-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- Smart Minor (Joint) Account

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Weichai

Wednesday, February 25, 2026  2138

2138

Weichai (2338 HK) - From a cyclical heavy truck enterprise to a structurally growing energy platform(2338)

| Recommendation | BUY (Maintain) |

| Price on Recommendation Date | $27.200 |

| Target Price | $34.600 |

Weekly Special - 1361 361 DEGREES

Company Profile

Weichai is one of the automobile and equipment manufacturing groups with the strongest comprehensive strength in China's heavy truck industry. Based on the powertrain system including engine, axle and gearbox, the Company extends upstream components and downstream heavy trucks, and takes the lead in forklifts and intelligent warehousing. After years of development, the Company has built a synergetic development pattern of four major industrial segments including powertrain (engine, transmission, axle/hydraulics), vehicle and machinery, intelligent logistics and other segments.

Investment Summary

Performance Review: Revenue Grows Steadily, Net Profit Continues to Improve

According to Weichai Power's FY2025 third-quarter report: In the first nine months of 2025, the company reported a revenue of RMB170.57 billion, representing a year-on-year (YoY) growth of 5.3%. Net profit attributable to the parent company amounted to RMB8.88 billion, marking a YoY increase of 5.7%. The net profit after excluding non-recurring items reached RMB7.97 billion, up 3.4% YoY, reflecting steady progress in overall performance.

Looking at the results by quarter, the revenues for the first three quarters were RMB57.46 billion, RMB55.69 billion, and RMB57.42 billion, showing YoY changes of +1.9%, -0.8%, and +16.1%, respectively. Net profit attributable to the parent company was RMB2.71 billion, RMB2.93 billion, and RMB3.23 billion, reflecting YoY changes of +4.3%, -11.2%, and +29.5%, respectively. The first two quarters saw more moderate growth in net profit, while the third quarter showed a sharp increase, mainly due to fluctuations in oil and gas price differentials and policy subsidies. The domestic natural gas heavy truck industry experienced a high in the early period of 2024 followed by a decline in the later period, while 2005 saw a weak first half and a rapid recovery in the second half, driving fluctuations in the company's natural gas engine sales. Additionally, in the first half of the year, Kion incurred a one-time expense related to its efficiency plan, resulting in a negative impact of RMB480 million. After adjusting for this, the net profit attributable to the parent company in the first half of the year increased by 3.8% YoY to RMB6.13 billion.

Profitability Remains Resilient

In terms of profitability, for the first three quarters, the company's gross margin and net profit margin attributable to the parent company were 21.9% and 5.2%, respectively, largely unchanged YoY (+0.04 ppts, +0.01 ppts). The sales expense ratio for the first three quarters was 5.82%, up by 0.18 ppts YoY, the administrative expense ratio was 5.4%, up by 0.74 ppts YoY, and the R&D expense ratio was 3.62%, down by 0.21 ppts YoY.

In detail, the gross margin for the first three quarters was 22.2%, 22.1%, and 21.4%, with YoY changes of +0.12 ppts, +0.74 ppts, and -0.74 ppts, respectively. The net profit margin attributable to the parent company was 4.72%, 5.27%, and 5.63%, with YoY changes of +0.11 ppts, -0.62 ppts, and +0.58 ppts, respectively. Profitability remains resilient, primarily due to the improved profitability of subsidiaries Shaanxi Heavy Duty Truck and Kion, as well as the fluctuation in provisions, supply chain optimization, and continuous cost reduction and efficiency improvements in various stages.

Heavy Truck Industry Structural Reshuffle, Weichai remain Steady Product Advantages

In January 2025, the government introduced a subsidy policy to promote vehicle replacements, expanding the subsidy coverage to vehicles meeting the National IV emission standard and below. In March, the policy was further extended to natural gas heavy trucks, driving a gradual increase in demand for heavy trucks. The penetration rate of natural gas and new energy heavy trucks has rapidly increased under the dual influence of policy and technology. According to data from the China Association of Automobile Manufacturers (CAAM), the cumulative sales of heavy trucks in the Chinese market reached 1,145 thousand units in 2005, a YoY growth of 27%. Of this, 341 thousand units were exported, showing a YoY growth of 17.4%. The market now features a three-way division among diesel, natural gas, and new energy vehicles, with market shares of 46%, 25%, and 29%, respectively.

To align with industry trends, the company has developed multiple technological routes, including pure electric, fuel cell, and hybrid solutions. In the first three quarters, the company sold a total of 536 thousand engines, including 188 thousand heavy truck engines. By fuel type, the sales of diesel heavy truck engines were approximately 117 thousand units, while natural gas heavy truck engines accounted for around 71 thousand units. According to the First Commercial Vehicle Network, the company's new energy power system business achieved a revenue of RMB1.97 billion (RMB, the same below) in the first three quarters of 2005, marking an 84% YoY growth. Its subsidiary, Shaanxi Heavy Duty Truck, sold 109 thousand heavy trucks in the first three quarters, a YoY growth of 18%. Sales of new energy heavy trucks reached about 16 thousand units, a YoY growth of approximately 2.5 times, maintaining a leading position in the industry.

