-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- Smart Minor (Joint) Account

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

361 DEGREES (1361.HK) - Channel penetration and high cost-effectiveness build a moat in lower-tier markets

Wednesday, December 17, 2025  1859

1859

361 DEGREES(1361)

| Recommendation | Buy |

| Price on Recommendation Date | $5.870 |

| Target Price | $7.470 |

Weekly Special - 3606 Fuyao Glass

Overview

The 361° brand was founded in 2003, with its brand positioning centered on "Professional + Youthful." It focuses on mid-price range product lines within the mass consumer market, covering multiple segments such as running, basketball, comprehensive training, children's products, and outdoor sports. The company consistently advances its "Single Focus, Multi-Brand, Globalization" strategy. With the main brand 361° at its core, it is complemented by sub-brands including 361° Kids, 361° International Line, forming a multi-layered product matrix. Currently, 361° products are popular across major cities and regions in China, and the brand is gradually expanding into overseas markets. As of June 30, 2025, the number of 361° retail stores in mainland China reached 5,669, most of which are located in third-tier and below cities in China. The number of 361° Kids sales outlets stood at 2,494, while the number of 361° International sales outlets was 1,357.

Digital Transformation Yields Notable Results, Overseas Market Expansion Continues

In the third quarter of 2025, the 361° main brand and its children's wear brand both recorded a 10% year-on-year increase in offline retail sales, while e-commerce platform retail sales achieved a 20% year-on-year growth. In the first half of 2025, the company's revenue reached RMB 5.705 billion, representing an 11% increase compared to the same period last year. The revenue breakdown by product category is as follows: Footwear contributed RMB 3.29 billion, accounting for 57.6% of total revenue; apparel contributed RMB 2.12 billion, accounting for 37.2%; accessories contributed RMB 210 million, accounting for 3.7%; other products contributed RMB 90 million, accounting for 1.5%. From the perspective of channel structure, online-exclusive products from the e-commerce business contributed RMB 1.82 billion in revenue, representing 31.8% of the total and marking a 45% year-on-year growth. This indicates that the effectiveness of digital transformation continues to be evident. In terms of regional distribution, the domestic market remains the core sales market for the company. 361°'s international business contributed 1.5% to total revenue, with a year-on-year growth of 19.7%. This growth primarily stemmed from expansion in Southeast Asia, the Americas, Europe, and regions along the "Belt and Road" initiative. The company will continue to strengthen its presence in overseas markets going forward. We believe the company still possesses significant room for development in international markets. With sustained brand-building efforts overseas, the company may contribute more incremental revenue in the coming years.

Gross Margin Remains Stable for Years, Demonstrating Profit Resilience

In the first half of 2025, the company's gross margin was 41.5%. Since 2021, the gross margin has remained above 40% for four consecutive years. The selling and distribution expense ratio was 18.2%, showing a slight increase year-on-year, mainly due to the company allocating more resources to advertising and promotional activities, particularly brand promotion via e-commerce platforms. Online sales are currently the mainstream trend in the consumer industry, and we anticipate the company will invest more resources in e-commerce platforms in the future, which may keep the selling and distribution expense ratio on an upward trend. The net profit margin attributable to shareholders was 15.3%, representing an increase of 2.94 percentage points year-on-year and 3.45 percentage points quarter-on-quarter, demonstrating its profit resilience across economic cycles. Earnings per share were RMB 0.41, up 8.6% year-on-year. The debt-to-asset ratio stood at 34.3%. Over the past four years, the company's debt-to-asset ratio has consistently remained below 30%, indicating a healthy financial structure and relatively low debt pressure.

Leveraging Meituan Flash and Taobao Flash to Enable "Half-Hour Delivery," Full-Scenario Store Matrix Builds Growth Resilience

361° has officially announced partnerships with both Meituan Flash and Meituan Group Purchase services, offering consumers new experience in sports consumption. 361° has also announced the full rollout of its Taobao Flash service, with the first phase launching in Chongqing. Popular cities such as Beijing, Shanghai, and Guangzhou will follow soon. The company's collaborations with Meituan and Taobao are not merely about expanding sales channels but represent a strategic complementarity. Meituan Flash and Taobao Flash address the "immediacy" pain point in sports consumption, converting online traffic into offline fulfillment within half an hour, significantly boosting conversion efficiency and user experience. This creates a closed loop of "online traffic generation and offline redemption," directly driving footfall to physical stores, countering fluctuations in offline customer flow, and enhancing store operational predictability and sales per square foot. The advantages of e-commerce are further highlighted. This reflects the company's precise understanding of local consumption habits and agile channel innovation.

