-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Teletext

Please enter a stock code or name to get quote details.

| Day High | -- | Day Low | -- |

| Open | -- | Prev. | -- |

| Turnover | -- | Volume | -- |

| Day Change | -- | Lot Size | -- |

| Lot Amount | -- |

INSPUR INT`L (596.HK) - Surged costs and expenses cause net loss in the coming future

Thursday, July 3, 2014  6827

6827

INSPUR INT`L(596)

| Recommendation | Neutral |

| Price on Recommendation Date | $1.650 |

| Target Price | $1.560 |

Weekly Special - 425 Minth Group

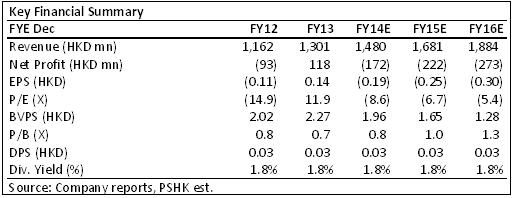

-Inspur’s turnover for 2013 increased 12% to HK$ 1.3 Bn while gross profit just slightly went up 4.7% yoy, with gross profit margin dropped 2.4% yoy to 34.1%.

-Operating loss amounted to HK$ 150.9 Mn, while profit attributable to parent was HK$ 116 Mn after calculating the disposal gain from discontinued operation HK$ 268.2 Mn.

-In fact, the revenue gained from core operation was not enough to cover the cost and expenses. More disappointing estimate showed that the loss would likely last for several years even revenue continued to grow on software development.

-We conservatively give Inspur an initial rating of “Neutral” with target price HK$ 1.56, slightly lower than the current price.

Financial Highlights

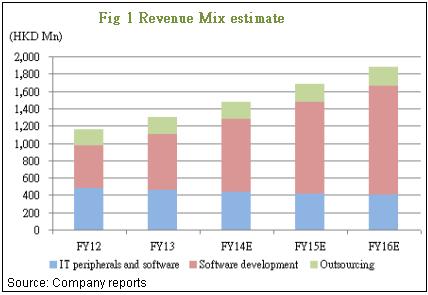

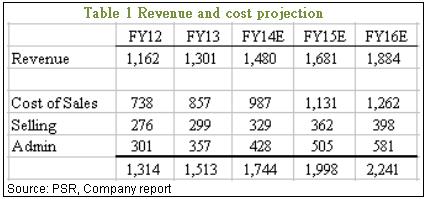

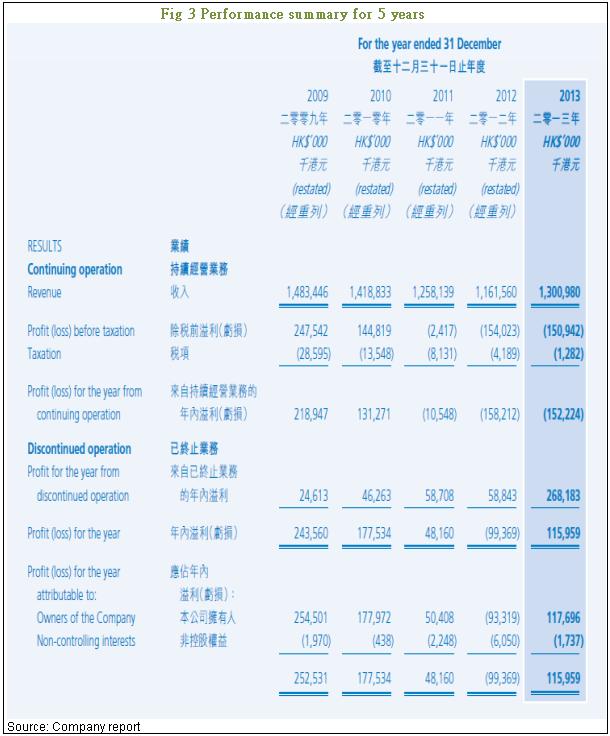

Inspur’s 2013 turnover increased 12% yoy to HK$ 1.3 Bn, in which revenue from software development rose 31.7% yoy to HK$ 648 Mn; outsoursing amounted to HK$ 194.3 Mn, up 3.1% yoy. and sales of IT peripherals and software dropped 4.6% yoy to HK$ 458.7 Mn. The cost of sale rose 16.2%yoy to HK$ 857.2 Mn, causing the gross profit just slightly went up 4.7% yoy to HK$ 443.8 Mn, with gross profit margin dropped 2.4% yoy to 34.1%. Operating loss amounted to HK$ 150.9 Mn, while profit attributable to parent was HK$ 116 Mn after calculating the disposal gain from discontinued operation HK$ 268.2 Mn.

