-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

POLY REAL ESTATE (600048.SH) - A-shares leading property company with an appeal of its assessed value

Friday, December 5, 2014  19759

19759

POLY REAL ESTATE

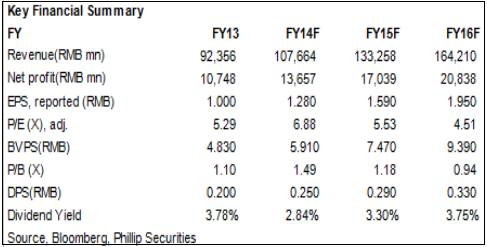

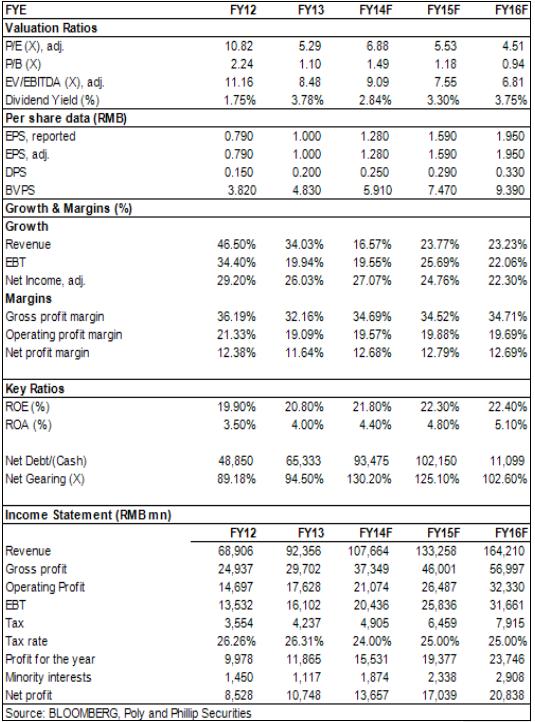

| Recommendation | Accumulate |

| Price on Recommendation Date | $7.950 |

| Target Price | $8.800 |

Weekly Special - 175 Geely

-Poly Real Estate sticks to a ŗ+2+X" regional distribution strategy which is focused on first-tier and second-tier central cities. By the end of June, 2014, Poly Real Estate's total housing area of land reserve has exceeded 84 million square meters, which mainly distributed in five main economic zones in Pearl River Delta, Yangtze River Delta, Bohai Bay Rim area and the Middle West;

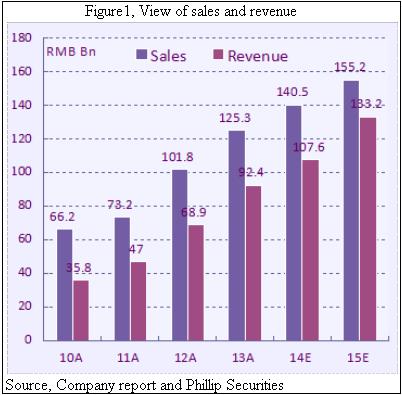

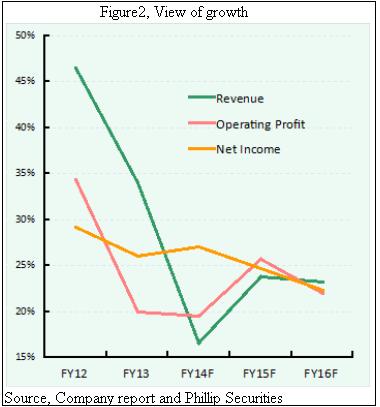

-From 2009 up to now, Poly Real Estate's property sale keeps growing rapidly, and its sales volume has grown from RMB 50,500 million in 2009 to an amount of expected over RMB 140,000 million in 2014, with a compound growth rate at 22.6%, which guarantees Poly Real Estate to be the No. 1 group in real estate companies of China;

-In 2014, Poly Real Estate basically remains rather rapid growth, especially from the beginning of the third quarter, the growth is significant. The sales volume and sales area of the former ten months of 2014 has added up to RMB 106900 million and 8.32 million square meters, with a growth rate at 6.1% and a reduction rate at 6% respectively. The fabulous sales data benefits from Q3's pre-selling and market rebound. From November to December is the tidal wave for sales promotion, and we predict that the Company's sales volume may hit a growth of double digits and may have a possible to exceed RMB 140,000 million in 2014.;

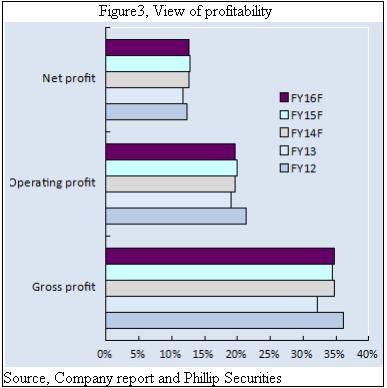

-The report of the third quarter shows, its business revenue and net profit amount to RMB 52,200 million and RMB 6,080 million, with a growth rate at 18% and 32% respectively, which is evidently rapider that that of the interim performance. We predict that the gross margin of 2014 will have a slight pick-up, that the Company will greet a tidal wave of settlement in the fourth quarter, and that the full-year performance is sure to perk up;

-Poly Real Estate's book cash amounts to RMB 35800 million, its interest-bearing debt amounts to RMB 129300 million in total, and the average cost is 6.48 percent of the benchmark floating. Its net debt ratio is 130%, rising by 12 points compared with the end of the first half of the year, which still remains relatively high level;

-The financial features of Poly Real Estate Group can be summarized as: it achieves rapid growth in its scale by means of relatively high financial leverage, and pays its matured debts and interests with abundant sale cash flow, thereby achieving its financial goals of high growth, turnover and ROE under huge scale of debts. We expect a slight decline in EBITDA/interest coverage ratio of the whole year in 2014 based on 2013, but it will still remain above 3 times.

How we view this

Poly Real Estate Group is one of the most competitive Chinese real estate companies, which can be seen from its leading position in domestic residential market, strong recurring income and favorable financing channels. We think that Poly Real Estate Group has a better sales growth, stable gross margin and attractive valuation compared with the average value of the industry.

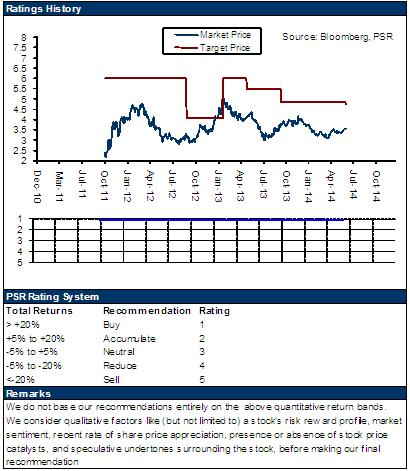

Investment Action

The rebound in Shanghai-Hong Kong Stock Connect and real estate, and the revaluation of the asset price of A shares will be a catalyst in its share prices. We give it a "Accumulate" rating, with a 12-month target price of RMB 8.8 yuan, which equals to 5.5x and 4.5x expected P/E ratio in 2014 and 2015.

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|