-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

CAR Inc (699.HK) - The new business has huge potential

Monday, May 11, 2015  7676

7676

CAR Inc(699)

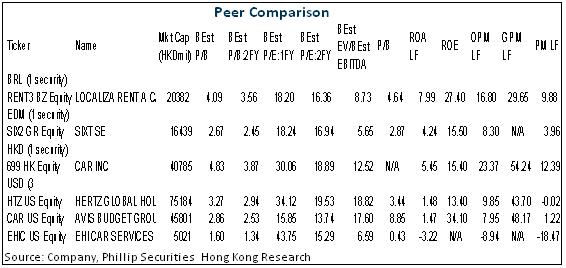

| Recommendation | Accumulate |

| Price on Recommendation Date | $17.400 |

| Target Price | $19.940 |

Weekly Special - 175 Geely

Turned loss to a net profit of RMB440 million in FY2014

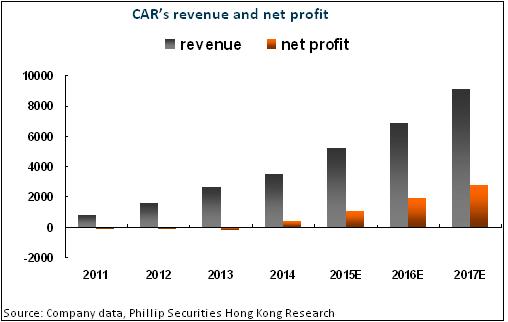

In 2014, CAR(China Auto Rental Ltd.)recorded a revenue of RMB3.52 billion, a net profit of RMB436 million and a diluted EPS of RMB0.21, basically meeting our prior forecast.

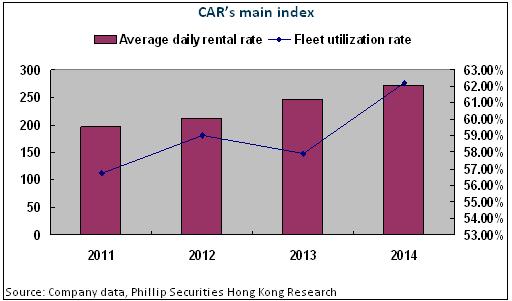

Traditional business continued to grow

CAR continued to solidify its industry leading position in the Chinese market. In the reported period, the average rent per day and average income per day per vehicle increased from RMB246 and 142 in 2013 to 272 and 170 respectively. In the meantime, the fleet utilization rate increased from 57.9% in 2013 to 62.2% in 2014.

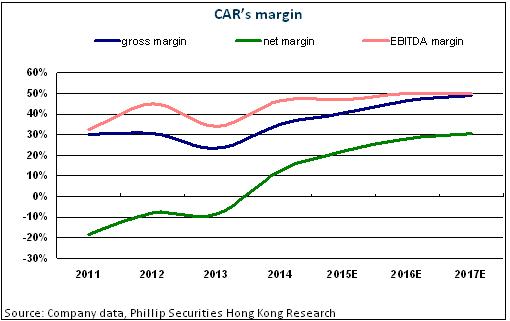

Gross margin was up by nearly 12 ppts

Thanks to economies of scale and outstanding cost control, CAR's gross margin increased from 23.3% in 2013 by 11.94 ppts to 35.21% in 2014, out of which, the gross margin on rental business jumped 12.2 ppts to 42.1% while that on sale of used-cars increased sharply by 10.4 ppts from -5.5% in 2013 to 4.9% in 2014, making it a profit-making business.

Thanks largely to economies of scale and operating efficiency improvement, in the reported period, the selling, administrative and financial expenses were down by 39%, 7% and 8% respectively on yoy basis. CAR was in fairly good financial position and as of the end of 2014, its debt to asset ratio was down from 62% in 2013 to 37% and the net debt/asset ratio was down by 37 ppts from 48.1% in 2013 to 11.5%.

The chauffeured car new business has huge potential

CAR announced in the end of January that it would partner with UCAR Technology to launch “UCAR Chauffeured car” service. We believe that cities in China have a huge potential for chauffeured cars and the UCAR Chauffeured car service, although introduced later, will overtake on curves due to our apparent competitive advantages over other companies offering chauffeured car service. We estimate that UCAR Chauffeured car fleet will grow to the size of 30,000-40,000 units by 2015.

Investment Thesis

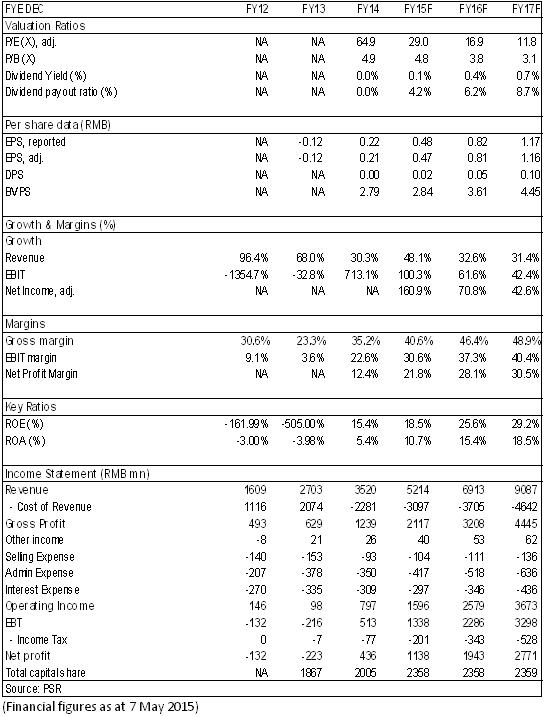

By a conservative estimate, we forecast that CAR's rental income will increase by more than 50% in 2015. In the meantime, the bond issuance in the amount of USD500 million is likely to add RMB170 million to the financial cost. We forecast EPS for 2015/2016/2017 to be at RMB0.48/0.82/1.17 respectively and set a 12-month target price of HK$19.94. Corresponding to the PE ratio of 33/19/14 for 2015/2016/2017, we therefore reaffirm the “Accumulate” rating. (Closing price as at 7 May 2015)

