-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

ChinaGas (0384.HK) - Short-term investment requires adjustment and long-term depends on potential

Monday, March 18, 2013  11404

11404

ChinaGas(384)

| Recommendation | Accumulate |

| Price on Recommendation Date | $7.340 |

| Target Price | $8.030 |

Weekly Special - 002085.SZ Wanfeng Auto Wheel

Company profile

China Gas Holdings Limited is a natural gas services operator listed on the main board of Hong Kong Stock Exchange Limited. It engages principally in the investment, operation and management of city gas pipeline infrastructure, distribution of natural gas to residential, commercial and industrial users, construction and operation of gas stations, and development and application of natural gas related technologies in Mainland China.

Investment Overview

On February 28, Beijing Enterprises Group Company Limited (Hereinafter referred to as Beijing Enterprise Group) increased its over-the-counter holding of 75 million shares of China Gas, through which the shareholding ratio of Beijing Enterprises Group had increased from 19.48% to 21.12%, becoming the largest shareholder of China Gas. It has been the fifth time that Beijing Enterprises Group increased its shareholding of China Gas, indicating its great confidence in the Company's prospects for development.

"The 12th Five-Year Plan" in respect of natural gases aims to form a market-oriented pricing mechanism as soon as possible. It is expected that upstream enterprises will increase the ex-factory prices of natural gas, while its end-user prices will be intervened by governments, thus significant increase will be difficult to be seen in the short period of time. Nevertheless, considering that residential customers account for a smaller share of the natural gas market, the impacts of governments` price-fixing arrangements will be limited, instead the downstream distribution companies will have certain pricing power over industrial users. Management of China Gas also expected to transfer the additional costs to end users in a timely manner.

It was also mentioned in the plan that greater efforts would be made to the development of unconventional natural gases, aiming to break the monopoly of large state-owned oil companies on the natural gas network. In December 2012, China Gas acquired Fortune Oil with U.S.D400 million in cash and the current share capital of not more than 5.5% of the shares. Its downstream gas business has been successfully extended to LNG and coal bed methane as well as other unconventional natural gas fields. Meanwhile its market share of urban pipeline gas and natural gas filling stations as well as other downstream natural gas businesses will also be further expanded.

China Gas has entered into a strategic cooperation framework agreement with Sinopec, in which a joint-venture company will be set up to develop LPG market and major urban pipeline gas projects. We believe that China Gas will benefit from Sinopec's extensive distribution network in the future. Taking full advantage of Sinopec's LPG resources, the future profitability and market share of China Gas's LPG business will experience a huge potential for improvement. For natural gas business, Sinopec will also assist China Gas in the construction of distribution network, and ensure the upstream supply.

Overall, we are strongly optimistic about the prospect of China Gas's natural gas business, and its share price has been far beyond our previous target price. As part of China Gas's potential favorable factors have been basically absorbed by the market, its share price will be difficult to see ongoing rise in short-term or will fall properly, but the favorable trend in the middle and long-term may continuously exist. By taking all these factors into consideration, we slightly increase China Gas's six-month target price to HKD 8.03, and give "Accumulate" rating.

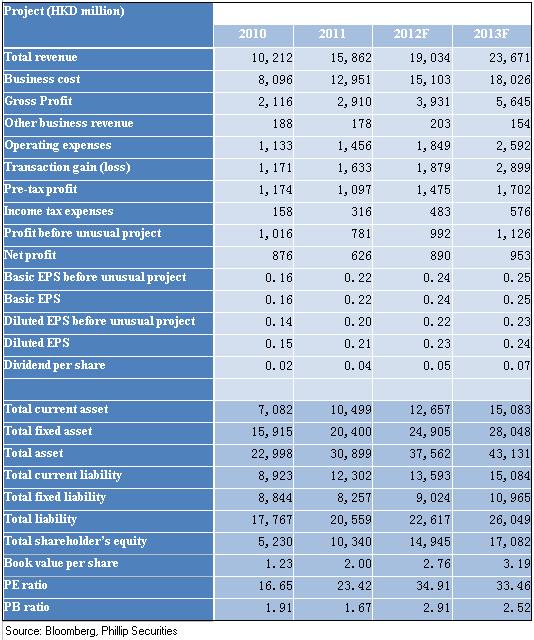

Financial Statements and Predictions

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|