-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

DONGJIANG ENV (895.HK) - Continue to optimize its business structure and maintain steady growth in its main business of hazardous waste treatment

Wednesday, October 11, 2017  20161

20161

DONGJIANG ENV(895)

| Recommendation | Buy |

| Price on Recommendation Date | $11.460 |

| Target Price | $14.000 |

Weekly Special - 3306 JNBY Design Limited

Summary of Investment

- Continuous optimization of business structure and enhanced proportion of main business of hazardous waste treatment;

- Newly constructed/increased project + extension of M&A accelerated expansion of treatment scale;

- New breakthrough in layout of Beijing-Tianjin-Hebei region;

Investment Advice

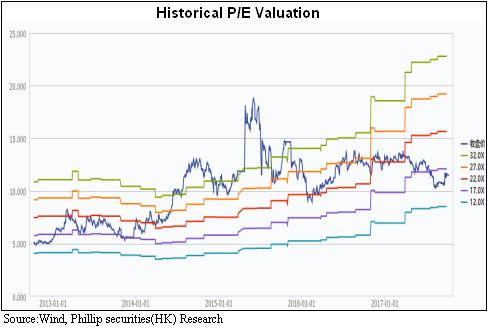

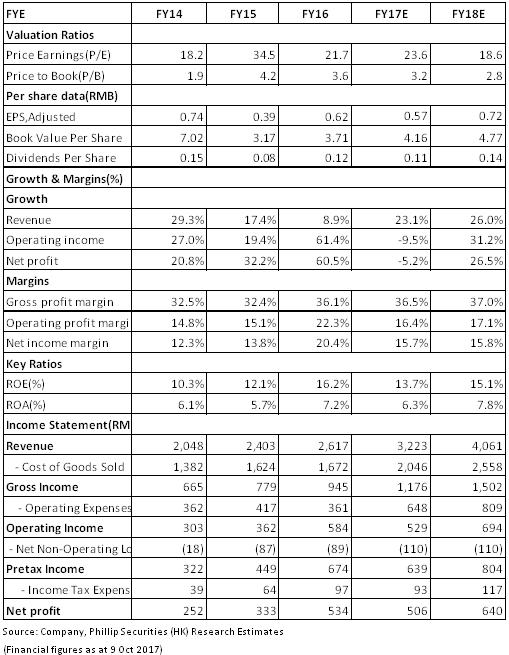

The Company spares no efforts to accelerate the expansion of newly constructed/increased hazardous waste treatment projects, coupled with rapid expansion of treatment scale. With the release of new capacity and concentration of market share to the dominant industry, it is expected that the main business of hazardous waste treatment will maintain high-speed growth. In addition, environmental facilities services and municipal business will make a significant complement to overall result. Also, the Company seizes the opportunity to launch PPP new business and focuses on expanding soil restoration, watershed management, urban pipe network and other new projects with the aim of creating new profit growth point and opening upward space for overall result. It is forecast that net profit of the Company in 2017 and 2018 will reach RMB506 million and RMB640 million, respectively; earnings per share (EPS) will be RMB0.57 and RMB0.72, respectively; the target price will be HKD14.0, with a Buy rating.

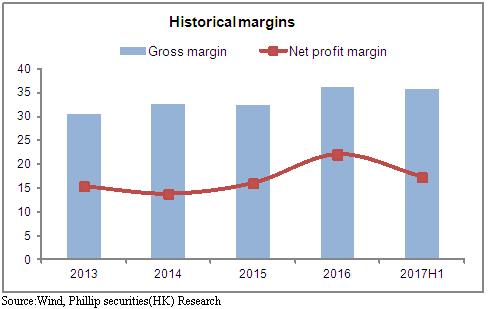

Growth of net profit slowed down in H1

In H1 2017, revenues and the net profit attributable to the parent company of Dongjiang Environmental Company Limited amounted to RMB1.403 billion and RMB220 million, respectively, representing a year-on-year increase of 19.96% and 6.83%, respectively. The net profit attributable to the parent company after deduction of non-recurring profit or loss recorded at RMB215 million, with a basic EPS of RMB0.25 (+4.2%). As the Company stuck to enhance market development and technology R&D, sales costs and administration expenses increased significantly over the same period last year, resulting in higher growth rate of revenue than that of net profit. The Company reported that its net profit of the first three quarters were between RMB266-380 million, with a year-on-year growth of -30%-0%. If non-recurring profit or loss brought by share sales in the same period last year was deducted, the year-on-year growth would be 0-30%.

In terms of profitability, the gross margin of each business has declined slightly, but industrial waste disposal (47.3%) and industrial waste of resource utilization (29.2%) with higher gross margin reported a substantial increase in revenue, with the overall gross margin only down by 0.25% to 35.75%, while the net profit fell by 1.78% year on year to 17.31%. In addition, owing to acceleration of accounts receivable, operating cash flow improved significantly and net operating cash flow increased 3.5 times year on year at the end of the period.

