-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Singapore Stock Market

Singapore is one of the important financial markets in the Asia-Pacific region. Its economy is highly dependent on external trade and it is situated at strategic location in Asia. The feature is reflected in the securities market. At the end of 2021, there were 673 listed companies with a market capitalization of nearly S$900 billion. Overseas domiciled companies account for about 40% of the total number, the percentage is much higher than other exchanges. Most of these foreign companies come from Greater China and Southeast Asia , followed by Europe, America, Japan and South Korea. Singapore plays a key connector role within ASEAN economies. The aggregate size of ASEAN economies is close to US$3 trillion. There are about 80 ASEAN companies listed in Singapore - Malaysia 47, Indonesia 26, Thailand 3, Myanmar 3 and the Philippines 1. The household names include Malaysian agricultural product producers Wilmar International (WMI.SG), Lippo Malls Indonesia Retail Trust (LMT.SG), Thai Beverage (TBV.SG), Myanmar’s Yoma Strategic (YMS.SG) and Philippine food and beverage giant Del Monte (DMP.SG). Singapore is major venue for real estate investment trust REIT in Asian Pacific region, after Japan and Australia.

Besides benefiting from the Southeast Asian economy, the Singapore stock market has other highlights:

- Politically and economically stable - Singapore and Southeast Asia benefit from the current geopolitical tensions of other major countries. The tension is believed not to ease in short term, which has strengthened Singapore position as an international financial center for asset management and custody;

- Oil and gas, offshore and marine sectors - Singapore is not rich in resources, its technology expertise and exploration of oil and gas fields in neighboring regions facilitates the development of supporting sectors. Examples are oil exploration and drilling engineering, rigs construction and operation, personnel and logistics transportation. The arm has reached South America. Offshore and marine listed companies are relatively few in Hong Kong and China markets. They are usually small cap stocks and prices are highly sensitive to level and change in oil price.

- High dividend yield – With S-REITs universe, the T12M dividend yield of Strait Times Index is 3.12% vs Hang Seng Index’s 2.45%, S&P Singapore REIT USD Gross Total Return Index’s 4.38%.

Singapore Exchange (SGX)

SGX, as the major operator of financial products trading in Singapore, provides trading and clearing services for a number securities and derivative products). In addition, SGX is known aggressive to solicit overseas companies for primary or secondary listings, develop new products (e.g. leveraged and inverse ETFs, the popular SGX FTSE A50 Index futures and daily leverage certificates), new listing mechanism recently introduced - Special Purpose Acquisition Company SPACs, etc.

SGX was established in December 1999 by the merger of two trading venues at the time - the Stock Exchange of Singapore (SES) and the Singapore International Monetary Exchange (SIMEX). Singapore Exchange was listed on the local stock market as early as November 2000, becoming the second listed exchange in the Asia-Pacific region. Its market capitalization reached about S$10.2 billion as of January 20, 2022.

Securities Trading Section

There are three securities trading segments in SGX , namely Main Board, Catalist, GlobalQuote, ETFs and structured warrants, etc. The average daily turnover in 2021 is about S$1.3 billion . The main board is the major trading segment accounting for 87% of the aggregate trade value. Major companies are DBS Bank DBS Group (DBS.SG) among the 3 key banks, Jardine Matheson (JMH.SG), and Capitaland Investment (CLI.SG), Singtel (SGT.SG), 40+ REITs and property funds. Catalist, analog to the Growth Enterprise Market board in Hong Kong, was established on December 7, 2007, primarily based on the model of the UK AIM market. Catalist is specifically designed for for local and international fast-growing enterprises to go listing via IPO or a reverse takeover. The full sponsor is responsible for proposing listing and directly supervising Catalist companies, under delegation and regulation by SGX. SGX does not set quantitative entry thresholds. The average daily turnover in 2021 is S$11.3 million. Examples are Duty Free International Limited (DFIL.SG) and Audience Analytics (AUD.SG).

