-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Travelsky Technology (696.HK) - Interim performance in line, Airline industry will still suffer in the short term

Friday, September 27, 2019  8893

8893

Travelsky Technology(696)

| Recommendation | Buy |

| Price on Recommendation Date | $15.900 |

| Target Price | $23.400 |

Weekly Special - 175 Geely

Investment Summary

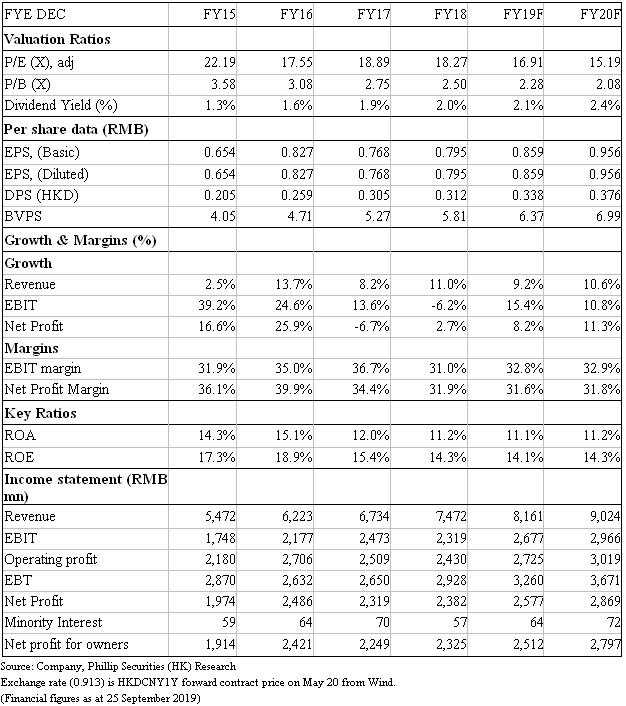

Travelsky Technology is the largest provider of the aviation information systems in China, which developed systems, such as flight control, air ticket distribution, check-in, boarding and load planning, accounting, settlement and clearing system, and aviation logistic. Based on DCF valuation, we derived a TP of HK$23.40, implied a P/E of 24.9x and 22.4x in 2019/20F. We maintain a “Buy” rating with a potential upside of 47.2%. (Closing price at 25 Sep 2019)

Interim performance in line

The Group announced interim results with revenue of RMB 3.84 billion, up 9.2% YoY. Aviation information technology service revenue, settlement and clearing income, system integration service revenue, data network revenue and other revenues increased by +8.9% and +3.5%, respectively. 23.8%, -1.5% and +7.7%. Net profit was RMB 1.44 billion, up 4.3% YoY, mainly due to the higher growth on cost than revenue. Total operating costs increased by 12.1% YoY. Among them, labor costs, depreciation and amortization, commission and promotion expenses and costs of software and hardware sold increased by 17.9%, 38.4%, 6.4% and 66.9% respectively.

As of 2019H1, the system processed volume of the Group reached 337 million, a YoY increase of 7.8%, of which China and foreign commercial airlines increased by 7.7% and 9.6% respectively; BSP ticket system processing volume also reached 206 million, an increase of 7.6%. The number of newly added airports and number of system integration projects under implementation also reached 10 and 90 respectively.

China's passenger traffic has continued to grow, but the freight transport volume has declined

Despite the adverse effect on Chinese economy from US-China trade war, along with the sharp depreciation of the RMB, passenger traffic from January to July increased by 8.7% YoY to 381 million, but the growth rate was 3.4% lower than the same period last year. This is the same situation as in the 2008 financial crisis, and passenger traffic continued to grow even in times of economic downturn. We believe that this phenomenon is due to the fact that with the increase in people's purchasing power and the emergence of low-cost airlines, the people have gradually been able to afford the aircraft for travel, making the demand for the service less elastic, so even in the economic downturn, passenger traffic still has a good performance. However, freight transport was affected more by US-China trade war. The freight transport volume from January to July fell by 0.5% YoY to approximately 4.129 million tons.

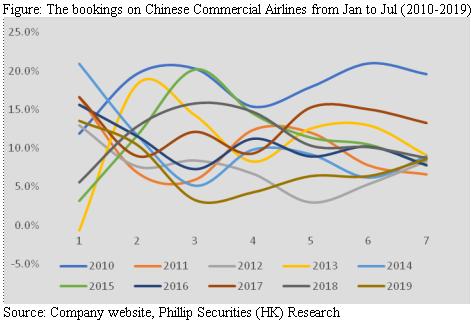

Booking volume rebounds, but still lower than the past

Although the Group's bookings for commercial airlines in China in March and April this year were the lowest in nine years, only 3.3% and 4.3%, whereas the growth in bookings in May, June and July began to pick up, which were 6.4%, 6.4% and 8.6 respectively. However, this year's bookings are still at a relatively low level compared to the past. In view of the fact that the US-China trade war and the depreciation of the RMB are not likely to be resolved in the short term, we believe that the growth in booking volume will remain low this year.

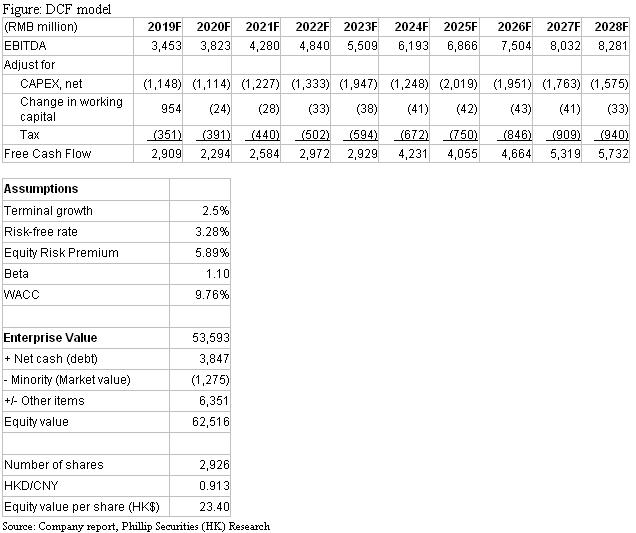

Valuation

We adopted the DCF model for valuation, where we assume the discount rate to be 9.76%, and terminal growth to be 2.5%, with FCFF forecast to 2028F. We derived a TP of HK$23.40, implied a P/E of 24.9x and 22.4x in 2019/20F, 1.47% lower than our previous TP, due to the depreciation on RMB. We believe the investment ground in the long term still remains, but may suffer in the short term due to the economic downturn. In view of the plunge in stock price, we maintain a “Buy” rating with a potential upside of 47.2%. (HKD/CNY=0.913)

Risk

1. Economic downturn

2. Aviation system market opening up

3. Airlines develop their own systems

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|