-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Weekly Specials

Proya Cosmetics (603605.CH) - Proya Cosmetics 's leading position of domestic beauty brands remains solid, with a positive outlook on full-year performance

Friday, March 14, 2025  5340

5340

Proya Cosmetics(603605)

| Recommendation | Buy |

| Price on Recommendation Date | $83.680 |

| Target Price | $114.250 |

Weekly Special - 1318 MAO GEPING

Overview

As a leading domestic cosmetics company, Proya Cosmetics primarily engages in R&D, production, and sales of cosmetic products. Its offerings span skincare, makeup, cleansing &personal care, and more. The company owns brands such as Proya, Hapsode, Timage, Off&Relax, CORRECTORS, INSBAHA, UZERO and Anya.

Performance review

In the first three quarters of 2024, the company achieved revenue of RMB 6.97 billion with a year-on-year increase of 32.7%, driven by growth in online channel sales and steady expansion of smaller brands. Net profit attributable to shareholders reached RMB 1.00 billion with a year-on-year increase of 34.0%. Gross profit margin stood at 70.1% with a year-on-year decrease of 1.1 percentage points, primarily due to rising operating costs from increased promotional activities and full-scale deployment on Douyin. Benefiting from a year-on-year decline of 57.53% in asset impairment losses, the net profit margin remained stable at 14.7%. Net cash flow from operating activities was RMB 400 million with a sharp year-on-year decrease of 49.4%, due to earlier payments for major promotions and increased inventory payments. EPS rose to RMB 2.53 with a year-on-year increase of 35.3%.

Industry Analysis

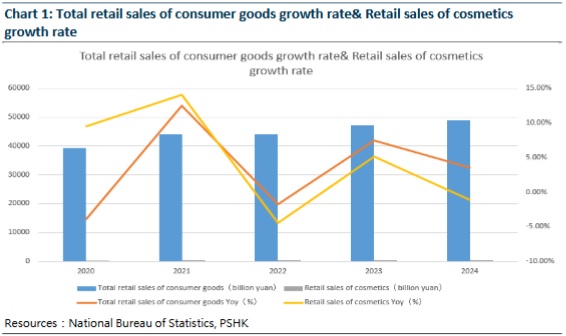

According to the National Bureau of Statistics, China's total retail sales of consumer goods in 2024 reached RMB 48.79 trillion with a year-on year increase of 3.5%. However, cosmetics retail sales reached RMB 435.7 billion with a year-on-year decrease of 1.1%, which was underperforming in the whole market. As shown in Chart 1, the cosmetics industry's compound annual growth rate (CAGR) was robust from 2020 to 2021, fueled by rapid e-commerce expansion during the pandemic. However, CAGR slowed significantly from 2022 to 2024, reflecting intensifying competition, rising of raw material price and data traffic costs, and heightened investment in online channels by major players. Cost reduction and efficiency improvements have thus become critical for cosmetics companies. Proya Cosmetics's gross-to-sales spread improved by 2.4 percentage points quarter-on-quarter (QoQ) to 25.3% in Q3 2024, driven by its cost optimization strategies.

Combining Hero Products with Omni-Channel Brand Marketing Strategies to Drive Sustained Sales Growth

The company has adopted a "hero products + omni-channel branding" strategy, deepening its presence in niche beauty markets to diversify risks and cater to diverse customer segments.

Skincare Segment

The company owns two popular exquisite skincare brands: Proya and Hapsode.

Proya focuses on tech-driven skincare targeting young white-collar women, with products priced between RMB 200–500. In the first half of 2024, it upgraded its core hero products, including the“Advanced Firming Nourishing Series” and “Advanced Original Repair Series”. The world's exclusive innovative ingredient “Recombinant Collagen Type XVII” was firstly applied in “Advanced Original Repair Cream 2.0”, further solidifying the brand's expertise in basal membrane repair and anti early-aging. In “Advanced Firming Nourishing Essence 3.0”, Proya applied “cyclic peptide”, the first patented raw material of the Chinese beauty industry, together with the special “Retinol + HPR” formula, and also adopted exclusive collagen activation technology, thus achieving advanced anti-wrinkle effects. Proya also launched a brand-new product line, the “Sebum Control Purifying Series” and rolled out the “Illuminating Skin-Purifying Series” and a new-edition of Sun Around Protective Shield Sunscreen Serum at the same time. Recently, Proya debuted the “Super Film Silver Tube Sunscreen” product, targeting daily commuters, reflecting its strategy to build a full-scenario sun protection portfolio. Hapsode is positioned as an expert for oily skin, with products priced between RMB 50–200. CORRECTORS is a high-efficacy skincare brand priced between RMB 260–600.

