-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Grandblue Environment (600323.SH) - Mergers and Acquisitions Fuel Rapid Growth in Revenues

Friday, January 27, 2017  25990

25990

Grandblue Environment(600323)

| Recommendation | Buy |

| Price on Recommendation Date | $14.560 |

| Target Price | $18.200 |

Weekly Special - 1836 Stella International

Rapid Growth of Revenues

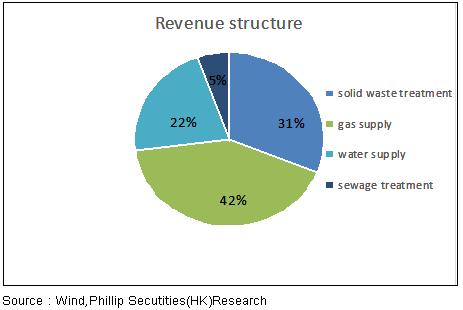

Grandblue Environment has established the business structure of four major segments covering water supply, sewage treatment, solid waste treatment and gas supply by means of accelerated mergers and acquisitions and expansion over the past few years. Its current capacity of water supply reaches 1.61 million cubic meters/day, and its scale of food waste disposal amounts to 850 tonnes/per day. Besides, the company has 19 waste incineration projects with a total capacity of 15,350 tonnes/day and 21 sewage treatment projects with a total capacity of 600,000 tonnes/day. Furthermore, it also established a joint venture with the international waste disposal giant -- Germany's Remondis, and is engaged in the hazardous waste disposal market for the first time.

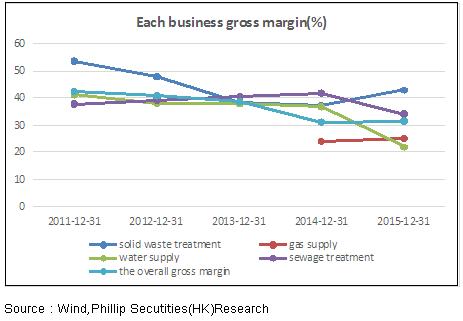

Presently, solid waste disposal business is the company's core source of profit. It contributed 41.78% of the company's pre-tax net profits in H12016, and its gross profit margin was as high as 44.19%, far greater than the company's overall gross profit margin of 34.02%. The company recorded a total revenue of RMB2.708 billion in the first three quarters of 2016, and completed 73.2% of RMB3.7 billion set out in the annual revenue guideline. Its attributable net profits stood at RMB433 million, representing a year-on-year increase of 35.4%, while its cost and expense ratios dropped by 3.1 ppts to 80.69%, meeting the target of 85%. Therefore, its cost control was sound. Moreover, its net profit margin grew by 3.4 ppts to 17.5%, marking a significant increase in profitability.

Continued Development in Solid Waste Disposal Business

In 2014, the company completed the acquisition of 100% equities in C&G Environmental Protection (China) Co., Ltd., enabling the company to rank the top in the production capacity of waste disposal industry and to preliminarily complete national business layout. So far, the C&G Environmental Protection (China) took charge of 16 projects with a total treatment capacity of 11,350 tonnes/day. Specifically, the project of Huangshi Phase II and the Dalian project are expected to be put into operation in early 2017, and the project of Fuqing Phase II is estimated to be put into operation soon after completion of commissioning. A new capacity of 1700 tonnes/day is projected to be put into operation in 2017.

The Nanhai Industrial Park owned by Foshan Nanhai Green Power Renewable Energy Co., Ltd. has two waste incineration projects totaling 3,000 tonnes/day which are currently operating at full capacity. Additionally, the company acquired 70% equities in Zhangzhou Zhongyan Ecological Energy Investment Co., Ltd. in February, and increased its treatment capacity by 1000 tonnes/day. At the end of September, the company won the bidding of share capital increase project launched by Shunkong Environmental Investment Co., Ltd. The two companies will jointly run the project of Shunde Solid Waste Industrial Park with a waste treatment capacity of 3,000 tonnes/day. We expect that the company will continue to increase capital expenditure on by focusing on solid waste treatment, accelerate business expansion and market development and its business layout throughout the country.

Financial Profile

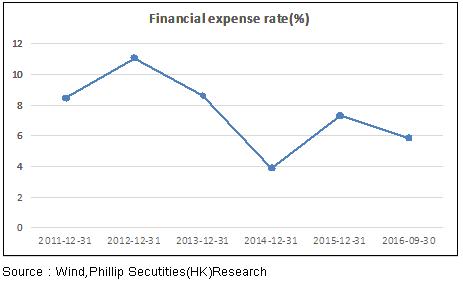

At the end of the third quarter of 2016, the company's money funds amounted to RMB964 million, down 30% over 2015. But the net book value of its accounts receivable increased by RMB72 million over 2015, which primarily resulted from expanded scope of solid waste disposal business and delay in government settlement. Debt-equity ratio reached 57.41%, and current ratio and quick ratio were 0.56 and 0.50, respectively, reflecting the greater capital expenditure needs in rapid expansion. In October, the company issued corporate bonds worth RMB1 billion with a coupon rate of 3.05% (totalling RMB2 billion by several issues). It is expected to provide ample liquidity to the company and promote the rapid development of its business. Meanwhile, the issuance also helps to optimize debt structure, save financial expenses and enhance financial strength.

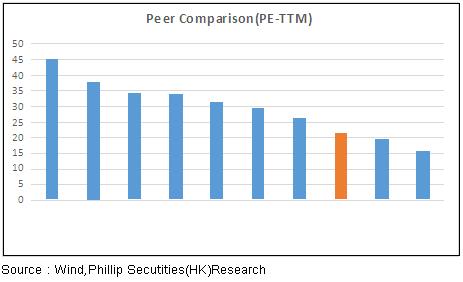

Valuation and Rating

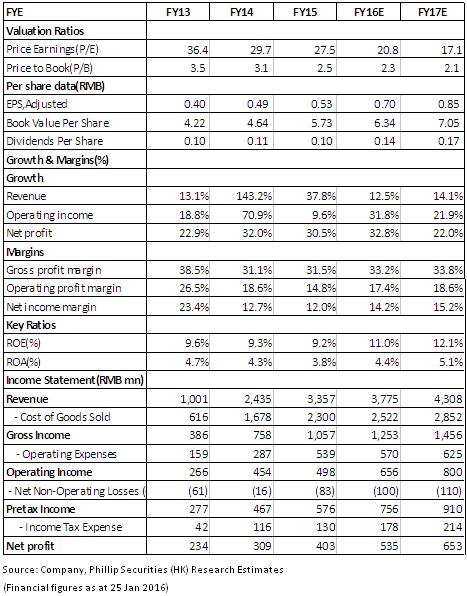

Overall, the company's water, gas and solid waste business segments generate steady profits. Its ability to obtain cash flow is remarkable. Furthermore, the company has set up a complete industrial chain in the field of solid waste treatment, contributing to its competitive edge. We pay great attention to the company's expansion and mergers and acquisitions in the domain of solid waste treatment. We predict that the company's revenues in 2016-2017 will amount to will reach RMB37.75million and RMB43.08 million, respectively; net profits will be RMB5.35million and RMB6.53 million, respectively; EPS will be RMB 0.70 million and RMB 0.85 million, respectively. We give the target price of RMB18.2 and the rating is Buy.

Risk Warnings

Fierce market competition;

Project expansion falls short of expectations;

Changes in tax and industry policy;

Decrease in gas and sewage treatment prices;

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|