Turned loss to a net profit of RMB440 million in 2014, meeting expectations

CAR's rental income and total income both grew by 30% yoy in 2014. It recorded total revenue of RMB3.52 billion and successfully turned profitable, posting a net profit of RMB436 million and a diluted EPS of RMB0.21, basically within the range of our prior forecast of RMB0.20, without distribution of end dividends.

Traditional business continued to grow and operating indicators were improved

CAR recorded revenues of RMB2.87 billion and 654 million from car rental and sale of used-cars respectively, two major sources of CAR's income, representing a growth of 29.8% and 32.2% yoy. The size of the fleet in operation increased by 38% to 58,773 units in 2014, 75% of which were short-term vehicles,16% were long-term vehicles and 9% were financial leasing vehicles. As of the end of 2014, the number of service outlets directly operated by CAR increased to 723 that included 489 pick-up sites.

CAR continued to solidify its industry leading position in the Chinese market, significantly boosting the company's operating indicators. In the reported period, the average rent per day and average income per day per vehicle increased from RMB246 and 142 in 2013 to 272 and 170 respectively. In the meantime, the fleet utilization rate increased from 57.9% in 2013 to 62.2% in 2014.

Thanks to the economies of scale and outstanding cost control, the direct operating costs increased by merely 15% yoy and the percentage over rental income dropped by 4.5 ppts to 34.5%.

Gross margin jumped by nearly 12 ppts

Due to the steady increase of average income per day per vehicle, operating efficiency improvement and reduction of costs associated with the fleet not in operation, CAR's gross profit increased from RMB630 million in 2013 by 97% to RMB1.239 billion, and its gross margin increased from 23.3% in 2013 by 11.94 ppts to 35.21% in 2014, out of which, the gross margin on rental business jumped 12.2 ppts to 42.1% while that on sale of used-cars increased sharply by 10.4 ppts from -5.5% in 2013 to 4.9% in 2014,making it a profit-making business.

The good scale economy was also reflected in the reduction of operating expenses. In the reported period, the selling expenses were down by 39% yoy to RMB92.7 million mainly attributable to the growth in booking through CAR's mobile application, continued downsize of long-term car rental sales team and the decrease in the demand for brand marketing. Administrative expenses dropped by 7% yoy to RMB350 million mainly attributable to economies of scale, administrative efficiency improvement and C&B reform. Financial expenses dropped by 8% yoy to RMB310 million.

CAR was in fairly good financial position. As of the end of 2014, its debt to asset ratio was down sharply by 25 ppts from 62% in 2013 to 37%. It had around RMB2.48 billion cash in hand and the net debt/asset ratio was down by 37 ppts from 48.1% in 2013 to 11.5%.

The chauffeured car new business promised huge potential

CAR announced in the end of January that it would partner with UCAR Technology to launch “UCAR Chauffeured car” service. According to the agreement, CAR will provide UCAR Technology with short-term and long-term rental cars at fair market prices while UCAR Technology, as an independent third-party chauffeured car service provider, will offer premium chauffeured car service in China by leveraging on CAR's fleet size and brand awareness.

We believe that at least for the following reasons, cities in China have a huge potential for chauffeured cars and the UCAR Chauffeured car service, although introduced later, will overtake on curves due to our apparent competitive advantages over other companies offering chauffeured car service.

1) Chauffeured cars are sort of substitutes for part of taxis. Taxies are in short supply by a huge gap due to government license requirement and quantity control. In Beijing, for example, the total number of taxies by the end of 2003 was 65,000 units and remained 66,000 units in 2012 while by contrast, its permanent residents increased by 6.22 million for the same period. In the period of 2009-2013, the total number of taxies in operation in the entire country increased by merely 150,000 to 1.3 million units, representing a less than 3% annual growth rate. A 1% replacement rate by chauffeured cars will translate to a nearly 10-billion-yuan market.

2) The prior intensified marketing campaigns launched by Didi Taxi and other operators have won the recognition of chauffeured cars from both the market and the government. The government has clarified its stance on prohibiting private cars from offering the service, leaving vehicles with the operating license to be the only participants. This has made the vehicles in the terminal of the service very important relative to the platform. CAR, as a qualified operator with the biggest size, has unquestionable competitive advantage over its competitors.

3) Capital and vehicle plates are two major obstacles that face our competitors. The huge prior investment has drained capital of our competitors. In addition, the restriction on issuing vehicle plates in large and medium-sized cities in China has added to their operating difficulties. In comparison, CAR's advantage is apparent as it has a large number of vehicle plates from the plate-restricting cities.

4) CAR emphasizes on customer experience and technical platform. improving customer service will bring good customer experience and thus increases customer retention. Its value-added services include accident insurance, GPS, 7*24 road assistance, vehicle pick-up and return as well as vehicle return to a different location etc. With regards to the IT platform, as of the end of 2014, the total installations of CAR mobile application reached 7 million. In December of 2014, 51% of orders came from its mobile application.

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|