Makeup Segment

The company introduced Timage, a professional makeup artist brand tailored for Chinese faces, with products priced between RMB 150–300. It continues to strengthen its hero product matrix in face makeup, including Three-color contour palettes, Dual-color highlighter discs, Master Primer, Three-color concealer palettes, Blush palettes. In the first half of 2024, Timage launched new products such as the Translucent Loose Powder Compact, Balanced Soft Glow Cushion (for combination skin), Dry Skin Foundation Cream and Zhengqing Lip Gloss and so on.

Haircare Segment

Off&Relax is positioned as an "Asian scalp health expert", with products priced between RMB 150–200. The company employs a mainly-online, offline-supported sales mode. Online channels include Tmall, Douyin, JD.com, Kuaishou, PDD. Offline channels include Cosmetics specialty stores and department stores. The brand continues to boost penetration of its hero product, the OR Refreshing & Volumizing Shampoo, and launched a new product, Hair Care Oil in the first half of 2024.

With Strong R&D capabilities as foundation, accelerating the launch of new products

Proya Cosmetics focuses on science-based skincare. As early as 2008, the company established a "Scientific Skincare Laboratory" dedicated to formula development. In 2021, it set up the International Science Research Institute to conduct continuous fundamental research and explore cutting-edge technologies and applications in cosmetics. By 2023, both the Hangzhou Longwu R&D Center and Shanghai R&D Center had been put into use. Adopting a production mode that primarily relies on in-house production with OEM as a supplement, Proya Cosmetics owns self-built skincare and cosmetics factories. The company maintains R&D collaborations with multiple universities, chemical companies, and premium raw material suppliers. In the first half of 2024, Proya Cosmetics` s R&D expenditure reached RMB 95 million, representing a year-on-year increase of RMB 3.09 million. As of 2023, the company's R&D team had grown to 322 members, with master's and doctoral degree holders accounting for 41.6% of the workforce. Underpinned by its robust R&D capabilities, Proya Cosmetics has significantly accelerated its new product launch pace. The company's sustained investment in R&D is expected to drive continuous innovation, facilitate product upgrades, and ultimately fuel sustained high growth in Proya's brand revenue.

On Double 11, Proya achieved the top 1 on both platforms of Tmall and Douyin, and its leading position of domestic beauty brands remains solid

As of 24:00 on November 11, the estimated GMV of online beauty channels for Double Eleven 2024 is RMB 123.78 billion with a year-on-year increase of 27%. PROYA became the biggest winner, ranking No. 1 on both Tmall and Douyin platforms. According to information from PROYA WeChat official account, in terms of brand, PROYA ranked No.1 in transaction amount on Tmall Beauty/TikTok Beauty/JD.com's domestic beauty, with GMV increasing by 10%+/60%+/30%+ year-on-year. Timage achieved a full-scale outbreak, ranking 2nd/2nd/4th in Tmall cosmetics/JD domestic cosmetics/TikTok domestic cosmetics, with GMV increasing by 30%+/190%+/-30% year-on-year. Among them, the three-color contouring palette, three-color concealer palette, and three-color blush palette won the top in their categories. Off&Relax's transaction amount in Tmall stores/ Douyin stores/ JD.com stores increased by 150%+/450%+/200%+ year-on-year. As star products, OR fluffy shampoo, hair care oil and anti-hair loss essence have achieved outstanding results. Hapsode achieved rapid sales growth, with GMV on Tmall/Douyin/JD.com/PDD increasing by 20%+/remaining the same/80%+/100%+ year-on-year. Its star products, such as Multi-Acid Mud Mask, Facial Cleansing and Redness Correcting Essence, were extremely popular. The company has made comprehensive arrangements on the Douyin platform, sorting out the segmentation of the crowds in each broadcast room and the cargo orders it has accepted, and opening up the entire chain of the crowds for hero product series, expanding in-depth cooperation with Dabo, refining crowds to match people (influencers) and goods and refining operation of commercial cards to further increase the sales share. On Tmall Live, the top tier, second tier, and store self-broadcasting are organically combined to create multiple product tiers such as new products, exclusive products, and brand benefits to promote the explosion of live streaming.

