-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

BYD Electronic (0285.HK)-Negative Outlook Mostly Priced In

Wednesday, August 19, 2015  12902

12902

BYD Electronic

| Price on Recommendation Date | $6.300 |

| Target Price | $9.100 |

Weekly Special - 1836 Stella International

Similar to electronic products such as digital cameras, tablets and ultrabooks, metal handset casings become the mainstream of smartphones. This rising trend is attributable to the superior mechanical functionality, outlook & texture as well as strength of signal reception of metal casings. Metal casings are now mostly used in high-end handsets. Moreover, it has penetrated to new comers such as Gree and LeTV. This trend should help absorb capacity of computer numeric control (CNC) machines, and then increase ASP and profitability of metal casings. As a result, suppliers such as BYD Electronic will continue to benefit from the trend.

Since May, the company's share price performance has been disappointing. Other than the weak market sentiment, the performance is also dwarfed by the falling global market share of its top customer, Samsung. To ease the negative impact, we expect the company will actively tap into the domestic handset market in order to secure more orders. Other than continuing to cooperate with Huawei, OPPO and etc., it is also actively seeking cooperation opportunities with Xiaomi. We believe Chinese handset manufacturers will be poised for a bigger share in global handset market. With labour and equipment cost advantages over its competitor, BYDE can grow its market share by offering value-for-money to the domestic players.

Equipped with a pioneering advantage in the core technology of the metal casings, ie, plastics-and-metal hybrid technology (PMH), BYD Electronic is widely recognized by foreign and domestic handset brands. By the end of April this year, the company has 17,000 units of CNC machines in production. The company will stay ahead of its peers by continuing expanding its production capacity. Its CNC production line is expected to reach 20,000 units of machines by the year end. Therefore, the company can improve its product mix. We expect metal handset casings will account for 30% or more, up from about 20% of total revenue in 2014. As the profit margin of metal casings is around 20%, which is much higher than the approximate 10% level achieved by plastic casings, better product mix may gradually raise the company's profitability.

Negative Outlook Mostly Priced In The waning competitiveness of its major customers has depressed the share price performance of BYD Electronics. However, its leading position in producing metal handset casings remains intact. As metal handset casings gradually become the mainstream of handset models, BYD Electronics can tap into domestic customers to offset weaker demand from overseas brands. We are still positive on its earnings outlook. Trading at just 8x P/E, we believe the negative outlook is mostly priced in. We recommend a `BUY` rating, with a target price of HKD9.1, which is equivalent to 2015 P/E of 12x.

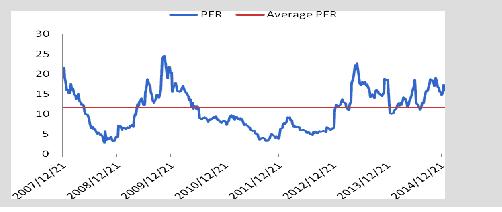

Historical P/E valuation

Metal Handset Casings Becoming the Mainstream Similar to electronic products such as digital cameras, tablets and ultrabooks, metal handset casings become the mainstream of smartphones. This rising trend is attributable to the superior mechanical functionality, outlook & texture as well as strength of signal reception of metal casings. Metal casings are now mostly used in high-end handsets. The top-selling models of the top 3 handset brands, namely Sumsung, Apple and Huawei, have used metal casings. The new models of these three brands, such as Galaxy A8 of Samsung and P8/P8 Max of Huawei, also follow suit. It should be noted that metal casings have penetrated to new comers such as Gree and LeTV. This trend should help absorb capacity of computer numeric control (CNC) machines, and then increase ASP and profitability of metal casings. As a result, suppliers such as BYD Electronic will continue to benefit from the trend.

Planning to Tap into Domestic Handset Customers Since May, the company's share price performance has been disappointing. Other than the weak market sentiment, the performance is also dwarfed by the falling global market share of its top customer, Samsung. The company has long been focusing on serving Samsung, with over 10,000 units of dedicated CNC machines for the brand. While Samsung still managed to maintain a high shipment volume, its shipment in Q2 dropped 6.6% yoy. Its market share even slipped by 1.8 percentage points to 20.5%

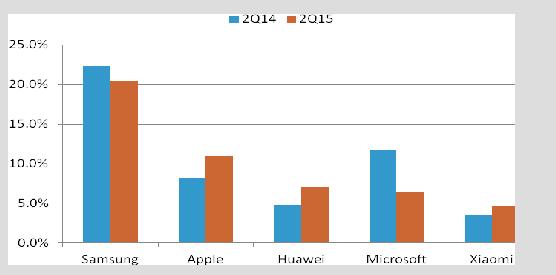

Global Mobile Phone Vendor Market Share (%)

To ease the negative impact, we expect the company will actively tap into the domestic handset market in order to secure more orders. Other than continuing to cooperate with Huawei, OPPO and etc., it is also actively seeking cooperation opportunities with Xiaomi. Recently, Huawei has just become the world's third largest handset manufacturer. Its shipment in Q2 reached 30.6 million units, boosting its market share by 2.2 percentage points to 7%. Xiaomi is just behind Microsoft to rank the 5th, selling 19.8 million units and grabbing a market share of 4.6%. Chinese handset manufacturers in total accounted for 19% of global share in Q2, surpassing Apple's 19% and are closing the gap with Samsung. We believe they will be poised for a bigger share. With labour and equipment cost advantages over its competitor, the company can grow its market share by offering value-for-money to the domestic players.