How we view this

Based on the company’s adjusted performance summary for the recent years (Fig 3), turnover increased gradually but the expenses surged during the 5 years, which led to the sharply slumped of the company’s profit. In fact, the revenue gained from core operation was not enough to cover the cost and expenses. Profit in 2013 is only due to the disposal of operation. More disappointing estimate showed that the loss would likely last for several years even revenue continued to grow on the software development. Although the company is actively invested in the R&D and claimed to transform its focus to the cloud business since 2011, the result was not as significant as forecasted, while the investment expenditures continued to go up.

Investment Action

As a result, based on the negative historical results and future outlook, we expected the company can hardly generate positive profit in the coming years. Although there is news on the replacing of IBM server business and the compnay confirmed to employed former IBM staff recently. It is still a doubt that any realistic future revenue would earn. Therefore, we just conservatively give Inspur an initial rating of “Neutral” with target price HK$ 1.56, slightly lower than the current price.

Revenue from software development remains the growth momentum

The revenue from software development rose 31.7% yoy to HK$ 648 Mn; outsoursing amounted to HK$ 194.3 Mn, up 3.1% yoy. and sales of IT peripherals and software dropped 4.6% yoy to HK$ 458.7 Mn. It is forecasted that the growth on software development, included the cloud business can reach a 20%-30% yearly growth in the coming few years. According to company’s previous financial statements, the outsourcing business expanded rapidly in 2012 with over 50% growth, but the growth rate suddenly dropped to 3.1% this year implied unstable or negative growth may occur in the future.

Revenue from continuing operation is not enough to cover the cost and expenses

The cost of sale rose 16.2%yoy to HK$ 857.2 Mn, causing the gross profit just slightly went up 4.7% yoy to HK$ 443.8 Mn, with gross profit margin dropped 2.4% yoy to 34.1%. There is operating loss of HK$ 150.9 Mn for the year, but HK$ 116 Mn profit attributable to parent since the disposal gain from discontinued operation HK$ 268.2 Mn was calculating.

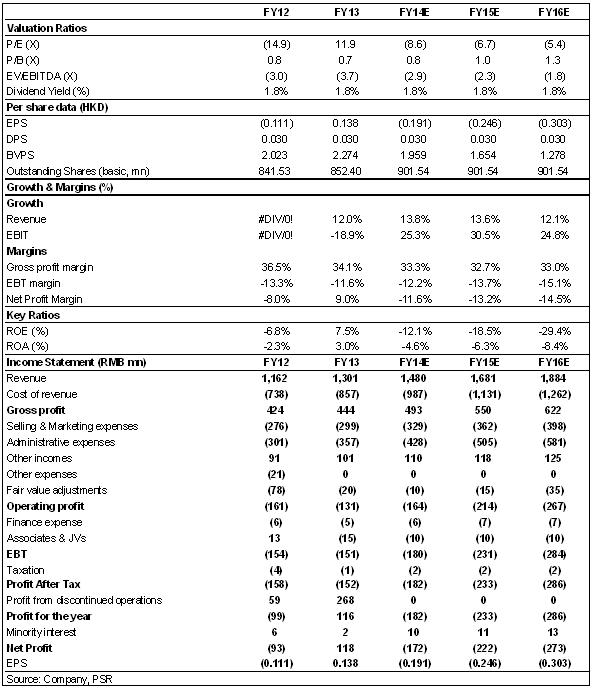

The table below is the reported and estimated revenue and expenditures, which showed that there is still a big negative gap between two.

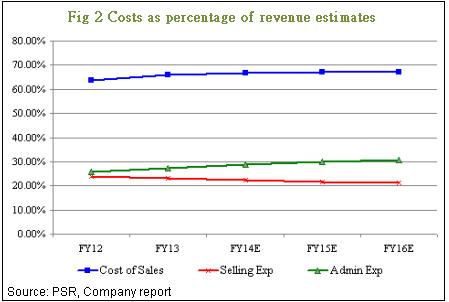

Cost of sales is believed to rise slighly to around 67%. The forecasted growth rate in selling expenses will maintain at around 10%, while 15%-20% in admin expenses.

Negative historical performance due to surge in cost and expenses

Based on the company’s adjusted performance summary for 5 years (Fig 3), turnover increased gradually in the recent 3 years but the attributable profit sharply slumped which implied the expenses surged during the years, and the profit is only resulted from the disposal of operation. Although the company cliamed to invest heavily in R&D and started to transform its focus to the cloud business since 2011, we estimate that the loss would likely last for several years even revenue continued to grow.

Valuation

Based on the negative historical results and future outlook, we expected the company can hardly generate positive profit in the coming years. Although there is news on the replacing of IBM server business and the compnay confirmed to employed former IBM staff recently. It is still a doubt that any realistic future revenue would earn before heavily investment. Therefore, we just conservatively give Inspur an initial rating of “Neutral” with target price HK$ 1.56, slightly lower than the current price. The target is calculated based on cash in hand plus the entrusted loan per share.

Potential Risks

The growth on clould business slow down;

The cost structure worsen;

Top of Page

|

請即聯絡你的客戶主任或致電我們。 市場拓展部 Tel : (852) 2277 6666 Email : marketing@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|