-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Tasly Pharmaceutical Group (600535.CH) - Steady recovery of the result in 1H17

Thursday, August 24, 2017  15332

15332

Tasly Pharmaceutical Group

| Recommendation | Accumulate |

| Price on Recommendation Date | $38.520 |

| Target Price | $43.800 |

Weekly Special - 002085.SZ Wanfeng Auto Wheel

Investment summary

Tasly's pharmaceutical manufacturing sector has recovered steadily with its pharmaceutical commerce business growing faster. Plus the adjustment of channels, the trading volume of the second-line potential varieties and the heated class I new drugs such as rhPro-UK will explode hopefully after entering the NDRL. The result of the Company will return to the upward trend. Moreover, as a leader in modern traditional Chinese medicine industry, the internationalization of Compound Danshen Dripping Pills will also have a positive influence. The Company's brand influence will be significantly improved. In light of comparable companies, we give Tasly an estimation of 35x PE in 2017 and a 12-month target price of RMB43.8, with the "Accumulate" rating maintained. (Closing price at 21 Aug 2017)

Steady recovery of the result in 1H17

In 1H17, Tasly recorded a revenue of RMB7.26 billion, representing an annual growth of 13.5%. The net profit attributable to the parent company stood at RMB760 million, an increase of 10.4%. In terms of the quarter, the revenue in 2Q was RMB3.72 billion, up by 20.4% yoy. The net profit was RMB440 million, increased by 7.4% yoy, up by 37.7% qoq. The Company sees the trend of recovery.

In the previous two years, since the Company adjusted the channel structure and strengthened the management of accounts receivable, it was evident that the result of the sector of pharmaceutical manufacturing grew slowly until the first quarter of this year. However, the revenue of the second quarter reached RMB1.59 billion, up by 7.3% yoy, increased by 22.6% qoq, which has recovered to the level of the same period in 2015, which is the level before the decrease of the inventory of the pharmaceutical manufacturing sector. We expect that the Company will continue to recover because it is adjusting the sales model transforming from the agency mode to both the agency mode and the mode of sales through its own channels, covering the second and third class hospital market uncovered before.

Its pharmaceutical commerce business reported a revenue of RMB4.33 billion in 1H17, up by 15.8% yoy, mainly due to the enhanced expansion of the Company's hospital business. Profit growth was slower than revenue growth, mainly because the increased proportion of pharmaceutical commercial revenue pulled gross margin down by about 1.6 ppts. However, the gross margin of the pharmaceutical commerce sector increased by 0.8 ppts to 7.4%. In addition, because the Company controlled the expenses effectively, the marketing expense, administration expenses, and financial costs annually increased by only 3%, 5.5%, 9.5%, respectively, lower than the growth of revenue.

rhPro-UK was included in the NDRL through negotiation

The Company's exclusive product, Recombinant Human Prourokinase for Injection (rhPro-UK), is introduced into the class B through the NDRL negotiation. Previously, the lowest bidding price of the drug was less than RMB1,200/bottle. The negotiation set the medical insurance payment standard of RMB1,020, a drop of only about 14%, at the low level of the same batch, reflecting the recognition of government and the market of its efficacy. The patency rate of rhPro-UK in patients with acute myocardial infarction is over 85%, and the incidence of intracranial hemorrhage is only 0.19%, which is superior to its competitors. Moreover, as a thrombolytic drug, it is more effective at the substrate level than PCI. Therefore, its future market is promising. With a good competitive landscape, we expect it will become another blockbuster after Compound Danshen Drop Pills.

Stock ownership plan of employees highlighted its confidence of development

At the end of March, the Company released its first stock ownership plan of employees in 2017, with 16 executives, including the Chairman taking active part in it. On June 10, the Company announced the completion of the stock purchase of the plan, a total of 506,800 shares from the secondary market with the average transaction price of about RMB39.5 per share. We believe that the immediate implementation of stock ownership plan of employees highlights the confidence of management in the development of the Company, forming the positive support for the intrinsic value of the Company.

Risks

Risk of price drop in drugs;Progress in FDA certification of Compound Danshen Dripping Pills below expectations.

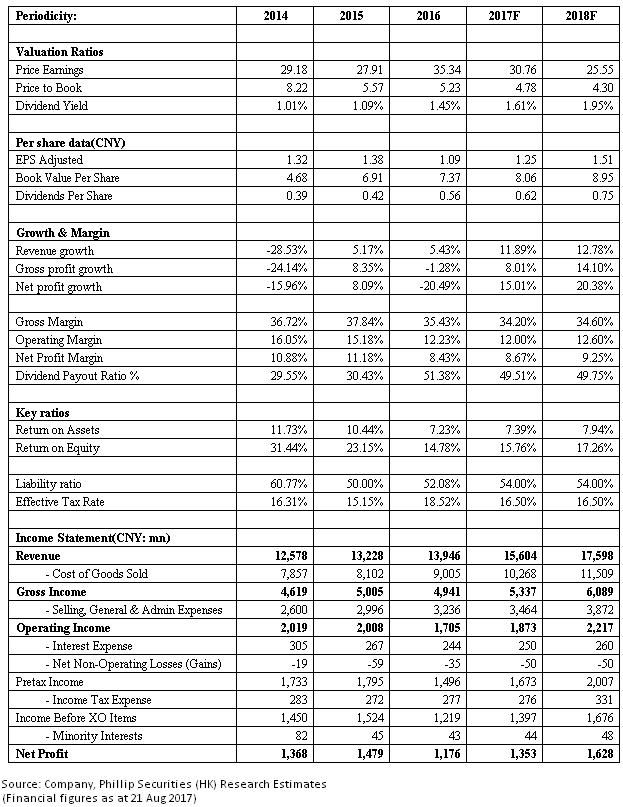

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|