-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Weekly Specials

Minth Group (425.HK) - Overseas part continues to lead the way and the battery house business maintains growth momentum

Monday, October 21, 2024  1814

1814

Minth Group(425)

| Recommendation | BUY |

| Price on Recommendation Date | $14.260 |

| Target Price | $22.650 |

Weekly Special - 002472.CH Shuanghuan Driveline

Company Profile

Minth Group is a world-renowned supplier engaged in the design, manufacturing and sales of automotive interior and exterior trim and body structure parts. The domestic market share of its core products exceeds 30%. The company has production bases in China, the United States, Mexico, Thailand, Germany, Serbia and other countries, and its customers cover major vehicle companies in the market. Based on a variety of new materials and surface treatment technologies, in recent years the company has developed new electrified and smart product lines such as aluminum power battery boxes and smart front faces, forming a series of competitive terminal products.

Investment Summary

Earn 20% in over half a year in 2024, and exhibit an improvement in gross margin

Minth Group, in H1 of 2024, recorded a total revenue of RMB11.09 billion, up 13.78% yoy and 1.85% hoh. The net profit attributable to the parent company hit RMB1,068 million, up 20.4% yoy and 6% hoh. The main reason is the economies of scale driven by revenue growth, the continuous increase in the capacity utilization of the production line of battery house and the yoy increase in gross profit of each product line compared with 2023 due to the cost reduction and efficiency measures pushed by each product line. As a result, the Company generally maintained a good level of profitability.

During the Reporting Period, the gross margin was approximately 28.5%, up 2.2 ppts year on year. It was mainly driven by the increase in segment margin of plastic products and battery house by 2.0 ppts and 2.7 ppts, respectively. Specifically, the segment margin of the battery house business reached 20.6%, one step closer to the 25% target.

The Company's yoy selling expenses, administration expenses, and R&D expense ratio increased by 1.1 ppts, 0.3 ppts, and 0.1 ppts, respectively, to 4.8%, 6.7%, and 6.4%. It was mainly due to the rise in transportation costs due to the Red Sea Crisis, the expense rise due to the increase in international business volume, and R&D investment in continuously innovative products and new material technologies. However, the rise in gross margin has offset the increase in expense ratio. The net profit margin increased by 0.47 ppts year on year to 9.63%..

Overseas part continues to lead the way and the battery house business maintains growth momentum

The Company continuously optimizes the operating efficiency of global factories. It has built "hub" central factories in various operating regions around the world, and established satellite factories around the hub factories, so as to achieve global capacity synergy and continuously improve the collaborative operation efficiency between various product lines. Among all regions, China's turnover was approximately RMB4,526 million, up around 7.5% yoy, which mainly benefited from the increase in the battery house and Chinese brand business. The turnover internationally was approximately RMB6.56 billion, up roughly 18.6% yoy, accounting for 59.2% from 56.8% in H1 of 2023. This was mainly a result of the rapid growth in the battery house business and the increase in traditional product business in North America and Asia Pacific.

During the Reporting Period, the turnover of such products as battery house, body and chassis structural parts, and smart exterior parts maintained rapid growth, while traditional products recorded stable growth. On a closer look at product lines, the revenues of the four segments, namely metal and trim products, plastic products, aluminum products, and battery house products, amounted to RMB2,542 million, RMB2,843 million, RMB2,372 million, and RMB2,391 million, up by 1.2%, 14.3%, 14.04%, and 32.7% year-on-year, respectively. The segment margin was 26.6%, 24.1%, 35%, and 20.6%, respectively, except for the decrease in aluminum products by 0.9%, the segment margin increased by 0.3 ppts, 2.0 ppts, and 2.7 ppts, respectively. With the rapid volume growth of multiple product lines in Europe, the gross margin of the battery house is expected to continue to benefit from the scale effect.

Following market changes, the Company has focused on the business expansion of Chinese brands and new car-making forces while working hard to gain new business orders from European Japanese, and Korean OEMs in the international market, making steady progress. The turnover of Chinese brands has increased by 2.3 ppts from 12.4% in H1 of 2023 to 14.7% during the Reporting Period and the market share of the European brands has grown by 2.2 ppts to 41.7%.

The Company turned its free cash flow positive and the repurchase and the resumption of dividends have manifested the Management's confidence

Capital expenditure in H1 of the year fell 45.7% year on year to RMB1,093 million, and the full-year guidance is no more than RMB2.5 billion. After years of investment and construction of new business capacity (in particular, the layout of overseas factories), the Company has survived the stage of high investment and is expected to focus on equipment renewal and flexible transformation investment in the future. The Company's cash flow has also improved, with free cash flow going from negative (-RMB417 million) to positive (+ RMB637 million). It is expected to resume its suspended one-year dividend by the end of the year. Meanwhile, the Company has announced that it plans to use no more than HK$500 million for share repurchase, which conveys the confidence of the Management in the future development of the Company.

In H1, the Company undertook new orders worth an annualized turnover of RMB6.3 billion, and the orders in hand were RMB236 billion, up RMB31 billion yoy. The Company continues to invest in R&D for innovative products and new materials including battery house, body and chassis structural parts, smart integrated exterior parts, hydrogen storage system, and storage and charging machine, and has gained multiple new business orders. Moreover, the development of new product tracks such as battery cell structural parts that have been laid out will drive the Company's long-term sustainable development..

Valuation

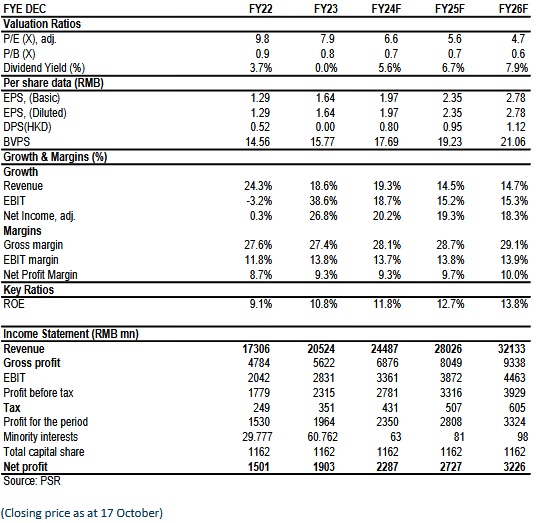

We slightly decreased the expected earnings per share for 2024/2025 to 1.97/2.35(from 2.17/2.53), taking into account the pressure on the overall gross profit margin from new business during the ramp-up period.

We believe that it is reasonable to give the Company a valuation of 10.5/8.8/7.4x P/E and 1.2/1.1/1.0x P/B for 2024/2025/2026, equivalent to target price of HK$ 22.65 and BUY rating. (Closing price as at 17 October)

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|