Looking ahead, the expected balanced supply-demand structure is likely to support natural gas prices at a stable and reasonable range, and the application of natural gas heavy trucks will become more widespread, with the penetration rate continuing to rise. With continued policy support, technological upgrades, and improvements in infrastructure, the market penetration of new energy heavy trucks is also expected to keep increasing. In the medium term, the positive effects of fiscal and monetary stimulus policies, along with the next phase of emission standard upgrades in the industry, will have a positive impact on heavy truck sales. Weichai leads the market share in heavy truck engines, particularly in the natural gas heavy truck engine market, with shares of 23% and 52%, respectively, and is expected to benefit first.

Accelerated Computing Infrastructure Drives Growth in Large-Bore Engine and Fuel Cell (SOFC) Businesses

With the rapid iteration of AI technology in recent years driving the acceleration of computing infrastructure, the power generation industry has experienced rapid growth. The demand for backup power engines has surged, and the company has deeply invested in multiple product forms, including diesel, natural gas, and solid oxide fuel cells (SOFC), to meet market needs. The company's large-bore engine (diesel) business has reached a certain scale and is entering a phase of rapid growth. In the first three quarters of 2005, sales exceeded 7,700 units, marking a YoY increase of over 30%. Among these, sales of products related to data centers surpassed 900 units, growing more than threefold YoY.

Regarding solid oxide fuel cells, in November, Weichai signed a manufacturing license agreement with its affiliate, Ceres, to establish production lines for batteries and stacks to be used in the stationary power generation market. Some key components will be supplied by Ceres, and the products will provide power for applications such as AI data centers, commercial buildings, and industrial parks. This means the company will have full control over the core technologies of batteries, stacks, systems, and power stations, and will be authorized to enter the global market for sales. Currently, the company has now a good order backlog in the SOFC field, with promising profit prospects.

We expect that with the rapid development of the global computing power market, the domestic supply chain will gradually mature and production capacity will steadily be released, leading to an accelerated expansion of the power generation equipment business order scale. The second growth curve is becoming increasingly clear.

Investment Thesis

As the share of profits from AIDC power generation business is expected to exceed 30% by 2030, the company is being revalued from a cyclical heavy truck enterprise to a structurally growing energy platform, with broad long-term growth potential. Overall, the company's leading position remains solid, with a clear strategy framework of "power + hydraulics + new energy". The forward-looking new businesses are opening up growth potential, and the high dividend payout ratio is expected to be maintained.

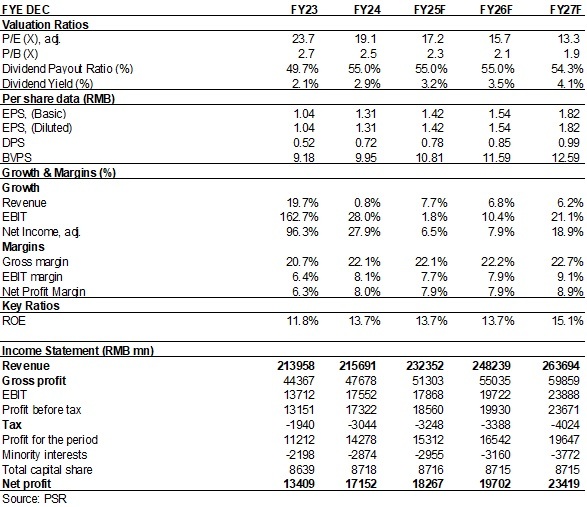

We forecast the EPS of the Company to be RMB 1.42/1.54/1.82 yuan in 2005/2006/2007. We will also revise target price to 34.6HKD (22/20/17x P/E and 2.9/2.6/2.4x P/B for 2005/2006/2007) and BUY rating. (Closing price as at 5 February)

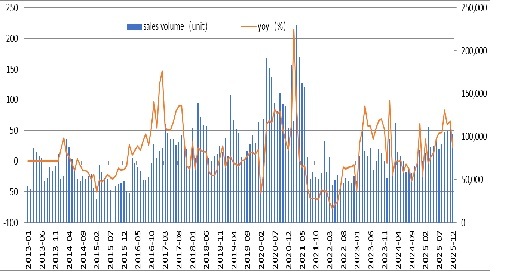

Domestic Heavy-duty truck monthly sales and growth

Source: Wind, Company, Phillip Securities Hong Kong Research

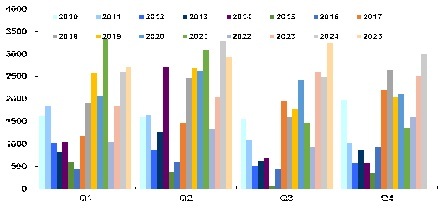

Weichai Quarterly Net Profit

Source: Wind, Company, Phillip Securities Hong Kong Research

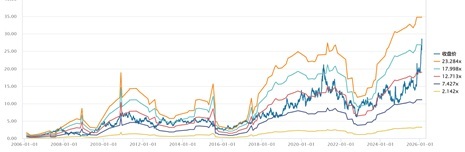

Historical P/E Band

Source: Wind, Company, Phillip Securities Hong Kong Research

Financials

(Closing price as at 5 February)

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|