Investment Thesis

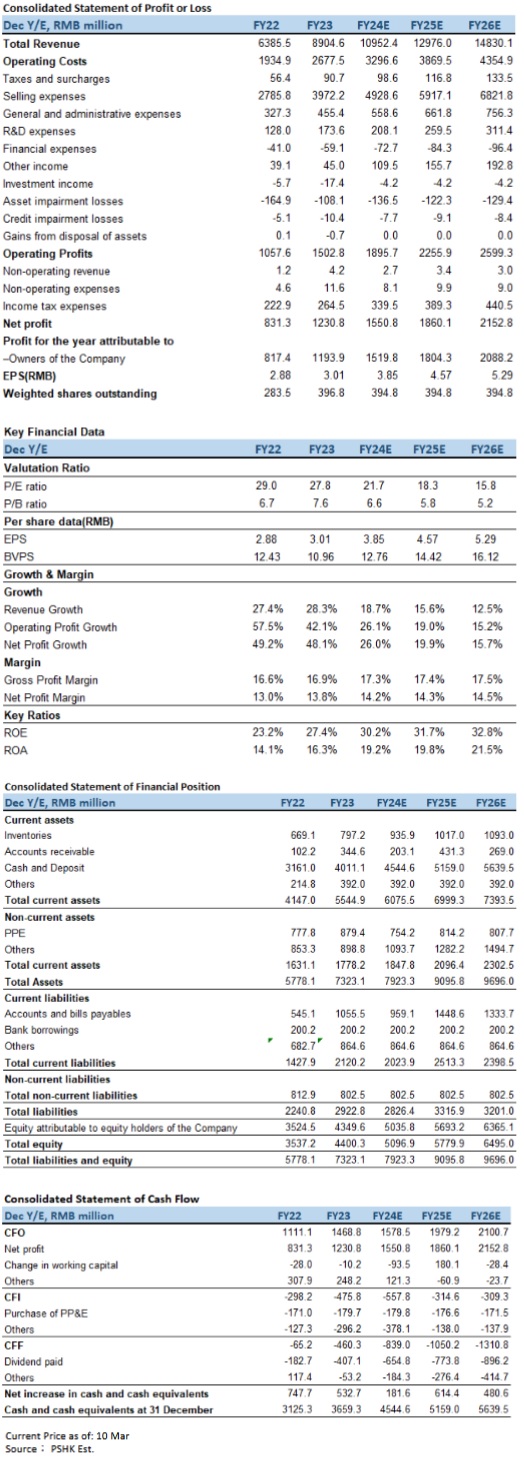

The Chinese cosmetics market has continued to grow in recent years. The main driving forces are the increase in cosmetics consumption, the increasing recognition of domestic products among young people, and the expansion of online channels (such as live streaming e-commerce). The Chinese cosmetics market has huge growth potential. With its popular strategies such as "Morning C and Evening A", PROYA has successfully established an image of technological skin care. The main brand "PROYA" contributes nearly 80% of the revenue, and at the same time, it incubates the cosmetics brand "Timage" (with impressive growth rate) and cleansing brand “Off&Relax”. Net operating cash flow matches net profit, and there is no significant debt repayment pressure (the debt-to-asset ratio is maintained below 40%). PROYA has strong product innovation and pipeline operation capabilities in the domestic beauty market, with a high degree of certainty in short-term performance growth. It firmly holds the leading position in the domestic beauty market. We are optimistic about PROYA's overseas opportunities in the future. The company is expected to expand into new markets in Southeast Asia and achieve breakthroughs in revenue. We forecast that the company's operating income will be RMB 10.95 billion, RMB 12.98 billion and RMB 14.83 billion in 2024-2026, with EPS of RMB 3.85/4.57/5.29, corresponding to a price-earnings ratio (P/E) of 21.7x/18.3x/15.8x. We give the company a P/E of 25 times in 2025, a target price of RMB 114.25, and give it a "buy" rating for the first time. (Current price as of March 10)

Risk factors

Downward macroeconomic situation, intensified industry competition, management changes, and new product promotion failing to meet expectations.

Financial

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|