-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- Smart Minor (Joint) Account

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Tuesday, December 16, 2025  566

566

(293)

| Recommendation | Accumulate (Downgrade) |

| Price on Recommendation Date | $11.790 |

| Target Price | $12.600 |

Weekly Special - 3606 Fuyao Glass

Investment Summary

First Half Profit of HK$3.65 Billion, Essentially Flat

According to Cathay Pacific Airways(CX) FY2025 interim results, it recorded revenue of HK$54.309 billion (HKD, the same below), a yoy increase of 9.5% for the first half of the year. However, profit growth was weak, primarily due to pressure on passenger yield and the expanded losses of its low-cost subsidiary. Net profit amounted to HK$3.651 billion, with a yoy increase of just 1.1%. Basic earnings per share (EPS) for ordinary shares were 56.7 Hong Kong cents, with a dividend of 20 Hong Kong cents per share, representing a dividend payout ratio of 35%. This marks the second consecutive year of interim dividends since the pandemic recovery.

Strong Recovery Momentum in Business Indicators, but Yield Falls from High Levels

During the reporting period, yoy experienced strong recovery momentum in its business volume. Passenger capacity (available seat kilometres, ASK) grew by 26.3% yoy, and revenue passenger kilometres (RPK) surged by 30.0%. The number of passengers carried reached 13,600 thousand, and the passenger load factor increased by 2.4 percentage points to 84.8%, higher than the pre-pandemic level of 84.2%.

As global capacity supply recovered, market competition intensified, and ticket prices retreated from historical highs. yoy's unit revenue per passenger kilometre (yield) dropped sharply by 12.3% yoy to 60.4 Hong Kong cents (still higher than the pre-pandemic level of 54.9 Hong Kong cents), with particularly large declines of 17.5% and 14.3%, respectively, on routes to the Americas and North Asia. Additionally, the company expanded its long-haul network and increased low-yield routes, which further diluted overall yield levels. This led to revenue growth being offset by pricing pressure. The group's passenger service revenue was HK$37.21 billion, a 12.7% yoy increase, but the growth rate was slower than the increase in passenger volume.

In the cargo sector, although tonnage increased by 11.4%, the cargo load factor declined by 1.3 percentage points yoy to 58.6%, and yield decreased slightly by 3.4% to HK$2.59 (still higher than the pre-pandemic level of HK$1.88). The company's diversified layout and adjustments to its global network helped it cope with the changes, easing the groups pressure. The group's passenger stable, growing by 1.2% yoy to HK$12.76 billion.

Hong Kong Express, a subsidiary, faced challenges due to a decline in demand for Japanese tourism caused by earthquake rumors, as well as the impact of a new route cultivation period. Additionally, intensified competition in the low-cost market and falling ticket prices on short-haul routes negatively affected performance. Hong Kong Express' passenger yield dropped by 21.6% yoy, and its pre-tax profit turned into a loss of HK$524 million (compared to a profit of HK$66 million in the same period last year). Additionally, the share of profits from associates (mostly from its stake in Air China) recorded a loss of HK$180 million, though this represented a reduction in losses by HK$160 million yoy, partially offsetting the operational pressures from the subsidiary.

Falling Fuel Prices Benefit Costs, Unit Costs Diluted

According to the consolidated financial statements, yoy's cost structure for the first half of 2025 showed the following characteristics: fuel costs benefitted from a 14.3% drop in fuel prices, rising only 3.5% yoy, which led to an 11.0% decrease in fuel cost per ATK. Non-fuel costs, driven by expanded capacity, increased by 14.2% yoy to HK$33.71 billion. Employee costs, onboard service costs, and ground service costs grew by 20.7%, 32%, and 23%, respectively, reflecting increased manpower and higher route and maintenance expenses.

The expansion of capacity helped dilute unit costs, with unit ATK costs decreasing by 4.1% yoy and unit non-fuel costs dropping by 0.9%. However, the relative rigidity of costs, the pressure of new route cultivation periods, and the decline in unit yields weakened marginal profitability.

Other expenses showed a slight increase, with net financial expenses growing by 1.5% yoy, while aircraft depreciation and rental expenses decreased by 6.9%, reflecting the fleet optimisation effects.

Fleet Efficiency Improvements and Cost Optimisation will be the Key Concern

In its interim report, yoy highlighted the successful integration with Hong Kong International Airport's three-runway system, becoming one of the first base carriers to achieve full runway coordinated operations. This significantly improved its flight punctuality rate to 92.3%. As of mid-2025, yoy's fleet comprised 234 aircraft, and it plans to purchase 14 more Boeing 777-9 aircraft to strengthen its long-haul network, with expected deliveries by 2034 or earlier, further enhancing its long-range capacity.

From July to October 2025, yoy continued to see strong passenger demand, with the cumulative number of passengers reaching 27,000 thousand, a 26.1% yoy increase. In October, the monthly load factor rose to 86%, a new high for the period, driven by holidays and business activities such as National Day, Mid-Autumn Festival, and the Canton Fair. In terms of cargo, the cumulative tonnage from July to October grew by 7.6% yoy, with October cargo tonnage surpassing 150 thousand tonnes, a 12% increase from the previous month. The "Cathay Fresh Cargo" and "Cathay Priority Cargo" services saw strong demand, supporting cargo resilience. Hong Kong Express' passenger volume in October increased by 32% yoy, with capacity and demand growing in sync, showing the initial success of network diversification. With fleet efficiency improvements and cost optimisation, along with strong Christmas season bookings, profitability in the second half is expected to recover. However, the sustainability of demand recovery on Japanese routes remains to be observed.

Investment thesis

We revised the EPS forecast of Cathay to be HK$1.20/1.40/1.63 in 2025/2026/2027. Based on the revised financial forecast, we lift target price to HK$12.6 for the Company, equivalent to 2025/2026/2027E 10.5/9.0/7.5 x P/E, the Accumulate rating. (Closing price as at 11 December)

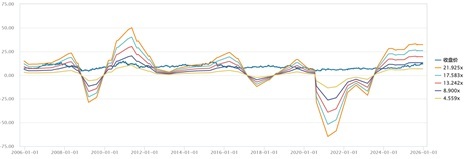

CX's P/E trend

Source: wind, Phillip Securities Hong Kong Research

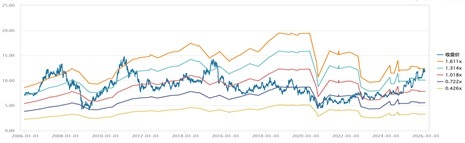

CX's P/B trend

Source: Company, Wind, Phillip Securities Hong Kong Research

Risk

Surging oil price

Unfavorable Exchange fluctuations

Weaker Demand affected by economy

Fiercer ticket competition

War, Epidemic, etc

Financials

(Closing price as at 11 December 2025)

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|