Winter Sports Season Begins, ONEWAY's Performance is Worth Anticipating

The establishment of ONEWAY outdoor stores and women's sports concept stores represents a deep exploration of niche markets and a contextual expression of brand value. This not only enhances brand image and increases customer loyalty but also helps test new product categories and acquire high-value user data. The new ONEWAY stores primarily feature the newly launched outdoor footwear and apparel series for the Fall/Winter 2025 season, including three main product lines: NUUKSIO, SISU, and LUXE. These cover professional skiing, professional outdoor gear, and urban outdoor-style wear. Winter has arrived, and ice and snow facilities in many northern regions have begun operations. With the start of the new winter sports season, the supply of various types of ice and snow venues continues to diversify, and the number of people participating in winter sports in China is steadily growing. This trend is driving rapid growth in the ice and snow industry. According to data from China Central Television (CCTV) Internet, the total scale of China's winter sports industry reached 970 billion yuan in 2024, representing a year-on-year increase of approximately 9%. It is projected to exceed 1 trillion yuan in 2025. Coupled with the upcoming "Double 12" shopping festival, this is expected to boost sales of related ski apparel. Given these factors, ONEWAY's performance is highly anticipated.

Super Premium Store Drive Diversified Sales Development

361° Super Premium Stores reinforce the brand's differentiated advantages by offering an integrated, full-category consumer experience. Serving as benchmarks (with 93 such stores already established), they form a layered retail network alongside diverse store formats, effectively covering different customer segments and consumption scenarios. This structure enhances omnichannel operational capabilities and strengthens growth resilience.

Company valuation

According to data from the National Bureau of Statistics, from January to October 2025, the total retail sales of consumer goods reached 41.22 trillion yuan, representing a growth of 4.3%. Nationwide online retail sales of physical goods amounted to 10.40 trillion yuan with a year-on-year increase of 6.3%. Retail sales of sports and recreational goods reached 139.7 billion yuan, up 18.4% compared to the same period last year. A report from the General Administration of Sport of China shows that the number of participants in outdoor sports in China has exceeded 400 million. It is believed that, amid the nationwide fitness trend, this number is expected to continue growing, thereby driving increased sales of sportswear. 361° is actively expanding into the women's and children's segments, establishing a differentiated competitive advantage. This year, China launched a nationwide unified childbirth subsidy. By reducing the costs of childbirth and child-rearing and increasing willingness to have children, this policy is expected to contribute to the recovery of the child population base in the long term. Coupled with the growing demand for children's sports activities driven by the "Double Reduction" policy and the national fitness campaign, parents' willingness to spend on children's sportswear is rising. The children's sportswear market is expected to maintain strong growth momentum. We believe that 361°'s children's business will provide steady growth drivers for the company. In the future, 361° will continue to sponsor multiple sports events, such as the WTCC World Tennis Continental Cup and others. NBA superstar Nikola Jokić officially became a brand ambassador for 361° at the end of 2023, entering into a long-term partnership with the brand and launching his own signature shoe series (the JOKER series). He visited China in July this year. These activities have effectively enhanced brand awareness and exposure. We are optimistic about 361°'s advantages in lower-tier markets and its prospects for expanding into overseas markets.