In the total transaction value of S$316 billion in 2021, the financial industry shared the largest pie (50.7%). Apart from banking and financial services, the industry also comprises real estate development and operation, REITs and property trusts, followed by industrial sector (15.7%) , consumer services (11.5%), consumer goods (6%), communications (5.8%) and oil and gas (3.96%).

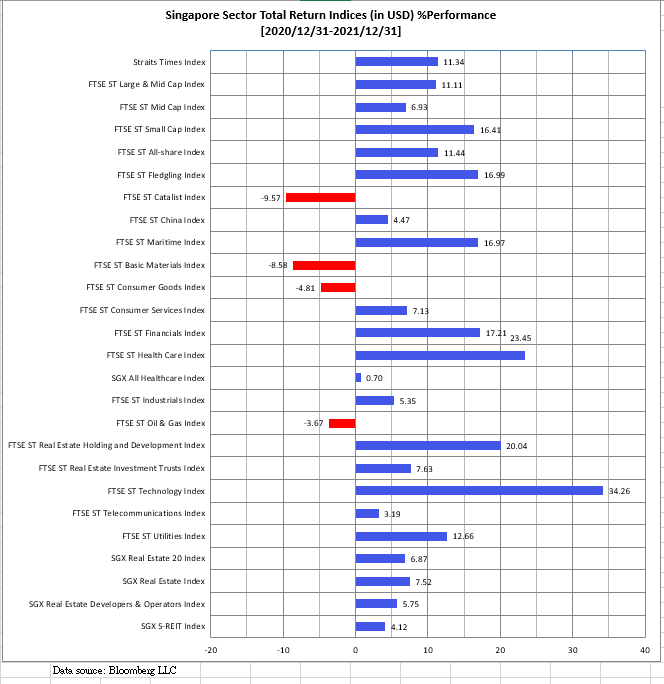

2021 Industry Index Performance

Benchmark Index (Straits Times Index)

The Straits Times Index is a market capitalization-weighted index that tracks the performance of the 30 listed companies with highest market capitalization and liquidity on SGX, at the inception of 12 February 1987. Index composition is reviewed every March and September. As of December 31, 2021, the total market capitalization of the top ten constituent stocks was S$211.2 billion, accounting for 71% of the index. The top 5 capitalization constituent stocks were DBS Group (DBS.SG, 19.80%), OCBC Bank (OCBS.SG, 13.43%), United Overseas Bank UOB (UOB.SG, 11.69%), Singtel (SGT.SG, 5.88%), Jardine Matheson (JMH.SG, 5.16%). 11 are property stocks and REITs [e.g.: CityDev (CID.SG), UOL (UOL.SG), Mapletree Industrial Trust (MIT.SG), Frasers L&C Trust (FRLIT.SG). In addition, there are 4 Jardine stocks denominated in US dollars - Jardine Matheson (JMH.SG), Jardine Cycle & Carriage (JCC.SG), Hongkong Land (HKL.SG) and DairyFarm (DFH.SG)

For details, please visit https://www.sgx.com/indices/products/sti

Our Singapore-domiciled affiliate, Phillip Securities Pte Limited established in 1975. It is a financial institution licensed by the Monetary Authority of Singapore, a SGX securities trading member and a CDP securities member.

Moreover, its professional research team covers a number of sectors, e.g. Banking & Finance, Property & REITs, Consumer, Industrial, Conglomerates, Small-Mid Cap, Technical Analysis.

As a result, Phillip Securities (Hong Kong) Limited has a number of advantages over peers:

- Competitive online commission

- Stock margin facility with financing ratio up to 80%, more on ratios

- Support three settlement currencies (trading currency, HKD and USD), client is hassle-free for conversion

- Low SGD and USD margin interest rates (4.25% p.a., i.e. SCB HK$ Prime Rate - 1% within promotion period)

- Research Reports (e.g. Banking and SREITs monthly update)

- Straight-through Processing (STP) technology to handle your orders -Speedy to the Exchange without our manual handling

- Real-time streaming Level 1 price quote subscription service, please go to our data vendor CyberQuote (HK)

- Support both online, Apps and phone order channels

- Support Block Trade / Married Deal trade (by offline channel, subject to our due diligence exercise and minimum order value/quantity). The special service is particularly useful when order quantity is significant in terms of a counter’s average daily traded volume.

