-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- Smart Minor (Joint) Account

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Promotion

| CME e-mini S&P500 Weekly Options | ||

| Last Trading Day | Contract Month | |

| 1 st Week | 1st Friday of the Contract Month | EW1 |

| 2 nd week | 2 nd Friday of the Contract Month | EW2 |

| 3 rd week | 3 rd Friday of the Contract Month | EW3 |

| 4th week | 4th Friday of the Contract Month | EW4 |

Futures Trading Platforms

>

Inquiry(24-hour hotline):(852) 2277 6677

(852) 22776722

E-mail : futures@phillip.com.hk

Declaration and Disclosures

Phillip Securities Group (the "Company") reserves the right to vary any promotion offers and services at anytime without further notice. In case of dispute, the decision of the Company shall be final. Investment involves risks. For more details, please refer to the Risk Disclosures Statement at www.poems.com.hk.

If do not wish to receive any more messages from Phillip Securities Group ,please contact our Customer Service Department at cs@philllip.com.hk or 22776555.

Phillip Securities Group (the "Company") reserves the right to vary any promotion offers and services at anytime without further notice. In case of dispute, the decision of the Company shall be final. Investment involves risks. For more details, please refer to the Risk Disclosures Statement at www.poems.com.hk.

If do not wish to receive any more messages from Phillip Securities Group ,please contact our Customer Service Department at cs@philllip.com.hk or 22776555.

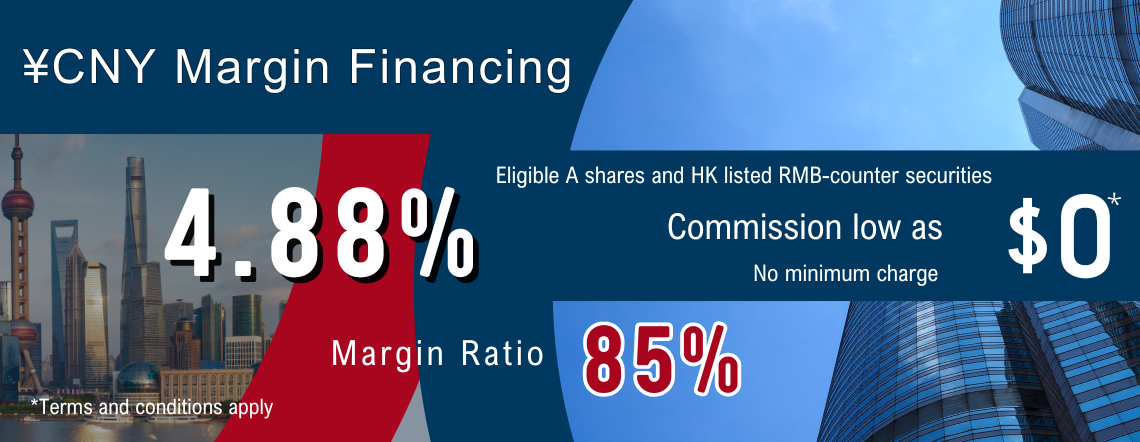

Our CNY margin financing interest rate is now as low as 4.88%. The service with leverage effect fits for over 1,000 eligible A shares of eligible stocks included in the northbound trading of Shanghai-Shenzhen Stock Connect, Hong Kong dollar-RMB dual-counter securities and RMB-counter Hong Kong-listed ETFs. Exchange-risk free.

Commission:

| Transaction Amount (RMB) | Online Buy Side Commission (RMB) | Online Sell Side Commission (RMB) |

|---|---|---|

| ¥30,000 or below | 0 | Transaction X 0.03% |

| Above ¥30,000 | Transaction Amount X 0.03% |

Footnote: Calculation of transaction amount is based on amalgamation order amount.

Margin Rate:

HKD margin interest rate is as low as 4.875%(P-0.5%)

RMB margin interest rate is 4.88%

P refers to the Prime rate of Standard Chartered Bank.

Terms and Conditions:

- This Promotion is valid from 1 June 2022 until further notice.

- This promotion is valid to online trading order only.

- Calculation of transaction amount is based on amalgamation order amount.

The Company reserves the right to alter these terms and conditions without prior notice and has final and irrevocable discretion in case of dispute.

Investment involves risks. Please refer to the Risk Disclosures Statement on our website at www.poems.com.hk.

You may contact our Customer Service Department at cs@phillip.com.hk or 2277 6555 to opt out of receiving marketing materials.

