-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

China Traditional Chinese Medicine (570.HK) - Concentrated TCM Granules Will Continue to Grow Rapidly

Monday, September 12, 2016  23297

23297

China Traditional Chinese Medicine(570)

| Recommendation | Accumulate |

| Price on Recommendation Date | $3.980 |

| Target Price | $4.400 |

Weekly Special - 358 JIANGXI COPPER

Rapid Growth in H1 2016

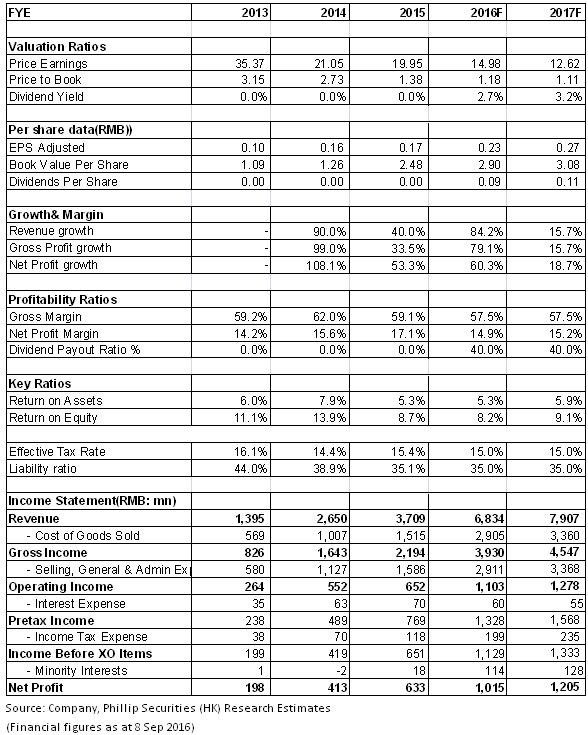

In 1H16, the revenue and profit attributable to shareholders of China Traditional Chinese Medicine (CTCM)both witnessed a substantial growth, soaring by 125% and 101.8% to RMB 3.2 billion and RMB 490 million, respectively. Also, EPS rose from RMB 0.08 to RMB 0.11, a YOY increase of 36.1%.

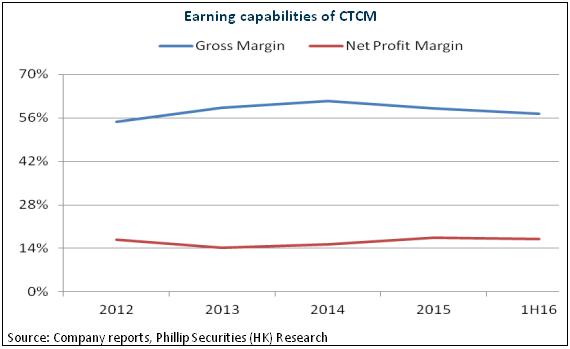

After the Company completed the acquisition of the concentrated traditional Chinese medicine (TCM) granules in Q4 2015, concentrated TCM granules business has become the Company's primary business. Revenue and net profit of the business reached RMB 2.05 billion and RMB 381 million, representing a YOY increase of 21.9% and 27.4%, respectively, contributing to over 60% of the total revenue and nearly 70% of the total net profit. Furthermore, the increase in gross profit margin of this business was mainly attributable to the decrease in purchasing cots, and to change of agency to direct sales of some products.

However, revenue and net profit of the Company's original TCM finished drugs business fell by 19.5% and 32.9% to RMB 1.14 billion and RMB 160 million, respectively. This mainly results from the introduction of "two invoices" policy and medical insurance cost control, and from reduction of inventories by dealers. Moreover, the tender price of the Company's products dropped by 3-4% on average, and second bargain was implemented in a number of provinces. The Company expected that de-stocking will continue in the second half of 2016, and that after the end of 2016, its revenue growth will catch up with the industry average.

Concentrated TCM Granules Will Continue to Grow Rapidly

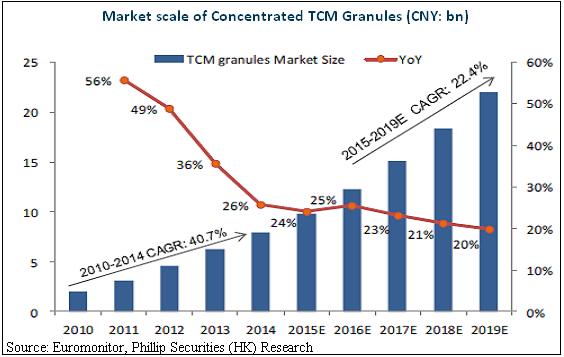

Last year, after the acquisition of Tianjiang Pharmaceutical, the Company took the leading position in the domestic concentrated TCM granules sector. Despite decline in growth of TCM industry, formula granules are a rising industry, with 23% CAGR from 2013 to 2015. Euromonitor forecast that the market size of domestic concentrated TCM granules will surge from RMB 7.8 billion in 2014 to RMB 18.3 billion in 2018, enjoying a favorable market prospect. Zhejiang Province announced in August 2015 that it started to pilot inclusion of concentrated TCM granules into medical insurance, demonstrating that the domestic government gradually recognized formula granules. More provinces are expected to follow suit, thereby significantly promoting the sales of formula granules. It is worth mentioning that county primary hospitals have completely abolished drug price addition, but excluding TCM decoction pieces. The regulations of cost addition of formula granules are also implemented in accordance with TCM decoction pieces. As a result, TCM decoction pieces will not be affected by price drop in drugs in the short term.

In respect of supply, although China is mulling over relaxing regulation of concentrated TCM granules` production permit, it is estimated that the six manufacturers with the approvals of concentrated TCM granules will experience a transition period of 2 to 3 years, and that the new competitors will need a relatively long time to own sufficient products. In contrast, Tianjiang Pharmaceutical boasts more than 700 products, and coupled with capital barrier, covers over 5,000 hospitals. Besides, CTCM owns a strong sales network. Therefore, we believe it is difficult for small- and medium-sized pharmaceutical companies to pose substantial threat to the growth of Tianjiang Pharmaceutical in the next two years, and that its revenue growth is still expected to exceed 20%.

Valuation

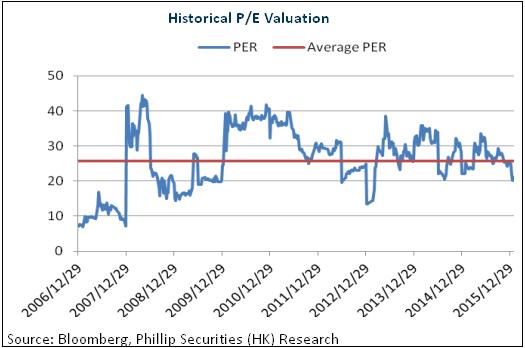

The Company also resumed dividend payout, with interim dividend standing at 6.44 HK cents. Besides, it indicated that in the event of no major investment, it will maintain a 30% dividend payout rate. We estimate that this will help the Company to win market recognition. We adopt the Sum of the Parts Valuation (SOTP), and give the Company's concentrated TCM granules business and TCM finished drugs business 20X P/E ratio and 10X P/E ratio, respectively. The target price is HK$ 4.4, and the "Accumulate" rating is given initially. (Closing price as at 8 Sep 2016)

Risks

Further price drop in products;

The competition intensifies more than expected.

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|