, marking a key milestone in the implementation of its "Copper-Gold Dual-Pillar" strategy. The acquisition is expected to add approximately 8 tonnes of annual gold production to the company's portfolio, along with significant resource reserves (gold resources of 5.013 million ounces and reserves of 3.873 million ounces). Combined with the Kahoos gold mine in Ecuador acquired in April 2025, the company's annual gold production is expected to exceed 20 tonnes in the future. This will create a dual-pillar growth engine alongside its core copper business. The strategic value of this acquisition is significant: First, it elevates the company's gold business from a by-product to a core operation, completing the transformation from a "copper-cobalt leader" to a "copper-gold dual-pillar" enterprise. Second, the assets are located across several states in northeastern and southeastern Brazil, enabling regional synergies with the company's existing niobium and phosphate operations in the country. This will facilitate shared infrastructure and management resources, deepen its presence in South America, and optimize operating costs. Third, the transaction was executed at a time when gold prices were at historic highs, with continued upward momentum, offering substantial profit potential. The gold business is expected to become one of the key drivers of long-term profit growth for the company.

Company valuation

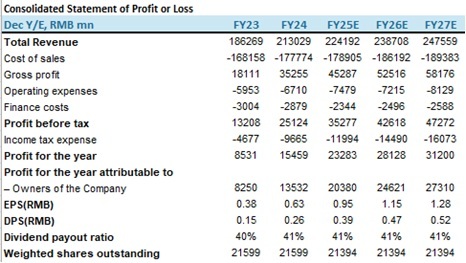

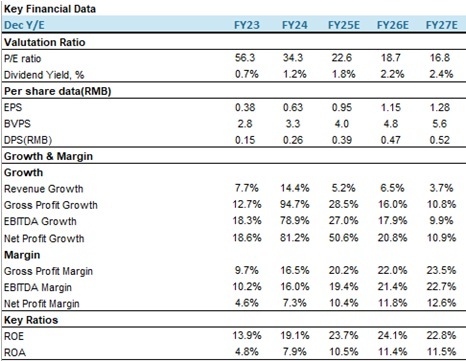

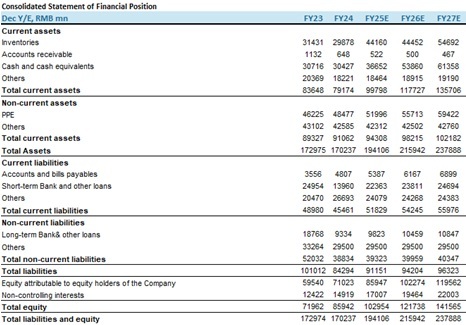

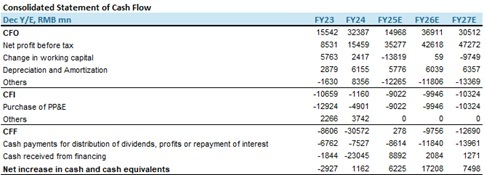

The company provided production guidance for its major products in 2026, which is as follows: copper metal is projected to be 760,000-820,000 tonnes; cobalt metal 100,000-120,000 tonnes; molybdenum metal 11,500-14,500 tonnes; tungsten metal 6,500-7,500 tonnes; niobium metal 10,000-11,000 tonnes; phosphate fertilizer 1.05-1.25 million tonnes; gold 6-8 tonnes; and physical trading volume 4.0-4.5 million tonnes. We believe the global copper market may remain in a tight supply-demand balance going forward. Supply is prone to disruptions, while demand benefits from increased investments in power grids and AI data centers. In October 2025, the government of the Democratic Republic of Congo (DRC) announced details of cobalt export quotas, ending an export ban that had been in place for eight months since the beginning of the year. The new regulations implement an annual quota management system, with quotas set at 96,600 tonnes per year for both 2026 and 2027. The tight cobalt supply-demand situation is expected to persist, ensuring strong business growth certainty and supporting continued strength in cobalt prices. This year marks the first time the company has provided gold production guidance. We look forward to a significant increase in its future gold output, which should boost operating revenue. We have raised our revenue forecasts for the company, projecting revenues of RMB 224.192 billion, RMB 238.708 billion, and RMB 247.559 billion for 2025, 2026, and 2027, respectively. EPS is forecasted at RMB 0.95, RMB 1.15, and RMB 1.28, with BVPS at RMB 4, RMB 4.8, and RMB 5.6. Applying a 2026 P/B multiple of 5x, we derive a target price of HKD 26.97 and maintain our rating to "Accumulate". (Current price as of January 28)

Risk factors

Fluctuations in prices of major products, geopolitical and policy risks, interest rate risks, exchange rate risks, safety, environmental protection and natural disaster risks.

Financial

(Current Price as of: 28 Jan 2026)

Exchange rate: HKD/RMB = 0.89

Source: PSHK Est.

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|