Investment involves risks. Please refer to the Risk Disclosures Statement on our website at www.poems.com.hk.

You may contact our Customer Service Department at cs@phillip.com.hk or 2277 6555 to opt out of receiving marketing materials.

Hong Kong investors and foreign investors must apply BCAN before trading A shares。

What is BCAN?

''BCAN'' stands for ''Broker-to-Client Assigned Number'' and Client Identification Data (CID) that are needed to support trading under the Northbound Investor ID Model. The BCAN-CID will be submitted to Mainland exchanges/ChinaClear for investors who wish to conduct Northbound trading through Stock Connect on T-day.

Do Hong Kong and overseas investors have to apply for China Connect BCAN before trading A shares?

Yes, they can trade A shares via China Connect in their original stock accounts.

How to apply BCAN?

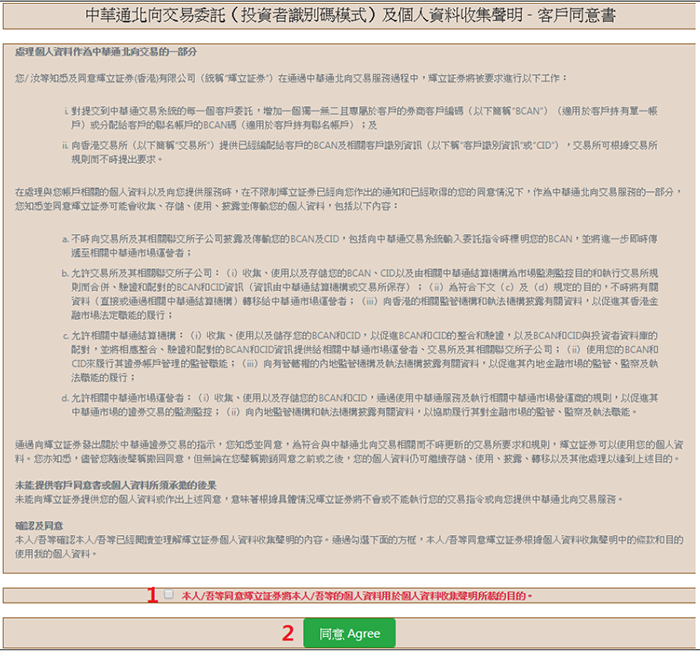

1. 登入POEMS平台後,於更改客戶資料(格C)中,按中華通「申請」按鈕。

2. 閱讀條款及細則後,於方格打勾,再按中華通「同意」按鈕。

Can BCAN be applied via POEMS APP?

No.

Can BCAN be applied via mail?

Yes. Please download the application form and mail it back to Customer Service Department or your account executive.

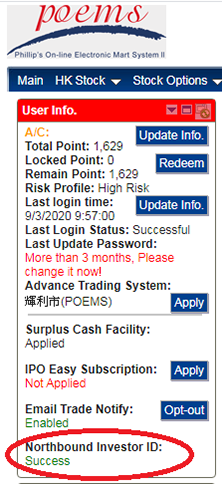

How could we know the BCAN application is approved?

The "Success" status will be shown in the column of "User Info" in POEMS.

Can all securities listed on the Shanghai Stock Exchange / Shenzhen Stock Exchange be traded through China Connect?

No. Please click and view Eligible Stocks of China Connect

Can all securities listed on the Shanghai Stock Exchange / Shenzhen Stock Exchange be traded with margin financing through China Connect?

No. Please click the list A shares with Margin Ratio

2,800 HK-listed ETF and US-listed ETF available

Trading with Commission Offer,No Platform Fee and Stamp Duty

Invest ETF monthly through the average cost method

For details , please click Monthly Investmenet Plan

For details , please click Monthly Investmenet Plan

Tutorial on investing ETF

Please view Video Tutorial

Please view Video Tutorial

What are ETFs?

Exchange Traded Funds (ETFs) are funds that are listed and traded on a stock exchange. Their main goal, depending on the type of ETF, is to either track the movements of an index through passive management, or outperform an index with active management.

When to/why invest in ETFs?

- ETFs allow for investing in sectors and/or indices, providing less risk versus investing in a single company.

- Like stocks, ETFs are traded on an exchange, providing higher liquidity and transparency

- As ETFs may hold vastly different constituent funds, an investor has exposure to multiple companies by investing in one fund, mitigating concentration risk.

