-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Sasa(178.HK) - Hong Kong's political situation affecting the market sentiment. Rent costs to be expected being further controlled.

Monday, July 8, 2019  11287

11287

Sasa(178)

| Recommendation | Accumulate |

| Price on Recommendation Date | $2.280 |

| Target Price | $2.500 |

Weekly Special - 175 Geely

Investment Summary

Sasa's FY2018 full-year revenue increased by 4.5% y.o.y., but fell by 5% in 2H of the year. The Hong Kong and Macau market fell by 5.8%, while same-store sales fell by 7.3%, compared with 18.5% in 1H. According to the management team, in the first month of FY2019 (April), the Hong Kong and Macao market continued to have a significant decline in revenue. In May, the decline was less than 4%. During June 1st to 8th before the mass demonstration, the decline was over 3% which was similar to May. During the large-scale demonstrations and conflicts from June 9 to 16, the number of mainland tourists dropped significantly, and the decline in revenue expanded to nearly 20%.

At the same time, consumer sentiment was affected by RMB depreciation due to the Sino-US trade war as well as a decline in both the stock and property markets, which began in late June 2018. The average sales per transaction decreased by 3.0% in 2H. During the year, a number of pharmacies selling skincare and cosmetic products aggressively opened new stores in tourist hot spots, which intensified competition. The result was that growth in the number of transactions by Mainland customers dropped from 21.8% in 1H to 1.0% in 2H. The number of transactions by local customers also changed from positive growth in the first half to a decline of 7.0% in 2H. The launch of the HK Section of the Express Railway Link and the Hong Kong-Zhuhai-Macau Bridge did not contribute to greater traffic in its retail stores. Nevertheless, the company believes that the two mega infrastructure projects will eventually drive the economic development of the Greater Bay Area and boost the consumption power of both local customers and tourists. It will continue to seize the opportunities offered by the region's vast economic potential.

In Q1 of FY2018, sales from trendy products in HK and Macau markets outperformed those of house brand products. This resulted in a drop in the house brand mix from 39.8% to 35.8% in 1H. The house brand mix in 2H improved to 37.3% while GPM declined to 40.8%. Thanked for the decrease in rent and staff costs as a percentage of revenue, which led to a slight expansion in operating profit margin. We expect that due to the keen market competition, this year's GPM will be subject to pressure of 1 to 2 ppt, and the proportion of rent to income is expected to fall further. Last year, the ratio was 11.8%. According to the management team, instead of focusing on GPM, this year it will focus more on improving sales. It will decide the pace of new store opening on the rent situation. The new stores will probably be street shops, and it is expected to help increase the market share. The company is improving its product portfolio. Facing the keen market competition, it will target more expensive big-name skin care products sales, and has grown very well so far. And the health food business is also believed can help deal with the competition.

Turnover of the e-commerce business increased by 2.2%, of which Mainland China contributed over 90% of sales in the segment, demonstrating a growth rate of 10.6% over the previous year. Third party platforms were the key contributor to the sales of this segment, accounting for nearly 60% of sales. Excluding non-recurring expenses, losses from online operations narrowed from HK$29.6 million in the previous year to HK$24.8 million. The company began operating an online store on HKTVmall in Hong Kong at the beginning of 2019, and collaboration with other third-party platforms is under consideration.

Turnover for the mainland China operations slightly decreased by 1.9% , while SSS in local currency terms dipped by 1.1%. The company has improved sales of own brand products and organised marketing promotion activities to stimulate sales, prompting overall sales and same store sales to rebound in Q4. We lower the target price of Sasa to 2.5, the target price-earnings ratio is 16 times(Closing price at 4 July 2019)

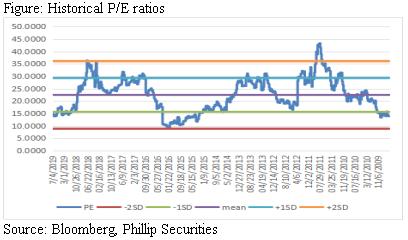

Valuation and Risk

We give Sasa Accumulate rating, the target price-earnings ratio is 16 times, and the target price is lowered to HKD2.5. Potential risks include HK's political environment getting worse which heavily hit consumer sentiments of Chinese tourists and visitors,and local consumption not as strong as expected. (Closing price at 4 July 2019)

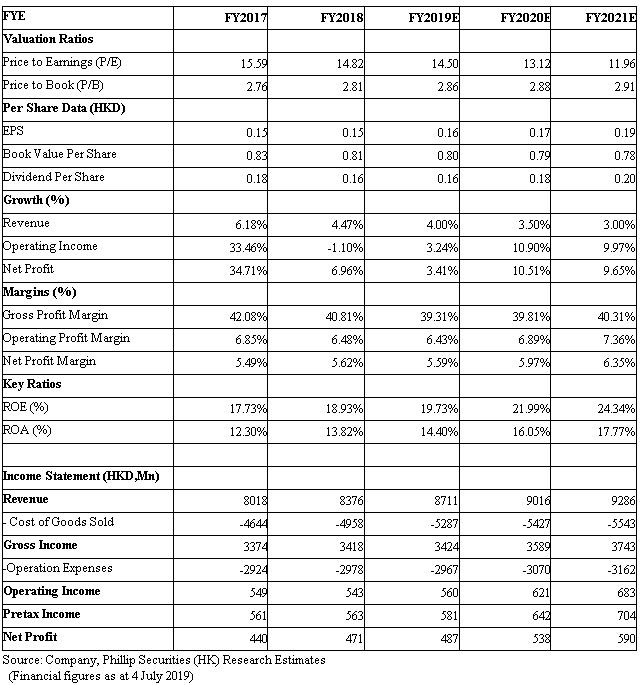

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|