Economies of Scale to Enhance Profitability Equipped with a pioneering advantage in the core technology of the metal casings, ie, plastics-and-metal hybrid technology (PMH), BYD Electronic is widely recognized by foreign and domestic handset brands. By the end of April this year, the company has 17,000 units of CNC machines in production, which has ensured the production capacity and yield of PMH products. The company will stay ahead of its peers by continuing expanding its production capacity. Its CNC production line is expected to reach 20,000 units of machines by the year end.

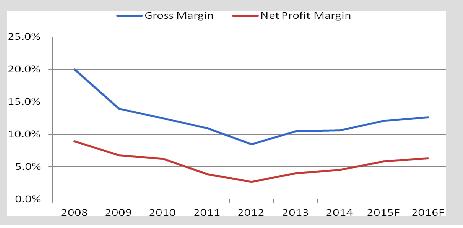

Through capacity expansion, the company can improve its product mix. We expect metal handset casings will account for 30% or more, up from about 20% of total revenue in 2014. As the profit margin of metal casings is around 20%, which is much higher than the approximate 10% level achieved by plastic casings, better product mix may gradually raise the company's profitability.

Gradually improved earning capabilities

Catalysts Better than expected shipment to top brands;Faster than expected penetration of metal handset casings

Risks Tough competitive in the metal casings market.

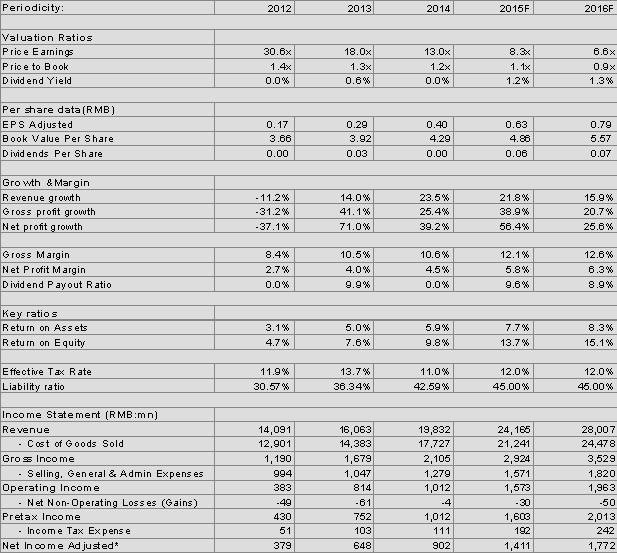

Financials

Since May, the company's share price performance has been disappointing. Other than the weak market sentiment, the performance is also dwarfed by the falling global market share of its top customer, Samsung. To ease the negative impact, we expect the company will actively tap into the domestic handset market in order to secure more orders. Other than continuing to cooperate with Huawei, OPPO and etc., it is also actively seeking cooperation opportunities with Xiaomi. We believe Chinese handset manufacturers will be poised for a bigger share in global handset market. With labour and equipment cost advantages over its competitor, BYDE can grow its market share by offering value-for-money to the domestic players.

Equipped with a pioneering advantage in the core technology of the metal casings, ie, plastics-and-metal hybrid technology (PMH), BYD Electronic is widely recognized by foreign and domestic handset brands. By the end of April this year, the company has 17,000 units of CNC machines in production. The company will stay ahead of its peers by continuing expanding its production capacity. Its CNC production line is expected to reach 20,000 units of machines by the year end. Therefore, the company can improve its product mix. We expect metal handset casings will account for 30% or more, up from about 20% of total revenue in 2014. As the profit margin of metal casings is around 20%, which is much higher than the approximate 10% level achieved by plastic casings, better product mix may gradually raise the company's profitability.

To ease the negative impact, we expect the company will actively tap into the domestic handset market in order to secure more orders. Other than continuing to cooperate with Huawei, OPPO and etc., it is also actively seeking cooperation opportunities with Xiaomi. Recently, Huawei has just become the world's third largest handset manufacturer. Its shipment in Q2 reached 30.6 million units, boosting its market share by 2.2 percentage points to 7%. Xiaomi is just behind Microsoft to rank the 5th, selling 19.8 million units and grabbing a market share of 4.6%. Chinese handset manufacturers in total accounted for 19% of global share in Q2, surpassing Apple's 19% and are closing the gap with Samsung. We believe they will be poised for a bigger share. With labour and equipment cost advantages over its competitor, the company can grow its market share by offering value-for-money to the domestic players.

Through capacity expansion, the company can improve its product mix. We expect metal handset casings will account for 30% or more, up from about 20% of total revenue in 2014. As the profit margin of metal casings is around 20%, which is much higher than the approximate 10% level achieved by plastic casings, better product mix may gradually raise the company's profitability.

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|