-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- Smart Minor (Joint) Account

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Investment Opportunities of Shenzhen-Hong Kong Stock Connect (II) - Pharmaceuticals & TMT

Wednesday, November 2, 2016  20564

20564

Investment Opportunities of Shenzhen-Hong Kong Stock Connect (II)

| Recommendation | No Rating |

Weekly Special - 1361 361 DEGREES

Northbound Shenzhen Trading Link: Pharmaceuticals

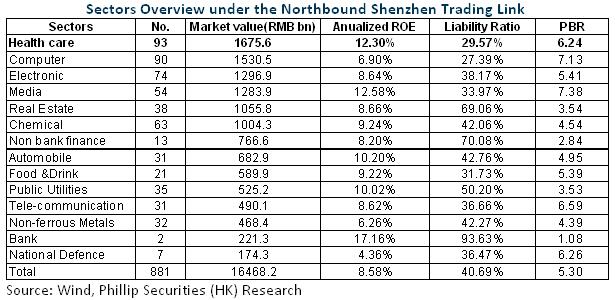

The Shenzhen-Hong Kong Stock Connect program will be launched soon. The A-shares that will concern overseas investors mainly include: pharmaceuticals, finance, food and beverage and other reasonably valued blue chips, based on past experiences of Shanghai-Hong Kong Stock Connect and QFII investment. High-value sectors in the A-share market make up a lion's share, while some stand out due to their scarcity, rapid growth and strong attraction to investors, such as pharmaceuticals.

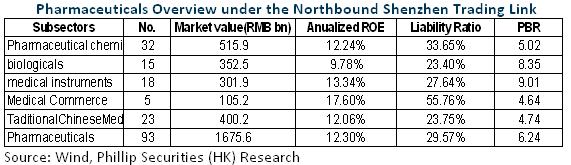

According to estimates, the pharmaceuticals theme will make up the largest share in Shenzhen trading link by market cap. Compared with other sectors, outlook of pharmaceuticals appears certain: 1) domestic pharmaceutical industries account for only 5-6% of China's GDP, which is far lower than developed countries like the United States and Japan. 2) China's ageing population is growing, with the number of people over 60 increasing from 200 million in 2012 to 300 million in 2025. And as country is ageing, people will spend more money on health care, in particular those over 60. Furthermore, the sector has stable cash flow, high profitability, and low leverage. Since the 21st century, the sector's asset-liability ratio has dropped by 20 percentage points to only around 41%.

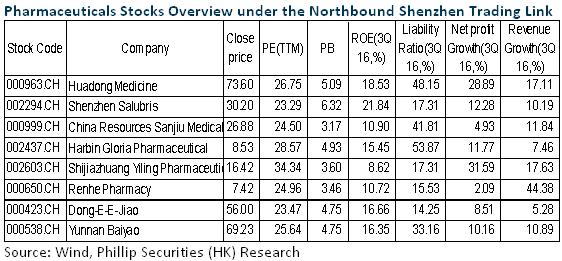

Meanwhile, since 2H 2015, many pharmaceutical policies have been made, including self-examining clinical trial data for drugs, consistency assessment of generic drugs, two-vote system, grading diagnosis and treatment, etc. We believe, in addition to a bright outlook, such policies will optimize the structure of the sector in Mainland China, which means enterprises with innovation power and a wide range of products and channels will be more competitive, thus increasing the concentration ratio of the sector. Therefore, we pay close attention to Huadong Medicine(000963 CH), Shenzhen Salubris(002294 CH), China Resources Sanjiu Medical & Pharmaceutical(000999 CH), Harbin Gloria Pharmaceutical(002437 CH), Shijiazhuang Yiling Pharmaceutical(002603 CH), Renhe Pharmacy(000650 CH), etc.

It is worth noting that, the traditional Chinese medicine (TCM) sector is China-featured, so companies such as Dong-E-E-Jiao (000423 CH) and Yunnan Baiyao(000538 CH) hold scarce resources to some degree. Moreover, currently, since TCM enterprises have low liability ratio and their stocks are undervalued, coupled with clear policy support, the outlook is optimistic.

Northbound Shenzhen Trading Link: TMT

The scope of eligible stocks of Shenzhen Trading Link under Shenzhen-Hong Kong Stock Connect are constituents of the Shenzhen Component Index and Shenzhen Small/Mid Cap Innovation Index with a market value of RMB6 billion and above, as well as the stocks of Shenzhen-listed companies with both A and H shares. Therefore, investment opportunities in the TMT Sector are more abundant with nearly 250 companies, the total market value of which account for up to 28% of the total market value of Shenzhen Trading Link, and is several times that of its counterpart in Shanghai Trading Link.

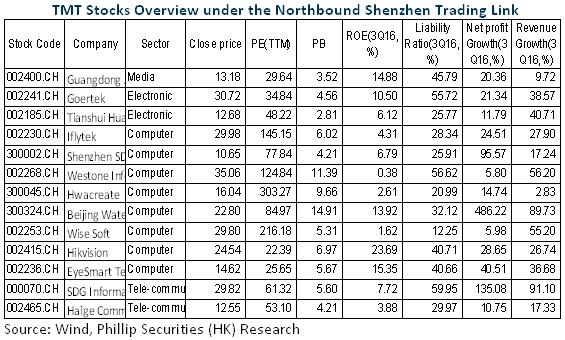

TMT will be one of the core drives of the new economy in the context of supply-side structural reforms and the Internet+, with the most promising growth prospects. Nevertheless, in light of the general high valuation of the sector, we take a positive attitude to companies with core competitiveness, great potential for long-term development and a high safety pad.

First of all, based on the experience of Shanghai Trading Link, constituents of Shenzhen Stock 100 and Shenzhen Stock 300 have the highest certainty among the initial pilot stocks, including Iflytek(002230 CH), Guangdong Advertising(002400 CH), Beijing Ultrapower Software(300002 CH), Goertek(002241 CH), etc.

Secondly, there is a lack of investment opportunity in themes like state-owned enterprise reforms and national defence military industry in current Hong Kong-listed stocks. Therefore, relevant names are worthy of note, including Shenzhen SDG Information (000070 CH), Westone Information Industry (002268 CH), Hwacreate(300045 CH), Guangzhou Haige Communications(002465 CH), Beijing Watertek Information Technology(300324 CH), Wisesoft(002253 CH), etc.

Furthermore, to some extent, QFII positions reflect the preferences of overseas investors. We believe White Horse shares which have high market value and dividends will be favoured, including Hikvision(002415 CH), EyeSmart Technology(002236 CH) and other leading security giants and leading semiconductor giants like Tianshui Huatian Technology(002185 CH).

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|