The Company continues to optimize its business structure and maintains steady growth in its main business of hazardous waste treatment

The Company yielded remarkable results in its business transformation and further optimized its business structure. In H1, 75% of its revenue came from industrial waste treatment and industrial waste utilization, which together contributed a total revenue of RMB1.051 billion, a year-on-year increase of 52.2%. In 2016, the contribution rate was 62.45%. Substantial increase in revenue was mainly due to the steady increase in new project production and capacity utilization. In particular, collection and treatment volume of materialized waste and incineration waste increased by about 100% and 50%, respectively, over the same period of last year. In addition, production and sales volume and metal sales price also witnessed significant rise.

In H1, the price of new environmental engineering contract was about RMB286 million, which recorded an environmental engineering and service revenue of about RMB143 million, up by 31.08% year on year and a gross margin of 25.13%, representing a stabilized year-on-year increase. The Company actively built the EPC general contracting capability of hazardous waste facilities, introduced the full flow experience of hazardous waste project into the engineering market, and planned to build a high standard waste treatment and disposal facility for the industry. It is expected that the asset-light operation mode of "technology + service" may significantly increase the overall operational efficiency, while environmental engineering business is also expected to become another result growth engine of the Company.

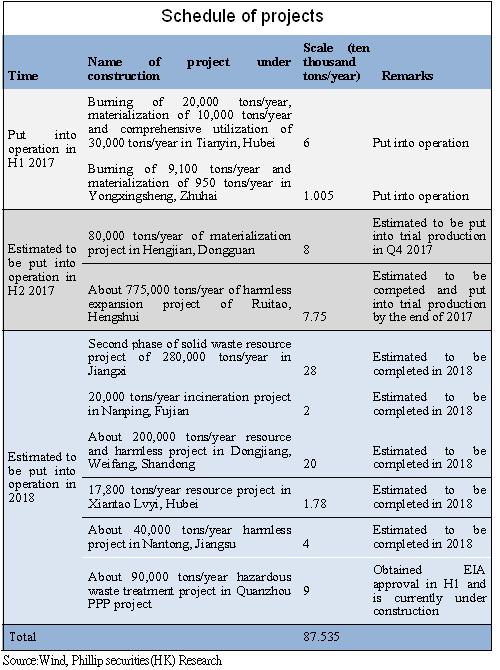

Considerable scale of projects under construction and release period of capacity concentration

In 2017 H1, new project capacity recorded 70,000 tons/year, which promoted the development of industrial waste treatment and disposal, with an increase in revenue of 53.35% year on year to RMB526 million. Among the projects under construction of the Company, it is expected that a total of 155,000 tons of capacity per year will be put into operation by the end of 2017 and 647,800 tons will be put into operation in 2018. Once completed and put into operation, this project will add a treatment volume of about 800,000 tons/year. It is expected that concentrated release of capacity in the next two years will continue to support high-speed growth. Rapidly promoting and enriching experience in extension and merger with newly constructed/increased project, the Company will be able to achieve the target of 3.5 million tons of waste treatment in 2020.

New breakthrough in layout of Beijing-Tianjin-Hebei region

In September 2017, the Company acquired 80% equity interest in Wondux (Caofeidian, Tangshan) with RMB130.4 million. Currently, the target company is preparing to build Caofeidian hazardous waste and general solid waste treatment center in Tangshan, with an annual treatment volume of 5.816 million tons, including incineration of 19,800 tons/year, landfill 18,900 of tons/year, materialization of 3,705 tons/year, curing of 8,452 tons/year and other types of 7,323 tons/year. This project is expected to be completed by the end of 2018 and will become a comprehensive treatment base for widest range of hazardous waste in Tangshan.

At present, national waste treatment and disposal market develops dramatically. As one of the core markets for hazardous waste treatment in China, Beijing-Tianjin-Hebei region is featured by large scale of hazardous waste production, while waste treatment and disposal facilities and capacity fail to manage such hazardous waste production, resulting in a huge rigid demand. The acquisition is another significant layout in hazardous waste market of Beijing-Tianjin-Hebei region following the acquisition of Hebei-Hengshui project, enhancing the Company's treatment capacity in Beijing-Tianjin-Hebei region to 145,300 tons/year. It is expected that layout of hazardous waste market of Beijing-Tianjin-Hebei region may be achieved, laying a solid foundation for in-depth market development of Beijing-Tianjin-Hebei region.

Multi-channel financing enhances financial strength

The Company actively expands diversified financing channels and financing models and achieved remarkable results: 1) To issue asset-backed securities and acquire an actual financing of RMB300 million with sewage treatment fees and usufruct of controlling shareholder of Humen Lvyuan as underlying assets, which is the first transaction between Guangdong Province and Shenzhen Stock Exchange PPP+ABS business; 2) To issue first stage of green company bonds with an issue size of RMB600 million, which is the first company that issues green bonds and lists in Shenzhen Stock Exchange; 3) To sign a framework agreement of industry M&A fund with GDRISING FINANCE with a total value of RMB3 billion and mother fund of RMB550 million and the Company subscribes RMB50 million; 4) To launch non-public offering of A shares project and raise funds of RMB2.3 billion. Diversified financing channels will help reduce financing costs, enhance capital strength and promote the development of main business.

Risk Warnings

Industry policy risks;

Project progress below expectations;

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|