-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Weekly Specials

JNBY Design Limited (3306.HK) - All three brands portfolio delivered revenue growth, with effective cost management

Tuesday, December 10, 2024  1733

1733

JNBY Design Limited(3306)

| Recommendation | Buy |

| Price on Recommendation Date | $14.760 |

| Target Price | $17.730 |

Weekly Special - 1810 Xiaomi

JNBY Design Limited (“JNBY”), a leading designer-brand fashion group in China, demonstrated robust performance in the fiscal year ended June 30, 2024 (FY2024). Leveraging its diversified brand portfolio, solid business model, and operational excellence, JNBY has maintained a strong foothold in the competitive Chinese fashion market.

Effective cost management

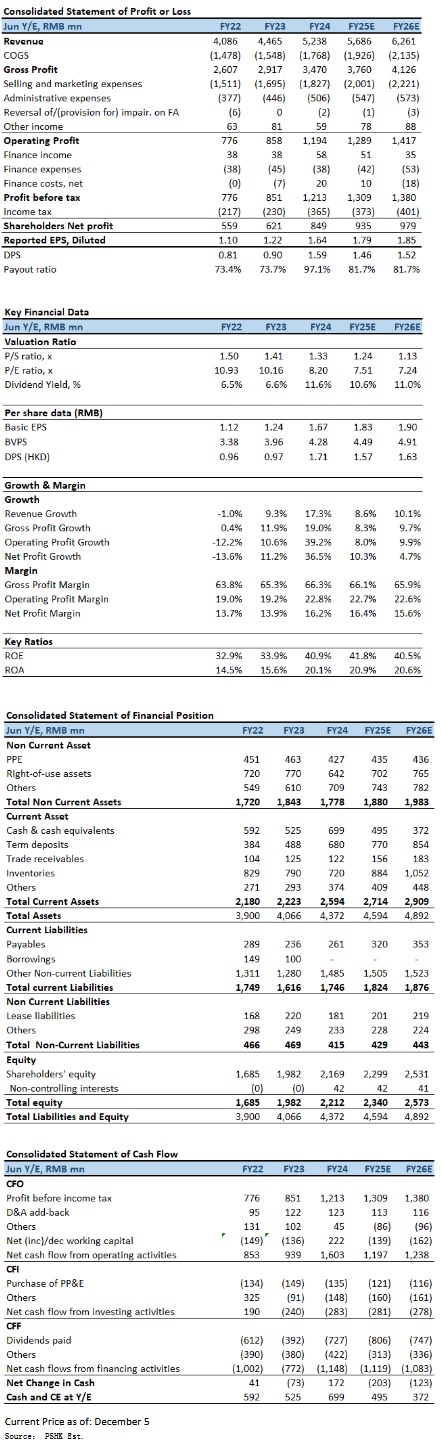

In FY2024, JNBY reported total revenue of RMB 5.238 billion, a year-on-year increase of 17.3%. This growth was primarily driven by a 10.7% rise in comparable sales across physical stores, an 18.4% expansion in online sales, and a moderate increase in store footprint. Gross margin improved to 66.3% (FY2023: 65.3%), reflecting the Company's strong brand equity and effective cost management.

Net profit surged by 36.5% year-on-year to RMB 848.1 million, with the net profit margin increasing from 13.9% in FY2023 to 16.2% in FY2024. This demonstrates significant profitability improvement. Notably, net cash inflow from operating activities increased by 70.7% to RMB 1.603 billion, showcasing a robust cash position and strong operational efficiency. With a final dividend of HKD 0.86 per ordinary share, bringing the total dividend payout for FY2024 to 97% of net profit. This reflects the Company's solid cash flow and commitment to shareholder returns.

All three brands portfolio delivered revenue growth

JNBY's diversified brand portfolio spans mature brands (e.g., JNBY), growth brands (e.g., CROQUIS, jnby by JNBY, LESS), and emerging brands (e.g., POMME DE TERRE, onmygame, JNBYHOME). In FY2024, all three segments delivered revenue growth. Core brand JNBY posted revenue of RMB 2.944 billion, up 17.1% year-on-year, accounting for 56.2% of total revenue. Growth brands generated RMB 2.184 billion (+17.0% YoY), while emerging brands contributed RMB 109.8 million (+28.7% YoY). The diversified brand strategy enables JNBY to penetrate various consumer segments and mitigate risks while enhancing market share.

The Company's dual-channel strategy, encompassing an extensive offline retail network and strong online presence, has driven stable growth. Offline channels grew by 17.1% in revenue, while online channels achieved an 18.4% increase. JNBY's active membership accounts exceeded 550,000 in FY2024, with high-value members (annual spending above RMB 5,000) reaching over 310,000. These members contributed more than 60% of total offline retail sales, underscoring the Company's success in brand building and membership operations.

As of June 30, 2024, JNBY operated 2,024 independent retail stores worldwide, a net increase of 34 stores compared to FY2023. Its offline retail network covers all provinces in mainland China and nine other countries and regions globally. The launch of “JIANGNANBUYI+” multi-brand collection stores and the upgrade of store visuals have enhanced the shopping experience, boosting comparable store sales and reinforcing the Company's brand presence.

With the steady recovery of China's economy and improving domestic consumption, JNBY is well-positioned to benefit from favorable market trends. The growing demand for designer brands, particularly among younger consumers seeking personalized and sustainable products, offers significant opportunities for the Company's multi-brand portfolio.

Meanwhile, the rapid growth of digital consumption and deeper integration of online and offline channels will create new growth drivers for JNBY. The Company's investments in smart supply chains, omnichannel marketing, and new retail formats position it to adapt quickly to market changes and solidify its leadership in the designer-brand segment.

Company valuation

Considering JNBY's strong financial performance, brand advantages, and industry prospects, we remain cautiously optimistic about its future. With a net profit margin of 16.2% and robust cash flow in FY2024, the Company demonstrates a solid foundation for sustained earnings growth, we expect FY2025E & FY2026E estimated basic EPS to be RMB$1.79 & RMB$1.85 respectively, with TP is HKD17.73, implies a FY2025E P/E of 9.0x (in line with its 5 years average +1 standard deviation) and FY2025E dividend yield of ~8.9%. Our investment rating is “BUY”.

Risk factors

1) Consumer Demand Volatility; 2) Intensified Brand Competition; and 3) Raw Material Cost Fluctuations.

Financial

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|