-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Weekly Specials

Wanfeng Auto Wheel (002085.CH) - The short-term impact of the pandemic does not change the long-term growth logic

Wednesday, February 9, 2022  2038

2038

Wanfeng Auto Wheel

| Recommendation | BUY |

| Price on Recommendation Date | $4.910 |

| Target Price | $6.000 |

Weekly Special - 1810 Xiaomi

Company Profile

After nearly 20 years of organic development and inorganic acquisitions, the Company has established a "dual engine" growth strategy driven by the application of lightweight metal materials in auto parts industry and the general aviation aircraft manufacturing industry, including six major business sectors, namely, 1) aluminum alloy wheels, 2), magnesium alloy automobile die castings, 3) high-strength steel stamping parts and other metal castings, 4) environmentally friendly dacromet coatings, and 5) general aviation aircraft. The Company is leading in many sub-industry fields.

Investment Summary

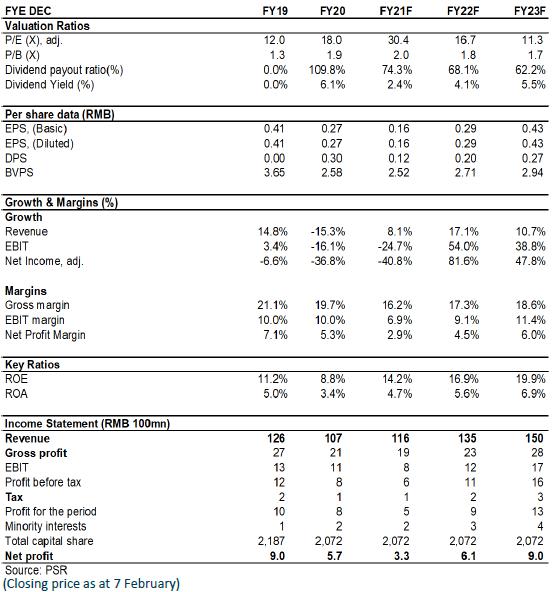

The Transmission Pressure of Raw Material Costs Is High, and Q2 and Q3 Results Are under Pressure

Due to the low base effect caused by the pandemic, Wanfeng Auto Wheel recorded an overall increase in production, sales volume and sales revenue for the automotive metal parts lightweight business. However, the Company's year-on-year cost increase was much higher than revenue growth due to the large year-on-year increase in the prices of main raw materials, the rising shipping prices due to the tight shipping schedule amid the pandemic, and the lag in the linked settlement of customers` sales prices and raw material prices, as well as the fact that some customers have not yet linked together. As a result, the overall profitability showed a downward trend. In the first three quarters of 2021, the Company's operating revenue increased to RMB8.52 billion, up 15.8% yoy. The total operating cost grew by 19.9% yoy. The net profit attributable to the parent company was RMB240 million, a sharp decrease of 42.6% yoy.

Gross Margin Has Declined Significantly and May Increase in Q4

The main raw materials of the Company's automotive metal parts lightweight business are aluminum ingots, magnesium ingots and steel. The sales prices of the Company and most of its customers will be linked according to the price fluctuations of the main raw materials. The prices are generally adjusted on a monthly, quarterly or semi-annual basis. In the first three quarters, the Company's gross margin fell to 16%, down 6 ppts yoy. It was the lowest point in the past ten years, corresponding to the ten-year high of international prices of bulk commodities including aluminum, magnesium and steel. The prices of such commodities in Q4 have dropped from the highs in Q3. It is expected that the Company's procurement costs will decrease accordingly. Meanwhile, the impact of the lag in price linkage settlement with downstream customers will also be weakened. The gross margin is expected to increase qoq..

The General Aviation Aircraft Localization Project Is Progressing Steadily, with Development Potential

In 2020, the Company acquired a 55% stake in Wanfeng Aircraft Industry Co., Ltd., the world's leading general aviation aircraft manufacturer. The Company officially entered the field of general aviation aircraft manufacturing, starting the dual-engine-driven business development model. In February and June 2021, the Company successfully introduced two major strategic investors, Qingdao City Construction Investment (Group) Limited, a state-owned company, and Aviation Development Fund Management Co., Ltd., a Beijing-based company. They hold 35% and 10% of the shares, respectively. In H1 2021, due to the overseas pandemic, the revenue recognition of some orders of the general aviation aircraft manufacturing business was delayed, which affected the results of this segment.

The production of the Company's current domestic orders has been scheduled to start in 2023. The construction of new base and the introduction of new models are generally promoted as planned. The DA50 has completed TC certification. In Qingdao, the Company will invest in a project with an annual output of 220 Diamond aircraft (including 120 Diamond DA50 and 100 Diamond HK36). DA62 and DA62 MPP will be introduced in succession. We think that the domestic general aviation market is currently still in the early stage of development, with vast market space. The short-term impact of the overseas pandemic does not change the long-term growth logic of the general aviation segment.

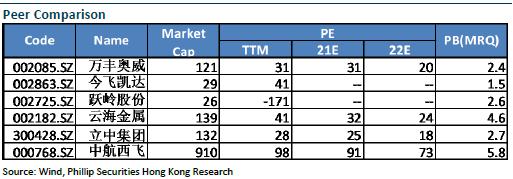

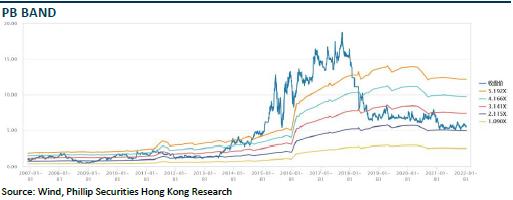

Investment Thesis: Focus on the Follow-up Results Recovery

According to the latest financial data, we adjusted the EPS forecast for 2021, 2022 and 2023 to RMB0.16, RMB0.29 and RMB0.43, respectively (It was RMB0.37, RMB0.46, and RMB0.61, respectively) to reflect the impact of the rising raw material costs. We give the Company's target price to RMB 6, respectively 37.1/20.4/13.8 x P/E, 2.4/2.2/2.0 x P/B for 2021/2022/2023, a "BUY" rating. (Closing price as at 7 February)

Risk

Price war among peers

Raw material price increase

New business risk

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|