Drawbacks of ETFs

- Some ETFs that track specific sectors may be influenced by large swings within that sector (eg. Oil)

- Some ETFs that are not as actively traded may have high bid/ask spread

- If one constituent stock is performing poorly, an investor cannot spin off that one stock within the ETF

What are the types of fees that I may be charged?

Unlike trading of shares, there is no stamp duty collected for ETFs, nor do we have a minimum charge for trades. We only charge commission at 0.08%, or 0.05% for day trading, and the transaction fees that HKEx charges.

New HK Stocks Commission for New Customers

Buy commission: HKD 50*

Buy More, Save More

No more rising costs as trade volume grows

Buy Batches, Pay Once

Buy the same stock all day, pay commission just once.

larger trade, lower rate

Buy Amount

HKD 500,000

(500k)

(500k)

HKD 1,000,000

(1M)

(1M)

HKD 5,000,000

(5M)

(5M)

Commission Fee*

HKD 50

HKD 50

HKD 50

Effective Commission Rate^

0.01%

0.005%

0.001%

When markets are volatile, buy in batches to stay versatile.

Example: You buy 10 lots of Alibaba (9988.HK) in a single day, purchasing 2 lots at a time with an average price of HKD 12,500 per lot.

Phillip

Other Traditional Brokers

Other Online Brokers

Platform Fee

No Platform Fee

No Platform Fee

HKD 75

Commission Fee

HKD 50*

HKD 250

No Commission Fee

Commission/Platform Fee Effective Rate^

0.04%

0.2%

0.06%

×

港股交易費比較

Phillip Securities

Other Traditional Brokers

Other Online Brokers

Platform Fee

No Platform Fee

No Platform Fee

Platform Fee HK$15(Per Trade)

Commission Fee

Buy Commission 0.00%

Buy Commission 0.068%

No Commission Fee

Minimum Charge

Flat Rate HKD 50

Minimum HKD 50

-

Combine orders

Unlimited Combine orders* /day

Max 50 orders /day

No Auto-Amalgamation

Only 5 Steps

1. Fill in personal information

(Mobile or PC)

2. Watch and consent

《Risk Disclosure Statement》

3. Upload Personal Information

4. Choose How to Open Your Account (Online or Face-to-Face)

Deposit at least HK$10,000 and upload deposit proof

● FPS

● Regular E-banking Transfer

*More information

● FPS

● Regular E-banking Transfer

*More information

Come to Phillip's Office with identity proof in person for certification

● Fill in E-form and tick Face-to-Face Account Opening

● Account owner brings Identity Proof and come to Phillip's Head Office or Branches

● No HK$10,000 initial deposit required.

*More Information

● Fill in E-form and tick Face-to-Face Account Opening

● Account owner brings Identity Proof and come to Phillip's Head Office or Branches

● No HK$10,000 initial deposit required.

*More Information

5)Account opening complete upon successful background review

Ready for HKD 50 Buy More Save More?

Open a Phillip account now for clear commission plan.

Open AccountFAQ

This commission program is exclusive for new customers. Existing customers can contact your account manager or call our customer service for details on switching.

Customer Service: 2277 6555

Customer Service: 2277 6555

This offer is only applicable to online transactions. Orders placed by phone or other means will be charged according to the standard schedule. Details of charges

The HKD 50 is a promotional commission rate. It excludes government stamp duty, transaction levies, CCASS fees, and other charges. For details, please visit Commission & Fee Schedule

This offer is not applicable to Hong Kong stock options. The offer only covers the following products traded on the Hong Kong Stock Exchange:

- Hong Kong Stocks

- Warrants

- Callable Bull/Bear Contracts (CBBCs)

- Exchange Traded Funds (ETFs)

Terms and Conditions

(1) This offer is only applicable to customers who open a new securities account with Phillip Securities from November 1, 2025 onwards.

(2) The offer is only applicable to buy transactions executed via our designated online trading platform or mobile application. Phone orders, counter orders, or other channels are not eligible; such transactions will be charged according to the company's standard schedule.

(3) This offer is limited to securities listed on The Stock Exchange of Hong Kong, for example: Hong Kong stocks, Exchange Traded Funds (ETFs), warrants, and CBBCs.

(4) All buy transactions of the same stock code on the same trading day, regardless of the number or amount, will be charged a flat fee of HKD 50.

(5) The offer does not include any government or exchange levies, including but not limited to stamp duty, HKEX trading fee, SFC transaction levy, and FRC levy.