- Support to deposit physical share certificate (with conditions, handling fees and other charges, on a case-by-case basis)

Trading Session

| Country | Trading Session(Hong Kong) | Trade Currency | Settlement Currency & Duration | Earliest HK time to accept orders for next trade day |

|---|---|---|---|---|

| ** We offer brokerage services for limited scope of companies listed at US OTCBB. *** Only limited services of Pre-open, pre-close & after-close auction sessions are provided |

||||

| Singapore | Monday ~ Friday

|

SGD USD HKD CNY AUD EUR |

SGD USD HKD CNY AUD EUR T + 2 |

Monday ~ Friday at 18:15 after previous market close |

SGX Code "SingID" vs Phillip's Stock Code

SGX assigns a designated stock code “SingID” to each counter, for instance, S68 for Singapore Exchange Limited. It is different from Phillip’s stock code and Bloomberg ticker, SGX.SG and SGX SP respectively.

How to search Phillip’s stock code for order input with SGX’s SingID ?

- Click here

- Search "ISIN Code Download Link" and click the file underneath

- Search the "SingID" on web page, the subject "SingID" should be highlighted in the second rightmost column

- Confirm the target counter with the first column "NAME" or the third column "ISIN CODE".

- Copy the data (except symbol) in the last column "TRADING COUNTER NAME"

- In our foreign stock trading platform, click "Search Stock Code" button, then paste the copied "TRADING COUNTER NAME" in search cell, then press "Search"

Please note SGX’s stock code is different from Phillip Sec HK's.

| Category | Column | Remarks |

|---|---|---|

| Info & Prices | Summary | Today’s update| Indice Movement|Market Performance|Sector Heatmap|Market Updates by SGX Research |

| Securities Prices | For detail and chart of each counter, click their Trading Name or input Sing ID in "Search Securities" cell. | |

| Stock Screener (Incl. S-REITs, but excl. ETF) | Customize your search with max 14 criteria and display with 15 options; 2) Data Download |

|

| ETF Screener | 1) Customize your search with max 5 criteria; 2) Three default sorting displays |

|

| Historical Data for Download | 1) Securities prices and amendments over past 22 trading days; 2) Short-sell data (share borrowing and short sell services not available); 3) CDP Buy In; 4)ISIN Code Download Link |

|

| Listed Company Information | Announcements | |

| Corporate Actions (e.g. dividend, interest, entitlements and etc.) | ||

| Annual Reports & Related Documents | ||

| Meeting Schedules | ||

| IPO Performance (Singapore IPO subscription service not available) | ||

| Written by SGX Research | Market Updates | |

| Interview with Listed co ’s management | ||

| Sector | Monthly "Chartbook: SREITs & Property Trusts" | |

| Data Report | Daily Momentum Report SGX Institutional and Retail fund flow weekly tracker Singapore Equities - The Monthly Digest (Monthly) |

|

| Market Statistics Report (Monthly) | Covers Securities and Derivatives markets | |

| Local Media | Business Times | Singapore's leading business daily |

| Straits Times | Singapore's main English-language newspaper | |

| Channel News Asia | Singapore's regional news network | |

| Today | Singapore's free daily newspaper | |

| Newspaper SG | Singapore newspaper archives | |

| The Edge Singapore | Singapore business and investment weekly |

Top of Page

|

Please contact your account executive or call us now. Foreign Stock Tel : (852) 2277 6678 (24Hr) Fax : (852) 2277 6006 Email : foreignstock@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|