-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

KWG Property (1813.HK) - Quality Developer of Top Tiers Cities

Thursday, November 24, 2016  23246

23246

KWG Property(1813)

| Recommendation | Buy |

| Price on Recommendation Date | $4.380 |

| Target Price | $5.900 |

Weekly Special - 002085.SZ Wanfeng Auto Wheel

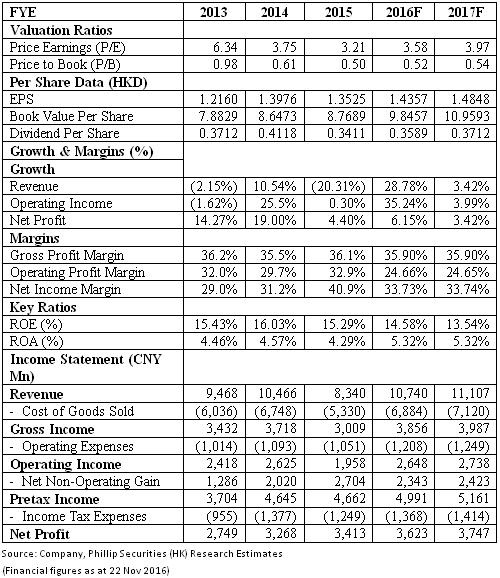

KWG Property has an improved result in 1H2016. Total revenue increased 38.9%, from CNY3,921Mn in 1H2015 to CNY5,448Mn in 1H2016. Net profit rose 3.64% in 1H2016 to CNY1,421Mn. By October 2016, the company has achieved 88% of its targeted pre-sale in 2016, with a total achieved pre-sale value of CNY19.3Bn. The improved result is caused by the increased amount of GFA delivered to clients and the rising sales price per square metres.

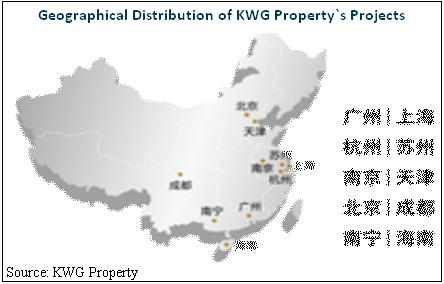

Developer in Top Advanced Cities

KWG Property has strong presence in top tier cities in China and has 33 projects in Tier 1 Cities, namely, Beijing, Shanghai, and Guangzhou, with a total GFA of 4.75 million square metres in these cities. In particular, projects in Tier 1 Cities contribute to 48% of the revenue in pre-sale and the remainder was contributed by Tier 2 Cities, mainly Hangzhou and Nanning. KWG Property has 60 development projects with 10.4 million square metres of GFA attributable to the company, which is sufficient for development use in the next 4 to 5 years. KWG Property's development projects are well-positioned in the major cities in China, with huge population as well as economic development, both of which are the fundamental drivers of housing demand. Therefore, despite the recent adoptions of property market regulations, we expect the sales of property to continue to grow moderately for KWG Property, and the company would still benefit from these macro drivers of property market growth.

Excellent Location Selection for Property Development

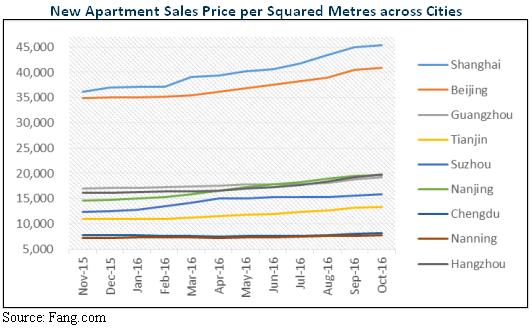

According to the graph below, throughout the last twelve months, property price for newly built apartment in Shanghai, Beijing and Guangzhou rose 25.7%, 17.2% and 13.4% respectively. This will certainly benefit KWG Property since Shanghai, Beijing and Guangzhou are at the core of company's strategy. Another strategic objective of KWG Property is to expand into advanced Tier 2 Cities from the strategic base of Guangzhou and the company has already set its foot in a few of the Tier 2 Cities, such as Hangzhou, Nanjing, Chengdu and Suzhou. At the same time although the property price of newly built apartment in Tier 2 Cities is not rising as rapidly as those in Tier 1 Cities do, the property price in the Tier 2 Cities is still rising steadily, benefiting the sales of KWG Property especially the other 52% of the pre-sale are from the Tier 2 Cities.

Government Intervention on the Property Market

In October, the Chinese government has adopted several property market tightening policies, which affect almost all of the cities where KWG Property engages in. The policies consist of both measures suppressing the purchasing power of the consumers as well as that of the developers. In particular, the Chinese government increased the statutory down payment ratio, debit limit and purchase limit. From the developer's perspective, the government has adopted policies such as decreasing the credit period for land premium payment in places such as Shenzhen and Hangzhou, and allowing only equity financing in land acquisition in places such as Nanjing and Guangzhou. The government is expected to further enhance the tightening policy by further raising the down payment ratio, limiting the purchase by both internal and external citizens of the provinces, and limiting the use of the debt in the property market.

These tightening policies have led to the recent adjustment in the sales price in top tier cities and the decrease in transaction volume. Moreover, land premium is a major contributor to the rising property price and property development companies usually pay the majority of the land premium using debt financing. Allowing only equity financing in land acquisition will put pressure on land price, thereby suppressing the property price ultimately.

Although the property market has experienced short term fluctuation, as evident in the current price adjustment in property market such as the one in Shenzhen, we believe these policies will create a healthier and more realistic environment for the property market in China.