(6) This offer may not be used in conjunction with any other promotion, discount, or special offer.

(7) The company reserves the right to amend or terminate this offer at any time without prior notice.

(8) In case of any dispute, the company reserves the right of final decision.

(9) In case of any discrepancy between the English and Chinese versions, the Chinese version shall prevail.

How to Transfer in Stock

1.Log in POEMS to submit instruction

2.Inform you Account Executive

3.Fill in and e-mail to cs@phillip.com.hk

Transfer in Reward

Phillip 50th Anniversary presents : Stock transfer-in rewards increase ! Each Phillip account could enjoy e-coupons for redemption in 7 types of transaction and services, including local stock interest, IPO subscription fees, US dollar interest rebates, local stock commissions, stock option commissions, fund subscription fees, and foreign stock commission. More stock value you transfer, more rewards you get. Action now!

Terms and Conditions

- This promotion is effective from 1 April 2025 to 28 February 2026 ("Promotion Period").

- The clients will be entitled a set of cash coupons if successfully transfer Hong Kong or U.S stocks (no minimum requirement) into Phillip Securities account during the promotion period. Details are as the table shown. The upper issue limit of the above electronic coupons is 124 e-coupons per day.

- E-coupon will be deposited in stock account after 2 working days of transferring in stock successfully

- The total market value of the transferred shares is based on the closing price of the settlement date.

- The issued E-coupons are valid for 180 days from the date of issuance.

- The E-coupon is only for redemption of commission,handling fee and interest. All e-coupons are not transferable, nor can they be exchanged for cash or any discounts.

- E-coupon will be granted for transferring stock from bank or other brokerages, and physical deposit only.

- Phillip Securities Group reserves the right to change the relevant terms and conditions without prior notice. In case of any dispute, the company has the final and irreversible decision.

How to redeem e-coupon?

user guide or view Phillip Youtube Channel

When could cash coupons be redeemed?

On the day after IPO subscription fee refunded.

Frequently Asked Questions on Local stock / USD Margin Interest Rebate e-coupon

Is there any upper limit of interest rebate?

Each local stock interest rebate e-coupon is only eligible for once. Upper limit is 20% of local stock margin interest and 20% of USD margin interest occurred. For the rebate margin interest excess the nominal value of coupon, the rebate amount is capped at the nominal value. </>E.g. The total interest incurred in March is HKD 300 and USD200, and the upper limit of interest rebate is HKD 60 and USD 40 (calculated as 20% of the total monthly interest). If you were given of six interest e-coupons in face value of HKD 100 and three e-coupons in face value of USD 20 in March, the maximum interest amount that can be rebated from the beginning of April is HKD 60 and USD 20, i.e. using one HKD 100 and one USD 20 interest e-coupon.

Can the local stock interest rebate coupon and handling fee cash coupon be used simultaneously?

Yes.

When could cash coupons be redeemed?

At the end of each month.

Hotline : (852) 2277 6678(Mon to Fri)Foreign Stock Department E-mail: foreignstock@phillip.com.hk

Latest Highlights on Japan Stock Trading

Latest Highlights on Japan Stock Trading

- Zero Commission* for all BUY transactions within ¥250,000*

- Trades Amalgamation

- Multi-currency facility

- ¥0 Custody fee, ¥0 Membership

- JPY margin rate as low as 2.8% p.a. Maximize purchasing power as high as 5x

*For Online Transactions Only.

Trading Notes

- Clients must complete the form of "Foreign Stock Trading Access Right" active Japan stocks trading service.

- Terms and Condition applies. Platform Maintenance Fee will be charged separately. please check other items on Basic Fee and Charges

- The board lot size for Japan stocks is 100 shares.

- Trading settlement on T+2

- Settlement currency: JPY, USD, HKD

- Trading hours are from

Morning session: 08:00-10:30(HKT) / 09:00-11:30(JPT)

Afternoon session: 11:30-14:00(HKT) / 12:30-15:00(JPT)

#Japan stock price quote delays at least 20 minutes

**Click and download the Declaration form and e-mail to cs@phillip.com.hk. Or login POEMS, click FOREIGN STOCK for online declaration.

Terms and conditions

- Effective from 04 January 2022 under further notice.

- This promotion is only applicable for online BUY transactions (trades done via POEMS Mobile App / POEMS online platform) with an amount less than or equal to JPY 250,000.

- Platform Maintenance fees will be charged separately.

