-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Teletext

Please enter a stock code or name to get quote details.

| Day High | -- | Day Low | -- |

| Open | -- | Prev. | -- |

| Turnover | -- | Volume | -- |

| Day Change | -- | Lot Size | -- |

| Lot Amount | -- |

CEA (670.HK) - Brief review of its positive profit alert

Monday, February 9, 2015  13700

13700

CEA(670)

| Recommendation | Accumulate |

| Price on Recommendation Date | $3.650 |

| Target Price | $3.950 |

Weekly Special - 3993 CMOC Group Limited

-A positive profit alert, expecting to record a yoy increase of 40%-60% in net profit for 2014, namely EPS between RMB 0.275-0.3144.

-We predict that the contribution of the fuel oil cost reduction factor to the performance of CEA in the fourth quarter turning to positive may reach 40%.

-The capacity input of CEA was the most conservative among the big-three carriers, the growing rate of the amount of passenger traffic of CEA was also the lowest.

-Southeast Asia routes were in the downturn and the recovery of Japan and Europe routes was weaker than expected, both of which had the most obvious adverse effects on CEA's international routes.

-Shanghai Disney Park is opening soon, CEA will undoubtedly become the biggest beneficiary. In addition, the attempts of CEA in the fields of budget airline, E-commerce, freight logistics and so on also provide the space for the company's performance improvement.

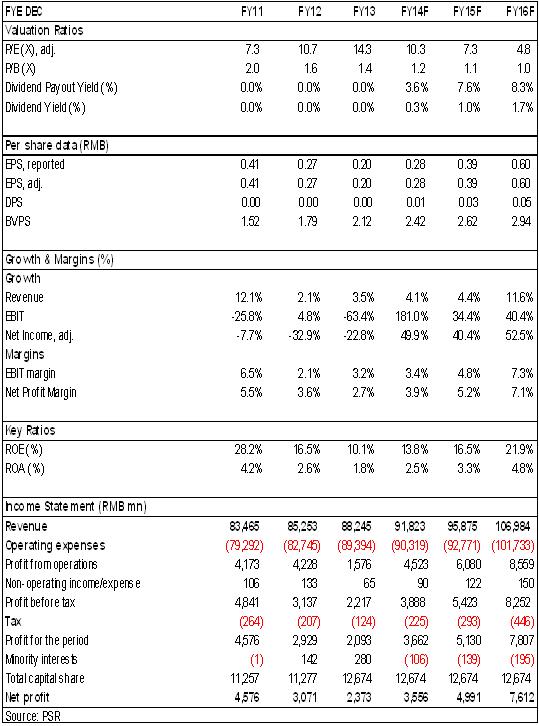

The performance of 2014 is predicted to increase by 40-60%

CEA has issued its performance predicted increase report: according to the Chinese Accounting Standards, it is predicted that until 2014, the annual net profit has increased by 40-60% every year. The company obtained RMB 2.376 billion of net profit in 2013, and the corresponding net profit should be between RMB 3.326 billion and RMB 3.8 billion in 2014, namely EPS would stood between RMB 0.275-0.3144. Because the results of the first three quarters of CEA have actually decreased on yoy basis, meaning that CEA has made a profit of RMB 1.268-1.742 billion during the fourth quarter comparing with the loss of RMB 1.036 billion during the same period in 2013, turning loss into gain. There are three main reasons why the company will have a better performance:

1) The drop of the price of fuel

2) The raise of operation and management efficiency

3) The adjustment of welfare policies for employees

Investment Thesis

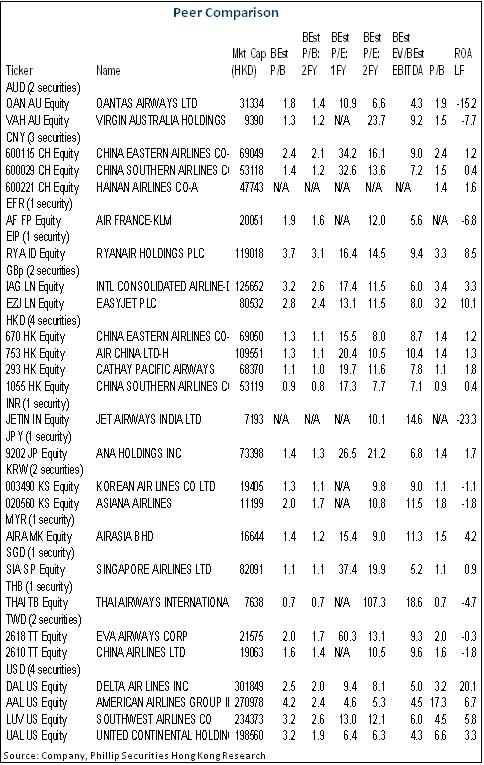

We revised EPS expectation of the Company to RMB 0.28, 0.39, 0.60 of 2014/2015/2016. And we accordingly revised the target price to 3.95, respectively 11/8/5x P/E and 1.3/1.2/1.1x P/B for 2014/2015/2016. We reiterate "Accumulate" rating.

The drop of fuel price is the most important reason

Since July 2014, the international crude oil price has dropped continuously and seriously from 100 dollars per bucket to around 50 dollars per bucket, with a decrease of 40-50%. Viewing from the data of 2013, the fuel oil cost of CEA was RMB 30.68 billion, accounting for 38.2% of the total operation cost. In H1 of 2014, the fuel oil cost of the company was RMB 14.95 billion, accounting for 38.07%. The big drop of oil price cost has an obvious impact on improving the performance. We predict that the contribution of the fuel oil cost reduction factor to the performance of CEA in the fourth quarter turning to positive may reach 40%.

Operation efficiency has been raised after controlling capacity input

The capacity input of CEA was the most conservative among the big-three carriers in 2014. Its ASK only increased by 5.57% yoy, while that of Air China and China Southern Airlines achieved double-digit yoy growth ratio, 10.2% and 12.3% respectively. However, what was corresponding to this was that the growing rate of the amount of passenger traffic of CEA was also the lowest. The increase of the passenger traffic and the number of passengers was 6% and 5.9% respectively on yoy basis. And the increase of passenger volume of domestic, international and regional routes was 6.5%, 4.4% and 9.5% respectively on yoy basis. Its increase in international routes was significantly slower than that of 14.6% of Air China and 20.2% of China Southern Airlines. We think it was mainly determined by the international route structure characteristics of CEA. Southeast Asia routes were in the downturn and the recovery of Japan and Europe routes was weaker than expected, both of which had the most obvious adverse effects on CEA.

On the other hand, benefited from the control of the capacity, the P L/F of CEA was the only one achieving the positive growth ratio among the big-three carriers, with the yoy increase of the overall P L/F of 0.33ppts in 2014, reaching 79.5%, while that of Air China and China Southern Airlines decreased respectively by 0.9 ppts and 0.03 ppts to 79.9% and 79.4%.

To be benefit from the coming Disney and layout of low cost air in the future

As the world's sixth Disney theme park, Shanghai Disney Park is opening soon, which is expected to bring at least 10 million passengers in 2016, among which, the newly added airline passengers are expected to reach 0.4 million. With the subsequent follow-up development advancing, the newly added airline passengers will increase to 1.2 million/year. With more than 40% market share in Shanghai, CEA will undoubtedly become the biggest beneficiary. Chinese United Airlines owned by the company announced to transform into a budget airline, which we think, is of great significance, helping CEA to obtain the domestic leisure and tourism passengers, who are more sensitive to the prices. In the trend of the competition normalization of High-speed Rail and the rapid development of the leisure tourism, the early layout of low cost airlines lays the foundation for the company to develop the subdivision sub-markets. In addition, the attempts of CEA in the fields of E-commerce, freight logistics and so on also provide the space for the company's performance improvement.

Financials

Top of Page

|

請即聯絡你的客戶主任或致電我們。 市場拓展部 Tel : (852) 2277 6666 Email : marketing@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|