Financial Position of the Company

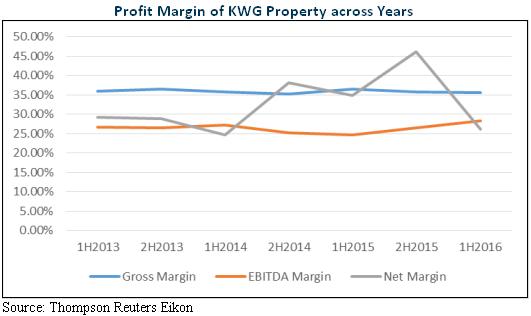

The profitability of KWG Property remains to be strong, with gross profit margin remaining stable at about 35%, and EBITDA margin staying above 25% across the years. In particular, in 1H2016, the gross profit margin reached 35.6% while EBITDA margin reached 28.3%, implying that the company has stable and improving cash flow generating ability. As shown from the graph below, the difference between gross margin line and EBITDA line have been relatively stable whilst the net margin line has been quite volatile, implying the non-operating gain or loss has been causing some variation to the company net result.

The main reason for the discrepancy between net profit and EBITDA is the share of profit by the company's associates and joint ventures well as the interest expenses. With the adoption of land acquisition policy allowing only equity financing, we believe the company's debt ratio has reached its maximum especially the company has a large land reserve, which is enough for the development projects in the next 4-5 years.

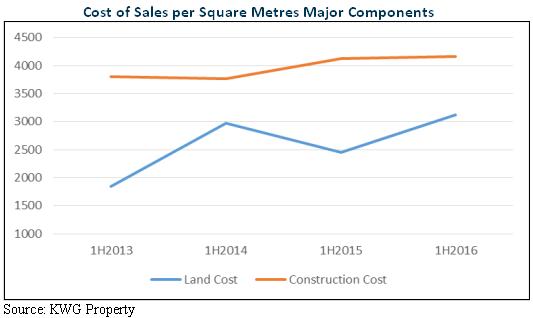

The company's profitability is further assured by the fact that its cost of land in income statement is relatively cheap, as evident by the cost of land only reaching CNY3,100 per square metre for the first time in 1H2016. In particular, in Guangzhou, the primary operating area of KWG Property, the recent land acquisitions performed by Agile Property and Yuexiu Property implied a cost of CNY35,000 and CNY34,000 per square metre respectively, which are more than 10 times larger than the current cost of KWG Property.

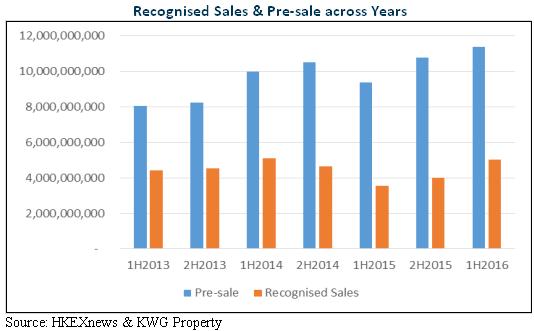

KWG Property also has strong sales in almost every year. In particular, their pre-sales regularly exceed the recognised sale. In recent years, pre-sale is more than double of the recognised sales, allowing the company to generate revenue in advance of the actual completion of the property. Therefore, despite the tightening regulations, we believe that the short term fluctuation of the property price and transaction would not affect KWG Property significantly because of the strong pre-sale and stable profit margins.

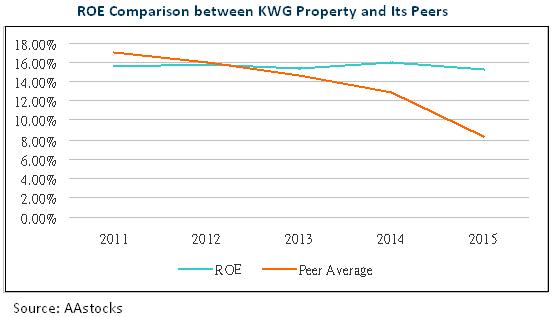

Besides, the company also has better ROE than its peers of similar size in recent years. Financially, it is partly contributed by the levered capital structure of the company, i.e. 132.4% Long Term Debt/Equity, which the company could reduce its income tax expense via debt interest payment.

Valuation

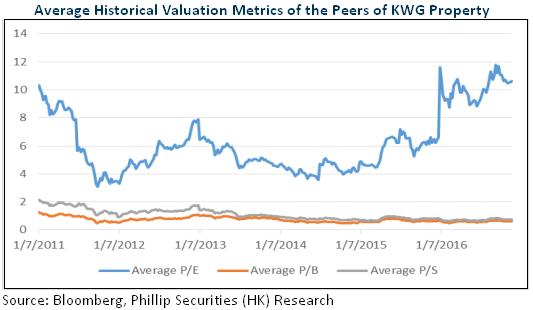

The tightened regulation has brought short term volatility to the market. However, the housing demand in top tier cities still exist. The ultimate purpose of the regulation is to promote a healthy growth of the property market. With strong sales, stable profitability and good strategic location the company bases in, we expect KWG Property to achieve growth despite the tightening regulation. The average valuation metrics, i.e. P/E, P/B and P/S, of the peers are 6.22x, 0.73x and 1.08x. We assign KWG Property the target price of HK$5.90, with the “Buy” rating assigned. (Closing price as at 22 Nov 2016)

Risks

Systematic default of the pre-sales buyers

Tightened regulations

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|