- This offer is not eligible to capital management customers, Investment immigration plan customers, Institutional Customers and corporate Customers, and customers who have enjoyed preferential rates.

- Offline transactions (trades placed over the phone through Account Executive or Stock Dealer) are charged at 0.50% of Transaction Amount (less than or equal to JPY 1,000,000) and 0.40% of Transaction Amount (over JPY 1,000,000) with a Minimum of JPY 3,000.

24-hour Global stocks trading hotline: +852 2277 6678

Declaration and Disclosures

Phillip Securities Group (the "Company") reserves the right to vary any promotion offers and services at anytime without further notice. In case of dispute, the decision of the Company shall be final. Investment involves risks. For more details, please refer to the Risk Disclosures Statement at www.poems.com.hk.

If do not wish to receive any more messages from Phillip Securities Group ,please contact our Customer Service Department at cs@philllip.com.hk or 22776555.

Phillip Securities Group (the "Company") reserves the right to vary any promotion offers and services at anytime without further notice. In case of dispute, the decision of the Company shall be final. Investment involves risks. For more details, please refer to the Risk Disclosures Statement at www.poems.com.hk.

If do not wish to receive any more messages from Phillip Securities Group ,please contact our Customer Service Department at cs@philllip.com.hk or 22776555.

風險聲明:

此網頁內所載之內容不應理解為買入或出售任何產品或服務之建議、邀請、廣告或勸誘。本網頁有關人士對於網頁所提供的任何資料或意見均屬可靠,惟其所產生之任何損失或虧損概不負任何責任。金融市場具一定風險,投資價格可跌可升。 買賣期貨合約的虧蝕風險可以極大。在若干情況下,你所蒙受的虧蝕可能會超過最初存入的保證金數額。即使你設定了備用指示,例如“止蝕”或“限價”等指示,亦未必能夠避免損失。市場情況可能使該等指示無法執行。你可能會在短時間內被要求存入額外的保證金。假如未能在指定的時間內提供所需數額,你的未平倉合約可能會被平倉。然而,你仍然要對你的帳戶內任何因此而出Save現的短欠數額負責。因此,你在買賣前應研究及理解期貨合約,以及根據本身的財政狀況及投資目標,仔細考慮這種買賣是否適合你。

Enquiry : 2277 6733

PhillipMart commission offer is as follows:

| Buy Side Commission | Sell Side Commission* (Applicable to shares bought in Phillipmart) |

| HK$ 0 | 0.05% / min. HK$ 10 |

Terms and Conditions:

- The promotion is valid from 29 September 2025 until further notice.

- All transactions under this promotion are calculated on amalgamation basis.

- *Commission for selling allotted shares: Charged as per standard HK Local Stock Commission Fee.

- Transactions which enjoy special offer are calculated separately with general transaction fee.

# The trading hours of PhillipMart / Grey Market is from 4:15 p.m. to 6:30 p.m. one business day prior to the official listing date of the new shares. For half trading day, the trading hour of PhillipMart is from 2:15 p.m to 4:30 p.m. Please refer to the latest notice.

Please call your account executive or contact

Hotline : 2277 6733

e-mail: ipo@phillip.com.hk

The Company reserves the right to alter these terms and conditions without prior notice and has final and irrevocable discretion in case of dispute.

Investment involves risks. Please refer to the Risk Disclosures Statement on our website at www.poems.com.hk.

You may contact our Customer Service Department at cs@phillip.com.hk or 2277 6555 to opt out of receiving marketing materials.

Investment involves risks. Please refer to the Risk Disclosures Statement on our website at www.poems.com.hk.

You may contact our Customer Service Department at cs@phillip.com.hk or 2277 6555 to opt out of receiving marketing materials.

Top of Page

- Friendship Links

- HKEX

- CNFOL HK

- Tencent HK

- SSE

- SZSE

|

Customer Service Department (General Enquiries) Tel : (852) 2277 6555 Fax : (852) 2277 6008 Email : cs@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|

Contact Us

Tel : (852) 2277 6555

Fax : (852) 2277 6008

Email : cs@phillip.com.hk

Enquiry & Support

Branches

The Complaint Procedures

About Us

Phillip Securities Group

Join Us

Phillip Network

Phillip Post

Phillip Channel

Latest Promotion

新闻稿

Phillip Securities Group

Join Us

Phillip Network

Phillip Post

Phillip Channel

Latest Promotion

新闻稿