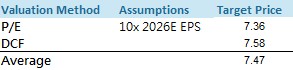

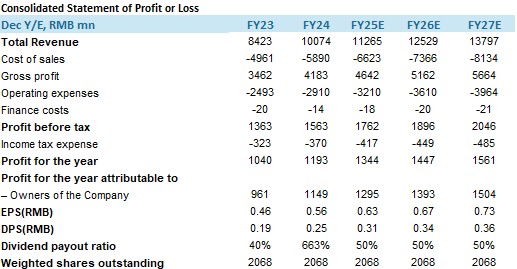

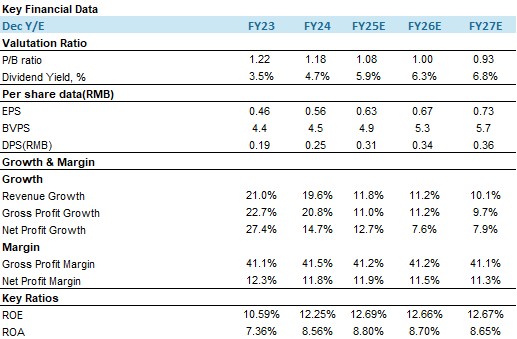

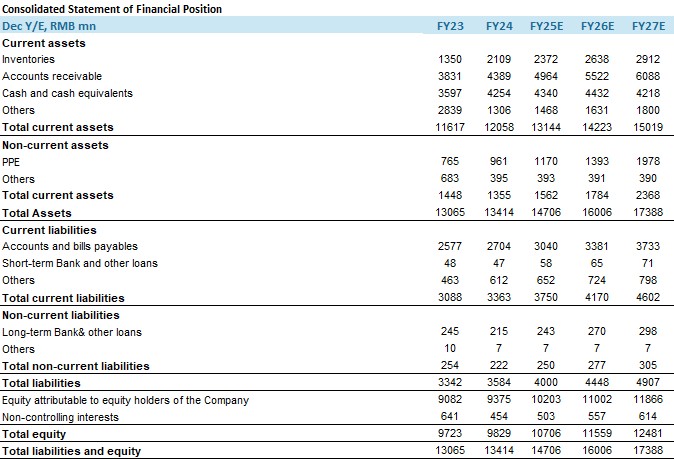

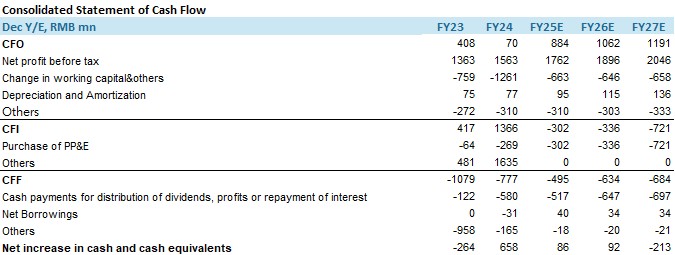

We forecast the company's revenue for 2025-2027 to be 11.27 billion yuan, 12.53 billion yuan, and 13.80 billion yuan, respectively, with EPS of 0.63 yuan, 0.67 yuan, and 0.73 yuan. We employ two valuation methods: the relative valuation method (P/E) and the absolute valuation method (DCF).

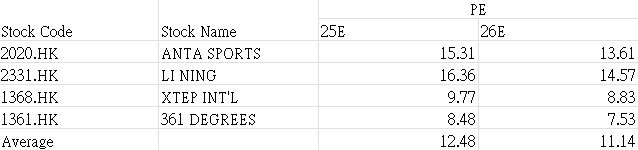

Relative valuation method: We selected comparable companies for valuation, including Li Ning, Anta, and Xtep, which have similar business models. Under this approach, the target price is forecasted to be HK$7.36, corresponding to a forward P/E ratio of 10x for 2026.

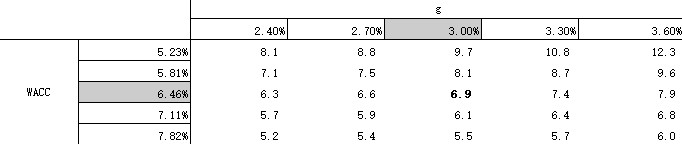

Absolute Valuation Method: Key assumptions in the DCF analysis:1. The WACC, calculated using the formula WACC = Kd × Wd × (1 - T) + Ke × (1 - Wd), is 6.46%.2. The discount period spans from 2025 to 2029.3. The terminal growth rate is 3%.With a WACC of 6.46% and a terminal growth rate of 3%, the company's reasonable intrinsic value per share is HKD 7.58. Under scenarios where the WACC ranges from 5.81% to 7.11% and the terminal growth rate varies between 2.7% and 3.3%, the reasonable intrinsic value per share ranges from HKD 6.48 to HKD 9.56.

Considering the limitations of the DCF model, we have taken the arithmetic average of this valuation result and the P/E valuation outcome. This yields a final target price of HKD 7.47, and we initiate coverage with a "Buy" rating.

Risk factors

1) Slower-than-expected growth in the domestic athletic apparel industry;

2) Intensified industry competition;

3) Macroeconomic downturn impacting end-consumer spending;

4) The company's sales performance falling short of expectations.

Financial

(Current Price as of: 12 Dec 2025)

Exchange rate: HKD/RMB = 0.91

Source: PSHK Est.

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|